The supply chain analytics market is undergoing rapid evolution, driven by heightened demand for operational visibility, cost optimization, and data-driven decision-making across industries. Digital transformation initiatives, accelerated by post-pandemic supply disruptions, have led enterprises to adopt advanced analytics to mitigate risks and enhance real-time responsiveness.

Industry press releases and investor briefings from global software vendors have emphasized increasing investments in cloud-native analytics platforms, predictive modeling, and AI-powered optimization tools tailored for supply chain operations. Additionally, manufacturers and retailers are prioritizing end-to-end traceability and scenario planning to navigate global uncertainties, including geopolitical shifts and raw material shortages.

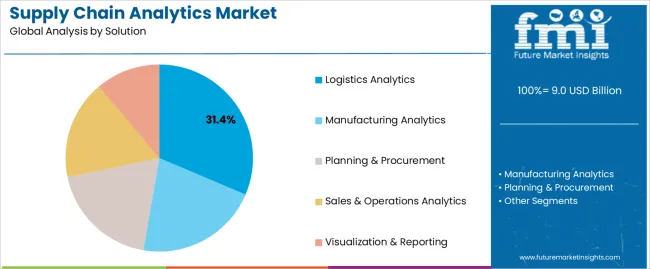

With growing regulatory pressures around sustainability and compliance, analytics solutions that enable carbon tracking and responsible sourcing are gaining prominence. The market outlook remains positive, with long-term growth supported by integration of IoT, blockchain, and machine learning in supply chain workflows. Segmental dominance is being observed in Logistics Analytics, Professional Services, and Large Enterprises, reflecting where technology readiness and operational complexity are driving the highest adoption rates.

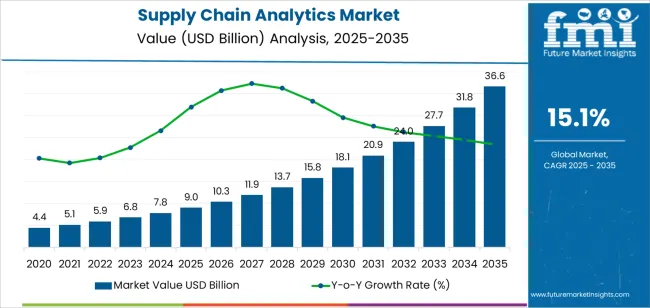

| Metric | Value |

|---|---|

| Supply Chain Analytics Market Estimated Value in (2025 E) | USD 9.0 billion |

| Supply Chain Analytics Market Forecast Value in (2035 F) | USD 36.6 billion |

| Forecast CAGR (2025 to 2035) | 15.1% |

The market is segmented by Solution, Service, Enterprise Type, End Use Industry, and Deployment and region. By Solution, the market is divided into Logistics Analytics, Manufacturing Analytics, Planning & Procurement, Sales & Operations Analytics, and Visualization & Reporting. In terms of Service, the market is classified into Professional and Support & Maintenance. Based on Enterprise Type, the market is segmented into Large Enterprises and SMEs. By End Use Industry, the market is divided into Retail & E-commerce Industry, Healthcare Industry, Transportation & Logistics Industry, Automotive Industry, Manufacturing Industry, Oil & Gas Industry, Chemical Industry, and Others. By Deployment, the market is segmented into Cloud-Based and On-Premise. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Logistics Analytics segment is projected to account for 31.4% of the supply chain analytics market revenue in 2025, making it the leading solution category. This dominance has been shaped by the growing complexity of transportation networks and rising demand for real-time visibility into shipment flows.

Organizations have prioritized logistics analytics to reduce lead times, optimize routing, and improve last-mile delivery performance. Industry publications and company announcements have highlighted investments in fleet management systems, route optimization software, and warehouse automation as key contributors to this segment’s expansion.

Additionally, disruptions caused by global events have underscored the importance of predictive analytics in managing delivery risks and identifying cost-saving opportunities. As cross-border commerce and e-commerce volumes continue to grow, logistics analytics is expected to remain critical for businesses seeking resilience, efficiency, and agility in their distribution strategies.

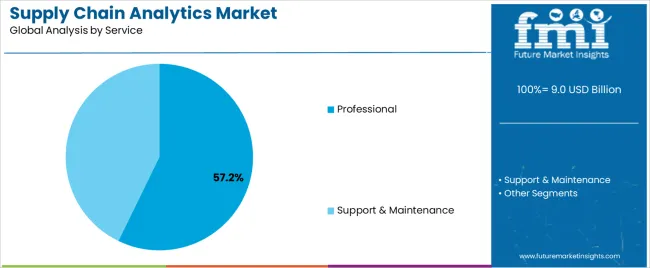

The Professional Services segment is projected to contribute 57.2% of the supply chain analytics market revenue in 2025, maintaining its position as the dominant service category. Growth in this segment has been fueled by the need for customized implementation, integration, and strategic consulting services to support analytics platform adoption.

Enterprises have increasingly relied on professional services to bridge the skills gap in advanced analytics and to ensure seamless alignment with existing enterprise systems. Service providers have offered tailored solutions including data cleansing, dashboard creation, machine learning model development, and supply chain transformation roadmaps.

Analyst briefings and corporate service portfolios have emphasized the role of professional services in accelerating digital maturity and ROI realization. As supply chains grow more complex and globalized, the demand for expert-led deployments and change management support is expected to sustain the prominence of the Professional Services segment.

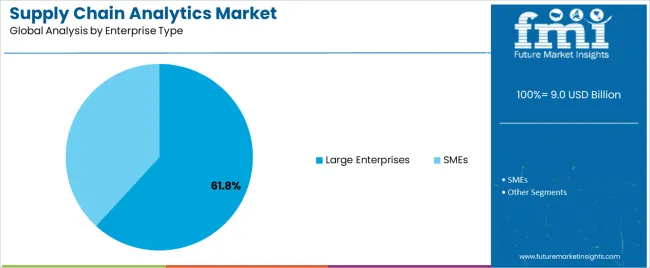

The Large Enterprises segment is expected to hold 61.8% of the supply chain analytics market revenue in 2025, positioning it as the leading adopter group. Growth of this segment has been driven by the scale and intricacy of operations across multinational corporations, which require advanced analytical capabilities to manage diverse supplier bases, multimodal logistics, and dynamic customer demand.

Internal reports and IT spending disclosures from large enterprises have shown increased budget allocations toward data infrastructure modernization, cloud-based analytics platforms, and predictive demand planning. These organizations have also been early adopters of digital twins and AI-powered supply chain control towers to enhance scenario modeling and decision-making.

Moreover, compliance with global regulatory frameworks and ESG commitments has necessitated the use of supply chain analytics for transparency and sustainability tracking. With greater financial and technical resources to support enterprise-grade analytics deployments, large enterprises are expected to continue driving the majority of market demand.

Despite the promising growth, several restraining factors impact the supply chain analytics market. One significant challenge is the high cost of implementing advanced analytics solutions. The initial investment in software, hardware, and skilled personnel can be prohibitive for small and medium-sized enterprises (SMEs), limiting widespread adoption. Additionally, integrating SCA solutions with existing legacy systems poses technical difficulties, requiring substantial time and resources for seamless integration and data migration.

Data privacy and security concerns also hinder market growth. As SCA involves handling vast amounts of sensitive information, companies are wary of potential data breaches and cyber-attacks, which could lead to financial losses and reputational damage. Compliance with stringent regulatory requirements regarding data protection further complicates the deployment of these solutions.

Another restraining factor is the lack of skilled professionals capable of managing and interpreting complex analytical tools. The shortage of data scientists and supply chain analysts creates a bottleneck, preventing companies from fully leveraging the benefits of SCA technologies.

Lastly, resistance to change within organizations can impede the adoption of new technologies. Many businesses remain hesitant to overhaul their traditional supply chain management practices, preferring familiar, albeit less efficient, methods over innovative analytics solutions. This cultural inertia slows the pace of market penetration for advanced SCA tools.

Adoption of AI and Machine Learning and Focus on Sustainability

AI and ML are revolutionizing supply chain analytics by enabling predictive insights and automation. Companies are increasingly leveraging these technologies to forecast demand, optimize inventory, and streamline logistics, resulting in improved efficiency and reduced costs.

Sustainability is becoming a critical focus area, with companies utilizing analytics to optimize routes, reduce waste, and lower carbon footprints. SCA solutions help businesses align with environmental regulations and consumer expectations for sustainable practices.

Real-Time Data and IoT Integration and Cloud-Based Solutions

The integration of IoT with supply chain analytics is providing unprecedented real-time visibility into operations. IoT devices collect data on asset conditions, locations, and movements, allowing companies to monitor and react to supply chain events instantly, thus enhancing responsiveness and decision-making.

The shift towards cloud-based SCA solutions is gaining momentum due to their scalability, flexibility, and lower upfront costs. These solutions facilitate seamless data integration from various sources, enabling comprehensive analytics and fostering collaboration across the supply chain network.

Customization and Industry-Specific Solutions

There is a growing demand for tailored analytics solutions that address specific industry challenges. Vendors are developing specialized tools that cater to the unique needs of sectors such as retail, manufacturing, and healthcare, enhancing the relevance and impact of SCA implementations. These trends are collectively enhancing the capabilities of supply chain analytics, making it an indispensable tool for modern supply chain management.

Investors have strategic opportunities in the supply chain analytics market by focusing on companies developing AI and ML-driven analytics solutions, which are crucial for predictive insights and automation. Investing in IoT and real-time data integration technologies offers potential, as these enhance supply chain visibility and responsiveness.

Additionally, supporting cloud-based SCA platforms can be lucrative due to their scalability and growing adoption across industries. There's also a promising opportunity in sustainable supply chain analytics solutions, aligning with global sustainability trends. Lastly, funding niche startups offering industry-specific SCA tools can yield significant returns, given their tailored market appeal and specialized capabilities.

The United States is at the forefront of the supply chain analytics market expansion, driven by its robust technological ecosystem and high adoption rates of advanced analytics. Major corporations like IBM, Oracle, and SAS Institute are spearheading innovations in AI and machine learning applications for supply chain optimization. The presence of leading retail, manufacturing, and logistics companies further fuels the demand for sophisticated SCA solutions, making the USA a critical hub for supply chain innovation and investment.

China is rapidly advancing in the supply chain analytics market, leveraging its extensive manufacturing base and increasing e-commerce activities. Chinese tech giants such as Alibaba and Huawei are investing heavily in AI, IoT, and big data technologies to enhance supply chain efficiencies. The Chinese government's initiatives to modernize industry practices and improve digital infrastructure are also propelling the growth of SCA solutions. This focus on technological advancement positions China as a significant player in the global SCA landscape.

Germany is emerging as a key player in the supply chain analytics market, particularly within Europe. Known for its engineering and manufacturing prowess, Germany is adopting advanced SCA solutions to maintain its competitive edge in industries like automotive, machinery, and chemicals. Companies such as SAP SE are leading the way with innovative analytics platforms. Additionally, Germany's strong emphasis on Industry 4.0 and digital transformation initiatives supports the integration of cutting-edge supply chain analytics, solidifying its role in the market's growth.

Logistics analytics is paramount in the supply chain analytics market due to its ability to optimize transportation routes, warehouse management, and inventory tracking. In today's competitive landscape, efficient logistics operations are essential for timely delivery, cost reduction, and maintaining customer satisfaction, driving the demand for advanced analytics solutions.

The retail and e-commerce industry leads in supply chain analytics due to its complex and dynamic supply chains, necessitating real-time insights for inventory management, demand forecasting, and order fulfillment. With fierce competition and customer expectations for fast delivery, retailers heavily rely on analytics to optimize operations and enhance customer satisfaction.

Manufacturers are investing in advanced analytics tools to optimize production, inventory management, and distribution networks. They're leveraging predictive analytics to forecast demand accurately, minimize stockouts, and streamline supply chain operations. Additionally, partnerships with tech firms facilitate the integration of IoT and AI technologies for enhanced visibility and efficiency.

Industry Updates

Based on solution, the industry is categorized into logistics analytics, manufacturing analytics, planning and procurement, sales and operations analytics, visualization, and reporting.

Professional and support and maintenance are two services categorized in the supply chain analytics industry.

SMEs and large enterprises are bifurcated segments of the enterprise type of the sector.

The sector is applicable to healthcare, retail and e-commerce, transportation and logistics, automotive, manufacturing, oil and gas, chemical, and other industries.

On-premise and cloud-based are two segment categories of deployment in this industry.

A regional analysis has been conducted across key countries of North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

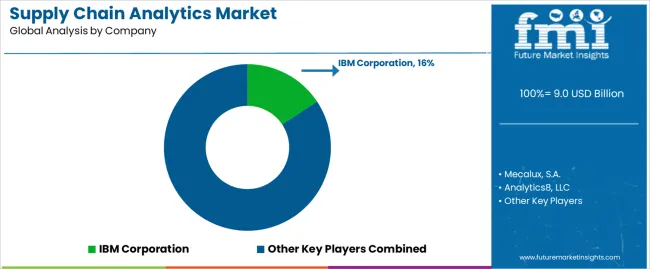

The global supply chain analytics market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the supply chain analytics market is projected to reach USD 36.6 billion by 2035.

The supply chain analytics market is expected to grow at a 15.1% CAGR between 2025 and 2035.

The key product types in supply chain analytics market are logistics analytics, manufacturing analytics, planning & procurement, sales & operations analytics and visualization & reporting.

In terms of service, professional segment to command 57.2% share in the supply chain analytics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Supply Chain Management Market Size and Share Forecast Outlook 2025 to 2035

Supply Chain Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Supply Chain Management BPO Market Analysis 2025 to 2035 by Outsourcing Model, Application, Service Type, Enterprise Size & Region

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Office Supply Market Forecast and Outlook 2025 to 2035

IoT in Supply Chain Market Insights – Trends, Growth & Forecast 2023-2033

Shipping Supply Market Size and Share Forecast Outlook 2025 to 2035

DC Power Supply Module Market – Powering IoT & Electronics

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Supply Chain Market Forecast Outlook 2025 to 2035

Commodity Supply Chain Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Aviation Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Sulphate Supply Market-Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Digital Transformation in Supply Chain Market

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PVC-M High Impact Resistant Water Supply Pipe Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Direct Current Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA