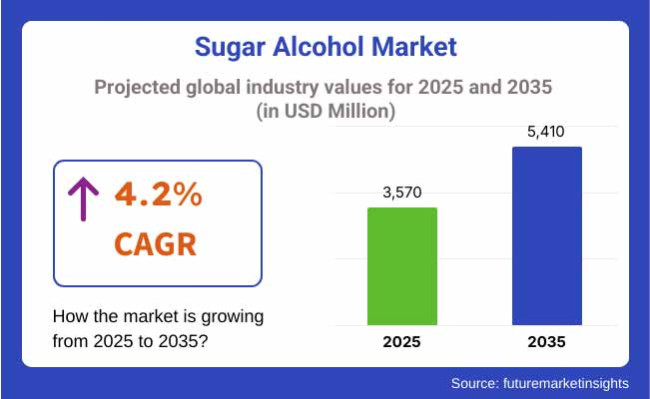

The sugar alcohol market is projected to witness steady growth from 2025 to 2035, driven by increasing consumer preference for low-calorie sweeteners, rising health consciousness, and growing demand for sugar alternatives in food & beverage applications. The market is expected to expand from USD 3,570 million in 2025 to USD 5,410 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.2% over the forecast period.

Sugar alcohols, including sorbitol, xylitol, erythritol, and maltitol, are witnessing rising demand due to the growing number of diabetes, obesity, and metabolic disorders as they provide fewer calories and oral health benefits over conventional sugar. In addition, food producers are adding sugar alcohols to sugar-free candy, bakery goods, dairy products, and drinks for health-conscious consumers.

An increase in the adoption of natural and plant-based sugar alcohols is also propelling the growth of the market. This growth will also be due to the need for low-glycemic index sweeteners in functional foods, pharmaceuticals, and personal care products. Moreover, government initiatives encouraging sugar reduction policies and clean-label products are providing lucrative opportunities for manufacturers.

Strong consumer awareness and strict regulations on sugar content in food products further reinforced this dominance in North America and Europe, leading to extensive use of sugar alternatives in processed foods. On the other hand, the Asia-Pacific region is expected to grow at the highest rate, owing to increasing urbanization, rising disposable income, and demand for sugar-free and functional food products.

The sugar alcohol market is poised for steady growth in the coming decade with the continuous advancements in the production of sugar alcohol (using fermentation) and plant-derived sweeteners alongside innovative formulation strategies that are set to cater to the evolving preference of health-conscious consumers across the globe.

North America highly dominates the sugar alcohol market due to rise in demand for sugar substitutes driven by increasing health awareness and rising diabetes and obesity prevalence. Increasing demand for natural sweeteners: The USA and Canada are prominent players in the market growth, as consumers are looking for natural and low-calorie sweeteners for use in food and beverage products.

The trend of healthier diets and clean-label products has led food and beverage manufacturers to use sugar alcohol, including erythritol, xylitol and sorbitol, in their product formulations.

Moreover, the prosperous functional food and drinks sector, along with the increasing adoption of sugar-free and low-calorie items, has additionally driven the growth of the market. Increased market presence of major industry players and supportive regulations for sugar alternatives have spurred product innovation and availability.

However, factors such as gastrointestinal issues related to sugar alcohol overdose and regulations on product labelling may hinder growth. Although these challenges are significant, the rising acceptance of plant-based sugar alcohols and continuous improvements in formulation techniques are projected to drive market growth in the region.

Due to the shift towards sugar reduction in food and beverages, Europe is a leading market for sugar alcohols, with countries like Germany, the UK, France, and Italy leading the way. Manufacturers view sugar alcohols as promising alternatives in confectionery, bakery and beverage products due to the region's strict regulatory framework on sugar consumption, including sugar taxes and front-of-pack labelling initiatives.

As consumers in Europe become more health-conscious, they are looking for natural and plant-derived sweeteners that do not sacrifice on taste. Another is xylitol, a sweetener found in chewing gums and oral care products that has well-deserved popularity because of its oral health benefits. In a similar way, maltitol and sorbitol are often used in sugar-free chocolates and low-calorie baked goods. The region also features a well-established supply chain and a strong presence of leading sugar alcohol manufacturers.

However, the volatility of the price of cane sugar and consumer scepticism about artificial sweeteners could present challenges for the adoption of the new sugar. However, the rising popularity of functional foods and the increasing popularity of diabetic-friendly products are anticipated to boost the market growth in the upcoming years.

Growth of the sugar alcohol market in Asia-Pacific is rapid, driven by the growing incidence of lifestyle diseases, increasing consumer awareness regarding healthy eating, and growing food processing industries. The continual expansion of the market is being found in countries such as China, Japan, South Korea, and India as consumers strive for natural sugar substitutes for weight control and diabetes management.

As a top producer, China capitalizes on a high industrial base and demand for sugar-free and functional food products. The sugar alcohol market in Japan. However, Japan, being an advanced food innovation landscape, has seen an increase in the demand for sugar alcohols, and it is consumed in low-calorie and functional beverages.

South Korean health-aware consumers also drive increasingly the use of sugar alcohols in formulations for reduced-calories food. Regional preferences for sugar alternatives, particularly in India, where rising disposable incomes and urbanization have increased awareness of sugar alternatives, especially among diabetics and those looking to maintain a healthy lifestyle.

Challenges - Price Volatility and Supply Chain Disruptions

The sugar alcohol market has been facing challenges due to the moderate commodity price range, leading to volatility in raw materials as well as the supply chain due to the pandemic crisis. Selected sugar alcohols (or polyols) like sorbitol, xylitol, and erythritol are based on agricultural commodities, namely corn, wheat, and birch wood.

Availability and cost of these raw materials are influenced by insensible climate conditions, trade restrictions, and geopolitical factors. Moreover, market volatility, exacerbated by supply chain inefficiencies and transportation limitations, complicates manufacturers' ability to sustain competitive pricing and production rates.

Opportunities - Rising Demand for Low-Calorie Sweeteners and Clean Label Products

Due to the rising consumer demand for low-calorie and sugar-free products, there has been a marked increase in the demand for sugar alcohols owing to their use as natural sweeteners. The increasing awareness of health implications due to high sugar intake, including diabetes and obesity, has paved the way for food and beverage manufacturers to use sugar alcohols in their formulations.

Lastly, the clean-label phenomenon promotes the research and development of plant-based and organic sugar alcohols, which are expected to create a whole new landscape of opportunities for industry players.

The sugar alcohol market observed gradual growth from 2020 to 2024, due to an increase in the use of sugar substitutes in the food and beverage industry. Government regulations pushing for lowered sugar consumption and the growing trend of keto diets and diabetic-friendly options also favoured market growth. Nonetheless, hurdles like volatile availability of inputs and elevated manufacturing expenses constrained widespread uptake.

In the future, the years 2025 to 2035 are anticipated to see technological progress in making fermentation-based and bioengineered sugar alcohols more cost-effective and environmentally friendly. The growing availability of plant-based sweetener alternatives, coupled with the platform of investment for research and development, will provide an up thrust to the market growth. Furthermore, increasing regulatory approvals and consumer preference for sugar alcohols derived from the region will propel the need for product innovations in formulations.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Focus on sugar reduction policies and labelling regulations |

| Technological Advancements | Improved extraction and purification processes |

| Industry Adoption | Rising use in food, beverages, and pharmaceuticals |

| Supply Chain and Sourcing | Challenges in raw material availability |

| Market Competition | Presence of established manufacturers |

| Market Growth Drivers | Consumer demand for low-calorie sweeteners |

| Sustainability and Energy Efficiency | Focus on reducing the carbon footprint in production |

| Consumer Preferences | Preference for sugar alternatives in diabetic-friendly products |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on artificial sweeteners, promoting natural sugar alcohols |

| Technological Advancements | Expansion of bioengineered and fermentation-based sugar alcohol production |

| Industry Adoption | Widespread use in functional foods and nutraceuticals |

| Supply Chain and Sourcing | Diversification of raw material sources and localized production |

| Market Competition | Entry of biotech firms and sustainable sweetener start-ups |

| Market Growth Drivers | Growth in plant-based and clean-label food products |

| Sustainability and Energy Efficiency | Increased investment in eco-friendly and energy-efficient manufacturing |

| Consumer Preferences | Higher demand for organic and naturally derived sugar alcohols |

Sugar alcohols are in the United States and are an important factor for comparative production because of the high demand for low-calorie and sugar-free products for food and beverage applications.

The rising health consciousness of consumers is driving the demand for sugar substitutes such as sorbitol, xylitol, and erythritol. And there's been a surge in obesity and diabetes, forcing the paradigm towards sugar alcohols because they don't spike blood sugar. The increasing applications of sugar alcohols in products like chewing gum, candies, baked foods, among others, further fuel the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.6% |

The demand for sugar substitutes is increasing due to rising worries regarding the health impacts of high sugar consumption. The sugar alcohol market in the United Kingdom is projected to enhance owing to growth in the food and beverage industry.

The growing presence of sugar-free and low-calorie food options, such as confectionery, beverages, and dairy products, is driving the demand for sugar alcohols. Moreover, the UK market has benefited from the stringent government regulation towards low sugar diets throughout the country, which is augmenting the adoption of sugar alcohols as a healthy alternative.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.4% |

Driven by consumer awareness regarding the harmful effects of sugar, the sugar alcohol market in the EU is witnessing steady growth. The health and wellness trend continues to thrive across Europe, leading to an increase in demand for food and drink products that are either sugar-free or low in calories.

In addition, the European market is essentially upheld by strong regulatory frameworks that enable the use of sugar alcohols as safe and effective sugar alternatives. Moreover, increasing demand for functional foods and beverages is also augmenting the consumption of sugar alcohols in several product lines.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.8% |

This market is being fuelled by Japan's strong emphasis on health and wellness, and includes sugar alcohols. More Japanese consumers are becoming aware of health potential of low-calorie sweeteners and sugar substitutes such awareness, along with the rising popularity of sugar-free and reduced-calorie foods such as beverages, snacks, and confections, has fuelled the demand for sugar alcohols like erythritol and xylitol. Japan's aging population, ever-increasing diabetes, and obesity concerns continue to drive the market for sugar alcohols.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The demand for low-calorie and low-sugar products is driving the sugar alcohol market in South Korea. Taking the market ahead is the growing shift towards sugar replacements in drinks, confectioneries and baked foods. Korean consumers are also switching to healthier lifestyles and thus, sugar alcohols are preferred to other sweeteners. The country’s strong food and beverage sector and consumer preferences for functional food products are also driving consumption of sugar alcohols.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.7% |

With the increasing need for sugar alternatives, particularly in food-focused sectors like hospitals and hospitality, the sugar alcohol market is witnessing remarkable growth.

Sugar alcohols, like sorbitol, xylitol and erythritol, are commonly employed as sweeteners because they contain fewer calories than sugar, and they are especially favoured in food and drinks, medicine and personal care products. Global sorbitol demand followed by food & beverages industry continued to dominate the global market, as the segment is expected to gain market share over the coming years.

| Product Type | Market Share (2025) |

|---|---|

| Sorbitol | 31.5% |

Sorbitol is leading the market, projected to 31.5% of market share by 2025. A widely employed sugar alcohol, sorbitol can function as a low-calorie sweetener and humectant in several food and beverage applications, including candies, chewing gums, baked goods and beverages.

It provides the sweetness of sugar but is lower in calorie content and does not promote tooth decay and therefore is a common component in sugar-free and diabetic products. Its ability to hold moisture improves shelf life of food items, increasing its demand.

| End-use Industry | Market Share (2025) |

|---|---|

| Food & Beverages | 58.3% |

The food & beverages industry is the largest end-user of sugar alcohols in terms of volume, with a market share of 58.3% (value) in 2025. The rising consumer demand for sugar-free, low-calorie, healthy food products like sugar-free by row, diet sodas, and keto products is fuelling this demand.

With global health-conscious diet trends leading to a growing consideration for sugar content, sugar alcohols are increasingly being viewed as a perfect ingredient to strike the balance between health and taste, perpetuating the upward spiral in the growth of the segment.

The sugar alcohol market is emerging at a stable pace due to the upward need of sugar replacement due in part to the increasing health awareness, growing prevalence of diabetes and transition to the healthy meals. Low-calorie, low-sugar, and sugar-free food products commonly contain sugar alcohols, which are popular as they add sweetness to food without raising blood sugar levels. For example, manufacturers are pursuing novel applications and expanding product offerings in both the food & beverage and pharmaceutical industries.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Cargill, Incorporated | 25-30% |

| Archer Daniels Midland Company (ADM) | 20-25% |

| BASF SE | 15-20% |

| Ingredion Incorporated | 10-15% |

| Other Companies (Combined) | 20-25% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Cargill, Incorporated | Expanded its range of erythritol, sorbitol, and xylitol for use in sugar-free and low-calorie food formulations in 2024. |

| Archer Daniels Midland Company (ADM) | Enhanced sorbitol and xylitol offerings for use in beverages and baked goods, focusing on healthier alternatives in 2024. |

| BASF SE | Introduced new erythritol and xylitol products aimed at the health-conscious food and beverage segment in 2024 . |

| Ingredion Incorporated | Launched non-GMO, plant-based sugar alcohol solutions for low-calorie food products and clean-label applications in 2025. |

Key Market Insights

Cargill, Incorporated (a 25%-30% owner)

Cargill has a large market share with its broad range of sugar alcohol products such as erythritol, sorbitol and xylitol. It is no secret that there is much more emphasis placed on companies that prioritize sustainable and natural sources of food and beverages, and Vomit has a reinvented take on just this.

Archer Daniels Midland Company (ADM) (20-25%)

ADM's mainstay in sugar alcohol is the use of sorbitol and xylitol in sugar-free gums, wholesome mints, and consumables. It also aims to diversify its product portfolio to better cater to shifting consumer trends towards healthier food consumption.

BASF SE (15-20%)

Some of the major companies in the erythritol and xylitol market include BASF SE. They are investing in research and development to develop innovative sugar alcohol solutions to meet the increasing demand for calorie-conscious food and beverages.

Ingredion Incorporated (10-15%)

Ingredion is a leading supplier of low-calorie, sugar-free non digestible sugars and natural, non-GMO sugar alcohol products. The company is riding the wave of plant-based sweetener trend to meet growing demand for clean-label goods.

Other Key Players (Combined 20-25%)

The sugar alcohol market is highly competitive and several players are working on the development of sugar-free and low-calorie food and beverage formulations. Other key players include:

The overall market size for the sugar alcohol market was USD 3,570 million in 2025.

The sugar alcohol market is expected to reach USD 5,410 million in 2035.

The demand for sugar alcohol is expected to rise due to increasing consumer preference for low-calorie sweeteners, rising health consciousness, and growing demand for sugar alternatives in food & beverage applications.

The top five countries driving the development of the sugar alcohol market are the USA, China, Germany, Japan, and the UK.

Sorbitol and food & beverages is expected to dominate the market due to its wide application in food & beverages, pharmaceuticals, and cosmetics as a sugar substitute.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by End User, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by End User, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by End User, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by End User, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by End User, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by Form, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by End User, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End User, 2023 to 2033

Figure 23: Global Market Attractiveness by Form, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by End User, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End User, 2023 to 2033

Figure 47: North America Market Attractiveness by Form, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by End User, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by End User, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by End User, 2023 to 2033

Figure 95: Europe Market Attractiveness by Form, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by End User, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by End User, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by End User, 2023 to 2033

Figure 143: MEA Market Attractiveness by Form, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sugarcane Bottle Market Forecast and Outlook 2025 to 2035

Sugarcane-Derived Squalane Market Size and Share Forecast Outlook 2025 to 2035

Sugared Egg Yolk Market Size and Share Forecast Outlook 2025 to 2035

Sugar Toppings Market Size, Growth, and Forecast for 2025 to 2035

Sugarcane Fiber Bowls Market – Growth & Demand 2025 to 2035

Sugar Beet Pectin Market Growth - Functional Applications & Demand 2025 to 2035

Sugar-Free Cookies Market Insights - Consumer Trends 2025 to 2035

Sugar Substitute Market Trends - Low-Calorie Sweeteners & Demand 2025 to 2035

Sugar-Free White Chocolate Market Trends - Demand & Growth 2025 to 2035

Sugar-Free Syrups Market Insights - Innovations & Consumer Demand 2025 to 2035

Sugar-based Excipients Market Analysis by Product, Type, Functionality, Formulation, and Region Through 2035

Sugar-Free Gummy Market Insights - Consumer Trends & Growth 2025 to 2035

Sugar-Free Sweets Market Growth - Trends & Consumer Preferences 2025 to 2035

Sugar Beet Juice Extract Market Analysis by Confectionery, Cosmetics & Personal care, Dietary supplements, Sports Nutrition, Biofuel Through 2035

Sugar-Free Lollipops Market Growth - Consumer Trends 2025 to 2035

Sugar Free Candy Market Trends - Innovations & Demand 2025 to 2035

Sugar Confectionery Market Analysis by Form, Application, Packaging, Distribution Channel and Region through 2035

Sugarcane Packaging Market Analysis by Material and Application 2025 to 2035

Sugar-Free Gumballs Market

Sugar Free Mints Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA