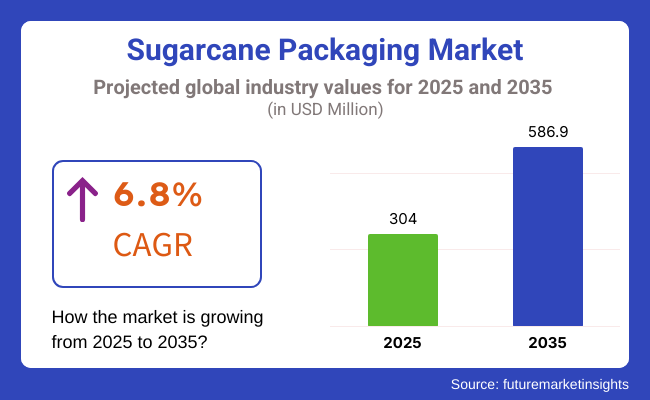

The sugarcane packaging sector market size is projected to be USD 304.0 million in 2025 and expected to amount to USD 586.9 million by 2035. The sales are projected to grow at a CAGR of 6.8% during the forecast period from 2025 to 2035.

The food and beverage industries are increasingly adopting sugarcane packaging because it is biodegradable and compostable. Driven primarily by the need for sustainable and biodegradable alternatives to plastics, the market is projected to account for more than 60.4% of sustainable packaging market share by 2035.

By product type, bagasse-based packaging is projected to account for over 67% market share. Adoption is also growing in other applications, such as flexible films made with sugarcane. The global sugarcane packaging opportunity is estimated to be around USD 5.7 billion, which will create a 1.8X growth over the forecast.

| Particular | Value CAGR |

|---|---|

| H1 | 6.5% (2024 to 2034) |

| H2 | 6.8% (2024 to 2034) |

| H1 | 6.9% (2025 to 2035) |

| H2 | 6.7% (2025 to 2035) |

According to the report, the market is expected to grow with a CAGR of 6.5% during 2024 to 2029 (H1) of the 2030s decades, followed by a relatively slower uptake in the first half (H2) of the 2030s, growing with a CAGR of 6.8% during this period. In the next period, from H1 2025 to H2 2035, the CAGR is expected to decrease slightly to 6.9% (H1 2025 to H1 2030) and rise to 6.7% over the second half (H2 2030 to end 2035 respectively. 60 BPS decline in H1, 80 BPS increase in H2.

Increasing Demand for the Compostable Packaging Solutions Propels the Market Growth

Growing awareness about plastic pollution has prompted consumers and businesses to search for sustainable alternatives such as sugarcane packaging. Regulatory mandates driving compostable material usage are further fuelling market growth.

Advancement of Modern Technologies for Processing Strengthens Market Growth

The introduction of sugarcane-based packaging has made a buzz, owing to its natural decomposition and significant contribution towards lessening landfill waste. Sugarcane trays, bowls, and clamshell containers are a major visual favourite with the foodservice industry.

Difficulties in Manufacturing Scale and Production Cost

Sugarcane packaging may be a superior option for the environment, but it can be more expensive to produce than a conventional plastic wrapper. Even more, large-scale supply-chain efficiency for sugarcane-based materials is predominantly limited. The rising processing technology and investments in sustainable manufacturing solutions are anticipated to overcome these concerns.

Newer biodegradable coatings

For better resistance to moisture, and yet compostability.

Automating and AI in Sugarcane Packaging Production

Enhancing productivity, minimizing costs, and increasing production to meet the demand globally.

Upmarket & Customization Capabilities

Service for high-end food and beverage and cosmetic industries needing branded green packing.

Circular Economy & Compostable Packaging

To meet regulatory and consumer expectations, closed-loop, fully compostable sugarcane-based solutions.

Government Collaboration & Compliance

Actual packaging should comply with worldwide sustainability policies and the approval course needs to be fast-tracked.

The worldwide sugarcane packaging market grew with a CAGR of 5.4% during 2024 and 2020, totalling around USD 4.8 billion in 2020, and the country is most likely to reach USD 6.1 billion by 2024. Growth was driven by the rising adoption of biodegradable and compostable alternatives in food service, retail, and e-commerce.

With a rise in the awareness of sustainability, the demand for moulded fibre trays, clamshells, and cups using sugarcane-based ones also grew. Governments have followed suit with tighter single-use plastic bags, adding to the demand for plant-based alternatives.

Market Growth

Moderate Growth (5.7% CAGR) due to current sustainability trends Significant Expansion (6.8% CAGR) after sugarcane packaging measures adopt mainstreamed

Sustainability Pressure

Move to plant-based and recyclable sugarcane packaging Industries must take up biodegradable solutions.

Raw Material

Dependency on bagasse waste from sugarcane processing Diversifying into multi-fibre solutions (Sugarcane with Bamboo & Seaweed)

Technology & Automation

Moulded fibre manufacturing gradually automated AI-driven material optimisation and mass customisation.

Product Innovation

Introduction of leak-proof and grease-resistant sugarcane packaging Advanced smart packaging with moisture-resistant, temperature-sensitive features.

Cost & Pricing

(Higher cost to produce in limited quantities in China) (Cost on demand (localised production, supply chain optimisation)

Industry Penetration

Previously limited to food service, retail, and disposable tableware Now penetrating the supply chain in electronics, pharma, cosmetics, and premium consumer goods.

Customisation

Less branding and structure flexibility High-end digital printing and custom-moulded designs for premium branding.

Policy Shifting

Rules to eliminate single-use plastics National mandates for compostable packaging on most consumer products.

Terminal Growth

Global needs are borne from laundry cars cannabis, carbon capture, and atlas seaweed food items on the menu, pharmacy, and beverage carts at selective restaurants.

Circular Economy

Initial emphasis on recyclability and compostability on an industrial scale Complete switchover to home-compostable and reusable sugarcane packaging solutions

| Factor | Consumer vs. Manufacturer Priorities (2020 to 2024 vs. 2025 to 2035) |

|---|---|

| Sustainability |

|

| Cost & Pricing |

|

| Performance (Durability, Moisture Resistance, Strength) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Reusability & Circular Economy |

|

Tier 1 segment constitutes companies that are the most mature players in the global sugarcane packaging market. These companies have scaled capacity and a broad portfolio. Specializing in the production of packaging products made from sugarcane, such as assorted trays, containers, and cutlery, they are also known for their market presence in over 40 countries along with a strong customer base.

These companies spend money on advanced technology, sustainable sources of raw materials, and compliance with regulations rather than fairies and elves to deliver quality products. Some of the key players in tier 1 are Huhtamaki Oyj, Pactiv Evergreen Inc., Genpak LLC, Eco-Products, Inc., and Veg Ware Ltd.

Tier 2 companies are those sprightly firms that flourish in localities, often with considerable clout in those markets. These companies have reasonable technical capabilities and regulatory compliance but not the advanced technology or global outreach as tier 1 players. They serve specific applications and specialised sugarcane packaging solutions. Tier 2 companies include Biopak, Dart Container Corporation, Duni AB, Sabert Corporation, and Green Good USA.

Tier 3 is small-scale local to regional players meeting local demand. These are primarily local providers serving local market needs and fit into an unorganised sector in contrast to tier 1 and tier 2 structured companies.

sugarcane packaging continued to grow at a steady pace, due to rising adoption in China and India’s foodservice industries. It was when demand for sustainable alternatives ramped up production. And moving forward, robust growth is forecast as sustainability regulations demand compostable packaging, with local manufacturers ramping capabilities to meet growing needs.

The EU enacted strict regulations on single-use plastics, pushing major brands in Europe to develop sugarcane-based packaging. The proliferation of sustainability mandates will increase the adoption of biodegradable packaging, with performance-enhancing coatings replacing plastic linings in the future.

Sugarcane products demand surge at the global level was driven by Growing awareness of sustainable packaging but varied by region due to concerns about cost and Availability.

Moderate growth led by hospitality in Brazil and Mexico. But limited production capacity hampered adoption. With government incentives for green packaging, strong growth is anticipated where local production is developed to cater to domestic demand.

MEA had sluggish adoption owing to the absence of major regulatory pressure along with dependence on conventional plastic packaging. Now sustainability awareness is growing, along with many government initiatives that will boost demand for sugarcane biodegradable packaging, along with many investments in local production.

The USA and Canada spearheaded innovations for sugarcane-based packaging, with leading QSR brands moving to biodegradable contributory alternatives. In the coming years, the expansion of compostable food packaging will be propelled by stringent plastic bags and increasing demand across retail, food service, and healthcare sectors.

Little adoption in this region due to the need for cost and infrastructure availability for sustainable packaging, and nothing except premium food service took the roles. So, between 2025 and 2035, the governments of India, Bangladesh, and Sri Lanka will implement plastic bags, leading to high demand for cost-effective alternatives from sugarcane and local manufacturing.

The section below covers future projections for the sugarcane packaging market in key countries across different regions. The United States is expected to remain a major market, with a CAGR of 6.4% through 2035. India is projected to lead South Asia with a CAGR of 8.1%.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

| India | 8.1% |

| Germany | 5.2% |

| China | 7.0% |

| Brazil | 4.1% |

| United Kingdom | 4.8% |

| Canada | 4.5% |

Driven by bans on single-use plastics in various markets, consumers are also opting for sustainable solutions, hence the rise in demand for sugarcane-based compostable packaging in the United States. As part of their sustainability goals, major foodservice chains and retailers are transitioning to biodegradable packaging.

The EU itself is already a lucrative market for sugarcane packaging and Germany is a key driver contributing towards this. To satisfy customers' performance needs while adhering to regulations, manufacturers are concentrating on recyclable and biodegradable coatings.

You are learning about the key segments in the market in this part. Sugarcane Bagasse share of material type is estimated to be at 70.2% by 2035. Food packaging is anticipated to be the prominent end-use segment, accounting for 55.3% share at the end of 2035 and dominating the market by application.

| Material Type | Market Share (2025) |

|---|---|

| Sugarcane Bagasse | 70.2% |

Sugarcane packaging is a natural biodegradable product mainly made up of sugarcane bagasse, a cellulosic fibrous residue after harvesting the sugarcane stalks. Because it is biodegradable, compostable, and made from renewable resources, it has gained popularity as an eco-friendly alternative to conventional plastic packaging.

Bagasse is widely used in making food containers, plates, and trays, as well as clamshells, which is in line with the world's attempt to reduce plastic use. Moreover, stringent eco-friendly regulations and rising consumer demand for eco-friendly packaging have made sugarcane packaging attractive, especially in areas where restrictions on plastic bags and single-use packaging are tightening.

| Application | Market Share (2025) |

|---|---|

| Food Packaging | 55.3% |

Food packaging continues to be the top application for sugarcane packaging, owing to the growing demand for sustainable foodservice and carryout packaging solutions. Restaurants, catering services, and fast-food chains use sugarcane-based products like bowls, plates, trays, and clamshell containers to serve ready-to-eat meals, salads, sandwiches, and desserts.

These products are preferred because they are durable, resistant to grease, and maintain their shape or properties (ideal for hot and cold food items). Moreover, as the foodservice industry continues to move toward eco-friendly packaging, sugarcane packaging options are projected to have healthy growth.

Key players in the sugarcane packaging market are focusing on developing innovative, sustainable packaging solutions, improving production efficiency, and expanding their geographical presence.

Discoveries by Key Companies (Sugarcane-Based Packaging)

Huhtamaki scaled up production of sugarcane-based food containers and is now deploying bio-based solutions across new geography. Chukoh Chemical Industries have outputs targeted at foodservice based on advanced sugarcane fiber and worked to enhance strength and moisture resistance. Dart Container Corporation, which focused on disposable sugarcane plates and bowls, is now expanding its capacity for custom sugarcane packaging for foodservice and retail markets.

Eco-Products, Inc. introduced sugarcane-based takeout containers and tableware and is now expanding its portfolio of compostable packaging options for the food industry. Pactiv Evergreen has focused on sustainable sugarcane trays and food containers, with developments to enhance grease and liquid resistance. BioPak extended its sugarcane pack for foodservice companies, and it is now working on improved insulated trays and clamshells.

Green Box, which created eco-friendly sugarcane containers for takeout, is now scaling custom solutions for the food sector. Veg Ware has pioneered the category of compostable sugarcane-based packaging and is now diversifying its product portfolio and opening new international markets. The Paper Tube Company specialized in sugarcane fiber-based foodservice packaging and is working on new offerings for large food retail operations.

In sugarcane, Stora Enso enhanced the amount of sugarcane pulp for packaging applications and is working on more sugarcane technologies. Clear Lam Packaging Divisions is emphasizing sustainable packaging such as sugarcane and natural fibers, and expanding worldwide. Compostable Packaging developed sustainable packaging from sugarcane fiber and is now working on large-scale adaptations for food delivery operations.

The project team designed 100% compostable sugarcane products for retail and foodservice and are scaling for international markets. Pulp Works, Inc. also made takeout food containers, using sugarcane pulp, and is growing its products for international takeout services. Pak-Sher developed sugarcane plates, trays, and clamshells for food packaging, and is expanding product innovation for customer-specific solutions.

The Green Packaging Company has specialized in compostable and sustainable sugarcane packaging for the food industry but is branded for new food uses and applications in retail.

With a steady demand for sustainable packaging solutions in the food service, retail, and e-commerce sectors, the sugarcane packaging market is anticipated to experience significant growth over the next few years. The industry stakeholders must make them a priority.

Through these tactics, businesses can strengthen their foothold in the market and take advantage of the rising need for sustainable packaging solutions.

It is anticipated that the market will experience a CAGR of 6.8% from 2025 to 2035.

The global market was USD 304 million in 2025.

The market is projected to grow at USD 586.9 million by the year 2035.

The South Asia & Pacific region is projected to experience the highest CAGR due to the expanding foodservice and retail industry in the region.

Key players in the market include Huhtamaki, Dart Container, Pactiv Evergreen, and Berry Global.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (Tonnes) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 5: Global Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 7: Global Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Volume (Tonnes) Forecast by Sales Channel, 2018 to 2033

Table 9: Global Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 11: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 13: North America Value (US$ Million) Forecast by Material, 2018 to 2033

Table 14: North America Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 15: North America Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 17: North America Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 18: North America Volume (Tonnes) Forecast by Sales Channel, 2018 to 2033

Table 19: North America Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 21: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 23: Latin America Value (US$ Million) Forecast by Material, 2018 to 2033

Table 24: Latin America Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 25: Latin America Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 28: Latin America Volume (Tonnes) Forecast by Sales Channel, 2018 to 2033

Table 29: Latin America Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Latin America Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 31: Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 33: Europe Value (US$ Million) Forecast by Material, 2018 to 2033

Table 34: Europe Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 35: Europe Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Europe Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 37: Europe Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Europe Volume (Tonnes) Forecast by Sales Channel, 2018 to 2033

Table 39: Europe Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Europe Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 41: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: East Asia Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 43: East Asia Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: East Asia Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 45: East Asia Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: East Asia Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 47: East Asia Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: East Asia Volume (Tonnes) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: East Asia Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 51: South Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 53: South Asia Value (US$ Million) Forecast by Material, 2018 to 2033

Table 54: South Asia Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 55: South Asia Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: South Asia Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 57: South Asia Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 58: South Asia Volume (Tonnes) Forecast by Sales Channel, 2018 to 2033

Table 59: South Asia Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: South Asia Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 61: Oceania Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: Oceania Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 63: Oceania Value (US$ Million) Forecast by Material, 2018 to 2033

Table 64: Oceania Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 65: Oceania Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: Oceania Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 67: Oceania Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 68: Oceania Volume (Tonnes) Forecast by Sales Channel, 2018 to 2033

Table 69: Oceania Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 70: Oceania Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 71: MEA Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: MEA Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 73: MEA Value (US$ Million) Forecast by Material, 2018 to 2033

Table 74: MEA Volume (Tonnes) Forecast by Material, 2018 to 2033

Table 75: MEA Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: MEA Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 77: MEA Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 78: MEA Volume (Tonnes) Forecast by Sales Channel, 2018 to 2033

Table 79: MEA Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 80: MEA Volume (Tonnes) Forecast by End Use, 2018 to 2033

Figure 1: Global Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Volume (Tonnes) Analysis by Region, 2018 to 2033

Figure 8: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 11: Global Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 12: Global Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 13: Global Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 14: Global Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 16: Global Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Volume (Tonnes) Analysis by Sales Channel, 2018 to 2033

Figure 20: Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 21: Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 22: Global Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 23: Global Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 24: Global Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 25: Global Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 26: Global Attractiveness by Material, 2023 to 2033

Figure 27: Global Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Attractiveness by Sales Channel, 2023 to 2033

Figure 29: Global Attractiveness by End Use, 2023 to 2033

Figure 30: Global Attractiveness by Region, 2023 to 2033

Figure 31: North America Value (US$ Million) by Material, 2023 to 2033

Figure 32: North America Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 34: North America Value (US$ Million) by End Use, 2023 to 2033

Figure 35: North America Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 38: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 41: North America Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 42: North America Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 43: North America Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 44: North America Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 46: North America Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 49: North America Volume (Tonnes) Analysis by Sales Channel, 2018 to 2033

Figure 50: North America Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 51: North America Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 52: North America Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 53: North America Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 54: North America Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 55: North America Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 56: North America Attractiveness by Material, 2023 to 2033

Figure 57: North America Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Attractiveness by Sales Channel, 2023 to 2033

Figure 59: North America Attractiveness by End Use, 2023 to 2033

Figure 60: North America Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Value (US$ Million) by Material, 2023 to 2033

Figure 62: Latin America Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 64: Latin America Value (US$ Million) by End Use, 2023 to 2033

Figure 65: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 68: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 71: Latin America Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 72: Latin America Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 73: Latin America Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 74: Latin America Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 79: Latin America Volume (Tonnes) Analysis by Sales Channel, 2018 to 2033

Figure 80: Latin America Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 81: Latin America Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 82: Latin America Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 83: Latin America Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 84: Latin America Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 85: Latin America Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 86: Latin America Attractiveness by Material, 2023 to 2033

Figure 87: Latin America Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Attractiveness by Sales Channel, 2023 to 2033

Figure 89: Latin America Attractiveness by End Use, 2023 to 2033

Figure 90: Latin America Attractiveness by Country, 2023 to 2033

Figure 91: Europe Value (US$ Million) by Material, 2023 to 2033

Figure 92: Europe Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Europe Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 94: Europe Value (US$ Million) by End Use, 2023 to 2033

Figure 95: Europe Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 98: Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 101: Europe Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 102: Europe Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 103: Europe Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 104: Europe Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Europe Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 106: Europe Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Europe Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Europe Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 109: Europe Volume (Tonnes) Analysis by Sales Channel, 2018 to 2033

Figure 110: Europe Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 111: Europe Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 112: Europe Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 113: Europe Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 114: Europe Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 115: Europe Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 116: Europe Attractiveness by Material, 2023 to 2033

Figure 117: Europe Attractiveness by Product Type, 2023 to 2033

Figure 118: Europe Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Europe Attractiveness by End Use, 2023 to 2033

Figure 120: Europe Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Value (US$ Million) by Material, 2023 to 2033

Figure 122: East Asia Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: East Asia Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: East Asia Value (US$ Million) by End Use, 2023 to 2033

Figure 125: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 128: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 131: East Asia Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 132: East Asia Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 133: East Asia Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 134: East Asia Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: East Asia Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 136: East Asia Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: East Asia Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: East Asia Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 139: East Asia Volume (Tonnes) Analysis by Sales Channel, 2018 to 2033

Figure 140: East Asia Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 141: East Asia Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 142: East Asia Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 143: East Asia Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 144: East Asia Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: East Asia Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: East Asia Attractiveness by Material, 2023 to 2033

Figure 147: East Asia Attractiveness by Product Type, 2023 to 2033

Figure 148: East Asia Attractiveness by Sales Channel, 2023 to 2033

Figure 149: East Asia Attractiveness by End Use, 2023 to 2033

Figure 150: East Asia Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Value (US$ Million) by Material, 2023 to 2033

Figure 152: South Asia Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: South Asia Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 154: South Asia Value (US$ Million) by End Use, 2023 to 2033

Figure 155: South Asia Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 158: South Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 161: South Asia Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 162: South Asia Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 163: South Asia Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 164: South Asia Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: South Asia Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 166: South Asia Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: South Asia Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: South Asia Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 169: South Asia Volume (Tonnes) Analysis by Sales Channel, 2018 to 2033

Figure 170: South Asia Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 171: South Asia Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 172: South Asia Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 173: South Asia Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 174: South Asia Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 175: South Asia Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 176: South Asia Attractiveness by Material, 2023 to 2033

Figure 177: South Asia Attractiveness by Product Type, 2023 to 2033

Figure 178: South Asia Attractiveness by Sales Channel, 2023 to 2033

Figure 179: South Asia Attractiveness by End Use, 2023 to 2033

Figure 180: South Asia Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Value (US$ Million) by Material, 2023 to 2033

Figure 182: Oceania Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: Oceania Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 184: Oceania Value (US$ Million) by End Use, 2023 to 2033

Figure 185: Oceania Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 188: Oceania Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 191: Oceania Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 192: Oceania Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 193: Oceania Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 194: Oceania Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 195: Oceania Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 196: Oceania Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 197: Oceania Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 198: Oceania Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 199: Oceania Volume (Tonnes) Analysis by Sales Channel, 2018 to 2033

Figure 200: Oceania Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 201: Oceania Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 202: Oceania Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 203: Oceania Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 204: Oceania Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 205: Oceania Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 206: Oceania Attractiveness by Material, 2023 to 2033

Figure 207: Oceania Attractiveness by Product Type, 2023 to 2033

Figure 208: Oceania Attractiveness by Sales Channel, 2023 to 2033

Figure 209: Oceania Attractiveness by End Use, 2023 to 2033

Figure 210: Oceania Attractiveness by Country, 2023 to 2033

Figure 211: MEA Value (US$ Million) by Material, 2023 to 2033

Figure 212: MEA Value (US$ Million) by Product Type, 2023 to 2033

Figure 213: MEA Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 214: MEA Value (US$ Million) by End Use, 2023 to 2033

Figure 215: MEA Value (US$ Million) by Country, 2023 to 2033

Figure 216: MEA Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: MEA Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 218: MEA Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 221: MEA Volume (Tonnes) Analysis by Material, 2018 to 2033

Figure 222: MEA Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 223: MEA Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 224: MEA Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 225: MEA Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 226: MEA Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 227: MEA Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 228: MEA Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 229: MEA Volume (Tonnes) Analysis by Sales Channel, 2018 to 2033

Figure 230: MEA Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 231: MEA Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 232: MEA Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 233: MEA Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 234: MEA Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 235: MEA Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 236: MEA Attractiveness by Material, 2023 to 2033

Figure 237: MEA Attractiveness by Product Type, 2023 to 2033

Figure 238: MEA Attractiveness by Sales Channel, 2023 to 2033

Figure 239: MEA Attractiveness by End Use, 2023 to 2033

Figure 240: MEA Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sugarcane Bottle Market Forecast and Outlook 2025 to 2035

Sugarcane-Derived Squalane Market Size and Share Forecast Outlook 2025 to 2035

Sugarcane Fiber Bowls Market – Growth & Demand 2025 to 2035

Sugarcane Based PET Bottles Market

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA