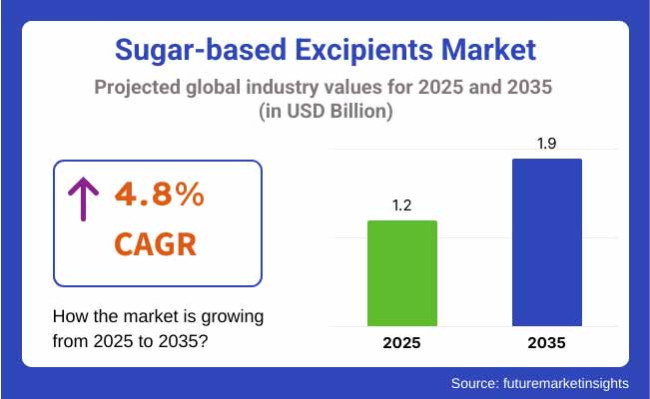

The sugar-based excipients market is estimated to be worth USD 1.2 billion in 2025 and is projected to reach USD 1.9 billion by 2035, expanding at a CAGR of 4.8% over the assessment period.The major factor in the steady pace of growth observed in sugar-based excipients is their extensive utilization in the pharmaceutical sector.

These excipients fortify the drugs, improve the taste, and make the administration of the different dosage forms easier. Thus, they are the main components in oral syrups, chewable tablets, and special needs formulations.

The ever-increasing patient-friendly dosage forms and the rising prevalence of chronic diseases are the propelling factors of the industry development. Nevertheless, the industry faces several challenges that restrain its expansion, such as the negative view on sugar contents in medications, especially the problems of diabetic and calorie-conscious patients that it can cause.

The need to address these challenges by finding alternative excipients, apart from the scrutiny of sugar-based formulations, digital marketing, and growth, among other things, are some of the issues that need to be faced before the breakthrough can be achieved.

One of the major contributing factors in the progress of such technology is the sugar-based excipient innovation, the addition of bioavailability improvement solutions, and the combination of sugar alcohols such as mannitol, sorbitol, and xylitol. The significant industry growth is due to the increasing focus on orally disintegrating tablets (ODTs) and effervescent formulations, which, in turn, drive demand.

New industry paths are found in the increase in developing countries, joint ventures, and the approval of the authorities of novel excipients. They would also contribute to the completion of the project. Sugar trends are the alteration in the population's affiliations towards naturally derived & plant-sourced sugar excipients; in turn, the demand for "clean-label" products is also growing.

Newly developed nanotechnology-based systems for drug delivery are creating a way for innovative excipient formulations. The stress on the sustainable and biodegradable excipient production modes is another factor directing the industry dynamics.

In spite of the fast transformation of the pharmaceutical field, the industry continues to be the basis for drug formulation advances. Manufacturers that will focus on such pathways as research investments, the creation of unique sugar-based products, and the development of patient-friendly formulations will be the ones to profit from this expanding sector.

The industry is regulated by independent needs of the manufacturers, distributors, drug companies, and end-users. Quality of the product, purity, and regulatory approval rank high as manufacturing priorities in order to meet the stringent pharmaceutical industry standards. Maintaining high safety levels during production guarantees the fitness of sugar-based excipients for drug formulation, and this has a direct implication on the use in medicinal applications.

Distributors are concerned with supply reliability and production costs to ensure the excipients reach the pharmaceutical companies effectively at affordable costs. Pharmaceutical organizations, being the main end-users of sugar excipients, place importance on product quality, safety, and compliance. Excipients should have strict formulation requirements to ensure drug efficacy and stability in manufacturing. Due to increasing demand from the pharmaceutical industry, keeping high-quality standards is not an option.

End users, such as healthcare practitioners and consumers, prioritize affordability and availability. Purity and safety are still important but leave those issues to the pharmaceutical corporations and distributors. Increasing demand for sugar-based excipients in pharmaceutical formulations and nutraceuticals continues to drive industry growth, and stakeholders weigh cost, quality, and supply chain efficiency.

The below table gives an overview of the change in CAGR over six months of the base year (2024) and current year (2025) for the industry. This analysis uncovers the critical fluctuations of performance and shows the pattern of revenue realization - giving stakeholders a clearer sight on the annual growth trajectory. H1 is short for the first six months of the year, from January to June. H2, the latter half of the year, the months of July through December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.5% |

| H2 (2024 to 2034) | 4.8% |

| H1 (2025 to 2035) | 4.6% |

| H2 (2025 to 2035) | 4.9% |

In the first half (H1) of the decade from 2025 to 2035, the industry is expected to grow at a CAGR of 4.6%, followed by an increase to 4.9% in H2. The steady shift towards patient-friendly drug formulations and natural excipients will continue to influence industry expansion.

Growing need for pharmaceuticals with improved taste, stability, and bioavailability, increased and steadied the growth of the sugar excipients market for the years 2020 to 2024. Some examples of widely used sugar excipients are sucrose, dextrose, mannitol, and sorbitol; they are frequently utilized in oral pharmaceutical formulations, such as tablets, syrups, and chewable medicines, to enhance palatability and patient acceptability.

This increasing geriatric and pediatric population is the driving-force behind this higher sugar excipients demand due to the fact that this sugar excipients manipulate bitter taste of the drug which makes it palatable when combined and controlled release of the drugs.

Moreover, the emergence of multifunctional excipients via direct compression and co-processing further reduces the total excipient burden, increasing the need for an efficient drug formulation process within the industry for these molecule types.

2025 to 2035, the industry will be growing with the help of developments in drug delivery systems technology and a stronger focus on biologics and personalized medicine.The use of inert, non-toxic, and biodegradable excipients together with an increasing requirement for both will improve the finding of sugar derivatives for specific pharmaceutical functions. In addition, currently growing fields such as 3D-printed medications and expansion of OTC medications will offer new frontiers for growth. Another factor buoying the adoption of the industry is regulatory backing of excipient quality and safety guarantees, especially in emerging markets. Nonetheless, the sugar-related problems in medicines and the trend for sugar-free or low-calorie preparations may prove more difficult for sector participants, possibly leading to inquiries into new sweetening excipients.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 Trends | 2025 to 2035 Projections |

|---|---|

| Growing demand for better drug palatability and stability | Advances in drug delivery systems and biologics |

| Sucrose, dextrose, mannitol, sorbitol | New sugar derivatives formulated specifically for pharmaceutical use |

| Oral dosage forms (tablets, syrups, chewable medications) | Enlargement into biologics, 3D-printed medicines, and personalized medicine |

| Direct compression and co-processing methods | Formulation of multifunctional excipients and biodegradable alternatives |

| Adherence to excipient quality and safety standards | Enhanced regulatory backing for excipient innovation in the emerging markets |

| Growing demand for sugar-free pharmaceutical formulations | Investigation into alternative sweetening excipients for health-focused consumers |

The industry experiences multiple threats, such as regulatory issues, supply chain disruption, price fluctuation, health risks, and technical barriers. Therefore, these can result in limited product, industry, and industry acceptance and the need for the strategy to be implemented for risk mitigation.

The image of sugar as a bad food ingredient is also a reputational risk for the health of the companies. More people now know about diabetes, obesity, and metabolic syndromes, which have made sugar constituents face more examinations.

A negative image, even when excipients are not ingested in significant amounts, can sometimes make people look for alternatives like sugar-free or other types of excipients, thus making the industry grow in the opposite direction. In order to remain competitive, firms are to devote funds to research and development of either low-calorie or non-glycemic alternatives.

Low levels of technology in sugar-based excipients also affect the industry negatively. Even though these excipients can do binding, stability, and taste-masking tasks, there might be some cases when they would not work for certain drug formulas, extended ones, or compounds that are sensitive to moisture. Creativity in the functional excipient design development and co-processing methods will be the way to go in order to increase their usage and broaden the industry.

Sugar-exemption industry does represent some opportunities, yet proactive actions in risk management, e.g., well-planned tackling of the regulatory constraints, supply chain dependencies, price fluctuations, and health issues, as well as addressing technological shortcomings, would be needed. Through a particular focus on compliance, innovation, and diversification, companies will have a better chance of rejecting these predicaments and maintaining growth in this forward-changing industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

| UK | 4.8% |

| France | 4.6% |

| Germany | 4.9% |

| Italy | 4.5% |

| South Korea | 5% |

| Japan | 4.7% |

| China | 5.5% |

| Australia | 4.4% |

| New Zealand | 4.3% |

The United Statesindustryis likely to remain key industry, recording a 5.2% CAGR during the forecast period. Highly advanced pharmaceuticals and high healthcare spending persistently drive industry growth. The growing use of direct compression methods of drug production further boosts the demand for sugar-based excipients.

Additionally, the USA is experiencing a growing geriatric population that is forcing the need for patient-friendly drug presentations, especially those enhancing taste and stability. Research and development activities are also enabling the launch of multifunctional excipients that enhance drug performance and efficiency in production.

The United Kingdom sugar excipients industry is expected to advance at a 4.8% CAGR between 2025 and 2035. The country has well-established pharmaceutical companies with strong regulatory environments that assure drug formulations of the highest quality.

The rising prevalence of lifestyle diseases such as diabetes and cardiovascular disease has created a demand for reformulated drug delivery systems wherein sugar excipients play a vital role. In addition, the UK emphasis on biopharmaceuticals and new oral products propels research into novel excipient combinations that improve drug solubility and bioavailability.

The French sugar excipients industry is anticipated to post a CAGR of 4.6% during the forecast period. France is equipped with a strong pharmaceutical sector through immense investment in formulation research on drugs. The demand for over-the-counter (OTC) drugs and children-friendly forms among the population is driving the growth of sugar excipients. The use of sugar alcohols in controlled-release formulations by French pharmaceutical firms is further diversifying the industry.

Germany will be growing at a CAGR of 4.9% during the period from 2025 to 2035 in the industry. Precision medicine and advanced drug delivery systems in Germany have been fueling the demand for customized excipient formulations.

German companies are reputed to follow EU pharmaceutical regulations to the letter, and this fuels excipient technology development. Besides, the growing burden of chronic illnesses, including neurological diseases and cancer, is driving demand for stable and reproducible oral drugs, which is driving sugar excipients use.

Italy's sugar excipients industry will grow at a CAGR of 4.5% in the forecast period 2025 to 2035. Generics and low-cost production of drugs dominate Italy's pharmaceutical industry. Italian pharmaceutical industries are investing in sugar excipients that improve the bioavailability of sugar drugs without sacrificing their cost-effectiveness.

Furthermore, increased cases of metabolic diseases have fueled the demand for research on developing sugar-free excipients for diabetic-compatible drugs.

South Korea is anticipated to experience a 5.0% CAGR in the industry for sugar-based excipients during the forecast period. Quality excipients fuel the country's speedy expansion of biopharmaceuticals and biosimilar. South Korean companies prefer excipient quality with a focus on co-processed excipients, improving the solubility and disintegration of pharmaceuticals. Incentives for local manufacturing by the government boost innovation in developing excipients so that the industry can remain competitive.

The Japanese industry for sugar excipients will grow at a CAGR of 4.7% during the forecast period from 2025 to 2035. Increasing demand for a highly aged population to develop easily administrable drugs drives the utilization of sugar-based excipients as a stabilizer and for masking the taste.

Quality management and R&D from Japanese drug makers result in manufacturing multifunctional excipients. Moreover, the robust regulatory environment in the country ensures excipient development according to international standards of safety and efficacy.

China is anticipated to grow at a CAGR of 5.5% in the industry. Expansion in the pharmaceutical industry in the country, driven by government incentives and growing domestic demand for drugs, drives industry growth mainly. Chinese companies are investing in new excipients to enhance the compressibility of tablets and bioavailability.

Furthermore, the necessity for independence from raw materials of drugs has resulted in heavy investment in local production of excipients. Therefore, China has been among the highest-increasing markets in the industry.

The Australian industry will register a 4.4% CAGR during the forecast period. A well-regulated pharmaceutical industry, along with growing demand for pediatric and geriatric drugs, propels the industry. Plant-based sugar-based excipient development is the focus of Australian companies as a response to the increasing demand for natural and sustainable ingredients in the pharma industries.

Moreover, research partnerships between the university and pharma industries continue to drive excipient application in specialty drug formulations.

New Zealand's industry is expected to grow at a CAGR of 4.3% during the period 2025 to 2035. The pharmaceutical industry of New Zealand is small but on the rise, with an emphasis on specialty drug products. The demand for dietary supplements and nutraceuticals has also increased the application of sugar-based excipients.

Additionally, New Zealand's standards of quality, combined with an interest in sustainable sourcing, encourage it to adopt sophisticated excipient formulations according to international regulatory norms.

| Segment | Value Share (2025) |

|---|---|

| Sugar Alcohols(By Product) | 42% |

In 2025, sugar alcohols are expected to lead the industry, capturing 42% of the total industry share, followed closely by actual Sugar at 38%.

Such dominance will continue for sugar alcohols since their increased applications in pharmaceuticals and food products endorsement among sugar substitutes. Sugar alcohols include sorbitol, xylitol, and mannitol. These are increasingly considered beneficial due to their hypoglycemic potential, fewer calories, and suitability for sugar-free, low-calorie, or diabetic formulations.

They are often seen as popular excipients for oral care products, chewing gums, and different medication formulations. Sugar alcohol includes lots of famous brands such as Cargill and Roquette that manufacture various sugar alcohols to meet the need for healthier alternatives in both the pharmaceutical and food industries.

Actual Sugar continues to make up 38% of the industry. However, it still plays an essential role in the excipients industry due to the functionality it provides in drug formulations. Sugar is being used as a binder, filler, and flavoring in various pharmaceutical products like syrups, tablets, and lozenges.

Apart from that, sugar-based excipients are used hugely in the food industry for flavor enhancement and texture preservation. Major players like Tate & Lyle, and Ingredion are interested in sugar-based solutions for pharmaceutical and food applications.

Thus, while sugar replacement options like sugar alcohols gain popularity in health benefits, actual Sugar remains an important excipient in the formulations of the past and current times, thus keeping the balance required in the industry between functionality and consumer preferences.

| Segment | Value Share (2025) |

|---|---|

| Direct Compression Sugars(By Type) | 38% |

Sugar-based excipient in 2025 direct compression sugars are going to hold a leading share of the Industry with 38%, followed by powders with 25%.

Direct compression sugars, an important complementary ingredient in the pharmaceutical field, relate to their effectiveness in processing tablet manufacture without any extra processing step. These sugars would be preferred for direct compression due to their excellent flowability, compression characteristics, and stability, which is suitable for solid dosage forms.

Pharmachem Laboratories Roquette, are the suppliers of direct compression sugars for quality and efficient tableting. Cost-effective and efficient manufacturing has led to a demand for direct compression sugars.

Powders represent almost 25% of the industry shares and remain significant in pharmaceutical and food-sourced applications. Sugar-based powdered excipients are utilized as fillers, binders, and stabilizers of tablet formulations, thus giving these powdered products a drug application and enhancing textural enhancement and mouthfeel for food applications.

Some key players in this segment, such as Ingredion and Tate &Lyle, are offering a range of powdered sugar-based excipients to provide tough solutions across industries.

The powders are still of consideration because they provide mechanisms for the direct compression of sugar ingredients, along with the multipurpose and growth parameters that were established in both food and pharmaceutical applications.

The industry is steadily increasing, mainly driven by the growing demand for orally disintegrating tablets (ODTs), pediatric formulations, and taste-masking solutions in the pharmaceutical industry. Key players like the Roquette Group, BASF SE, and Ashland Inc. are strengthening their positions through innovations in product development, acquisition of related firms, and expansion of production capacities.

The Roquette Group, a key industry player, has targeted its efforts on polyols and sugar-based excipients that are tailored for direct compression formulations. Similarly, BASF SE is setting its sights on multifunctional excipients that will advance drug solubility and stability. In pharmaceutical excipients, Ashland Inc. is expanding its portfolio of sugar-based binders and film coatings to improve drug delivery.

Some key trends include the increasing use of co-processed excipients, demand for non-GMO, organic excipients as well as development of technologies for drug formulation. Companies are also investing in R&D to develop high-performance sugar-based excipients that will optimize drug bioavailability and patient compliance.

As the competition keeps on increasing, the major focus of the players will be enhancing supply chain efficiencies, regulatory compliance, and customized excipient solutions addressing new pharmaceutical needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Roquette Group | 18-22% |

| BASF SE | 12-16% |

| Ashland Inc. | 10-14% |

| Colorcon , Inc. | 8-12% |

| Cargill, Inc. | 6-10% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Roquette Group | Leading supplier of sorbitol, mannitol, and maltodextrins for pharmaceutical excipients. |

| BASF SE | Focused on high-functionality sugar-based excipients for bioavailability enhancement. |

| Ashland Inc. | Specializes in sugar-based binders, stabilizers, and film-coating excipients. |

| Colorcon , Inc. | Expanding its direct compression and taste-masking excipient technologies. |

| Cargill, Inc. | Strengthening its pharmaceutical-grade sugar and polyol excipients portfolio. |

Key Company Insights

Roquette Group (18-22%)

A leader in polyol-based excipients, catering to solid oral dosage forms and ODT formulations.

BASF SE (12-16%)

Investing in multifunctional excipients to enhance drug solubility and absorption.

Ashland Inc. (10-14%)

Focused on sugar-based stabilizers and controlled-release excipients for enhanced patient compliance.

Colorcon, Inc. (8-12%)

Specializing in film coatings and taste-masking excipients, particularly for pediatric and geriatric formulations.

Cargill, Inc. (6-10%)

Strengthening pharmaceutical-grade sugar offerings, with a focus on natural and non-GMO excipients.

Other Key Players (30-40% Combined)

By product, the industry is segmented into actual sugar, sugar alcohols, and artificial sweeteners.

By type, the industry is categorized into powders, direct compression sugars, crystals, syrups, and others.

By functionality, the industry is segmented into fillers and diluents, flavoring agents, tonicity agents, and others.

By formulation, the industry is divided into oral, parenteral, topical, and others.

By region, the industry analysis is carried out in North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The industry is expected to reach USD 1.2 billion in 2025.

The industry is projected to grow to USD 1.9 billion by 2035.

China is expected to experience significant growth with a 5.5% CAGR during the forecast period.

The sugar alcohols segment is one of the most popular categories in the industry.

Leading companies include Roquette Group, BASF SE, Ashland Inc., Colorcon, Inc., Cargill, Inc., Associated British Foods Plc, DFE Pharma, FMC Corporation, MEGGLE AG, and The Lubrizol Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Functionality , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Functionality , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Functionality , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Functionality , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Functionality , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Functionality , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Functionality , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Functionality , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Products, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Functionality , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Functionality , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Functionality , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Functionality , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 21: Global Market Attractiveness by Products, 2023 to 2033

Figure 22: Global Market Attractiveness by Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Functionality , 2023 to 2033

Figure 24: Global Market Attractiveness by Formulation, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Products, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Functionality , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Functionality , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Functionality , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Functionality , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 46: North America Market Attractiveness by Products, 2023 to 2033

Figure 47: North America Market Attractiveness by Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Functionality , 2023 to 2033

Figure 49: North America Market Attractiveness by Formulation, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Products, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Functionality , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Functionality , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Functionality , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Functionality , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Products, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Functionality , 2023 to 2033

Figure 74: Latin America Market Attractiveness by Formulation, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Products, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Functionality , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Functionality , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Functionality , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Functionality , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 96: Europe Market Attractiveness by Products, 2023 to 2033

Figure 97: Europe Market Attractiveness by Type, 2023 to 2033

Figure 98: Europe Market Attractiveness by Functionality , 2023 to 2033

Figure 99: Europe Market Attractiveness by Formulation, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Products, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Functionality , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Functionality , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Functionality , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Functionality , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Products, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Functionality , 2023 to 2033

Figure 124: South Asia Market Attractiveness by Formulation, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Products, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Functionality , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Functionality , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Functionality , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Functionality , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Products, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Functionality , 2023 to 2033

Figure 149: East Asia Market Attractiveness by Formulation, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Products, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Functionality , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Functionality , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Functionality , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Functionality , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Products, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Functionality , 2023 to 2033

Figure 174: Oceania Market Attractiveness by Formulation, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Products, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Functionality , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Functionality , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Functionality , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Functionality , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 196: MEA Market Attractiveness by Products, 2023 to 2033

Figure 197: MEA Market Attractiveness by Type, 2023 to 2033

Figure 198: MEA Market Attractiveness by Functionality , 2023 to 2033

Figure 199: MEA Market Attractiveness by Formulation, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nutraceutical Excipients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sustained Release Excipients Market Report – Trends & Industry Forecast 2018-2026

Biopharmaceutical Fermentation Excipients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA