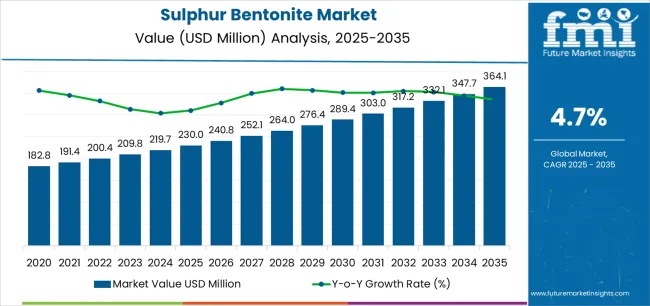

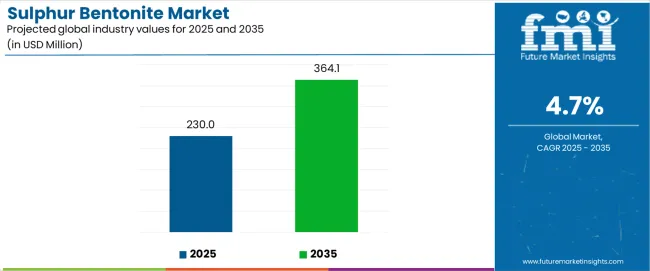

The sulphur bentonite market is likely to grow from USD 230.0 million in 2025 to USD 364.1 million by 2035 represents substantial growth, demonstrating the accelerating adoption of slow-release sulphur formulations and balanced fertilization practices across oilseed production, cereal cultivation, and specialty crop sectors.

The first half of the decade (2025-2030) will witness the market climbing from USD 230.0 million to approximately USD 303.4 million, adding USD 64.4 million in value, which constitutes 46% of the total forecast growth period. This phase will be characterized by the rapid adoption of high-concentration sulphur bentonite pastilles, driven by increasing soil sulphur deficiency awareness and the growing need for efficient nutrient delivery systems worldwide. Advanced formulation technologies and precision agriculture integration will become standard expectations rather than premium options.

The latter half (2030-2035) is expected to witness sustained growth, increasing from USD 303.4 million to USD 364.1 million, representing an addition of USD 60.7 million or 20% of the decade's expansion. This period will be defined by mass market penetration of variable-rate application systems, integration with comprehensive digital farming platforms, and seamless compatibility with existing agronomic practices. The market trajectory signals fundamental shifts in how farmers approach sulphur nutrition optimization and soil health management, with participants positioned to benefit from sustained demand across multiple formulation types and crop segments.

The market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its awareness expansion phase, expanding from USD 230.0 million to USD 303.4 million with steady annual increments averaging 4.7% growth. This period showcases the transition from conventional sulphur sources to controlled-release bentonite formulations with enhanced nutrient efficiency and integrated agronomic support becoming mainstream features.

The 2025-2030 phase adds USD 64.4 million to market value, representing 46% of total decade expansion. Market maturation factors include standardization of sulphur application protocols, declining unit costs for high-concentration pastilles, and increasing farmer awareness of sulphur deficiency impacts reaching 85-90% nutrient use efficiency in oilseed applications. According to validated data from FMI’s Chemical Industry Analytics, tracking raw material price and sustainability drivers, competitive landscape evolution during this period features established fertilizer manufacturers like Coromandel International and National Fertilizers Limited expanding their sulphur bentonite portfolios while specialty producers focus on advanced formulation development and enhanced dispersion capabilities.

From 2030 to 2035, market dynamics shift toward precision agriculture integration and global soil health enhancement, with growth continuing from USD 303.4 million to USD 364.1 million, adding USD 75.0 million or 54% of total expansion. This phase transition centers on variable-rate application technologies, integration with digital soil mapping networks, and deployment across diverse cropping systems, becoming standard rather than specialized applications. The competitive environment matures with focus shifting from basic sulphur supply to comprehensive nutrient management optimization systems and integration with agronomic advisory platforms.

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 230.0 million |

| Market Forecast (2035) | USD 364.1 million |

| Growth Rate | 4.7% CAGR |

| Leading Formulation | 90% S bentonite pastilles |

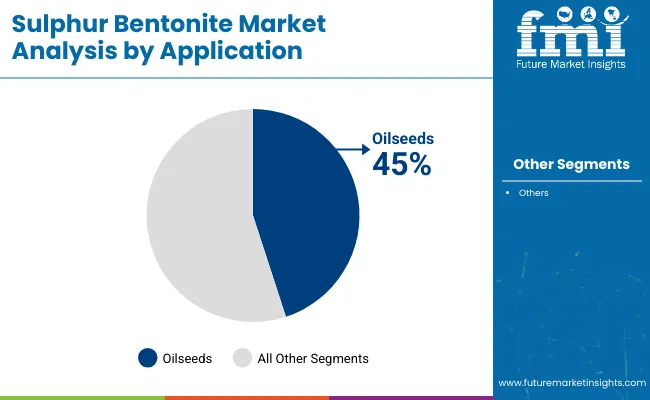

| Primary Application | Oilseeds Segment |

The market demonstrates strong fundamentals with 90% S bentonite pastilles capturing a dominant share through advanced slow-release characteristics and optimal nutrient density. Oilseed applications drive primary demand, supported by increasing cultivation intensity and sulphur-responsive crop requirements. Geographic expansion remains concentrated in developed agricultural markets with established fertilizer distribution infrastructure, while emerging economies show accelerating adoption rates driven by oilseed acreage expansion and rising balanced fertilization awareness.

Market expansion rests on three fundamental shifts driving adoption across the agricultural and crop nutrition sectors.

The soil sulphur depletion creates compelling agronomic demand through sulphur bentonite formulations that provide gradual nutrient release without leaching losses, enabling farmers to meet crop requirements while maintaining yield potential and reducing application frequency.

The oilseed cultivation intensification accelerates as production areas worldwide seek efficient sulphur sources that complement NPK programs, enabling optimal protein synthesis and oil content that align with crop quality standards and market premium requirements.

The balanced fertilization awareness drives adoption from progressive farmers and agronomic advisors requiring complete nutrient solutions that address micronutrient deficiencies while maintaining application convenience during field operations. The growth faces headwinds from elemental sulphur price volatility that varies across global sulphur markets, which may limit adoption in price-sensitive smallholder farming systems. Application challenges also persist regarding incorporation requirements and moisture-dependent release rates that may reduce effectiveness in arid climates, affecting nutrient availability and crop response consistency.

The sulphur bentonite market represents a specialized agricultural input opportunity driven by expanding global oilseed production, soil sulphur deficiency recognition, and the need for efficient slow-release nutrient formulations in crop production systems. As farmers worldwide seek to achieve 85-90% nutrient use efficiency, reduce application labor, and integrate sulphur management with precision agriculture platforms, sulphur bentonite products are evolving from basic commodity fertilizers to sophisticated agronomic solutions that ensure crop performance and soil health sustainability.

The convergence of oilseed acreage expansion, soil testing program proliferation, and balanced fertilization advocacy creates sustained demand drivers across multiple crop segments. The market's growth trajectory from USD 230.0 million in 2025 to USD 364.1 million by 2035 at a 4.7% CAGR reflects fundamental shifts in crop nutrition requirements and soil fertility management optimization. Geographic expansion opportunities are particularly pronounced in Asia-Pacific markets, where India (5.6% CAGR) and China (5.2% CAGR) lead through aggressive oilseed self-sufficiency programs and soil health care initiatives. The dominance of 90% S bentonite pastilles (62.0% market share) and oilseed applications (45.0% share) provides clear strategic focus areas, while emerging precision agriculture integration and cooperative distribution expansion open new revenue streams across diverse farming markets.

Strengthening the dominant high-concentration segment (62.0% market share) through enhanced pastillation technology, superior dispersion characteristics, optimized release kinetics, and seamless compatibility with existing application equipment. This pathway focuses on improving granule integrity, extending nutrient availability to 60-90 days, ensuring consistent particle size distribution, and developing specialized formulations for diverse soil types and climatic conditions. Market leadership consolidation through advanced manufacturing process control and comprehensive agronomic validation enables premium positioning while defending competitive advantages against alternative sulphur sources. Expected revenue pool: USD 70-110 million

Expansion within the dominant oilseed segment (45.0% market share) through specialized soybean formulations (35.0% sub-segment), rapeseed/canola programs (28.0%), and comprehensive agronomic support for oilseed producers. This pathway encompasses targeted nutrient recommendations, yield response demonstrations, application timing optimization, and compatibility with integrated pest management programs. Premium positioning reflects proven yield enhancement, consistent quality improvement, and comprehensive technical support enabling modern oilseed production optimization. Expected revenue pool: USD 50-80 million

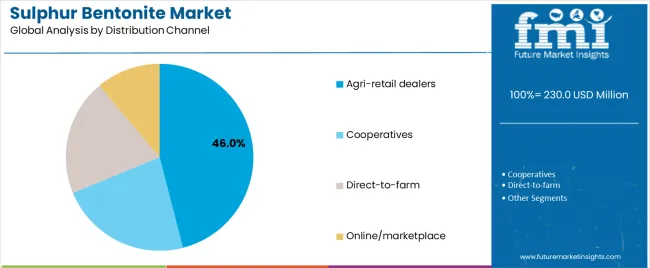

Expansion within agri-retail dealer channels (46.0% market share) through dealer margin optimization, technical training programs, comprehensive marketing support, and inventory management solutions. This pathway addresses point-of-sale merchandising, agronomic advisory integration, seasonal financing support, and digital ordering platform development for retail efficiency. Premium positioning through channel loyalty programs and exclusive territory agreements creates sustained distribution advantages. Expected revenue pool: USD 45-75 million

Rapid agricultural intensification across India (5.6% CAGR) and China (5.2% CAGR) creates substantial opportunities through local manufacturing capacity, cooperative network partnerships, and government soil health program alignment. Growing oilseed self-sufficiency initiatives, soil testing expansion, and balanced fertilization campaigns drive sustained demand for affordable sulphur solutions. Localization strategies reduce logistics costs, enable regional formulation customization, and position companies advantageously for government procurement programs. Expected revenue pool: USD 40-65 million

Strategic expansion through agricultural cooperatives (28.0% market share) requires volume supply capability, competitive bulk pricing, technical service support, and integrated agronomic programs. This pathway addresses large-scale farmer procurement, seasonal credit integration, quality assurance protocols, and comprehensive member education supporting cooperative value proposition. Premium positioning reflects supply reliability, technical expertise, and long-term partnership commitment enabling cooperative member benefit maximization. Expected revenue pool: USD 30-50 million

Integration of sulphur bentonite application with precision farming technologies, soil mapping platforms, and variable-rate spreader systems enabling site-specific nutrient management, application optimization, and comprehensive agronomic data analytics. This pathway encompasses GPS-guided application, soil sensor integration, yield mapping correlation, and extensive decision support for precision nutrient management. Premium positioning through technology leadership creates opportunities for service-based revenue models and ongoing farmer relationships. Expected revenue pool: USD 25-40 million

Development of sulphur bentonite applications beyond oilseeds including cereal crops, fruit and vegetable production, and plantation crops requiring sulphur nutrition for quality optimization. This pathway encompasses wheat and barley programs, vegetable sulphur nutrition, plantation crop applications, and specialty formulations for high-value crops. Technology differentiation through crop-specific recommendations, application method flexibility, and comprehensive agronomic validation enables market expansion beyond traditional oilseed focus. Expected revenue pool: USD 20-35 million

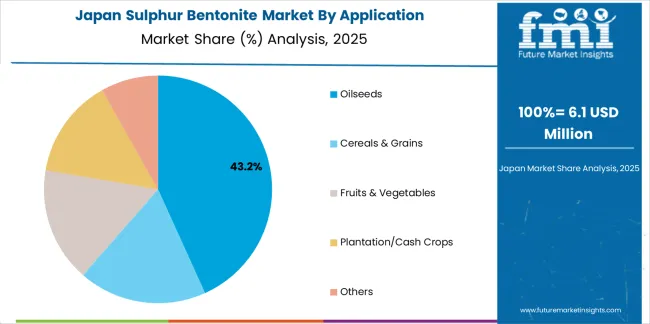

Primary Classification: The market segments by application into Oilseeds, Cereals & Grains, Fruits & Vegetables, Plantation/Cash Crops, and Others categories, representing the evolution from basic commodity sulphur application to crop-specific nutrient management for comprehensive agricultural optimization.

Secondary Classification: Sulphur content/formulation segmentation divides the market into 90% S bentonite, 85-89% S, and <85% S & blends sectors, reflecting distinct requirements for nutrient concentration, release characteristics, and application economics.

Tertiary Classification: Distribution channel segmentation encompasses Agri-retail dealers, Cooperatives, Direct-to-farm, and Online/marketplace categories.

Regional Classification: Geographic distribution covers North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa, with developed agricultural markets leading adoption while emerging economies show accelerating growth patterns driven by oilseed expansion programs.

Market Position: Oilseeds command the leading position in the Sulphur Bentonite market with approximately 45.0% market share through high sulphur responsiveness, including soybean (35.0% sub-segment), rapeseed/canola (28.0%), sunflower (22.0%), and groundnut & others (15.0%) that enable farmers to achieve optimal protein synthesis and oil content across diverse oilseed production environments.

Value Drivers: The segment benefits from agronomic preference for sulphur-responsive crops requiring amino acid synthesis support, enhanced oil quality development, and yield optimization without excessive nitrogen application. Advanced sulphur bentonite formulations enable gradual nutrient release, protein content enhancement, and integration with existing fertilizer programs, where sulphur availability and crop quality represent critical agronomic requirements.

Competitive Advantages: Oilseed applications differentiate through proven yield response, consistent quality improvement, and compatibility with sustainable intensification practices that enhance farm economics while maintaining optimal crop performance suitable for diverse oilseed markets.

Key market characteristics:

Cereals & grains maintain a significant market share through wheat, barley, and maize sulphur requirements for protein quality and yield optimization. These applications appeal to farmers requiring cost-effective sulphur sources with operational convenience for broadacre crop production. Market growth is driven by cereal intensification emphasizing grain quality and nutrient balance through integrated fertilizer programs.

Fruits & vegetables hold market share focusing on quality-sensitive crops requiring sulphur for flavor development, shelf life, and nutritional content. These applications demand precise nutrient management for high-value crop production requiring optimal sulphur nutrition.

Market Context: 90% S bentonite pastilles dominate the Sulphur Bentonite market with approximately 62.0% market share due to maximum nutrient concentration and increasing focus on application efficiency optimization, transport cost reduction, and handling convenience applications that minimize product volume while maintaining agronomic effectiveness across sulphur fertilization programs.

Appeal Factors: Farmers and distributors prioritize nutrient density, storage efficiency, and application rate simplification enabling coordinated sulphur management across large acreage operations. The segment benefits from substantial manufacturing investment and formulation programs emphasizing high-concentration pastille production for logistics optimization applications.

Growth Drivers: Precision agriculture adoption incorporates high-analysis fertilizers as standard inputs for nutrient management optimization, while transport cost sensitivity increases demand for concentrated formulations reducing handling and freight expenses.

Market Challenges: Varying soil moisture conditions and incorporation requirements may limit formulation standardization across different climatic zones or tillage scenarios.

Formulation dynamics include:

85-89% S bentonite captures approximately 25.0% market share through balanced economics in standard sulphur applications, price-sensitive markets, and conventional broadcast scenarios. These formulations demand effective nutrient delivery while providing competitive pricing for budget-conscious farmers.

<85% S formulations and blended products account for approximately 13.0% market share, including customized nutrient blends, micronutrient-fortified products, and economy formulations requiring application flexibility for specialized farming scenarios.

Agri-retail dealers capture approximately 46.0% market share through localized inventory, agronomic advisory services, and seasonal credit provision enabling convenient farmer access to sulphur bentonite products. These channels facilitate product availability, technical support integration, and trusted advisor relationships supporting farmer purchasing decisions across diverse agricultural regions.

Cooperatives account for approximately 28.0% market share through member procurement programs, bulk volume advantages, and integrated service offerings. Direct-to-farm channels hold 18.0% share serving large-scale operations, while online/marketplace platforms represent 8.0% share through digital commerce growth and direct farmer engagement.

Growth Accelerators: Soil sulphur depletion drives primary adoption as sulphur bentonite provides gradual nutrient release capabilities enabling farmers to meet crop requirements without excessive application frequency, supporting yield optimization missions and quality objectives requiring efficient sulphur nutrition. Oilseed cultivation intensification accelerates market expansion as production systems seek slow-release sulphur sources minimizing leaching losses while maintaining nutrient availability during critical crop growth stages and protein synthesis periods. Balanced fertilization awareness increases worldwide, creating sustained demand for complete nutrient programs complementing NPK applications and providing micronutrient support in diverse cropping systems.

Growth Inhibitors: Elemental sulphur price volatility varies across global commodity markets regarding industrial sulphur supply-demand dynamics, which may limit product affordability and market penetration in smallholder farming systems with limited input budgets or subsistence agriculture operations. Application incorporation requirements persist regarding mechanical mixing needs and moisture-dependent dissolution rates that may restrict adoption in no-till systems or arid climates, affecting nutrient release consistency and crop uptake patterns. Market fragmentation across multiple regional formulations and varying sulphur concentration preferences creates standardization concerns between different manufacturing sources and farmer application practices.

Market Evolution Patterns: Adoption accelerates in oilseed-intensive regions and sulphur-deficient soil zones where agronomic response justifies input investments, with geographic concentration in developed markets transitioning toward mainstream adoption in emerging economies driven by oilseed expansion and soil testing program proliferation. Technology development focuses on enhanced dispersion characteristics, improved release kinetics, and integration with precision agriculture platforms optimizing application efficiency and agronomic effectiveness. The market could face disruption if alternative sulphur sources or foliar application technologies significantly change deployment patterns of granular sulphur products in crop production systems.

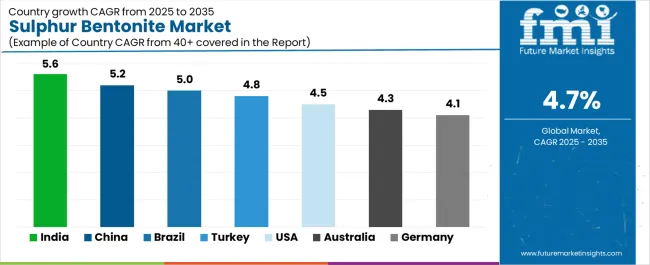

The market demonstrates varied regional dynamics with Growth Leaders including India (5.6% CAGR) and China (5.2% CAGR) driving expansion through oilseed acreage growth and soil health initiatives. Steady Performers encompass Brazil (5.0% CAGR), Turkey (4.8% CAGR), and United States (4.5% CAGR), benefiting from established oilseed production systems and balanced fertilization adoption. Mature Markets feature Australia (4.3% CAGR) and Germany (4.1% CAGR), where broadacre canola programs and CAP-driven soil management support consistent growth patterns.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

| China | 5.2% |

| Brazil | 5.0% |

| Turkey | 4.8% |

| USA | 4.5% |

| Australia | 4.3% |

| Germany | 4.1% |

Regional synthesis reveals Asia-Pacific markets leading adoption through oilseed cultivation expansion and government soil health programs, while Latin American countries maintain strong growth supported by Cerrado agricultural development and crop intensification. North American and European markets show moderate growth driven by precision agriculture integration and sustainable farming practices.

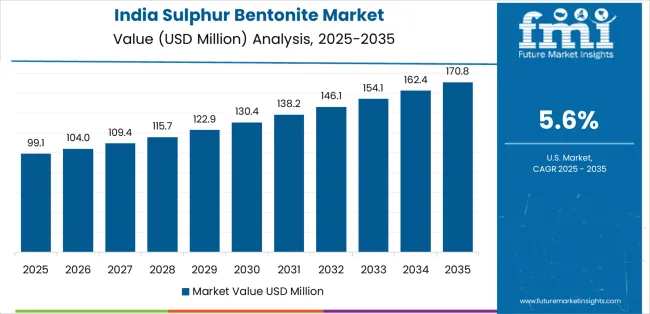

India establishes high-growth leadership through aggressive oilseed cultivation expansion including mustard and soybean acreage increases, comprehensive soil health card distribution programs providing field-level nutrient recommendations, and national balanced fertilization campaigns promoting secondary nutrient adoption, integrating sulphur bentonite as standard recommendation in oilseed production systems. The country's 5.6% CAGR reflects government initiatives promoting agricultural self-sufficiency and soil fertility enhancement that mandate nutrient testing and balanced fertilizer application in farming advisory programs. Growth concentrates in major oilseed regions including Madhya Pradesh, Maharashtra, and Rajasthan, where sulphur deficiency awareness showcases integrated nutrient management appealing to progressive farmers seeking yield optimization and quality enhancement.

Indian fertilizer manufacturers are implementing domestic production capacity that combines competitive manufacturing economics with government subsidy program alignment, including National Fertilizers Limited expanding bentonite sulphur availability and Coromandel International strengthening sulphur value chain integration. Distribution channels through agricultural cooperatives, state farming corporations, and private agri-retail networks expand market access, while soil health card recommendations and Krishi Vigyan Kendra extension programs support adoption across diverse oilseed production and crop diversification segments.

Strategic Market Indicators:

In Sichuan, Hubei, and Jiangsu provinces, Chinese oilseed producers and maize cultivation systems are implementing sulphur bentonite applications as standard agronomic practices for yield enhancement and quality improvement, driven by increasing rapeseed self-sufficiency objectives and agricultural modernization programs emphasizing balanced nutrition. The market holds 5.2% CAGR, supported by elemental sulphur adoption trends and sulphur-deficient soil zone identification promoting advanced fertilizer formulations. Chinese farmers adopt controlled-release products providing nutrient efficiency and labor savings, particularly appealing in regions where sulphur deficiency and mechanization represent critical production factors.

Market expansion benefits from growing domestic fertilizer manufacturing capabilities and agricultural extension system support enabling technology transfer and farmer education for sulphur nutrition management. Technology adoption follows patterns established in compound fertilizer markets, where convenience and proven performance drive purchasing decisions.

Market Intelligence Brief:

Brazil's agricultural expansion demonstrates robust sulphur bentonite adoption through Cerrado region development where natural sulphur deficiency requires external inputs, soybean-corn safrinha double-cropping intensification increasing annual nutrient removal, and precision agriculture implementation enabling variable-rate sulphur application based on soil testing. The country leverages tropical agriculture expertise and export-oriented production to maintain 5.0% CAGR. Production regions including Mato Grosso, Goiás, and Bahia showcase high-concentration pastille applications where logistics efficiency and agronomic performance support farm profitability optimization.

Brazilian producers prioritize nutrient use efficiency and application convenience in fertilizer selection, creating demand for premium sulphur bentonite formulations with features including rapid soil incorporation and extended release characteristics. The market benefits from established agribusiness infrastructure and technology adoption culture supporting advanced input utilization.

Market Intelligence Brief:

Turkey's agricultural policy evolution emphasizes oilseed self-sufficiency objectives reducing import dependency, domestic fertilizer manufacturing incentives promoting local production capacity, and balanced fertilization extension programs supporting micronutrient adoption. The country maintains 4.8% CAGR driven by sunflower and canola cultivation expansion, agricultural modernization initiatives, and input localization strategies supporting domestic fertilizer industry development.

Market dynamics focus on affordable sulphur formulations balancing agronomic performance with farmer purchasing power considerations. Growing agricultural extension activities create sustained demand for proven nutrient solutions supporting crop yield and quality objectives.

Strategic Market Considerations:

USA market expansion benefits from precision agriculture technology adoption enabling variable-rate sulphur application based on soil mapping, conservation tillage systems requiring broadcast-compatible sulphur sources, and agronomic research demonstrating sulphur response in corn-soybean rotations across Midwest production regions. The country maintains 4.5% CAGR driven by sustainable intensification practices, digital agriculture platform integration, and comprehensive nutrient management planning supporting environmental stewardship objectives.

American farmers prioritize application efficiency, equipment compatibility, and proven agronomic performance in fertilizer purchasing decisions, creating demand for high-quality sulphur bentonite products supporting operational convenience and yield optimization. Growing sustainability focus creates additional demand for efficient nutrient sources minimizing environmental losses.

Performance Metrics:

Australia demonstrates steady market development with 4.3% CAGR, distinguished by broadacre canola and wheat production systems' preference for efficient sulphur sources integrating seamlessly with existing application equipment and providing reliable nutrient supply in extensive cropping operations. The market prioritizes advanced features including precision application compatibility, moisture-responsive release, and comprehensive agronomic validation reflecting Australian agriculture's technological sophistication and operational scale.

German agricultural systems implement sulphur bentonite through Common Agricultural Policy soil health programs, high rapeseed cultivation share in crop rotations requiring sulphur nutrition, and comprehensive nutrient management planning supporting environmental compliance. The market holds 4.1% CAGR driven by sustainable intensification objectives, precision agriculture adoption, and integrated pest management systems requiring balanced crop nutrition.

Market expansion benefits from established agricultural advisory infrastructure providing nutrient recommendations and extension support aligned with environmental stewardship requirements. The regulatory framework supports balanced fertilization through agricultural policy incentives and sustainability certification programs.

Strategic Market Indicators:

In Japan, the Sulphur Bentonite market prioritizes 90% S bentonite pastille systems, which capture the dominant formulation share through maximum nutrient concentration and seamless integration with mechanized application equipment. Japanese agricultural systems emphasize efficiency, quality consistency, and operational convenience, creating demand for premium formulations providing optimal nutrient density and adaptive application based on soil conditions and crop requirements for specialized vegetable and rice production systems.

Market Characteristics:

In South Korea, the market structure favors agricultural cooperative networks which maintain dominant distribution positions through member purchasing programs, technical advisory services, and integrated input supply supporting oilseed and vegetable production systems. These cooperative organizations offer complete solutions combining sulphur bentonite supply with professional agronomic consulting and ongoing technical support appealing to Korean farmers seeking reliable nutrient management systems. Regional agri-retail dealers capture moderate market share by providing localized service and competitive pricing for standard applications.

Channel Insights:

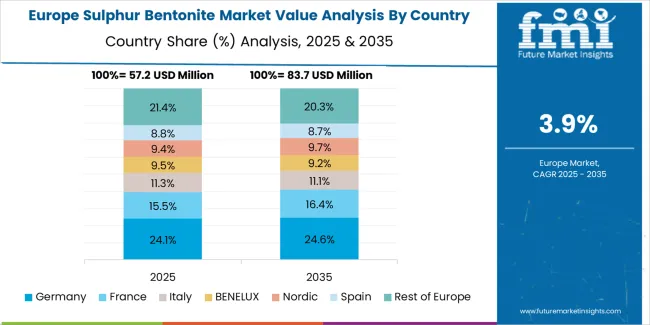

Europe is estimated to account for 23.0% of global sulphur bentonite demand in 2025 (approximately USD 55.0 million of the USD 230.0 million global total). Within Europe: Germany leads with USD 9.9 million (18% of European market), followed by France USD 6.6 million (12%), United Kingdom USD 6.1 million (11%), Italy USD 5.5 million (10%), Spain USD 5.0 million (9%), Nordics & Benelux collectively USD 11.0 million (20%), and Central & Eastern Europe USD 11.0 million (20%). The regional growth structure is comprehensively supported by CAP-aligned soil health programs promoting balanced fertilization, sulphur-deficient arable zones in Northwest and Central Europe requiring external sulphur inputs, and steady adoption in rapeseed, wheat, and barley rotation systems supporting sustainable crop intensification and quality optimization across European agriculture.

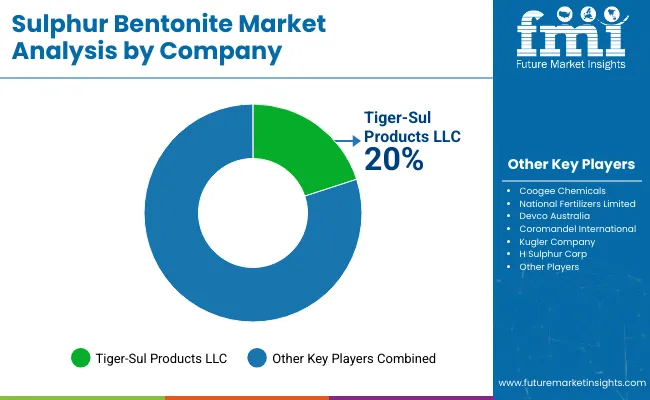

The market operates with moderate concentration, featuring approximately 15-20 meaningful participants, where leading companies control roughly 40-45% of the global market share through established distribution relationships and comprehensive manufacturing capabilities. Tiger-Sul Products LLC maintains the leading position with approximately 12.0% market share through extensive sulphur fertilizer expertise and North American market presence. Competition emphasizes product quality, distribution network strength, and technical service rather than price-based rivalry.

Market Leaders encompass Tiger-Sul Products LLC, Coromandel International, and National Fertilizers Limited, which maintain competitive advantages through extensive fertilizer manufacturing expertise, regional distribution networks, and comprehensive agronomic service capabilities creating farmer loyalty and supporting premium positioning. These companies leverage decades of agricultural input experience and ongoing agronomic research to develop advanced formulations with enhanced dispersion characteristics and proven crop response.

Technology Innovators include Devco Australia, Coogee Chemicals, and Indian Farmers Fertiliser Cooperative (IFFCO), which compete through specialized formulation technology focus and innovative pastillation processes that appeal to farmers seeking advanced nutrient efficiency and application convenience. These companies differentiate through rapid product development and specialized agricultural application focus.

Regional Specialists feature companies like The Mosaic Company, ICL Group, and Abu Dhabi Fertilizer Industries, which focus on specific geographic markets and integrated fertilizer portfolios. Market dynamics favor participants that combine reliable product quality with comprehensive technical services including soil testing support and agronomic recommendations. Competitive pressure intensifies as traditional fertilizer manufacturers expand into specialty products while agronomic service providers challenge established players through innovative distribution and precision agriculture integration.

| Item | Value |

|---|---|

| Quantitative Units | USD 230.0 million |

| Application | Oilseeds, Cereals & Grains, Fruits & Vegetables, Plantation/Cash Crops, Others |

| Sulphur Content/Formulation | 90% S bentonite, 85-89% S, <85% S & blends |

| Distribution Channel | Agri-retail dealers, Cooperatives, Direct-to-farm, Online/marketplace |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | India, China, Brazil, Turkey, United States, Australia, Germany, and 25+ additional countries |

| Key Companies Profiled | Tiger-Sul Products LLC, Coromandel International, National Fertilizers Limited, Devco Australia, Coogee Chemicals, IFFCO |

| Additional Attributes | Dollar sales by application and formulation categories, regional adoption trends across Asia-Pacific, North America, and Europe, competitive landscape with fertilizer manufacturers and distributors, farmer preferences for nutrient concentration and application convenience, integration with precision agriculture platforms and soil testing programs, innovations in pastillation technology and dispersion characteristics, and development of agronomic support programs with enhanced technical service and crop response validation capabilities. |

The global sulphur bentonite market is estimated to be valued at USD 230.0 million in 2025.

The market size for the sulphur bentonite market is projected to reach USD 364.1 million by 2035.

The sulphur bentonite market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in sulphur bentonite market are oilseeds, cereals & grains, fruits & vegetables, plantation/cash crops and others.

In terms of sulphur content/formulation, 90% s bentonite segment to command 62.0% share in the sulphur bentonite market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sulphur Recovery Technology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sulphur Coated Urea Market Growth - Trends & Forecast 2025 to 2035

Sulphur Hexafluoride Market Growth 2025 to 2035

Sulphur Chemicals Market

Solid Sulphur Market Size and Share Forecast Outlook 2025 to 2035

Hydrodesulphurization Catalyst Market Trends and Forecast 2025 to 2035

Flue Gas Desulphurization Market Size and Share Forecast Outlook 2025 to 2035

Residue Hydrodesulphurization Catalyst Market

Bentonite Clay Market Forecast Outlook 2025 to 2035

Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Bentonite Cat Litter Market Analysis by Type, Composition, Distribution Channel and Region Through 2025 to 2035

Demand for Bentonite in EU Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Organo-Modified Bentonite Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA