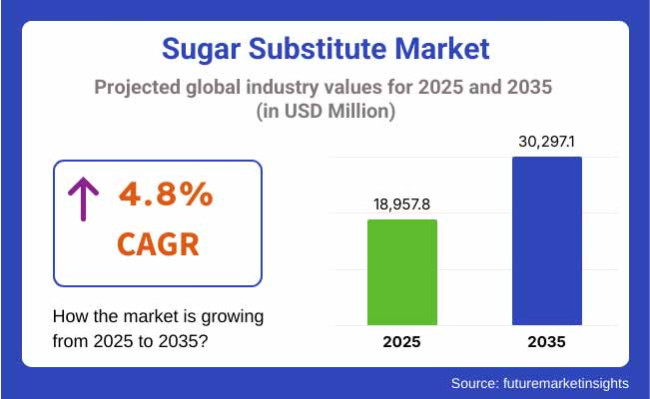

The sugar substitute market is expected to grow significantly between 2025 and 2035, driven by rising health awareness, increasing global diabetes prevalence, and growing demand for low-calorie, low-glycaemic index sweeteners. The market is projected to be valued at USD 18,957.8million in 2025 and is anticipated to reach USD 30,297.1million by 2035, reflecting a CAGR of 4.8% over the forecast period.

Sugar substitutes high-intensity sweeteners, sugar alcohols and natural alternatives are used to replace the sweetness of sugar with fewer or zero calories. The increasing consumer interest for sugar reduction in processed foods, functional nutrition combined with pressure from regulators to label added sugars, is driving adoption across food & beverage, pharmaceuticals, and personal care industries. But hurdles over consumer perception, flavour consistency and formulation stability remain shaping forces in the competitive landscape.

Blended sweetener systems; more plant-based innovations in monk fruit and stevia; fermentation-derived rare sugars; and AI-optimized sweetener formulation platforms designed to balance sweetness, mouthfeel and aftertaste.

North America continues to be a significant market with increasing obesity and diabetes rates, strong functional food innovation, as well as aggressive sugar reduction initiatives within government and private sectors. The USA leads in the use of monk fruit, stevia and erythritol, especially in beverages and low-carb snacks. Canada is also seeing increase in demand in the area of nutraceuticals and natural health products, in which sugar substitutes are used for label-friendly formulation.

In Europemarket dynamics are driven by EU sugar tax policies, EFSA-regulated health claims, and increasing interest in plant-based diets. Countries such as Germany, UK, France, Italy and Spain are embracing sweeteners from xylitol to isomalt and tagatose in bakery and dairy innovation. Natural origin and sustainability are strong purchase drivers. Blends based on clean-label stevia and chicory root fiber are getting traction in the wellness and children’s food segments.

Asia-Pacific is the fastest growing region, due to increased disposable income, awareness of chronic disease and urban lifestyle changes. China is also a major producer and exporter of high-intensity sweeteners, such as sucralose and aspartame, while India is growing in natural sweetener start-ups, such as coconut sugar, jaggery blends, and Ayurvedic alternatives. Economy The Japanese and South Koreans are leading innovation around rare sugars (e.g., allulose, D-psicose) and applications in functional beverages.

Challenges

Taste Profile, Clean Labeling, and Regulation

While sugar substitutes are increasingly used, they are difficult to develop because they have to deliver a sugar-like mouthfeel without bitterness or lingering aftertastes. Consumers have growing distrust of chemical-sounding ingredients, and also there’s pushback on legacy synthetic sweeteners. Managers must also navigate regulatory differences between global markets which influence product labeling policies, marketing claims, and use limits across categories.

Opportunities

Natural Innovation, Functional Benefits, and Personalized Nutrition

The space includes players in next-gen natural sweeteners, like fermented allulose, steviol glycosides produced via bioconversion, and hybrid sugar fibers that combine sweet taste with digestive health benefits. There is growing demand for custom sweetener solutions, driven by the proliferation of low glycaemic diabetic friendly foods, sports nutrition, and personalized metabolic health platforms. Long-term sustainability and leadership in the market for microbiome-targeted sugar alternatives, as well as production of carbon-neutral sweeteners, are anticipated from investments in these sectors.

