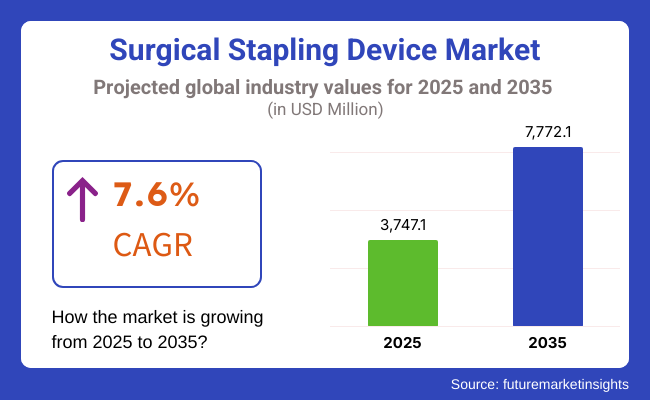

The market is likely to be around USD 3,747.1 million by 2025 and around USD 7,772.1 million by 2035, which represents a 7.6% compound annual growth rate (CAGR) for the forecast period.

The surgical stapling device market has high growth prospects over the 2025 to 2035 period, inspired by the increased focus on minimally invasive procedures, advanced stapling technologies, and the surging incidence of chronic diseases requiring surgical treatment. Demand for robotic-assisted and laparoscopic surgeries will drive higher adoption rates for innovative stapling solutions designed to improve procedural precision and enhance recovery for the patient.

The industry will see rising growth in the trend of powered and intelligent stapling surgery units with reduced chances of infection risk and increased wound closing efficiency. Besides this, the demand for bioabsorbable stapling devices will build pace with better outcomes of healing in the post-operative phase. High cost, strong regulatory guidelines for approvals, and complications occurring through stapling, though, may delay growth at large for a few territories.

In the future, the fusion of artificial intelligence (AI) and digital surveillance systems in surgical stapling will transform the market, allowing real-time analysis, improved accuracy, and enhanced patient safety. As medical infrastructure continues to evolve worldwide and surgical volumes continue to rise, industry participants will emphasize creating affordable and technologically advanced stapling products to keep their market positions intact.

Between 2020 and 2024, phenomenal growth was spearheaded by the demand for surgical stapling to replace sutures, increasing innovations in surgical technologies, and the ever-rising volume of surgical procedures globally. These are much faster, more efficient, and less likely to lead to infection than traditional types of suturing.

Powered surgical staplers and specially tailored devices for minimally invasive surgery offer significant advantages in improving the precision of their performance and in attaining rapid recovery. The demand for effective and reliable systems that close wounds is further endorsed by the increase in surgical trend activities, especially about bariatrics and GI subjects.

Explore FMI!

Book a free demo

Due to the large patient pool, comparatively better surgical facilities, and the presence of fewer major manufacturers of surgical equipment, the North American market for surgical stapling is most likely to dominate the global market. With growing trends of minimally invasive procedures on the rise, along with bariatric and gastrointestinal procedures on the rise, the market is also improving.

Reimbursement schemes that foster innovation, along with the technology which focuses on biodegradable and leak-proof surgical staples, are improving patient outcomes. So, certain regulatory matters surrounding surgical stapler safety and efficacy might limit market growth.

The increasing incidence of outpatient and ambulatory surgeries throughout North America drives the need for minimally invasive stapling solutions. The growing healthcare financing and rapid technology developments further fuel demand for precision and automatized smart surgical staplers.

The European market is more or less stable and subject to stringent regulations ensuring that the devices are safe and well-performing. The increasing use of surgical staplers in Germany, France, and the UK is due to an increasing geriatric population that is demanding more and more surgery. With the presence of well-established healthcare centers and greater investments in robotic-assisted surgery, there is a surge of growth for this market.

Moreover, European hospitals and operative theatres focus tremendously on bioabsorbable and environment-friendly stapling devices to combat postoperative complications. However, market players may face challenges due to cost-containment regulations set by public market schemes and stringent compliances.

Also, there is a much more significantly enhanced collaboration between the research bodies and manufacturers of surgical devices to look at the creation of next-generation stapling solutions in the region. The growing interest in affordable and efficient surgeries, particularly in the public healthcare system, is robustly driving the demand for advanced refinable stapling devices.

Fairly bright prospects are in sight for the Asia-Pacific market. With increased health expenditure, the number of surgeries, and the rapid expansion of private hospitals and specialty surgical facilities, this market has all the prerequisites to show huge growth. Countries like China, India, and Japan are extremely in demand for surgical staplers because of a rising incidence of chronic diseases such as obesity and gastrointestinal disorders.

Major drivers for market penetration also include medical tourism in strong growth momentum and burgeoning government initiatives towards improving surgical success rates. Moreover, the development of local medical device companies providing economical stapling products increases access to surgical procedures.

Nevertheless, low awareness about the region's advanced stapling methods and divergent regulatory scenarios could be an issue. Adopting artificial intelligence-driven surgical techniques and education programs for minimally invasive procedures is further driving market growth in Asia-Pacific.

Challenges

Stringent Regulatory Climate for Product Approval

Wound closure alternatives such as upgraded sutures, tissue adhesives, and hemostats could impact surgical stapling device market share. With increasing foothold for bioengineered adhesive and absorbable suture innovations, some surgical indications could move away from non-stapling alternatives. In addition, the increasing penetration of low-quality and counterfeit stapling instruments into certain of the markets is threatening patient safety, regulatory compliance, and brand reputation.

Skill variability and training are at the heart of incorporating surgical staplers. Uneven experience levels cause issues like misfires, anastomotic leaks, and wound healing impairment, ultimately affecting clinical results and patient safety. Market stakeholders address these issues by investing in more comprehensive training schemes, AI-based stapling systems, and real-time feedback to make surgical performance more consistent.

Opportunities

The increasing demand for minimally invasive procedures

High demand for minimal-invasive procedures and technological advancements in smart automated surgical stapling systems and bioabsorbable staples will surely open great avenues for growth. The advances in stapling technology, which are improving the accuracy and complication reduction potential, are driving technological innovation.

The growing market from strategic partnerships of healthcare providers and medical device companies to establish training modules and simulation-based education for surgeons is also boosted. In addition, the increasing number of outpatient and ambulatory surgical centers is driving demand for effective and economical stapling technologies. The feedback of real-time mechanisms on surgical stapling devices augment accuracy and outcomes in patient procedures.

Progress in Smart and Automated Stapling Devices: The latest advancements in surgical staplers are focused on improving the accuracy of surgery and reducing complications. Surgeons now use intelligent staplers with tissue-sensing ability to gain successful results in complicated procedures.

These staplers feature real-time pressure sensing and automatic staple height adjustment for fewer post-surgical complications and improved success rates. Integrating these technologies provides the surgeon assurance and accuracy when carrying out the procedure.

Exploring Bioabsorbable and Leak-Proof Surgical Staples Development: Bioabsorbable staples are an emerging focus area because of their efficacy in reducing foreign body reactions and post-surgical infections. New leak-proof staples are also being developed for gastrointestinal and bariatric procedures, which add to product innovation in this segment.

Research in nanotechnology-increased bioabsorbable staples is providing new avenues for more effective and safer wound closure products targeted towards the specifications of different applications in surgery.

Emerging Trends

Robotics-assisted robotic stapling is a new generation of minimally invasive surgical procedures. Robotic accuracy is likely to maximize suture cutting time with a minimum inoperative time; in the future, this technology will likely offer geriatric precision and professionalism on the surgery table.

Sustainability in surgical stapling: Increasing ecological awareness is being directed at surgical staples that can be recycled and biodegradable. Hence, there is the development of environmentally friendly solutions for healthcare practice. These companies are investing in cutting-edge material sciences to minimize waste and improve patient safety for the devices.

For example, redeemable and assailable staplers surface through hospital initiatives to reduce resource waste and practice sustainability in hospitals. Steps in making such advances in these features ensure a vigorous transition toward making surgical technologies safer, more effective, and ecologically sound for better patient outcomes in diverse medical specialty areas.

Growth in demand for minimally invasive surgeries will likely stimulate demand for specialty stapling equipment used to produce high-accuracy, reduced patient recovery-time surgery. The use of high technologies like real-time feedback loops and smart sensors will also increase accuracy and safety during surgeries.

Growing expansion into emerging economies will also significantly contribute to growth in the market, as increasing healthcare infrastructure opens access to surgery in developing markets. With the changing industry, manufacturers must focus on innovation, compliance with regulations, and strategic alliances to keep pace with the increasing demand for efficient, technologically superior surgical stapling solutions.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory Landscape Focus on the safety and efficacy of products, where rules guarantee precise labeling and compliance with health norms. |

| Technological Advancements | Technological Advances Design of intuitive devices with simplified features for routine surgical use. |

| Consumer Demand | Consumer Demand There is a Higher demand for effective and consistent wound closure solutions with increased surgical procedures. |

| Market Growth Drivers | The role of technological developments and rising levels of surgery is complemented by the effectiveness of stapling machines over manual techniques. |

| Sustainability | Moving towards environmentally friendly manufacturing processes and energy-conscious device designs to minimize the environmental burden. |

| Supply Chain Dynamics | Using traditional channels and e-commerce sites expands online reach to reach more consumers. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Adopt stringent guidelines to target device performance, user protection, and the environmental footprint, with certifications of green products. |

| Technological Advancements | Innovation of multidimensional devices integrated with AI-enhanced features to cater to tailored surgical procedures, tissue analysis in real-time, and improved security features. |

| Consumer Demand | Increased preference for newer, technology-enabled stapling devices with better results and shorter recovery periods. |

| Market Growth Drivers | Developments in emerging markets, ongoing product innovation, tactical alliances with healthcare providers, and convergence with digital health platforms providing end-to-end surgical solutions. |

| Sustainability | Total integration of sustainable practices like recyclable materials, carbon-neutral manufacturing processes, longevity, and environmentally friendly devices. |

| Supply Chain Dynamics | Supply chain transparency and efficiency using blockchain technology enables ethical sourcing of raw materials in real-time stock management and direct-to-consumer sales mechanisms to reduce middlemen and costs. |

In short, the surgical stapling device market is finding ways to maintain growth, empowered by technological advancements, the trend toward minimally invasive procedures, and the increasing penetration of emerging markets. While flexible toward regulatory reforms, industry players should continue investing in research and development to satisfy changing surgical demands and consumer tastes.

Market Outlook

The surgical stapling device market is growing rapidly in the USA due to the increasing number of surgical interventions, the incidence of chronic diseases, and the consistent improvement in medical technology. The increased demand for gastro-bariatric surgeries, where accurate and patient-safe stapling devices are paramount, has been heavily driven by the increased incidence of obesity and gastrointestinal disease.

Smart stapling technologies with live tissue feedback technology have been unveiled due to great research and development work. They aid the expansion and technological support of the market by enhancing operating room precision, optimizing wound closure, and enhancing overall patient performance.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.0% |

Market Outlook

A strong healthcare system, many surgical procedures, and ongoing developments in minimally invasive surgical technologies have all contributed to the steady expansion of the surgical stapling device market in Germany. The need for effective and dependable surgical staplers has increased due to the nation's aging population and the notable increase in surgeries, especially those involving orthopedic, bariatric, and cardiovascular treatments.

Only top-notch, cutting-edge stapling tools are used in surgical procedures, thanks to Germany's emphasis on medical innovation and strict regulatory standards. Concerns about surgical efficiency and infection control also contribute to the market's increased preference for disposable staplers.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 10.4% |

Market Outlook

This market is growing for surgical stapling devices in China at a high rate resulting from increased investments in healthcare and growing numbers of surgical procedures. Open as well as minimally invasive surgeries have increased the high demand for advanced stapling technology and, thus, the need for surgeries due to the high age dependency ratio combined with the rise in prevalent chronic diseases such as cancer, obesity, and cardiovascular disease.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.5% |

Market Outlook

The increasing number of surgical procedures and ongoing improvements in healthcare infrastructure are driving the market for surgical stapling devices in India. The need for surgical procedures has increased due to the rising incidence of chronic illnesses like obesity, cancer, and cardiovascular disorders. As a result, more and more surgeons are using minimally invasive procedures that call for sophisticated stapling tools to increase accuracy, shorten operating times, and improve patient recovery.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.4% |

Market Outlook

Obesity and cardiovascular disease are very common chronic diseases, which more or less lead to the requirement of open or minimally invasive procedures requiring high quality, safe, and reliable stapling instruments.

Some of the technologies used for enhancing precision in surgical procedures along with curtailing recovery times include robotic staplers, powered stapling instruments, and bio-resorbable staples. Hospitals and surgery centers investing in these technologies will be repaid with enhanced, safer, more efficient patient care, which will increasingly open up the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 6.9% |

Powered Surgical Stapling Device

Powered staplers are more useful in medicine because of their accuracy, ability to minimize tissue damage, and reliability in closing wounds. These staplers use motors to save energy while the surgeon performs challenging tasks. High-precision operations are the primary use for powered surgical staplers. These consist of weight-loss surgery, minimally invasive surgeries, digestive system surgeries, and chest surgeries.

The demand for these staples is rising for several reasons. The number of surgeries conducted worldwide is increasing, and more minimally invasive treatments are being carried out. Additionally, as smart technologies advance, powered staplers are changing as well. Their usage in the Asia-Pacific region has risen sharply as healthcare systems get better and use more advanced surgical tools.

The innovation in powered surgical staplers seems very bright and promising. Smart staplers, providing immediate feedback on tissue conditions, robotic stapling systems for enhanced accuracy, and bioabsorbable staples leading to better healing are few of them.

Manual Surgical Stapling Device

The manual surgical stapler would remain relevant, especially in resource-scarce settings such as the developing world. These types of staplers are physically operated by the surgeon's manual force, making them most effective for use in general surgery, trauma, and emergencies, where the main concern is sometimes closure time.

The forecasted increase in worldwide surgery and the growing demand for cost-effective instruments will keep the demand for manual staplers strong. They are popularized across many government medical centers and small clinics in Asia-Pacific and Latin America. In Europe and North America, manual staplers are employed for specific procedures, where powered staplers are not required.

Disposable Surgical Stapling Device

Disposable surgical staplers have, till now, been the most-selling devices in infection control and single-use applications. The increase in the utilization of these staplers is seen in all high-risk procedures occurring in outpatient clinics and emergency trauma care procedures, wherein sterility becomes the utmost issue.

Factors like increased awareness regarding hospital-acquired infections (HAIs) control, rising demand for single-use medical devices, and improvement in lightweight and ergonomic designs have driven this segment. North America and Europe rank highly in the use of disposable staplers due to stringent sterilization regulations and a strong emphasis on patient safety, whereas Asia-Pacific is witnessing an increasing demand for staplers due to rising surgical number practice and enhancement of healthcare.

Future trends to include biodegradable disposable staplers, antimicrobial-coated staples to prevent infection, and smart stapling devices with inbuilt pressure sensors for optimized wound closure.

Reusable Surgical Stapling Device

Reusable surgical staplers are becoming more and more popular because to their affordability and sustainability, which makes them suitable for both budget-conscious hospitals and high-volume surgery centers. Since these devices are intended to be reused following sterilization, less medical waste and long-term surgery expenses should result.

Advancements are aiding adoption in durable autoclavable stapling materials, growing environmental concern over the issue of disposable medical waste, and an increased emphasis on cost reduction in both public and private healthcare systems.

Europe and North America are the leading markets for reusable staplers, with hospitals focusing on sustainable medical practices, while Asia-Pacific is witnessing increased acceptance since, in the long run, surgical tools with better investment costs will be saved. Future innovations will include robotic-assisted reusable stapling devices, AI-driven predictive maintenance for optimal performance, and modular staplers with interchangeable staple cartridges for diverse surgical applications.

The surgical stapling device market is highly competitive, driven by increasing surgical procedures, advancements in minimally invasive techniques, and a growing demand for efficient wound closure solutions. Companies are investing in powered and reusable staplers, biodegradable staples, and smart surgical devices to maintain a competitive edge.

The market is shaped by well-established medical device manufacturers and emerging surgical technology firms, each contributing to the evolving landscape of surgical stapling solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic | 26.7% |

| Ethicon (Johnson & Johnson) | 21.9% |

| Intuitive Surgical | 17.7% |

| B. Braun Melsungen | 15.2% |

| Conmed Corporation | 5.0% |

| Other Companies (combined) | 13.4% |

| Company Name | Key Developments/Activities |

|---|---|

| Medtronic | 2025- Market leader offering advanced powered surgical staplers, including Endo GIA and Signia stapling systems. |

| Ethicon (Johnson & Johnson) | 2025- Provides high-performance surgical staplers such as the Echelon series, focusing on precision and tissue control. |

| Intuitive Surgical | 2024- Develop robotic-assisted surgical staplers integrated into the da Vinci robotic surgery platform. |

| B. Braun Melsungen | 2024- Specializes in reusable and disposable surgical staplers designed for various surgical applications. |

| Conmed Corporation | 2024- Offers cost-effective surgical stapling devices with a focus on reliability and user-friendly design. |

Key Company Insights

These companies focus on expanding the reach of surgical stapling solutions, offering competitive pricing and cutting-edge innovations to meet diverse surgical needs.

The overall market size for Surgical Stapling Device Market was USD 3,747.1 million in 2025.

The Surgical Stapling Device Market is expected to reach USD 7,772.1 million in 2035.

Increase in the Prevalence of Obesity has significantly increased the demand for Surgical Stapling Device.

The top key players that drives the development of Surgical Stapling Device Market are Medtronic, Ethicon (Johnson & Johnson), Intuitive Surgical, B. Braun Melsungen and Conmed Corporation.

Powered Surgical Stapling Device by product is Surgical Stapling Device Market is expected to command significant share over the assessment period.

Powered Surgical Stapling Device and Manual Surgical Stapling Device

Disposable Surgical Stapling Device and Reusable Surgical Stapling Device

Straight, Curved and Circular

Skin, Digestive Tract, Blood Vessels, Hernia, Lung, Others

Hospitals, Ambulatory Surgical Centers, Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa.

Cosmetic Peptide Manufacturing Market Analysis by Product, Application, End Product, End User, and Region through 2035

Contact Lens Solution Market Analysis by Product Type, Volume, Purpose, Distribution Channel, and Region through 2035

EMEA Emergency Medical Service Market Analysis by Services, Provider, Fleet, and Region Forecast Through 2035

Expectorant Drugs Market Trend Analysis Based on Drug, Dosage Form, Product, Distribution Channel, and Region 2025 to 2035

The High-Potent Oral Solid Dosage Contract Manufacturing Market is segmented by Dosage Form and End User Channel from 2025 to 2035

Infection Prevention Market is segmented by Product type and End User from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.