Sun control film market is reported to be growing with growing demand for energy-saving, UV-blocking, and heat-rejection window solutions. The automotive industry and consumers are investing in sun control films for car, home, and commercial applications to boost thermal comfort, reduce energy consumption, and shield interiors.

Thanks to nanotechnology, advanced smart tinting technology, and ceramic finishes, producers are creating high-performance sun control films with increased heat rejection and UV protection while retaining visibility.

Increasing 'green' efforts are being accompanied by moving towards the production of such environment-friendly, multilayer, digitally tunable films in accordance with sustainability objectives and regulatory demands. The technological shift towards smart window films, self-healing coatings, and anti-glare solutions assisted in durability as well as efficiency.

Premium players such as 3M, Eastman Chemical Company, and Saint-Gobain dominated a market share of approximately 39% on the basis of their expertise in advanced materials, extensive reach globally, and continuous research and development in sun protection technology.

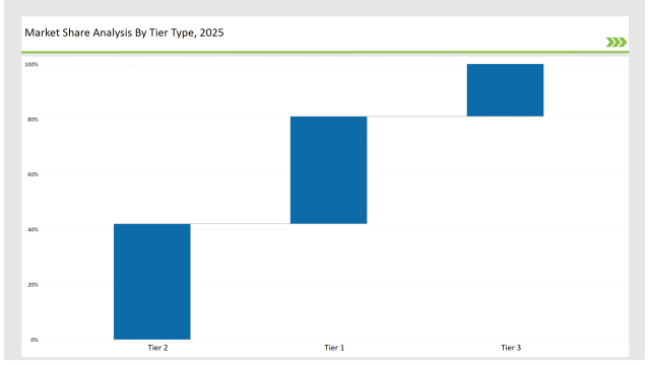

Tier 2 players like Madico, Solar Gard (Saint-Gobain), and Avery Dennison are gaining up to 42% of market share with affordable and high-performance automotive, architectural, and industrial sun control films.

Tier 3 includes regional and niche players with emphasis on decorative window films, energy-efficient coatings, and electronically controlled tinting solutions, accounting for 19% of the market.. The firms are pinning their hopes on local production, cutting-edge technology, and tailored solar protection solutions.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (3M, Eastman Chemical Company, Saint-Gobain) | 19% |

| Rest of Top 5 (Madico, Solar Gard) | 12% |

| Next 5 of Top 10 (Avery Dennison, Garware Polyester, Llumar, Johnson Window Films, Hanita Coatings) | 8% |

The sun control films industry serves multiple sectors where energy savings, UV protection, and heat control are critical. Companies are designing high-performance films that improve efficiency, safety, and comfort across different industries.

Manufacturers are optimizing sun control films with smart tinting technology, UV-blocking coatings, and durable multilayer films.

From a manufacturing perspective, businesses have started incorporating AI methods, multi-layer infrared coatings, and digital tinting technology to enhance film performance. These technologies bring together energy efficiency and sustainability to elevate decisions towards the sun control films business. Ultra-thin, long-durability films are being developed by businesses, considering optical clarity while ensuring maximum UV protection. Remote tinting feature and self-healing coatings are some of the popular porous provided by manufacturers under smart window film features. AI is increasingly being employed to further refine production with quality control intended to provide consistent film performance and durability properties.

Year-on-Year Leaders

Solar control films, with their constant evolution, require their technology vendors to lay emphasis on automation, sustainable film production, and AI-driven quality control. This will further enhance adoption and innovation in the domains of automotive, commercial, and defense.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | 3M, Eastman Chemical Company, Saint-Gobain |

| Tier 2 | Madico, Solar Gard, Avery Dennison |

| Tier 3 | Garware Polyester, Llumar, Johnson Window Films, Hanita Coatings |

Leading manufacturers are advancing sun control film technology with AI-driven manufacturing, smart tinting solutions, and energy-efficient coatings.

| Manufacturer | Latest Developments |

|---|---|

| 3M | Launched smart, energy-saving window films in March 2024. |

| Eastman Chemical | Developed advanced infrared-blocking sun control films in April 2024. |

| Saint-Gobain | Expanded multi-layered solar films for residential applications in May 2024. |

| Madico | Released anti-glare and scratch-resistant films in June 2024. |

| Solar Gard | Strengthened security-focused sun control films in July 2024. |

| Avery Dennison | Introduced decorative and privacy-enhancing window films in August 2024. |

| Garware Polyester | Pioneered affordable, high-performance automotive films in September 2024. |

The sun control film market is evolving as companies invest in smart window technology, sustainable materials, and high-performance infrared coatings.

The industry will continue integrating AI-driven automation, sustainable materials, and smart tinting technology. Manufacturers will refine infrared-blocking films to improve energy efficiency. Businesses will adopt fully recyclable sun control films to align with circular economy goals. Companies will develop self-tinting and temperature-sensitive films for better user experience. Smart labeling and digital authentication will enhance security and brand protection. Additionally, firms will optimize lightweight, high-performance coatings to maximize UV protection and durability.

Leading players include 3M, Eastman Chemical, Saint-Gobain, Madico, Solar Gard, Avery Dennison, and Garware Polyester.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 39%.

Key drivers include energy efficiency, smart tinting technology, UV protection, and sustainability.

Disposable Tea Flask Market Trends – Growth & Forecast 2025 to 2035

Disposable Lids Market Analysis – Growth & Forecast 2025 to 2035

Stretch Blow Molding Machines Market Segmentation based on Technology Type, Orientation Type, End Use, and Region: A Forecast for 2025 and 2035

Cup Carriers Market Insights - Growth & Forecast 2025 to 2035

Custom Boxes Market Trends – Growth & Forecast 2025-2035

Degassing Valves Market Analysis - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.