The sugar substitute market showed a profound growth after 2020 and in all throughout the period of 2024, owing to the increased health awareness around the globe, growing prevalence of diabetes and obesity, and pressure from regulations to cut down the added sugar in food and beverages. Recipes for low-calorie products alike found soaring demand for both natural (stevia, monk fruit, allulose) and artificial (aspartame, sucralose) sweeteners.

Largest adoption was seen in functional beverages, bakery products, and sugar-free confectionery. But concerns around taste profiles, long-term health impacts of synthetic substitutes and regulatory disparities across countries have created hurdles to broader mainstream adoption.

For 2025 to 2035, the outlook is for broadening of the market by new biotech-enabled sweetener innovation, personalized platforms for nutrition needs, and integration of AI in taste/flavours optimization. Fermentation-derived rare sugars, next-generation plant-based extracts, and enzyme-based sweeteners will change the game.

Sugar substitutes will increasingly be customized according to glycaemic response and microbiome compatibility, as well as consumer health targets. Sustainability too will have a central role. Carbon-neutral production methods and circular ingredient sourcing will be at the forefront of product development and brand positioning.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | FDA, EFSA, and CODEX approvals for GRAS substances; country-specific bans or limits on artificial sweeteners. |

| Technological Innovation | Natural extracts (stevia, monk fruit), synthetic sweeteners (aspartame, sucralose), and rare sugars (allulose). |

| Industry Adoption | Common in soft drinks, protein bars, baked goods, and diabetic supplements. |

| Smart & AI-Enabled Solutions | Use of consumer preference data for reformulation; limited real-time sensory feedback integration. |

| Market Competition | Led by Cargill, Ingredion, Tate & Lyle, Pure Circle , and Ajinomoto. |

| Market Growth Drivers | Health-conscious consumption, anti-obesity policies, and sugar taxes. |

| Sustainability and Environmental Impact | Focus on reducing caloric load and promoting plant-based sourcing. |

| Integration of AI & Digitalization | Digital health apps recommending sugar-free options; limited product-level AI use. |

| Advancements in Product Design | Powdered and liquid formats for food and beverage; focus on calorie reduction. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Harmonized global regulations for rare sugars, front-of-pack labeling mandates, and glycaemic impact scoring for sugar alternatives. |

| Technological Innovation | Fermentation-derived sweet proteins, enzymatic flavour modulation, and biotech-enhanced low-GI sweetener blends. |

| Industry Adoption | Expanded use in functional foods, personalized meal plans, medical nutrition, and next-gen plant-based dairy and meats. |

| Smart & AI-Enabled Solutions | AI-driven sweetness modelling , glycaemic -response personalization engines, and machine learning for flavour masking and optimization. |

| Market Competition | Growing competition from biotech food innovators, rare sugar fermentation startups, and personalized nutrition platforms. |

| Market Growth Drivers | Growth driven by precision nutrition, zero-calorie clean-label innovation, and global metabolic health initiatives. |

| Sustainability and Environmental Impact | Shift to carbon-neutral sweetener production, water-efficient fermentation systems, and zero-waste ingredient sourcing models. |

| Integration of AI & Digitalization | AI-enabled formulation tools, app-linked personalized sweetener dosing, and digital twin models of metabolic response. |

| Advancements in Product Design | Functional sweeteners with added probiotics or prebiotics, adaptive-release sweetness profiles, and clean-label blends for targeted health benefits. |

As the USA consumers continue to mindful of their sugar intake owing to the increasing prevalence of obesity, diabetes and metabolic disorders, the sugar substitute market in USA is increasing at a substantial rate. Low-calorie and zero-calorie sweeteners like stevia, monk fruit, erythritol and allulose are in high demand across beverages, baked goods and packaged snacks.

Food Manufacturers are continuing to reformulate legacy brands and bringing new SKUs to the market that align with clean-label and keto-friendly trends. The FDA's regulatory clarity and strong investment in natural sweet shoal are supporting innovation and market penetration.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

The largest share of the UK market is for healthy low-sugar alternatives, which are being driven by government-led sugar reduction initiatives that reduce the sugar percentage of a product's composition. The introduction of the soft drinks industry levy (sugar tax), and next on the agenda will be the alcohol duty review process and the prevention green paper, which has ushered a wave of reformulation in the beverage sector.

Natural sweeteners such as stevia and xylitol have also increasingly penetrated dairy products, breakfast cereals and desserts. We have the emergence of clean-label positioning, allergen-free claims and responsible sourcing which are becoming driving factors for consumers to purchase a product as well as product/platform innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

The main reason for the growth of the sugar substitute market in the EU is the increasing awareness of our sedentary lifestyle diseases and the increasing demand for sugar-free and reduced-sugar products in the countries like Germany, France, and Netherlands.

Such developments, along with EU regulations governing the use of natural sweeteners and restrictions on added sugars in processed foods, are reshaping market players. Sugar alternatives are primarily adopted in the Bakery, Confectionery, and functional beverage segments. The application scope across the region is wide due to innovations in taste-masking technologies and sugar reduction platforms.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.7% |

Japan’s sugar substitute market is steadily expanding due to its aging population, a hyper-focus on health and wellness, as well as the existing demand for functional foods. Sugar substitutes, like rare sugars, erythritol, and stevia, are commonly used in drinks, health dietary supplements, and food for diabetes.

For most local food manufacturers, taste balance, texture, and the degree of digestive tolerance is the prime factor in product formulation. Acceptance of low-sugar diets by the government and rising demand for "tokuho" (health claim-labelled) foods are driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

The sugar substitute market in South Korea is growing at a rapid pace due to rising demand for low-calorie and diabetes-friendly products. Urban consumers, especially Millennials and Gen Z, are searching for sugar alternatives in drinks, protein snacks, and café-style desserts.

Over the past few months, domestic food and beverage companies have been experimenting with monk fruit and stevia blends that provide sweet taste with little glycaemic effect. Government-led nutrition awareness campaigns and consumer interest in preventive health have been driving penetration across retail and online channels.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

Source Market Share (2025)

| Source | Value Share (%) |

|---|---|

| Natural | 56.8% |

By 2025, natural sugar substitutes are forecast to account for a value share of 56.8% in an expanding global sugar substitute market. As health focused consumers demand more ingredient transparency, there is an increasing preference for naturally sourced sweeteners such as stevia, monk fruit extract, erythritol, and xylitol. These ingredients are considered safer and more sustainable in comparison to artificial sweeteners.

Natural sugar substitutes not only provide sweetness without the sugar’s caloric cost, but also speak to the cleaner-label and plant-based dietary movements. Their uses are multiplying in drinks, dairy products, baked goods and personal care products. Furthermore, favourable regulations and approvals for natural alternatives in various regions have further enhanced their acceptance by manufacturers and end consumers.

Moreover, the rise in demand for diabetic- and keto-based food products has also spurred the application of natural sugar substitutes owing to its lower glycaemic index, as well as negligible impact on blood sugar levels. Cheaper, also, and as taste and formulation technologies evolve, these natural sweeteners are coming closer to sugar’s sensory qualities and market dominance.

Product Type Market Share (2025)

| Product Type | Value Share (%) |

|---|---|

| Non-Nutritive | 61.2% |

By 2025, the share of non-nutritive sugar substitutes is expected to be 61.2% of the total market share. These sweeteners provide little to no kilojoules of energy, so they are ideal for calorie-restricted diets or products aimed at weight management, diabetes care and metabolic health. Common non-nutritive sweeteners include aspartame, sucralose, saccharin and newer natural options like stevia and monk fruit.

Their extreme sweetness often several hundred times greater than sucroseallows them to be used in small amounts and so their use in food and beverage manufacturers is economically viable. This continued movement toward sugar reduction in both mainstream and specialty food categories is driving demand for non-nutritive formulations that deliver on flavour while promoting health objectives.

And new blending techniques have enabled better-tasting profiles that mask bitter aftertastes and make non-nutritive sweeteners more palatable in a wider range of applications. Just as global health authorities and food regulators are urging a reduction of sugar to fight obesity and chronic diseases, non-nutritive substitutes are becoming a go-to fix in packaged foods, beverages and even some pharmaceuticals.

As awareness increases, product innovation expands and the regulatory backdrop gets more beneficial, the non-nutritive product type is poised to maintain its lead in the sugar substitute market through the next several years.

The market for sugar substitutes is exploding, responding to increasing concerns about obesity, diabetes, and calorie-conscious diets, along with strong demand for clean-label, natural, and functional sweeteners. Sugars substitutes are increasingly used in the beverages, bakery, dairy, pharmaceutical and nutraceuticals. The major market growth factors of low-calorie sweeteners are regulatory support, the increasing diabetic population, the expansion of keto and low-carb lifestyles, and improved taste-masking and formulation technologies.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Cargill, Incorporated | 16-20% |

| Archer Daniels Midland Company | 13-17% |

| Tate & Lyle PLC | 11-15% |

| Ingredion Incorporated | 9-13% |

| Ajinomoto Co., Inc. | 7-10% |

| Others | 25-30% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Cargill, Incorporated | In 2024 , Cargill expanded its EverSweet® stevia and Reb M formulations , enabling sugar-like taste in carbonated beverages and dairy applications with clean-label positioning. |

| Archer Daniels Midland Company | As of 2023 , ADM introduced high-intensity monk fruit blends and fiber-based sweetener systems for baked goods, with emphasis on glycaemic control and satiety. |

| Tate & Lyle PLC | In 2025 , Tate & Lyle launched its new Tasteva® M Stevia Extract and allulose-based sweetener blends designed for calorie-reduction in confectionery and ice cream products. |

| Ingredion Incorporated | In 2023 , Ingredion rolled out its BESTEVIA® Stevia Leaf Extracts and Polyol Solutions , tailored for low-calorie, low-GI snack and functional beverage formulations. |

| Ajinomoto Co., Inc. | As of 2024 , Ajinomoto advanced its global reach with aspartame and Advantame production optimization , targeting pharmaceutical excipients and sugar-free gum segments. |

Key Market Insights

Cargill, Incorporated (16-20%)

Leads in plant-based sweetener innovation, focusing on scalable, zero-calorie alternatives like stevia and erythritol, with strong partnerships in beverage and dairy industries.

Archer Daniels Midland Company (13-17%)

Offers a broad portfolio of natural and synthetic sweeteners, including novel blends designed to enhance mouthfeel and reduce post-consumption glucose spikes.

Tate & Lyle PLC (11-15%)

Known for pioneering low-calorie sweetener solutions, including rare sugars and stevia derivatives, with emphasis on taste optimization and global sugar tax compliance.

Ingredion Incorporated (9-13%)

Specializes in formulation support and sugar substitute systems for health-positioned packaged foods, with a strong North American and LATAM presence.

Ajinomoto Co., Inc. (7-10%)

Long-time leader in aspartame and high-potency synthetic sweeteners, with expertise in high-stability compounds for pharmaceuticals, gum, and table top sweeteners.

Other Key Players (Combined Share: 25-30%)

A broad mix of specialty and regional players are advancing rare sugar development, clean-label formulation, and low-GI sweetener innovation, including:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: Western Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Western Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 38: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: Eastern Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 48: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 64: East Asia Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 66: East Asia Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 68: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 11: Global Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 15: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 19: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Source, 2023 to 2033

Figure 27: Global Market Attractiveness by Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 41: North America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Source, 2023 to 2033

Figure 57: North America Market Attractiveness by Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 71: Latin America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 75: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 79: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 101: Western Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 109: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 191: East Asia Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 195: East Asia Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 199: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The overall market size for the sugar substitute market was USD 18,957.8 million in 2025.

The sugar substitute market is expected to reach USD 30,297.1 million in 2035.

The demand for sugar substitutes will be driven by rising health concerns over sugar consumption, increasing prevalence of diabetes and obesity, growing demand for low-calorie and keto-friendly food products, and advancements in plant-based and natural sweetener formulations.

The top 5 countries driving the development of the sugar substitute market are the USA, China, India, Germany, and Japan.

The natural sweeteners (such as stevia and monk fruit) segment is expected to command a significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA