The sugar-free syrups market will grow steadily, with increasing customer demand for low-calorie sweeteners, increasing health consciousness, and increasing diabetic populations across the world fueling demand. Sugar-free syrups find extensive applications as substitutes for normal syrups and are appropriate for diabetics and healthy eaters of healthy food.

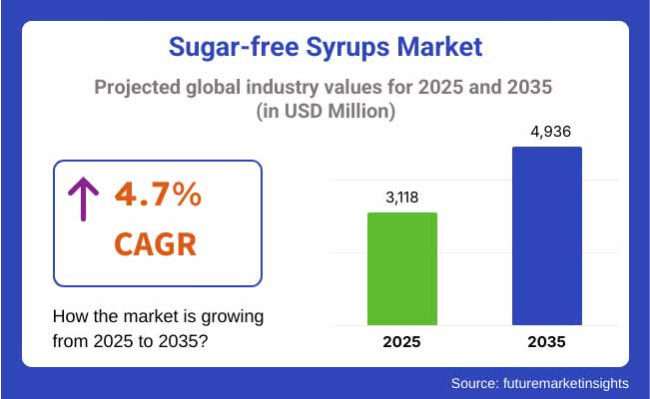

Food and beverage companies continue to break records with natural sweeteners such as stevia, monk fruit, and erythritol in order to provide the taste without compromising health. The market of sugar-free syrups was around USD 3,118 million in 2025. It is anticipated to be around USD 4,936 million in 2035 with 4.7% compound annual growth rate (CAGR).

Market growth is driven by ongoing innovation in formulation methods, such as the use of prebiotic fibers, natural sweetener alternatives, and flavoring components that substitute for traditional syrups. Owing to high demand from dairy alternative, confectionery, and beverage markets, the sugar-free syrup market will grow strongly until 2035.

North America is one of the leading markets for sugar-free syrups because of the levels of obesity, increased diabetic population, and increased consumer demand for alternative sugar. The US market is leading the market in the region with higher demand for healthier beverages, such as sugar-free coffee syrups, protein beverages, and keto dessert treats. Firms such as Jordan's Skinny Mixes and Walden Farms have benefited from the trend by offering a variety of sugar-free tastes.

Europe has emerged as an emerging market, particularly in countries such as Germany, the UK, and France, where stringent sugar-cutting policies have pushed demand for sugar-free food products. Bakery and confectionery companies throughout the continent have been employing sugar-free syrups in the manufacture of low-calorie pastries, chocolate, and breakfast foods. Market leaders such as The Skinny Food Co. are now extending their ranges of sugar-free foods based on customers' demands.

Asia-Pacific is the largest market for sugar-free syrups due to growing urbanization, dietary habits, and the incidence of diabetes. There has been a skyrocketing demand for sugar-free beverages in China, Japan, and India, and the majority of local tea and coffee outlets now offer low-calorie variants. The government has even started campaigns against adding sugar to foods, forcing manufacturers to use substitute sweeteners.

Challenges

Artificial Sweetener Concerns, Taste Consistency, and Higher Production Costs

Some of the most important problems in the sugar-free syrup industry are the public's distrust of artificial sweeteners sucralose and aspartame, both criticized for potential health effects. Consistency of flavor in removing the sugar is also a problem because some component of the alternative tastes horrible after use or does not dissolve optimally in other uses. Natural sweeteners such as stevia and monk fruit also add to the production cost, so sugar-free syrups are more expensive than regular syrups.

Opportunities

Functional Drinks Growth, Clean-Label Trends, and Customized Sweetness

Apart from these challenges, there are very good opportunities for growth in the market for sugar-free syrups. Growth in functional beverages such as sugar-free energy drinks, protein shakes, and herbal teas is propelling growth in this market.

Clean-label trends due to consumer pressure for natural ingredients without additives are forcing businesses to create syrups from organic erythritol, agave fiber, and botanicals. Second, the companies are manufacturing variable sweet levels where the buyer can customize syrup concentration according to their preference, thus improving the product attractiveness.

Between 2020 and 2024, the sugar-free syrup market exploded as consumers flooded keto and low-carb diets. Manufacturers went on to revamp their products to replace high-fructose corn syrup and artificial sweeteners with natural sweeteners. Still, the pinching shopper did not want to make the change as it involved a cost and a couple of brands suffered delivery issues.

Non-sugar syrups in 2025 to 2035 will increasingly become more innovative with multi-botanical, adaptogenic, and probiotic blends to address holistic wellness needs. AI-formulation technologies will improve taste-matching to sugar and intelligent packaging innovations for portion-sized dispensing. Sustainability concerns will drive brands to launch eco-packaging, and reduced sugar regulation policies will provide penetration potential globally.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA and EFSA regulations on artificial sweeteners and natural sugar alternatives. |

| Consumer Trends | Demand for keto -friendly, diabetic-safe, and low-calorie syrups. |

| Industry Adoption | High usage in coffee chains, bakeries, and processed food manufacturers. |

| Supply Chain and Sourcing | Dependence on corn-derived sweeteners, artificial flavors , and synthetic thickening agents. |

| Market Competition | Dominated by brands like Torani , Jordan’s Skinny Syrups, and Walden Farms. |

| Market Growth Drivers | Fueled by rising diabetes cases, sugar taxes, and demand for low-carb diets. |

| Sustainability and Environmental Impact | Early adoption of BPA-free packaging and recycled PET bottles. |

| Integration of Smart Technologies | Use of online nutritional calculators and AI-driven recipe customization. |

| Advancements in Formulation | Focus on erythritol , stevia, and sucralose blends for sugar-free alternatives. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Tighter controls on sugar substitutes, transparency in labeling , and possible prohibitions on high-intensity sweeteners such as aspartame. |

| Consumer Trends | Increased use of plant-based and gut-friendly syrups with prebiotics and fiber-based sweeteners. |

| Industry Adoption | Expansion into fitness supplements, meal replacement foods, and functional drinks. |

| Supply Chain and Sourcing | Transition to monk fruit, stevia, erythritol blends, and locally produced organic ingredients. |

| Market Competition | Inroads by nutraceutical firms, clean-label brands, and startups targeting natural fermentation-based syrups. |

| Market Growth Drivers | Propelled by innovation in fermentation-derived sweeteners, consumer demand for whole-food sweeteners, and functional health benefits. |

| Sustainability and Environmental Impact | Shift to compostable, bio-based packaging and carbon-neutral manufacturing sites. |

| Integration of Smart Technologies | Growth of AI-powered personalized nutrition, blockchain -traceable ingredients, and smart packaging with freshness markers. |

| Advancements in Formulation | Innovation in fermentation-derived rare sugars, fiber-enriched syrups with prebiotic functionality, and AI-optimized taste modulation. |

The USA sugar-free syrup market is expanding exponentially as consumers have increased awareness about their health, and government regulations are making efforts to reduce added sugars. With increasingly more Americans shifting to healthy foods, the food and beverage industry is also making this transition by using sugar-free syrups in food products such as energy drinks, flavored coffee, and mixed cocktails.

Further, the Food and Drug Administration (FDA) is themselves encouraging clean labeling, whereby the companies are themselves committing publicly to their ingredients. This has augmented product innovation because companies have replaced products with natural sweeteners like stevia and monk fruit to try to achieve customers' requirement for clean labeling.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3 % |

Regulatory action of sufficient strength, and shifting consumer consumption trends are favorable to the UK market for sugar-free syrups. Government levies on sugar have compelled producers to lower the content of sugar in products, and therefore syrups with no sugar are the most preferred in food and beverage preparation.

Secondly, diabetic foods are also gaining popularity as people more and more attempt to restrict sugar consumption. Coffee shop venues and fitness brands are in the lead concerning this innovation due to the introduction of natural as well as sugar-free syrups in the place of common syrups.

Natural sweeteners like allulose and stevia are hence becoming increasingly applied in the help of firms in order to battle the necessity to keep up with taste preferences along with well-being advantages. European Union sugar-free syrups demand is on the rise due to strict food laws that make it a piece of cake to use natural alternatives to sugar.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

Europeans are turning towards syrups from natural sources instead of artificial sweeteners. Germany and France are major drivers of this demand, employing products that employ monk fruit and oligofructose formulations.

Even more severe demand, however, is emanating from increasing consumer interest in functional sweeteners that is, products providing such health benefits as improved digestion and better glycemic control again propelling demand within this rapidly moving and dynamic sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.2% |

Japan's sugar-free syrup market is booming on the back of a culture of innovation and health options. The market is incorporating gut-health functionality and fermentation technology into syrups, making them appealing to health-conscious customers.

There is increasing demand for zero-calorie sweeteners that provide sweetness and umami-enriching functionality to conventional as well as fusion cuisine. The trend has given rise to syrups that complement Japanese cuisine, tea, and desserts. As customers must be healthier but not lose flavor, the market still brings new launches that align with evolving consumption patterns.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The South Korean sugar-free syrup market is expanding very quickly because of increasing popularity in health and overall wellness with the K-beauty phenomenon. The driving reason behind increasing knowledge of consumers about the need for health is compelling them towards sugar-free lives, and that in turn is propelling demand for low-GI next-generation syrups, which is increasing. Market growth is supported by sugar-free dessert cafes in Korea, health supplements manufactured using sugar-free materials, and functional drinks that allow individuals to live healthily.

Erythritol, allulose, and stevia syrups are being manufactured by firms to address this wellness-oriented consumer group. With more metabolically conscious information being produced, South Korea continues to be a market leader in the sugar-free category.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

| By Based on Flavour | Market Share (2025) |

|---|---|

| Fruits | 47 % |

Sugar-free fruit flavor syrups are also forecasted to have a 47% market share in 2025 due to rising demand for naturally flavored products that replace the use of conventional syrups. Popular brands which have developed strong market penetration are Jordan's Skinny Mixes and Torani Sugar-Free, selling strawberry, raspberry, and blueberry flavor syrups which win the approval of customers as low-calorie substitutes for food and drink.

Increased use of stevia, erythritol, and monk fruit sweeteners also supported category expansion, particularly with shoppers for clean-label offerings and health-oriented consumers. Sugar-free flavored fruit syrup demand is also being driven increasingly by do-it-yourself beverage trends such as home mixology, flavored sparkling water, and smoothies.

| By Based on Application | Market Share (2025) |

|---|---|

| Beverages | 52 % |

The drink category will dominate the market with a market share of 52% in 2025. Sugar-free cocktail trend, low-calorie coffee, and iced tea flavor have prompted specialty coffee houses and homebrewers to call for syrups.

Chains as large as Dunkin' and Starbucks are expanding their line of sugar-free syrup products to keep pace with increased consumer demand for guilt-free indulgence. Conversely, ready-to-drink (RTD) rivals are launching sugar-free syrups in their portfolios, which are capturing the market. Sugar-free syrups will be governing the drink market even in the future due to innovation in zero-sugar energy drinks, protein shakes, and functional beverages.

Increasing demand by diabetic and reduced-calorie customers has driven the market for sugar-free syrups. Natural sweeteners and artificial sweeteners are replacing syrups with no compromise in taste and texture. Companies are attempting to make through monk fruit extract, stevia, and allulose and improve solubility and viscosity. Flavor innovation and clean-label ingredients are propelling competition.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| The Kraft Heinz Company | 22-26% |

| The Hershey Company | 18-22% |

| Walden Farms | 12-16% |

| Torani (R. Torre & Co.) | 8-12% |

| Pyure Brands LLC | 5-8% |

| Other Companies (combined) | 12-16% |

| Company Name | Key Offerings/Activities |

|---|---|

| The Kraft Heinz Company | In 2024, introduced an allulose -based sugar-free chocolate syrup with improved viscosity. In 2025, expanded its product line with keto -friendly maple syrup infused with natural flavors. |

| The Hershey Company | In 2024, reformulated its sugar-free syrup with a monk fruit-stevia blend to enhance sweetness without aftertaste. In 2025, launched a new sugar-free caramel syrup targeting coffee enthusiasts and dessert toppings. |

| Walden Farms | In 2024, expanded its distribution network in Europe and Asia for its zero-calorie, sugar-free syrups. In 2025, introduced a naturally thickened vanilla syrup using prebiotic fiber. |

| Torani (R. Torre & Co.) | In 2024, launched a line of sugar-free fruit syrups using erythritol and monk fruit for improved sweetness balance. In 2025, collaborated with coffee chains to develop customized sugar-free flavor profiles. |

| Pyure Brands LLC | In 2024, introduced a USDA organic sugar-free pancake syrup using stevia and soluble fiber. In 2025, developed an all-natural keto syrup blend with enhanced stability for baking applications. |

Key Company Insights

Kraft Heinz Company (22-26%)

Kraft Heinz dominates the sugar-free syrup industry with its proprietary brand and high-intensity product innovation. Its recent products made with allulose closely match the flavor and texture of syrups regular, a favorite with health-focused customers.

Hershey Company (18-22%)

Hershey is the market leader in chocolate syrup with its sugar-free repositioned products. Through the addition of monk fruit and stevia in its formula, it has been able to avoid bitterness that accompany sugar substitutes.

Walden Farms (12-16%)

Walden Farms is a sugar-free and calorie-free syrup specialist with a number of flavors. Its expansion into international markets and focus on prebiotic fiber thickeners as sweeteners place it at the leadership in the sugar-free sector.

Torani (8-12%)

Torani is a specialist in sugar-free flavored syrup for coffee and beverages. Its affiliation with coffeehouses and use of erythritol and monk fruit make flavor customization its competitive advantage.

Pyure Brands LLC (5-8%)

Pyure Brands dominates the organic and keto market. Its use of all-natural syrup recipes and USDA organic certification is keeping pace with growing consumer demand for clean-label products.

Other Key Players (12-16% Combined)

The overall market size for the sugar-free syrups market was USD 3,118 million in 2025.

The sugar-free syrups market is expected to reach USD 4,936 million in 2035.

The increasing demand for low-calorie and diabetic-friendly alternatives, growing health consciousness among consumers, and expanding applications in food & beverage industries fuel the sugar-free syrups market during the forecast period.

The top 5 countries which drive the development of the sugar-free syrups market are USA, UK., Germany, Canada, and Australia.

On the basis of application, the food & beverage sector to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA