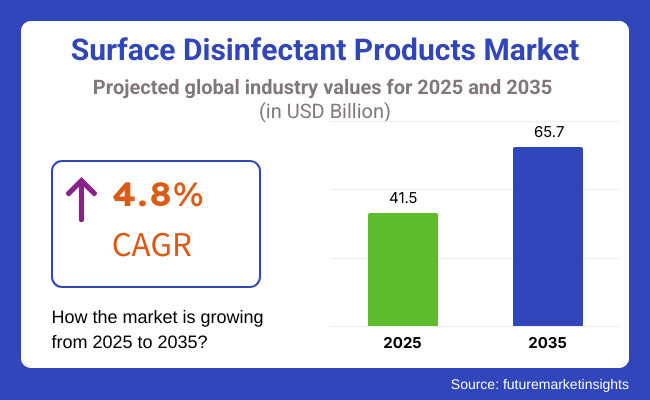

The market for surface disinfectant products is expected to grow steadily throughout the next decade. The market size is estimated to reach USD 41.5 billion by 2025 and is expected to grow further, to USD 65.7 billion by 2035, showcasing a CAGR of 4.8% from 2025 to 2035.

Growing health awareness, stringent sanitation regulations, and rising healthcare concerns are the driving factors for the market in this decade. Across sectors like healthcare, hospitality, and food processing, the demand for surface disinfectants remains uninterrupted.

Innovations in eco-friendly and non-toxic disinfectants are reshaping the market landscape. Consumers prefer sustainable products with effective antimicrobial properties. Also, advancements in biotechnology and nanotechnology will enhance product efficiency.

In 2024, surface disinfectants enjoyed considerable growth, as awareness toward hygiene increased, along with stringent sanitation regulations across various industries.

The surface disinfectant market was estimated to be worth about USD 7.56 billion in 2024, which will grow to USD 16.02 billion by 2034, a 7.9% CAGR. Increased demand in healthcare settings for infection control, coupled with rising awareness about hygiene among consumers in homes and businesses, drove this growth.

Healthcare was the dominant economic sector in the market, ensuring a sterile environment in a bid to prevent hospital-acquired infections. The food and beverage industry also made a significant contribution to demand, as surface disinfectants were very useful in securing food safety.

In 2023, North America led with a 37.4% market share because of the developed healthcare infrastructure and high awareness for consumer hygiene. In contrast, rapid market growth in Asia-Pacific was propelled by urbanization and government support for promoting public health and sanitation.

To address the demand of consumers for sustainability, companies are developing eco-friendly and non-toxic disinfectants. This prompted the introduction of plant-based formulations and alcohol-free alternatives that offered effective antimicrobial properties without harmful consequences to the environment. Increased expenditure on R&D saw innovations in biotechnology and nanotechnology that would boost the efficacy of disinfectants.

A further driver of growth for this market was e-commerce, which increased product accessibility and created an avenue for price competition. The increase in sales through retail chains and online marketplaces could be attributed to bulk procurement from healthcare providers and commercial consumers. Meanwhile, manufacturers and distributors entered strategic partnerships to optimize their supply chains and make sure their products were available across regions.

The disinfectant market experienced rapid growth from 2020 to 2024 due to global health crises which significantly increased global awareness of hygiene practices. Consumers and businesses became increasingly aware of cleanliness, leading to a surge in demand for disinfectant products. Companies quickly ramped up production and provided new ways to satisfy changing needs.

The government agencies and regulatory bodies provided a backdrop by which they kept consistent measures of product effectiveness and safety for their varied players such as hospitals, hotels, and food processors.

Between 2025 to 2035, the market shifts focus on sustainability and technology. Manufacturers invest in eco-friendly formulations and smart disinfectant technologies to meet the need of environmentally conscious consumers. Automation and IoT integration into disinfection processes are likely to revolutionize the industry standards for efficiency and effectiveness.

Smart dispensers, self-sanitizing surfaces, and UV-based disinfectant systems are expected to become common long-term solutions to microbial threats. Increased R&D attention enables the introduction of novel plant-based and biodegradable disinfectants with equal effectiveness levels.

Regulatory bodies have tightened guidelines on chemical formulations, thus forming an obligation on manufactures to produce safe, non-toxic disinfectants. Companies are phasing out harsh chemicals in favor of biodegradable and plant-based alternatives to address complaints regarding the long-term effect of traditional chemicals on the environment.

Consumers prefer products that blend effective performances with sustainability, which is pushing the innovation frontier in green chemistries. Demand for antimicrobial coatings, alcohol-free disinfectants, and long-lasting germ protection continues to grow in popularity and affects product development strategies.

Market growth is increasingly shifting toward developing economies, further bolstered by urbanization and better healthcare infrastructure. Businesses are focusing primarily on localizing the production and distribution of disinfectant to minimize the costs and ensure supply chain resiliency.

The partnerships between global and regional players are speeding up the pace of product accessibility, thus promoting the availability of sophisticated disinfectant solutions.

| Key Drivers | Key Restraints |

|---|---|

| Rising hygiene awareness among consumers | Strict regulatory guidelines on chemical usage |

| Increasing demand from healthcare facilities | Environmental concerns over chemical disinfectants |

| Growth in the food and beverage industry | High costs of eco-friendly and advanced disinfectants |

| Expansion in emerging markets due to urbanization | Market saturation in developed regions |

| Technological advancements in disinfectant solutions | Availability of alternative cleaning methods |

| Government initiatives promoting sanitation | Potential health risks from prolonged exposure |

Manufacturers target different raw materials to fit the evolving demand for the surface disinfectant market. Synthetic disinfectants have a major market share owing to their incredible antimicrobial properties and efficacy against an extremely broad spectrum of pathogens.

They have continued to be the preferred option for health care institutions, industrial sites, and the public where higher-grade disinfection is exigent. However, environmental concerns coupled with a more stringent regulatory environment are compelling alternatives.

Current consumer and industrial trends are leaning toward biobased disinfectants-a natural, non-toxic, and sustainable option. Natural disinfectants made from diatomaceous earth offer effective germ protection while minimizing environmental impact. This shift toward green chemistry and biodegradable formulations has largely driven the research-and-development efforts in this field.

A blended disinfectant that employs both synthetics and biobased ingredients is thought to strike a balance by offering an eco-friendly element to the Industrial-grade disinfectants, while still possessing the high power of the synthetic disinfectants.

As efforts are made to meet the requirements of the regulatory community-and perhaps just as importantly, the market's desires for disinfection solutions that are both sustainable and effective-this industry will see tremendous expansion.

Various product formats are helping to shape the development of the surface disinfectant market. Liquid disinfectants are the most popular formulation since they serve versatile applications.

Liquid formulations remain widely used by hospitals, industrial applications, and households for deep cleaning and large-area disinfection. Additional enhancements to include long-lasting antimicrobial effects and residual chemical properties on these products are being implemented by manufacturers.

There is great demand for wipes because they are easy to use. The demand for disinfectant wipes in workplaces, public transport, and personal use has increased due to their convenience, affordability, and portability. Companies ensure sustainability by making wipes either biodegradable or alcohol-free while producing high efficacy against bacteria and viruses.

Sprays are undergoing formulations that allow for unseen total coverage along the surface. For organizations employing a cleaning service, healthcare facilities, and homes, spray disinfectants are proving very effective towards ensuring easy application rather than wastage through minimal product application.

Manufacturers are now producing longer-lasting antimicrobial sprays that will reduce the need for frequent application.

The B2B portion is experiencing greater development than other distribution channels for surface disinfectants, thanks to broad-scale demand from healthcare establishments, corporations, and institutions. These bulk orders for high-grade disinfectants occur within hospitals, old-age homes, and medical laboratories to ensure appropriate cleanliness and infection prevention.

Other major contributors in expanding this segment include food-processing firms and pharmaceutical industries that conform to very demanding sanitary norms.

The B2C portion is booming under rapid expansion, with increased consumer awareness regarding hygiene and cleanliness. Trade outlets continue to be the major distribution points for household disinfectants, alongside hypermarkets, supermarkets, and convenience stores. Disinfectants for home use are actively being bought by consumers, Driving demand for user-friendly and eco-friendly products significantly.

Online retail platforms are a great driving force for market growth, by providing customers with options of tender products to pick from, competitive prices and timely deliveries.

The market head of E-commerce mode is forcing a change into the purchase behavior of the customers as many brands are adopting a digital-first model to popularize accessibility. Subscription-based marketing models stand to enhance direct-to-consumer marketing in the online segment.

The global surface disinfectant market is projected to attain substantial growth between 2025 and 2035, with increasing awareness of hygiene and stricter sanitation regulations taking effect in numerous regions.

North America: The global surface disinfectant products market is expected to grow at a CAGR of 4.8% from 2025 to 2035, reaching USD 65.7 billion by 2035. However, in North America, the market is projected to grow at a slightly higher CAGR of 5.2%, driven by increased healthcare spending, stricter sanitation regulations, and product innovations.

This growth could be traced to the heightened healthcare expenditure, rising incidence of nosocomial infections, and insistence on cleanliness, both in public and private sectors. The presence of key players in the industry further boosts market growth in the area, coupled with continuous product innovations.

Latin America: The surface disinfectant market in Latin America is expected to grow on a solid note due to the betterment of healthcare infrastructure coupled with growing awareness of hygiene procedures. Government efforts geared towards curbing infectious diseases along with the growth of the healthcare sector led to increasing demand for disinfectant products.

Countries like Brazil and Mexico are expected to power this growth as these governments focus on improving sanitation in public places and medical facilities.

Western Europe: The surface disinfectants market is expected to grow considerably in Western Europe with stringent regulatory standards and proactive measures toward controlling infection. The demand for disinfectants will continue to be primarily influenced by the demand for household disinfectants by the consumer and the sterilization of equipment.

Countries such as Germany, France, and the United Kingdom are at the forefront of applying strong hygiene measures across their industries.

Eastern Europe: In Eastern Europe, projections for the surface disinfectants market anticipated expansion as countries upgrade their sanitation and modernize their health care systems. Economic development and people being more aware of public health would entail the growing demand for disinfectant products. Modifications to remain congruent with the EU health standards could impact on the growth of the market in this region.

South Asia and Pacific: The South Asia and Pacific region will represent a budding surface disinfectant market as a result of urbanization, population density, and increased recognition of infectious diseases.

Countries such as India and Australia are putting money into healthcare infrastructure improvements and hygiene campaigns, which are expected to increase consumption of disinfectants. Growth in the hospitality industry and transportation infrastructure further supports the pressing need for surface disinfection solutions.

In 2024, reputed players from 3M, Procter & Gamble, and Ecolab expanded the surface disinfectant market through product innovations and partnerships to increase their market growth in this market. Procter & Gamble has launched the Microban 24 line of antibacterial cleaners to provide 24-hour bacteria protection.

This was done to meet increasing consumer demand for longer lasting and effective disinfectant solutions. Ecolab also extended its product range by adding several advanced technologies such as UV systems to offer comprehensive disinfection solutions to healthcare and commercial facilities.

By 2024, new startups focused on green and technologically advanced disinfection products to cater to environmentally conscious consumers. Nanova Care Coat, for example, introduced a self-disinfecting nanocoating of multi-purpose use relevant to HVAC systems and household surfaces.

These innovations will provide long-lasting antimicrobial protection reducing the frequency of cleaning and chemical usage. Other startups Smart Sanitizing Solutions brought the automatic room sanitizers into play by utilizing hypochlorous acid misting systems to disinfect harmful pathogens living in indoor spaces, including gyms, schools, and hospitals.

Both established companies and startups recognized the importance of sustainability and ease of use in 2024. This fueled the growth of products containing biodegradable ingredients and smart dispensing systems. It paved the way for the establishment of numerous new innovations such as automated disinfection robots and IoT-based devices seeking to meet the expectations of consumers and businesses about hygiene standards.

Demand is fueled mainly by increasing awareness about hygiene, rising nosocomial infections, and stricter legislative regulations.

Majorly, the end-use segments include healthcare, food processing industry, hospitality, and residential.

Leading companies are developing eco-friendly formulations, long-lasting antimicrobial coatings, and smart dispensing systems meant to enhance efficiency.

Some of the major challenges include fluctuation in raw material costs, regulatory compliance, and issues concerning the environmental respectability of chemical disinfectants.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Raw Material, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Raw Material, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Raw Material, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ million) Forecast by Raw Material, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 29: Western Europe Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 31: Western Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ million) Forecast by Raw Material, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ million) Forecast by Raw Material, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ million) Forecast by Raw Material, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 53: East Asia Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 55: East Asia Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ million) Forecast by Raw Material, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Raw Material, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Product, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Raw Material, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Raw Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Product, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ million) by Raw Material, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Product, 2023 to 2033

Figure 27: North America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ million) Analysis by Raw Material, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 41: North America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Raw Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Product, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ million) by Raw Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by Product, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ million) Analysis by Raw Material, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Raw Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ million) by Raw Material, 2023 to 2033

Figure 74: Western Europe Market Value (US$ million) by Product, 2023 to 2033

Figure 75: Western Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ million) Analysis by Raw Material, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 85: Western Europe Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 89: Western Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Raw Material, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ million) by Raw Material, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ million) by Product, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ million) Analysis by Raw Material, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Raw Material, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ million) by Raw Material, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ million) by Product, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ million) Analysis by Raw Material, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Raw Material, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ million) by Raw Material, 2023 to 2033

Figure 146: East Asia Market Value (US$ million) by Product, 2023 to 2033

Figure 147: East Asia Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ million) Analysis by Raw Material, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 157: East Asia Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 161: East Asia Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Raw Material, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ million) by Raw Material, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ million) by Product, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ million) Analysis by Raw Material, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Raw Material, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surface printed Film Market Size and Share Forecast Outlook 2025 to 2035

Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounting Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounted Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Market Size and Share Forecast Outlook 2025 to 2035

Surface Mount Technology Market Size and Share Forecast Outlook 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Film Market Trends, Growth, and Share Analysis from 2025 to 2035

Competitive Overview of Surface Printed Film Companies

Surface Water Sports Equipment Market Growth – Size, Trends & Forecast 2024-2034

Surface Plasmon Resonance System Market Analysis – Growth & Forecast 2024-2034

Surface Protection Services Market Growth – Trends & Forecast 2024-2034

Surface Measurement Equipment And Tools Market

Surface Drilling Rigs Market

Surface Disinfectant Chemicals Market Growth & Demand 2025 to 2035

Surface Disinfectant Market is segmented by product type, form and end user from 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Hard Surface Flooring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA