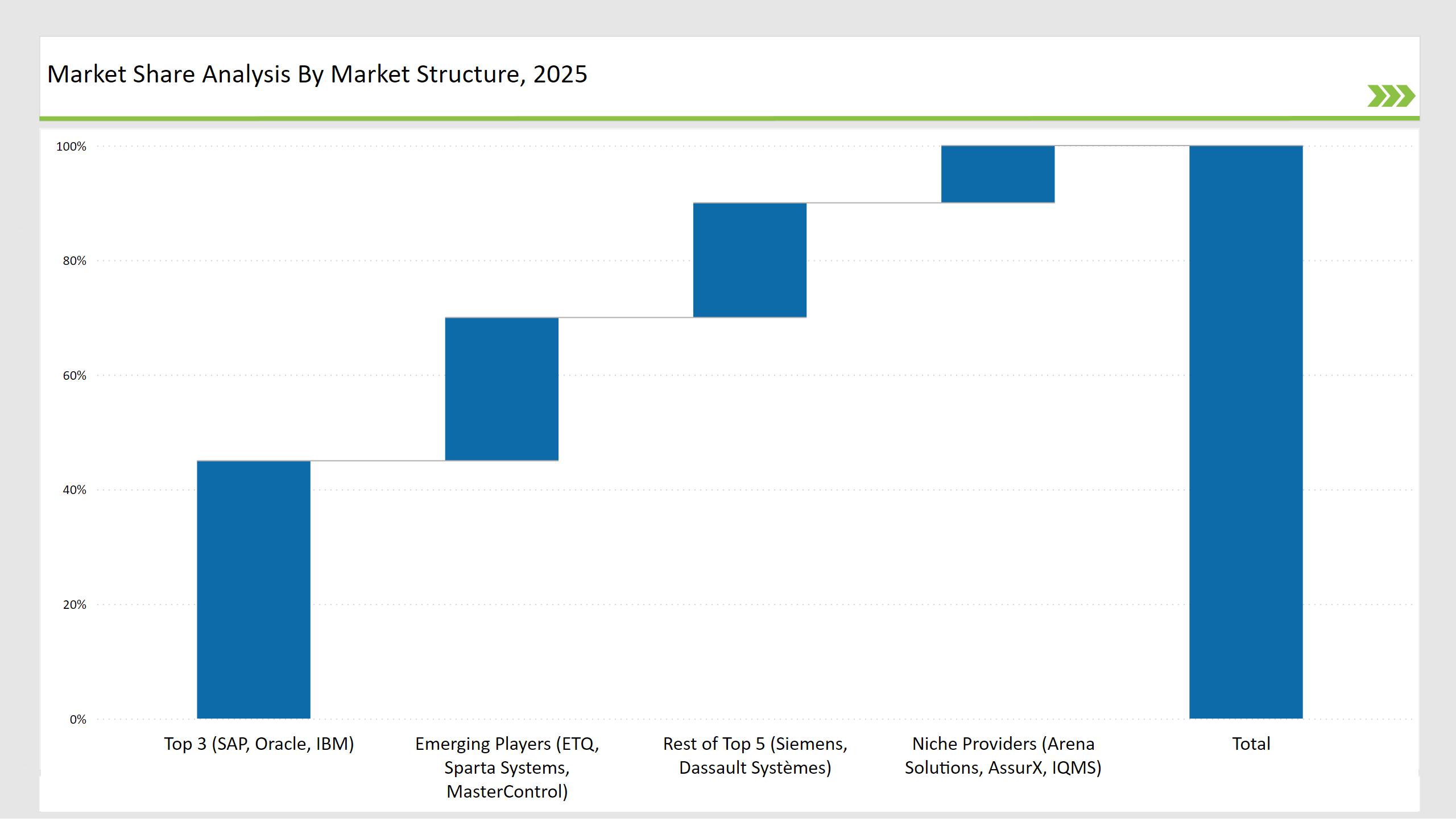

The Supplier Quality Management (SQM) Applications market is growing rapidly as organizations adopt digital solutions to streamline supplier audits, compliance, and risk management. Top 3 vendors-SAP, Oracle, and IBM-control 45% of the market, offering AI-driven analytics and automated compliance monitoring to ensure supplier reliability.

The rest of the top 5, Siemens and Dassault Systèmes, hold 20%, focusing on cloud-based supply chain visibility and predictive analytics. Emerging players such as ETQ, Sparta Systems, and MasterControl account for 25%, excelling in supply chain transparency and real-time risk mitigation.

Niche providers, including Arena Solutions, AssurX, and IQMS, capture 10%, addressing specialized needs in quality documentation and compliance automation. Enterprises prioritize quality assurance, compliance, and operational resilience, which drives the market's growth at a 12.8% CAGR, reaching USD 7.5 billion by 2035.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 7.5 billion |

| CAGR (2025 to 2035) | 12.8% |

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

| Category | Industry Share (%) |

|---|---|

| Top 3 (SAP, Oracle, IBM) | 45% |

| Rest of Top 5 (Siemens, Dassault Systèmes) | 20% |

| Emerging Players (ETQ, Sparta Systems, MasterControl) | 25% |

| Niche Providers (Arena Solutions, AssurX, IQMS) | 10% |

| Market Concentration | Assessment |

|---|---|

| High (> 60% by top 10 players) | Medium |

| Medium (40-60%) | High |

| Low (< 40%) | Low |

The Supplier Audit & Compliance Software segment dominates the market with a 35% share, driven by growing regulatory demands and the need for effective risk management. SAP and Oracle lead this segment by delivering AI-powered compliance tracking solutions that automate audits, detect risks, and streamline corrective actions.

These solutions help firms improve transparency, reduce compliance costs, and avoid disruptions from suppliers. As supply chains become increasingly complex, companies implement AI-driven compliance tools to enhance regulatory compliance and strengthen supplier relationships, driving this segment's rapid growth.

The manufacturing sector leads the market with a 40% share, as companies like SAP, Siemens Digital Industries, and IBM Watson Quality Management drive improvements in product quality, supplier audits, and defect reduction. SAP enhances AI-powered predictive quality control, enabling manufacturers to prevent defects and optimize processes.

Siemens strengthens IoT-driven supplier monitoring to boost manufacturing efficiency, while IBM Watson advances predictive analytics for supplier risk assessment, helping businesses detect risks early and streamline compliance.

These vendors empower manufacturers to track supplier performance in real time and automate risk management. As competition intensifies, companies invest in smart technologies to optimize operations.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

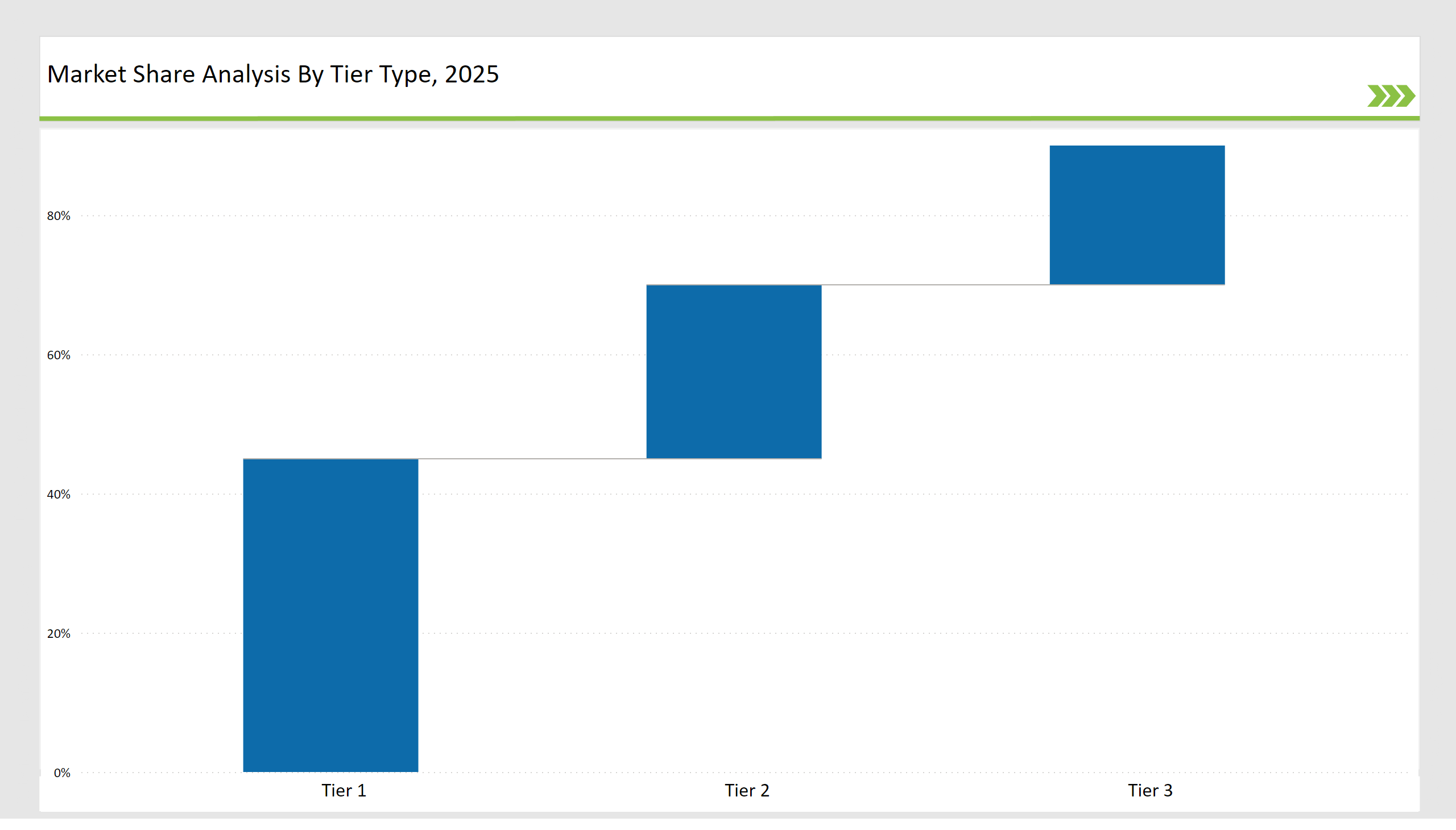

| Tier | Tier 1 |

|---|---|

| Vendors | SAP, Oracle, IBM, Siemens |

| Consolidated Market Share (%) | 45% |

| Tier | Tier 2 |

|---|---|

| Vendors | Dassault Systèmes, ETQ, Sparta Systems |

| Consolidated Market Share (%) | 25% |

| Tier | Tier 3 |

|---|---|

| Vendors | Arena Solutions, AssurX, MasterControl, IQMS |

| Consolidated Market Share (%) | 20% |

| Vendor | Key Focus |

|---|---|

| SAP | Advances AI-powered predictive supplier quality control and compliance automation. |

| Oracle | Strengthens risk mitigation with AI-driven audit tracking. |

| IBM | Enhances predictive analytics for supplier risk assessment. |

| Siemens | Develops IoT-driven supplier quality monitoring. |

| ETQ | Expands cloud-based supplier corrective action tracking. |

| Dassault Systèmes | Integrates PLM & supplier quality management. |

Vendors must refine AI algorithms to enhance supplier quality prediction, enabling businesses to identify risks proactively and maintain compliance. With the power of machine learning and real-time analytics, they will be able to predict accuracy better with a chance to prevent defects from occurring in production.

Automating supplier assessments and integrating blockchain-enabled traceability solutions will streamline audits, reduce inefficiencies, and minimize manual interventions. Strengthening AI-powered insights will also help businesses optimize risk management workflows and mitigate supply chain disruptions.

Expanding into emerging markets offers vast growth opportunities with industrialization and regulatory enforcement increasing the demand for supplier audit and compliance solutions. Suppliers need to make their platforms compliant with region-specific compliance requirements and multilingual capabilities to push adoption.

The efficiency of the global supply chain will improve through AI-driven communication tools and blockchain-backed transparency while enhancing supplier collaboration.

Scalability based on cloud will be an imperative for vendors in order to reach out to the businesses of any size with scalable and cost-effective solutions. A stronger partnership with ERP and PLM providers as well as the regulatory agencies will enable vendors to offer end-to-end compliance solutions.

Such partnerships will integrate data, simplify the management of compliance, and reinforce vendors' competitive edge in an increasingly dynamic market.

Leading vendors SAP, Oracle, IBM, and Siemens hold 45% of the market.

Emerging players ETQ, Sparta Systems, and MasterControl hold 25% of the market.

Niche providers Arena Solutions, AssurX, and IQMS hold 10% of the market.

The top 5 vendors (SAP, Oracle, IBM, Siemens, and Dassault Systèmes) control 65% of the market.

Market concentration in 2025 is categorized as medium, with the top 10 players controlling 60-70% of the market.

Explore Vertical Solution Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.