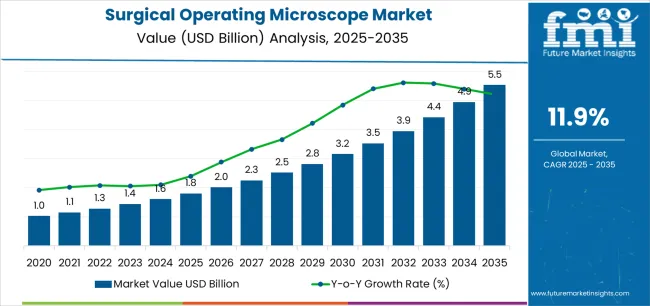

The Surgical Operating Microscope Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 5.5 billion by 2035, registering a compound annual growth rate (CAGR) of 11.9% over the forecast period.

The surgical operating microscope market is experiencing consistent expansion driven by advancements in microsurgical procedures, increasing adoption of minimally invasive techniques, and technological innovations enhancing visualization and precision. The current scenario reflects strong demand from ophthalmic, neurosurgical, and ENT applications, supported by healthcare infrastructure upgrades and rising surgical volumes across developed and emerging regions.

The future outlook remains positive as medical institutions invest in advanced optical technologies, ergonomically designed systems, and digital integration solutions to improve surgical outcomes and efficiency. Growth rationale is centered on the increasing need for high-definition imaging, improved workflow management, and the growing emphasis on patient safety and procedural accuracy.

Continuous innovation in optical performance, camera integration, and illumination systems, coupled with favorable reimbursement frameworks and surgeon training initiatives, is expected to sustain long-term market growth and solidify the role of surgical operating microscopes as essential tools across multiple surgical disciplines.

| Metric | Value |

|---|---|

| Surgical Operating Microscope Market Estimated Value in (2025 E) | USD 1.8 billion |

| Surgical Operating Microscope Market Forecast Value in (2035 F) | USD 5.5 billion |

| Forecast CAGR (2025 to 2035) | 11.9% |

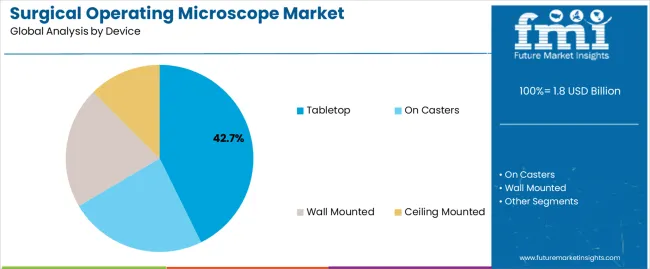

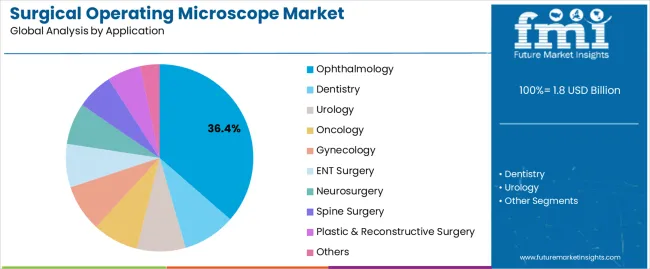

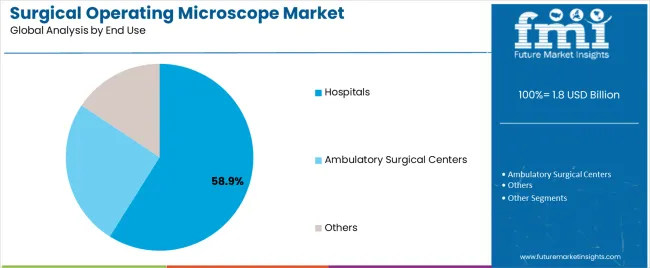

The market is segmented by Device, Application, and End Use and region. By Device, the market is divided into Tabletop, On Casters, Wall Mounted, and Ceiling Mounted. In terms of Application, the market is classified into Ophthalmology, Dentistry, Urology, Oncology, Gynecology, ENT Surgery, Neurosurgery, Spine Surgery, Plastic & Reconstructive Surgery, and Others. Based on End Use, the market is segmented into Hospitals, Ambulatory Surgical Centers, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tabletop segment, accounting for 42.70% of the device category, has been leading the market due to its compact design, ease of use, and cost efficiency, which make it ideal for diverse surgical environments. Adoption has been driven by its adaptability to various procedures and efficient space utilization in operating rooms.

Enhanced optical clarity, depth perception, and illumination control have strengthened its clinical reliability, while lower maintenance requirements have made it a preferred option for both large hospitals and specialty clinics. Demand has been supported by increasing usage in ophthalmic and dental microsurgeries, where mobility and precision are crucial.

Continuous improvements in digital imaging and ergonomic adjustments are contributing to operational efficiency and user comfort, ensuring the segment’s sustained dominance and broader integration across multiple medical applications.

The ophthalmology segment, representing 36.40% of the application category, has maintained its leading position due to the increasing prevalence of eye disorders and the rising demand for advanced visualization in delicate ocular surgeries. High adoption has been observed in cataract, retinal, and corneal procedures, where precision and magnification are critical.

The integration of digital recording and 3D visualization has improved surgical accuracy and training capabilities, supporting consistent demand from ophthalmic centers and hospitals. Technological innovations, including improved illumination systems and motorized positioning, have further enhanced workflow efficiency.

The segment’s growth trajectory is supported by rising geriatric populations, increasing surgical volumes, and continuous product development focused on optimizing visualization and reducing surgeon fatigue, ensuring its sustained contribution to the market.

The hospitals segment, holding 58.90% of the end use category, has emerged as the dominant end-user due to high surgical throughput, advanced infrastructure, and availability of trained professionals. Adoption has been driven by hospitals’ capacity to invest in high-end, multi-specialty surgical microscopes and their integration within comprehensive surgical suites.

Centralized procurement systems and favorable capital expenditure budgets have facilitated large-scale equipment upgrades, while adherence to stringent quality and safety standards has reinforced product reliability. Growing emphasis on precision-based surgeries and multidisciplinary operating rooms has further strengthened hospital demand.

Expansion of tertiary care centers in emerging economies and continuous improvement in operating efficiency are expected to sustain this segment’s leadership and promote long-term adoption of surgical operating microscopes across global healthcare systems.

| Attributes | Details |

|---|---|

| Device | On Casters |

| CAGR from 2025 to 2035 | 12.3% |

ACS and clinic facilities require microscopes that can be easily moved around and stored when not in use, making the On Casters segment more preferable.

| Attributes | Details |

|---|---|

| Top End Use | Hospitals |

| CAGR from 2025 to 2035 | 12.1% |

| Countries | CAGR through 2035 |

|---|---|

| United States | 12.8% |

| United Kingdom | 13.8% |

| China | 12.9% |

| Japan | 14.2% |

| South Korea | 15.0% |

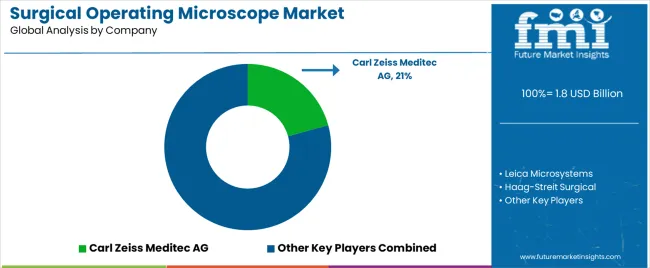

The market is highly competitive, with several players vying for higher market share. Established players in the market have a significant advantage in terms of brand recognition, product portfolio, and distribution network.

These players have been in the market for a long time and have built a reputation for quality and reliability. They have a strong foothold in the market and have established relationships with key stakeholders such as hospitals, clinics, and surgeons.

New entrants, on the other hand, have to compete with established players on multiple fronts. These include pricing, product quality, and innovation. New entrants often rely on disruptive technologies or innovative business models to gain a foothold in the market. They also need to invest heavily in marketing and distribution to create awareness and build a customer base.

Recent Development in the Surgical Operating Microscope Market

The global surgical operating microscope market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the surgical operating microscope market is projected to reach USD 5.5 billion by 2035.

The surgical operating microscope market is expected to grow at a 11.9% CAGR between 2025 and 2035.

The key product types in surgical operating microscope market are tabletop, on casters, wall mounted and ceiling mounted.

In terms of application, ophthalmology segment to command 36.4% share in the surgical operating microscope market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surgical Tourniquet Market Size and Share Forecast Outlook 2025 to 2035

Surgical Heart Valves Market Size and Share Forecast Outlook 2025 to 2035

Surgical Aspirators Market Size and Share Forecast Outlook 2025 to 2035

Surgical Robot Procedures Market Size and Share Forecast Outlook 2025 to 2035

Surgical Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Surgical Retractors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Drainage Devices Market Size and Share Forecast Outlook 2025 to 2035

Surgical Booms Market Insights - Size, Share & Industry Growth 2025 to 2035

Surgical Scissors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Instruments Tracking System Market Growth - Trends & Forecast 2025 to 2035

Surgical Instruments Packaging Market Size, Share & Forecast 2025 to 2035

Surgical Monitors Market Analysis - Industry Insights & Forecast 2025 to 2035

Surgical Scalpels Market Trends – Growth & Forecast 2025-2035

Surgical Generators Market – Trends & Forecast 2025 to 2035

Surgical Gloves Market Trends - Size, Demand & Forecast 2025 to 2035

Surgical Clips Market Analysis - Size, Share & Forecast 2025 to 2035

Surgical Mask Market Insights - Growth & Forecast 2025 to 2035

Surgical Drapes Market Overview - Growth, Demand & Forecast 2025 to 2035

Surgical Stapling Device Market is segmented by product, Usage Type, Stapling Type, Indication and End User from 2025 to 2035

Key Companies & Market Share in the Surgical Scrub Sector

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA