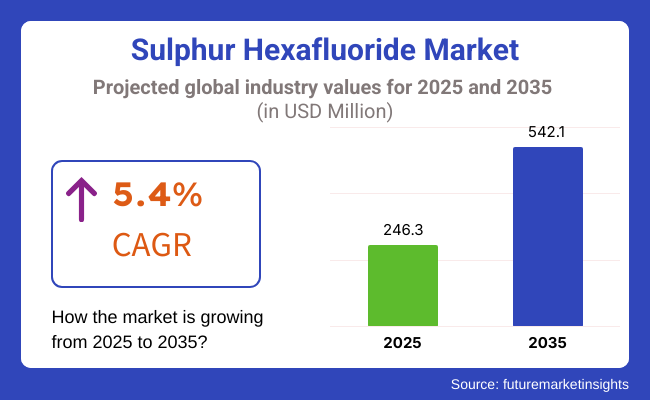

The Sulphur Hexafluoride (SF₆) market is expected to experience steady growth from 2025 to 2035, driven by increasing applications in the power and energy sector, electronics industry, and medical fields. The market is projected to grow from USD 246.3 million in 2025 to USD 542.1 million by 2035, reflecting a CAGR of 5.4% over the forecast period. The expansion is fueled by the rising demand for SF₆ in high-voltage equipment, circuit breakers, and semiconductor manufacturing, despite concerns over its environmental impact.

Sulphur Hexafluoride (SF₆) is a critical industrial gas known for its superior insulation and arc-quenching properties, making it indispensable in high-voltage electrical applications. Its demand is also rising in semiconductor manufacturing and medical imaging. Despite its advantages, SF₆’s high global warming potential has led to regulatory scrutiny, prompting innovations in gas recycling and alternative solutions to balance industrial needs with environmental sustainability over the forecast period.

Sulphur Hexafluoride is a highly efficient insulating and arc-quenching gas widely used in electrical transmission and distribution systems. The growing electricity demand and investments in grid infrastructure modernization are key drivers of market growth. Additionally, the increasing adoption of SF₆ in semiconductor manufacturing, where it is used as an etching gas, is further propelling demand. The medical sector also utilizes SF₆ in ultrasound imaging and ophthalmology, contributing to market expansion.

However, regulatory restrictions due to SF₆’s high global warming potential (GWP) are influencing market dynamics, prompting research into sustainable alternatives. Innovations in gas capture and recycling technologies are expected to mitigate environmental concerns and sustain market growth.

Explore FMI!

Book a free demo

The North American Sulphur Hexafluoride (SF₆) market is forging ahead primarily because of its robust electrical grid infrastructure and the newly added semiconductor industry. The USA is at the forefront of the region by far, where a lot of SF₆ is extensively used in high-voltage switchgear, transformers, and circuit breakers. However, the very strict regulations by the EPA that aim to cut down greenhouse gas emissions are rendering the adoption of SF₆ recycling and alternative gases.

Also, the SF₆ used in the semiconductor production is increasing, due to the positive effects in making chips and 5G technology. Moreover, the demand for SF₆, triggered by the integration of renewable energy and the smart grid revolution, has also been on the rise even though there are tougher regulations on emissions control.

Europe is characterized by a well-regulated and predominantly SF₆ market imposed by the EU's F-Gas Regulation, whose goal is to phase down high-GWP gases. Top players include Germany, France, and the UK, where SF₆ is widely used in power transmission and semiconductor manufacturing. The sector is also marking the diversification of insulating gases, starting with g3 (Green Gas for Grid), which will subsequently save the ecosystem.

Increasing investments in renewable energy projects and the upgrade of electrical grids have kept the demand for SF₆ alive. On the other hand, stricter emissions policies have spurred the industries towards SF₆ recycling technologies and the development of the next generation of switchgear with minimum or no SF₆ usage.

Asia-Pacific is the most rapidly growing SF₆ market, driven by urbanization, the construction of infrastructure, and an upturn in the semiconductor industry. Countries like China, Japan, South Korea, and India are the top consumers, with a significant SF₆ demand in power transmission and microelectronics. The deployment of smart grids and the promotion of clean energy projects by the local authorities have marked with the expansion of SF₆.

The key role of China as a semiconductor producer pushes growth in the market, where SF₆ is a must for the plasma etching process. However, the sharp rise of environmental concerns and the variable government policies on greenhouse gas emissions reduction might have a say in the near future SF₆ consumption, which could compel counties to invest more in recycling technologies and alternative gas solutions.

The Rest of the World SF₆ market which includes Latin America, the Middle East, and Africa, is expanding at a constant pace thanks to the increase in the demand for electricity and the improvement of infrastructure. Brazil, Saudi Arabia, and South Africa are all countries paving the way for this expansion by backing the development of the power transmission grid, which, in turn, leads to increased SF₆ use in GIS and circuit breaker projects.

Even though environmental regulations are less stringent compared to North America and Europe, global climate commitments are the driving force behind the gradual switch to alternative SF₆ gas. Most of these areas have newly formed semiconductor industries, and despite that, the progress of industrialization and foreign investments is seen as a good omen for the future SF₆ market.

Challenges

Regulatory Restrictions and Environmental Concerns

Sulphur Hexafluoride (SF₆) markets are encountering difficulties because of the gase's high global warming potential (GWP) which is nearly 23,500 times that of CO₂ over the span of 100 years. Tensions are arising between governments and regulatory bodies, for instance the EPA in the USA and the EU's F-Gas Regulation which impose stringent laws on SF₆.

The operators of electrical machines and semiconductor manufacturing process using SF₆ are imposed with stringent costs related to providing compliance to the required reporting and abatement measures. Moreover, studies related to other low-GWP gases and fluoronitrile being examples have put SF₆'s long-standing dominance at risk as the industries are facing application competition for years ahead.

High Cost of Recycling and Limited Alternatives

SF₆ recycling is not only the most expensive but also the tricky proposition, as it needs technical competencies as well as reliable handling processes that dismiss the chance of leakage and contamination. The financial impacts arising from the elevated costs of gas capture, purification, and reuse are casting a shadow on the industries depend on SF₆, especially in the regions that are imposed with rigorous environmental regulations.

Though the introduction of alternatives such as g³ (Green Gas for Grid) and Novec™4710 is a step in the right direction, their deployment is stifled by the fact that they are novel and unproven, and furthermore incompatible with the infrastructure as well as being overpriced. The slow shift to the solutions that are economically sustainable has kept market players in difficulty, which has also kept them in a state of uncertainty about the long-term commitment to SF₆.

Opportunities

Advancements in SF₆ Recycling and Emission Reduction Technologies

Concerning the increasing regulatory pressure, companies have started investing in SF₆ capture, recycling, and reuse technologies as an effort to lessen emissions and meet their sustainability targets. Technologies such as gas reclamation units, advanced leak detection systems, and closed-loop recycling which are emerging trends are causing to increase the usability of SF₆ while the environmental impacts are being decreased.

Businesses which are in the gas recovery domain are seeing their demand grow, especially in those regions where there are tangible regulations such as North America and Europe. Additionally, as the developments in equipment for gas management got better, the implementation of SF₆ recycling has become cheaper, which will allow the companies to fulfil their environmental policies while they keep the performance of SF₆ in high-voltage and semiconductor applications.

Growing Demand in Emerging Markets and Renewable Energy Expansion

The need for electricity has become one of the critical issues in developing economies, which has led to the demand for SF₆-insulated switches, transformers, and circuit breakers. The countries in Asia-Pacific, Latin America, and Africa are stretching their power grids, smart grid, and green energy sectors, producing the groundwork for SF₆ applications.

The changes to an energy matrix based on the wind and sun need transmission of electricity with high efficiency, for which SF₆-based insulation plays an important role. Even if there are some concerns with regulations, the governments and utilities in the regions which are not yet developed are taking a path of focus on the electrical grid being modernized and reliable, with SF₆-containing gear being the favoured choice in these projects until the time when other solutions become more common and affordable.

The sulphur hexafluoride (SF6) market has grown steadily between the years 2020 and 2024, majorly due to its extensive application in the electrical transmission and distribution industry. SF6 has been the major insulating and quenching gas in high voltage switchgear, substations, and circuit breakers due to its excellent dielectric features.

But, the environmental worries over its extremely high global warming potential (GWP) have led to more oversight and effort to find eco-friendly alternatives. As we are moving into the time frame of 2025 to 2035, the market is poised to experience drastic changes, thanks to the reshaping of the rules, the technological breakthroughs, and the demands for environmentally safe options.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Moderate restrictions in certain regions; voluntary industry efforts to reduce SF6 emissions |

| Technological Advancements | Focus on improving gas recycling and leak detection systems |

| Industry-Specific Demand | Electrical transmission and distribution dominated the market |

| Sustainability & Circular Economy | Initial research into SF6-free technologies; gas recovery and reuse programs |

| Market Growth Drivers | Expansion of power grid infrastructure, growing energy demand, rise in renewable energy projects |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter regulations, possible phase-outs in multiple countries, increased carbon pricing and compliance measures |

| Technological Advancements | Development of alternative gases such as fluoronitriles and fluoroketones, enhanced monitoring with AI-driven solutions |

| Industry-Specific Demand | Emerging applications in semiconductor manufacturing, continued demand in electrical insulation, but increasing adoption of alternative technologies |

| Sustainability & Circular Economy | Commercialization of sustainable alternatives, greater emphasis on lifecycle management and closed-loop systems |

| Market Growth Drivers | Regulations driving adoption of SF6-free technologies, advancements in smart grid infrastructure, increased emphasis on sustainability |

The USA SF₆ market is expected to expand at a 4.8% CAGR from 2025 to 2035. The state of the art implementing the latest technologies instead of the country's deteriorating old electrical grid and other renewable energy and smart grid infrastructure is a focus of the USA power sector. Despite its exceptional dielectric properties, SF₆ in high voltage equipment is still in demand by the industry due to solar power and equipment storage state.

However, constraining environmental regulations have started to affect the medical and semiconductor industries, which are still the major force behind the demand as well as the replace of these materials with more ecological friendly ones in electronic insulation.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

The SF₆ market in the United Kingdom is poised for a 4.3% compound annual growth rate during the given forecast period. The shift toward SF₆ substitutes in power transmission mainly is due to the country’s dedication to carbon dioxide (CO2) as a major cause of climate change. Sales of electrical equipment for offshore wind farms and grid modernization are some of the driving forces of this market.

Nonetheless, the pressures arising from the UK's environmental laws on the manufacturers to look for substitutes with lower global warming potential (GWP) are knocking at the door. The semiconductor sector still represents one of the main end-users, while further development in microelectronics is responsible for the constant SF₆ consumption despite the increased sustainability worries.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

Projected at a compound annual growth rate (CAGR) of 4.2%, the European Union market for SF₆ will expand from 2025 to 2035. The environmental regulations becoming stricter and, for instance, the EU F-Gas Regulation have put the usage of SF₆ by the industries under pressure. Manufacture and launch of the green substitutes are turning to ride now. Nevertheless, power distribution and semiconductor manufacturing are the two major industries maintaining the status of demand. The switch-over to smart grids and renewable energy projects in Europe that continues as a market driver, even in the case where the industry players search for the most promising inventive ways to fit in with their sustainability targets.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.2% |

Japan will have a CAGR of 4.5%, indicating a good expansion of the SF₆ market. The country is heavily dependent on SF₆, especially in urban areas with high population density, for electrical insulation in its power infrastructure. The substantial use of SF₆ in the semiconductor sector, in particular, is a result of the progressing industry in Japan and the high demand for electronic products with exceptional accuracy. The domestic manufacturers that have increased investment in efforts to swap SF₆ for more sustainable technologies feature also the side of the climate agreement. The government focus on new technologies is said to be an important influencer of the market in the next few years.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The South Korean market for SF₆ is forecast to grow at a CAGR of 5.0% until the year 2035. The advanced electronics and semiconductor manufacturing sector of the country, which is a forefront trendsetter of SF₆, continues to be the key driver of SF₆ demand. Also, the power distribution infrastructure modernization is the channel that SF₆-based switchgear and circuit breakers are introduced to the market through. Although, the development of alternative insulating gases has come to the fore through government support and rising environmental concerns. The companies in South Korea are continuously making efforts to discover the ways which ensure that they remain competitive while greenhouse gases are decreased through these mechanisms thus being South Korea as a leading actor in the transition to eco-friendly technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

Electronic Grade SF6 Supports Advanced Semiconductor Manufacturing

The semiconductor industry uses SF6 gas commonly for plasma etching and processes of chemical vapor deposition (CVD). The high purity of this material guarantees the exact manufacturing of microchips and electronic components which is the reason for its usage in utmost technologies such as integrated circuits, LED displays, and MEMS (or Micro-Electro-Mechanical Systems).

The soaring requirement for high-purity SF6 that parts like consumer electronics, 5G infrastructure, and smart devices increased by is instrumental. Furthermore, advancements in semiconductor fabrication technology, such as the transition to small node sizes, have led to increased dependency on ultra-clean gases like electronic-grade SF6 for achieving high-performance levels and reducing defects during production.

UHP Grade SF6 Gains Traction in High-Precision Applications

Ultra-High Purity (UHP) grade SF6 is the gas utilized in state-of-the-art devices like particle accelerators, specialized medical imaging, and laboratory research. With an extraordinary level of purification that exceeds 99.999%, the UHP-grade SF6 is the gas that is required for systems where a single trace of contamination can affect operation.

The rising focus on advanced research in such fields as nuclear physics and space exploration drives the demand for this type of research. Additionally, the medical sector uses UHP SF6 in ophthalmic surgeries and in contrast agents for MRI, which broadens its market potential. The last thing one may not observe is, however, the industries wanting top-notch SF6, therefore its prevalence will stay irreplaceable in science and industrial practices.

Electrical & Electronics Industry Dominates Due to High Dielectric Strength

Among the sectors that consume sulphur hexafluoride (SF₆) the most, the electrical & electronics sector is in the first place due to the exceptional insulating and high dielectric strength characteristics of this gas. SF₆ is the major component of insulating switchgear (GIS), circuit breakers, and transformers, which makes sure that power is transmitted effectively and with little loss of energy.

The increased consumption of SF₆ due to the expansion of renewable energy sources and grid infrastructure constitutes an additional effect. However, the pursuit of eco-friendly alternatives has been triggered by difficult rules and regulations that have resulted from the SF₆'s extremely high global warming potential. The countries in Europe and North America are imposing strict emission limits, thus catalysing technological breakthroughs in SF₆ recycling and gas substitutes.

Steel & Metals Industry Depends on SF₆ for Efficiency in Operations

The steel and metal industry uses SF₆ gas extensively for the purpose of forming an inert atmosphere in processes like magnesium casting, and preventing the oxidation of metal in aluminium refining. In this text, it is stated that SF₆ gas is the major protective agent in aluminium refining. The atmosphere created by SF₆ is inert, decreasing the chances of oxidation and producing superior quality products.

In the same light, the automotive and aerospace industries are driving the light metal solutions movement, which in turn is boosting the adoption of SF₆. Environmental problems concerning the use and emission of SF₆ have resulted in the invention of other protective gas alternatives. Stringent regulation frameworks in the EU and North America are compelling area producers to employ an eco-friendlier approach while meeting superior performance targets in metal processing.

The Sulphur Hexafluoride (SF₆) Market is experiencing steady growth due to its essential applications in electrical insulation, medical applications, and semiconductor manufacturing. SF₆ is widely used in high-voltage circuit breakers, gas-insulated switchgear (GIS), and transformers, making it crucial in the power and energy sector. Additionally, it finds niche applications in ophthalmic surgeries, tracer gas applications, and particle accelerators.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Solvay S.A. | 18-22% |

| The Linde Group | 14-18% |

| Air Liquide | 10-14% |

| Kanto Denka Kogyo | 8-12% |

| Showa Denko | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Solvay S.A. | Leading supplier of high-purity SF₆ for electrical applications; focusing on sustainable alternatives. |

| The Linde Group | Provides SF₆ for industrial and medical applications; invests in recycling and gas reclamation technologies. |

| Air Liquide | Manufactures SF₆ with a focus on gas-insulated switchgear applications; explores lower GWP gas alternatives. |

| Kanto Denka Kogyo | Specializes in high-purity SF₆ for semiconductor and microelectronics industries. |

| Showa Denko | Supplies SF₆ for both electronics and energy applications; emphasizes cost-effective production. |

Key Company Insights

Solvay S.A.

Solvay S.A. is a foremost SF₆ manufacturer, targeting the electrical, semiconductor, and industrial sectors. To follow environmentally sustainable practices, the company invests in gas recovery solutions and meets stringent environmental regulations. Moreover, Solvay is inventing alternative low-GWP gases to bring down emissions.

The constant improvement of SF₆ applications is assured due to the application of the world's best technologies and their highly qualified research and development capability. Besides, the cooperation and agreement with utilities, and equipment manufacturers is an additional measure, which really enriches its market power. Innovation and compliance, which Solvay put their heads and hands together to focus on, are the keys to the prosperity of the company in the changing SF₆ market.

The Linde Group

The Linde Group is an important player in the industrial and specialty gases domain, supplying SF₆ for power, medical, and electronics applications. The company backs a robust global distribution network, through which it offers a dependable gas supply while giving priority to reclamation and recycling technologies.

The enterprise is funneling considerable resources into the project of ecological gas management, which will help the entire industry achieve sustainability. Linde's advanced gas handling and purification processes boost efficiency, cutting down the leakage and wastage of SF₆. Utilization of technology and compliance to the rules, the enterprise is able to keep up the market as a SF₆ leader.

Air Liquide

Air Liquide is a notable SF₆ supplier to the electrical transmission and semiconductor industries. The organization has been developing fluorinated gas alternatives -the company says- that can lessen SF₆'s effect on the environment. The R&D section of Air Liquide is committed to developing technologies that minimize gas leakage from gas-insulated equipment and which technically are more or at least equally performant and safe.

The company's global infrastructure and networks are really solid, which obviously results in the easy management of gas delivery to the consumer and at the same time, reduce the risk fed by display issues of SF₆. The company is also investigating gas reclamation solutions, aligning with global targets to cut greenhouse gas emissions. The company's emphasis on innovation and sustainability fortifies its competitive edge.

Kanto Denka Kogyo

Kanto Denka Kogyo is mainly engaged in the production of ultra-high-purity SF₆, focusing on semiconductor, and electronics manufacturing. The company’s profound interest in the highest levels of engineering and gas purity, reason why they become the favorite supplier of advanced microelectronics to manufacturers.

Kanto Denka's scaling up in the Asia-Pacific region is a direct response to the expanding demand for semiconductor-grade gases. Investments in process optimization and cost-effective manufacturing facilitation support the maintenance of a competitive position; hence, it is a leading enterprise in the market. With their specialty gas-handling knowledge, Kanto Denka is a partner for many leading chip makers.

Showa Denko

Showa Denko is the preeminent SF₆ supplier with the main objective of producing cheap but reliable gas and covering niche applications as well. The enterprise also operates in the electrical and electronics branches, which means it can confidently guarantee the SF₆ gas provision for the power grid and the semiconductor manufacturing processes.

The company is currently working on the upgrading of the gas purification technologies, which are more efficient and eco-friendly. The company is accentuating its market expansion by the acquisition of regional demand in Japan and elsewhere in Asia. The technological speed and focus on sustainability that Showa Denko is committed to, ensure that SF₆'s competitive environment is still relevant to them.

The global Sulphur Hexafluoride market is projected to reach USD 246.3 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.4% over the forecast period.

By 2035, the Sulphur Hexafluoride market is expected to reach USD 542.1 million.

The Electrical & Electronics industry segment is expected to dominate the market, due to its use in high-voltage circuit breakers, gas-insulated switchgear, and transformers, ensuring efficient insulation, arc quenching, and operational reliability.

Key players in the Sulphur Hexafluoride market include Solvay S.A., The Linde Group, Air Liquide, Kanto Denka Kogyo, Showa Denko.

In terms of end use industry, the industry is divided into Electrical & Electronics industry, Steel & Metals industry, Medical applications, Glass Industry, Electrostatic loudspeakers, Entertainment industry

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

LATAM Road Marking Paint & Coating Market Analysis by Material Type, Marking Type, Sales Channel, and Region Forecast Through 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Industrial Oxygen Market Report - Growth, Demand & Forecast 2025 to 2035

Medical Grade Coatings Market Trends – Demand, Innovations & Forecast 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.