The sulphur recovery technology market globally is anticipated to grow at a steady CAGR over the next decade, as stringent environmental regulations, increasing industrialization, and growing demand from the oil and gas refineries remain the key drivers. Sulphur recovery technologies are important for reducing harmful emissions from hydrogen sulphide. However, the implementation of such technologies is a must for industries that can no longer get away with becoming nonetheless in the face of tightening environmental standards across the globe.

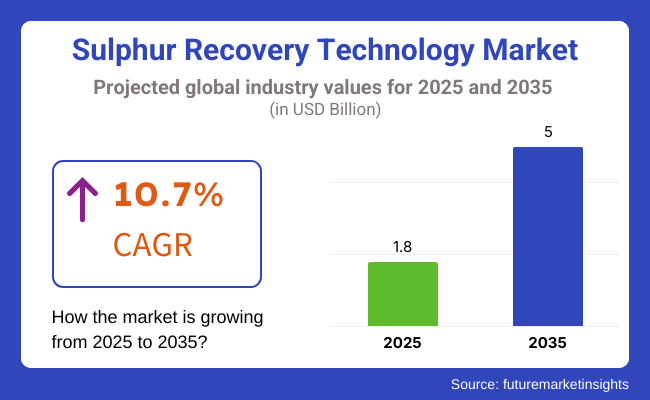

In 2025, the sulphur recovery technology market had a size of approximately USD 1.8 Billion and is expected to grow significantly to USD 5.0 Billion by 2035. This corresponds to a CAGR of 10.7%, supported by the continued development of Claus process technology, growing global energy demand, and the increasing importance of the sour gas processing facility. As refining and petrochemicals among several industrial sectors grow, so will the need for effective sulphur recovery solutions that are a significantly growing and needed market.

New technologies being developed including advanced Claus reactors, tail gas treatment units, and oxygen enrichment systems are facilitating more efficient sulphur recovery processes, working with innovation to reduce emissions and operational expenditure. As governments across the world adopt stricter measures for sulphur dioxide emissions, high-efficiency sulphur recovery units (SRUs) are anticipated to be standard practice in high-sulphur feedstock’s process industries.

The market is seeing steady growth with a 10.7% CAGR, as industries continue to implement sulphur recovery technology to meet increasingly stringent environmental regulations. Advanced sulphur recovery systems will, therefore, play an important role not just in ensuring compliance with regulations, but also in maximizing operational performance and minimizing environmental footprint.

Explore FMI!

Book a free demo

Demand for sulphur recovery technology is growing in North America due to strict environmental legislation in the US and Canada. Due to the region's mature oil and gas industry and both legislative requirements as part of, among other things, the Clean Air Act, the demand for state-of-the-art sulphur recovery has continued to grow. In order to comply with strict sulphur dioxide emissions limit state-of-the-art Claus units and tail gas treatment technologies are being installed at refineries and gas processing facilities.

Aside from oil & gas industry, sulphur recovery technologies adoption is also being witnessed for applications in multiple chemical production & fertilizer manufacturing in North America. Against the backdrop of an energy transition underway in the region, strong sulphur recovery systems will be important to maintain its environmental and regulatory compliance obligations.

The market for sulphur recovery technology in Europe benefits from the strong environmental policies and developed industrial infrastructure in the region. Germany, Netherlands and the UK are world leaders in adoption of the best available techniques on emissions control, resulting in deploying high-efficiency sulphur recovery units in refineries and gas treatment plants. Tighter sulphur limits in the European Union’s Industrial Emissions Directive and other regional standards have spurred demand for enhanced recovery systems.

Their market is also being impacted by the growing presence of renewable and low-carbon energy initiatives. Besides traditional refining operations, the implementation of sulphur recovery technology in new biofuels and hydrogen generations are expected to continue consolidating Europe’s market stance. With ongoing progress towards sustainability goals to drive industry practices, Europe’s need for dependable, efficient sulphur recovery solutions is set to steadily.

The sulphur recovery technology market in the Asia-Pacific region is expected to grow at the highest CAGR due to rapidly industrializing economies, increasing oil and gas processing capacities, and stringent regulations regarding emissions reduction. In addition, countries like China, India and nations within Southeast Asia are allotting considerable funds towards developing/upgrading their gas processing and refining plants, creating lucrative prospects for high-end sulphur recovery systems.

Key drivers for the uptake of high-capacity sulphur recovery units include China’s strong petrochemical industry and India’s growing energy demand. Faced with increasingly stringent national and regional emission limits and environmental standards, industries are leveraging state-of-the-art Claus processes, tail gas treatment technologies and integrated monitoring solutions to help ensure compliance while maintaining efficient operations. The Asia-Pacific market will see significant growth as the region undergoes more industrial and economic growth yet focusing on sustainable development.

Challenges

Increased Compliance Expenses and Complicated Recovery Procedures

The sulphur recovery technology market grapples with challenges like strict environmental laws, increasing compliance costs, and complex recovery processes. As governments across the globe have implemented stringent emission control legislation to limit sulphur dioxide (SO₂) emissions from refineries, gas processing plants and the petrochemical industries, such legislations have made it mandatory for companies to adopt state-of-the-art sulphur recovery technology.

Nevertheless, the significant cost of installing and maintaining these systems, as well as the technical issues related to treating feedstock’s with differing sulphur concentrations, are expected to limit market growth. To address these problems companies should use low-cost recovery options and improve process automation with modular systems that can dynamically adjust to changing operational environments. Adoption of predictive maintenance strategies and enhancing the efficiency of the catalyst will lead to further optimization in sulphur recovery process along with an increase in operating cost.

Opportunity

Growing Clean Energy Projects and Sustainable Industrial Practices

Increasing focus towards clean-energy initiatives & sustainability will drive the Sulphur Recovery Technology Market which in turn will offer wide opportunities. As industries progressively shift towards green operations, a demand for efficient sulphur recovery units (SRUs) is rising to comply with regulatory mandates and reduce carbon footprints. Improvements in sulphur recovery, including multi-stage Claus process technology, oxygen enrichment, and tail gas treatment units (TGTUs), are increasing efficiency, with minimum emissions.

Moreover, the real-time gas analytics is increasingly adopted with AI based monitoring to enhance process control and safety in sulphur recovery plants. Investments in advanced recovery technologies, circular economy business models, and green operational policies will present a competitive edge in an ever more regulation-fuelled marketplace.

The period from 2020 to 2024 saw the Sulphur Recovery Technology Market grow as stricter emission regulations and a demand for cleaner industrial processes pushed this technology into more and more production lines. The sulphur recovery capacity was enlarged by oil refineries, gas processing plants and chemical manufacturers to comply with environmental regulations of the respective government authorities leading to wider acceptance of advanced Claus and sub-dew point processes.

Nonetheless, factors like high capital expenditure, complex process optimization, and volatility in raw materials hampered the expansion of the market. Companies are upgrading to be more efficient in recovery, implementing digital process control systems and optimizing plant configurations for lower emissions and higher sulphur yields.

From a 2025 to 2035 perspective, we expect the market to witness game-changing advancements in sulphur recovery efficiency, digital integration, and sustainable refining practices. AI-informed process automation, real-time gas analysis and self-regulating SRU technologies will help to improve recovery levels while decreasing the energy consumed to do so. Green hydrogen projects and CCUS technologies will be increasingly integrated with sulphur recovery systems, driving cleaner industrial operations.

Moreover, these technologies such as alternative desulphurization techniques, bio-based sulphur removal will reshape the market significantly. In the coming decade, the companies shaping the landscape of sulphur recovery will be those that capitalize on smart recovery technologies, sustainability-driven innovations, and process improvements that comply with incoming regulations.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter sulphur emission limits in refineries and gas plants |

| Technological Advancements | Adoption of Claus process improvements and tail gas treatment units |

| Industry Adoption | Increased compliance with environmental mandates in oil & gas |

| Supply Chain and Sourcing | Dependence on high-purity catalysts and specialized equipment |

| Market Competition | Dominance of established players in oil refining and gas processing |

| Market Growth Drivers | Rising demand for low-sulphur fuels and emission control regulations |

| Sustainability and Energy Efficiency | Adoption of energy-efficient Claus process configurations |

| Integration of Smart Monitoring | Limited digitalization in sulphur recovery operations |

| Advancements in Alternative Sulphur Recovery Techniques | Use of conventional hydrodesulphurization and amine-based separation |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of net-zero policies and integration of sulphur recovery with carbon capture technologies. |

| Technological Advancements | AI-driven process automation, real-time gas monitoring, and enhanced catalytic efficiency. |

| Industry Adoption | Integration of sulphur recovery with green hydrogen and CCUS initiatives. |

| Supply Chain and Sourcing | Localization of sulphur recovery component manufacturing and circular economy adoption. |

| Market Competition | Emergence of sustainable technology providers and digital-first process optimization firms. |

| Market Growth Drivers | Expansion of sustainable refining, renewable energy integration, and waste-to-value sulphur recovery. |

| Sustainability and Energy Efficiency | Large-scale deployment of low-carbon and waste-free sulphur recovery solutions. |

| Integration of Smart Monitoring | AI-powered diagnostics, cloud-based performance tracking, and real-time predictive maintenance. |

| Advancements in Alternative Sulphur Recovery Techniques | Growth in bio-based desulphurization, plasma technology, and hybrid SRU systems for cleaner operations. |

The United States sulphur recovery technology market is rapidly broadening due to the Environmental Protection Agency's strict standards on sulphur emissions, many modernizing refinery projects, and expanding investments in gas handling technologies. The USA Clean Air Act necessitates low sulphur emissions in oil refining and power generation, driving adoption of high-efficiency sulphur recovery units.

The petroleum and natural gas industry, specifically in the massive and expanding markets in Texas, Louisiana, and California, constitutes a major customer of Claus processing technology and tail gas therapy units. Additionally, rising use of hydrogen-based desulfurization in petrochemical plants is cultivating novel growth chances.

With continuous developments in automation and catalytic transformation technologies, experts anticipate that the USA sulphur recovery technology sector will significantly develop over the coming years. Complex conversions and advanced control systems will raise unit efficiencies and lower costs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.0% |

The United Kingdom industry for recovering sulphur has steadily advanced, pushed forward by tightening environmental regulations, a rising demand for cleaner energy sources, and a growing installation of sulphur recovery units at refineries all across the country. Both the Environmental Agency and the Clean Air Strategy devised by the UK government impose increasingly stringent standards for low sulphur materials in fuels, inevitably guiding more investment in technologies for desulphurization and recovery to restrain emissions of hazardous sulphur dioxide.

Both the intricate chemical processing sector and the powerful power generation industry have significantly aided growth by concentrating on decreasing emissions of the lung-damaging sulphur dioxide. Additionally, the UK's ambitious pledge to substantially boost hydrogen production and evolve carbon-neutral substitute fuels has strongly buttressed widespread acceptance of pioneering sulphur recovery approaches. Refineries scattered nationwide have diligently installed cutting-edge, technically sophisticated sulphur recovery structures to remain dependably compliant with the country's exacting, rigorous environmental benchmarks.

With steadily mounting regulatory pressures and swelling investment in sustainable, eco-friendly fuel technologies, the dynamic UK sulphur recovery technology market is well-suited for sizeable, meaningful expansion in the coming years. Suppliers of sulphur recovery equipment and specialized services are aptly situated to astutely capture this burgeoning, promising market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.3% |

The European Union sulphur recovery technological market has considerably expanded owing to stringent emissions limitations under MARPOL Annex VI, increasing investments in clean energy endeavours, and broadening of the oil refinement and gas handling industries. Germany, France, and the Netherlands have emerged as pioneers in sulphur reduction across refining and petrochemical enterprises. Complex sulphur extraction strategies and state-of-the-art desulfurization cycles are being integrated to adhere to directions.

EU's Industrial Emissions Directive and Fuel Quality Directive are prompting refineries to invest in innovative sulphur retrieval and desulfurization arrangements to meet tightening guidelines. Moreover, increasing adoption of biofuels and developing demand in hydrogen production throughout Europe is driving request for technologies to remove sulphur. The strict EU regulations have motivated oil and gas companies to search for advanced solutions to extract sulphur.

With continued political support for clean energy progress and initiatives to decrease industrial emissions, it is anticipated the EU sulphur recovery technological market will experience steady growth going ahead. Sophisticated sulphur handling solutions along with customized recovery and treatment systems catering to diverse industry needs are likely to be crucial for compliance. Advanced technologies are being deployed to extract sulphur from solid and gas streams in an efficient and eco-friendly manner.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.8% |

Strict regulations on air pollution have fuelled rapid growth in Japan's sulphur recovery industry. The nation's stringent emissions laws mandate exceptionally low thresholds, pushing many facilities to install highly sophisticated extraction units to purge harmful fumes. In particular, large power plants and sprawling chemical works heavily rely on cutting-edge scrubbers for coal gasification and hydrogen generation to minimize impact.

Meanwhile, Japan's ambition to achieve carbon neutrality has stimulated intense demand for revolutionary desulfurization systems capable of eliminating sulphur at unprecedented levels. Continuous refinement has successively boosted effectiveness over decades. Substantial public and private investments in advanced controls should sustain the rise and increasing sophistication of this evolving sector well into the future. While compliance and renewables will continue expansion, maintaining steadfast commitment to innovation through applied research remains integral to longevity.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.6% |

The stringent environmental policies adopted by South Korea to lower emissions have powerfully driven oil refineries and petrochemical plants to substantially modernize processes, significantly spurring growth in domestic technologies to extract sulphur. South Korea's Clean Air Act places exceptionally strict caps on sulphur dioxide, intensely motivating interest in optimized Claus systems and innovative gas handling units with enhanced abilities to recover more sulphur.

Simultaneously, the emerging focus on hydrogen as a fuel has highlighted the importance of efficiently removing sulphur in production pipelines. Two substantial refinery renovation initiatives currently underway in Ulsan and Busan are helping promote sophisticated methods for reclaiming sulphur. Facing increasingly severe environmental issues and close oversight from regulators, projections foresee the South Korean sulphur recovery technology sector experiencing notable expansion in the coming years supported by these regulations and commercial factors.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.7% |

The Claus process and subsequent tail gas treatment occupy a dominant position within the sulphur recovery technology space as industries continue to implement new technological sulphur removal solutions in order to reduce environmental footprint, comply with rigorous emission regulations and improve operational efficiency in hydrocarbon processing. For oil refineries, natural gas processing plants and petrochemical facilities, these sulphur recovery solutions are essential as they significantly decrease sulphur dioxide (SO₂) emissions, recover elemental sulphur and enhance efficiencies within refinery and gas plant operations.

The Claus process has since become the most popular method for sulphur recovery, presenting an efficient means for the transformation of hydrogen sulphide (H₂S) into element sulphur, as well as reduced operational expenditure and increased compliance with environmental regulations. The Claus process enables sustainable sulphur recovery, which brings the most economical and environmental benefit compared to traditional flaring and disposal processes.

Increasing adoption of advanced multi-stage Claus reactors due to the need for efficient sulphur removal in hydrocarbon processing from oil refineries has been a boost to the Claus process technology market, as the refineries strive to meet stringent regulations regarding ultra-low sulphur fuel. According to studies today, Claus units worldwide achieve sulphur recovery of 95-98%, which provides low SO₂ emissions and betters environmental performance.

Growing game for Claus process implementation in natural gas processing with specialized acid gas treatment unit for high-sulphur content natural gas has buttressed the market, registering the extensive adoption in gas processing plants in sulphur-heavy gas fields.

The adoption has been further enabled by the integration of AI based Claus reactor monitoring systems, which track temperature in real-time and provide insight on conversion efficiency.

Market is optimized by the development of improved Claus reactor designs, which include high efficiency catalytic converters, improved sulphur yield, operational efficiency, and cost savings for oil refineries and gas processing units.

The advent of modular Claus process units with compact and scalable reactor configurations tailored for offshore and remote installations has further cemented market growth by enabling better adaptability of these units in decentralized sulphur recovery applications.

Although there are the benefits of high sulphur recovery, adherence to regulations, and lower operating cost designs associated with the Claus process, it also has disadvantages including complicated reactor maintenance, high capital investment, and high capital investment and efficiency restrictions for the treatment of low-H₂S loading gas streams. However, new developments in catalytic reaction optimization, process control, and hybrid Claus-tail gas treatment integration are raising recovery rates, efficiency, and sustainability levels, assuring sustained market growth for Claus process-based sulphur recovery.

The global tail gas treatment market has strong market acceptance especially in Enhanced Sulphur Recovery Units (SRUs), refinery off-gas treatment and gas plant operations, as industries are increasingly dependent on advanced tail gas treatment processes to attain ultra-high sulphur recovery efficiencies and meet stringent emission levels. Tail gas treatment systems, unlike standalone Claus units, have an additional sulphur removal stage allowing for increased recovery rates and lower SO₂ emissions.

An increase in the need for tail gas treatment equipment in larger capacity sulphur recovery plants with SCR and wet scrubbing systems for residual SO₂ removal, and adoption of advanced tail gas treatment units in refineries and gas processing plants where very low sulphur emissions compliance is required has fuelled the aforementioned tail gas treatment market. Modern tail gas treatment technologies increase overall sulphur recovery rates to more than 99.5%, resulting in improvement in environmental and economical benefits.

The introduction of tail gas treatment in ammonia and petrochemical processing, with dedicated catalysts that can selectively convert SO₂, has reinforced market visibility and driven increased uptake in high-sulphur-content process gases.

Adoption is driven further by hybrid Claus-tail gas treatment arrangements with multi-step oxidation as well as hydrogenation reactors to achieve optimal recovery with improved feedstock composition flexibility.

Artificial intelligence (AI)-powered emission control technologies, including integrating real-time SO₂ level monitoring and automated scrubbing system adjustments, have augmented market growth with higher sustainability and regulatory compliance in sulphur recovery operations.

Furthermore, the adoption of solvent-based tail gas treatment with amine-based absorption for effective sulphur capture has aided market expansion by providing improved efficiency in dealing with complex sulphur recovery operations.

While tail gas treatment has beneficial sides within the ultra-high sulphur recovery, emission reduction, and process efficiency developments, it still goes with drawbacks like high operational costs, complex system integration, and energy consuming processing. Nonetheless, new developments in next-generation catalytic systems, AI-assisted tail gas optimization and energy-efficient scrubbing technologies are increasing cost-effectiveness, sustainability, and scalability, which bodes well for the continued growth of sulphur recovery technologies based on tail gas treatment.

The oil and gas sectors are among the fast-expanding market drivers for the industry, with a growing number of such technologies deployed in industries to drive refineries to maximum efficiency, maximize gas processing, and meet international environmental regulations.

As such, the oil industry has become one of the biggest end-users of sulphur recovery technologies, with refineries installing state-of-the-art sulphur recovery units (SRUs) to convert high-sulphur crude oil, reduce SO₂ emissions, and ensure the efficiency of hydrocarbon processing. In this context, new sulphur recovery units (SRUs) stand out from conventional sulphur removal methods by offering sustainable and high-yielding sulphur extraction in terms of economic and environmental performance.

The growing trend for sulphur recovery in heavy crude oil refining, with high-capacity Claus reactors coupled with tail gas treatment units in single SRUs, is stimulating the uptake of next-generation SRUs as oil refineries aim for environmental sustainability and regulatory compliance. Advanced SRUs are over 95% more effective and meet SO₂ refinery targets to comply with international mandates.

Strong market demand and further adoption of sulphur recovery in high-sulphur crude refining were underpinned by high H₂S conversion for enhanced fuel quality in oil upgrading and hydrocracking units.

In addition, the incorporation of modular SRUs in offshore and remote oil refining operations, with compact, high-efficiency Claus-tail gas treatment units, has lent further impetus to adoption as it guarantees better modularity in decentralized refining plants.

While sulphur recovery in oil refining is advantageous in terms of emission reduction, process optimization and meeting regulatory compliance requirements, the SRU's energy demand, system integration challenges and maintenance-intensive operations pose difficulties. But recent advances in low-energy catalytic sulphur capture, AI powered reactor optimization and self-regenerating tail gas cleaning solutions are driving manageable and renewable sulphur recovery and just-in-time supply based on local refinery need.

Strong market adoption for the gas processing sector is driven in part by the need to sweeten natural gas as well as liquefied natural (LNG) gas production. Unlike oil refining, where H₂S is removed during crude oil processing to create lean, sulphur-rich oil, sulphur recovery in natural gas is a separate step that not only removes the H₂S but converts it to elemental sulphur, resulting in cleaner and more efficient fuel creation.

The growing trend for sulphur recovery in LNG and natural gas production with high-efficiency acid gas treatment units and Claus process integration has spurred the uptake of advanced sulphur removal technologies, as operators of natural gas target high-purity fuel output.

The sulphur recovery expansion in gas-to-liquids (GTL) processing, with the AI-driven sulphur conversion optimization, is expected to further contribute to market demand, leading to increased adoption in high-sulphur-content gas fields.

Sulphur recovery shows significant potential in gas quality enhancement, energy efficiency, and reduced emissions but remains a capital-heavy and high-priced process when considered for gas processing processes against the operating frequency complexities of every variation of gas composition. Nevertheless, advents in hybrid Claus-tail gas treatment, AI-based gas analysis, and modular sulphur recovery solutions are enhancing the scalability, cost-effectiveness, and operational flexibility ensuring that sulphur recovery will continue to grow in the gas sector.

The growing demand for environmental compliance, emission control, and efficient Sulphur extraction processes in oil & gas refineries, chemical plants, and power generation facilities are propelling the Sulphur recovery technology market. Industry participants are concentrating on advanced Claus process alterations, AI-powered process optimization and sustainable Sulphur recovery technologies to increase efficiency, since in-line with strict emission laws, and cost-effective solution. Participants in this space include global suppliers of industrial gas technologies, as well as specialized process device contractors that are all driving innovations in tail gas treatment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schlumberger Limited (Cameron) | 15-20% |

| Fluor Corporation | 12-16% |

| Worley Limited | 10-14% |

| Linde plc | 8-12% |

| Air Liquide Engineering & Construction | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schlumberger Limited (Cameron) | Develops high-efficiency sulphur recovery units (SRUs), AI-powered tail gas treatment, and sustainable gas processing solutions. |

| Fluor Corporation | Specializes in Claus-based sulphur recovery, proprietary technologies for higher efficiency, and AI-enhanced process optimization. |

| Worley Limited | Manufactures modular sulphur recovery plants, advanced emission reduction solutions, and energy-efficient tail gas treatment. |

| Linde plc | Provides tail gas treatment units, sulphur recovery efficiency optimization, and low-emission process technologies. |

| Air Liquide Engineering & Construction | Offers integrated sulphur recovery and gas treatment systems, including advanced Claus process solutions for refineries. |

Key Company Insights

Schlumberger Limited (Cameron) (15-20%)

Schlumberger is a leading player in sulphur recovery technology with a proven track record for providing reliable sulphur recovery units (SRUs) as well as top-tier AI governance for emission monitoring and tail gas treatment.

Fluor Corporation (12-16%)

Fluor's high-efficiency Claus and Super-Claus sulphur recovery technologies offer low environmental impact and regulatory compliance.

Worley Limited (10-14%)

Worley's sulphur recovery solutions are tailored for refineries, petrochemical and gas processing sites, maximizing energy recovery and emission management.

Linde plc (8-12%)

Focusing on cost savings and improved process efficiency, Linde has been developing AI-integrated sulphur recovery and tail gas treatment units.

Air Liquide Engineering & Construction (5-9%)

Air Liquide designs and builds high-performance sulphur recovery systems to sustain the low-cost recovery of sulphur and the treatment of the resulting tail gas.

Other Key Players (40-50% Combined)

A number of companies specialize in providing next-generation sulphur recovery technologies, AI-enhanced efficiency optimization, and sustainable sulphur recovery solutions in the sector including industrial gas processing and chemical engineering sectors. These include:

The overall market size for Sulphur Recovery Technology Market was USD 1.8 Billion in 2025.

The Sulphur Recovery Technology Market expected to reach USD 5.0 Billion in 2035.

The demand for sulphur recovery technology will be driven by factors such as stricter environmental regulations, the need to reduce sulphur emissions, increasing industrial activities in oil and gas sectors, and growing awareness about sustainable practices for managing sulphur by-products in refineries and petrochemical plants.

The top 5 countries which drives the development of Sulphur Recovery Technology Market are USA, UK, Europe Union, Japan and South Korea.

Claus Process and Tail Gas Treatment Drive Market Growth to command significant share over the assessment per.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.