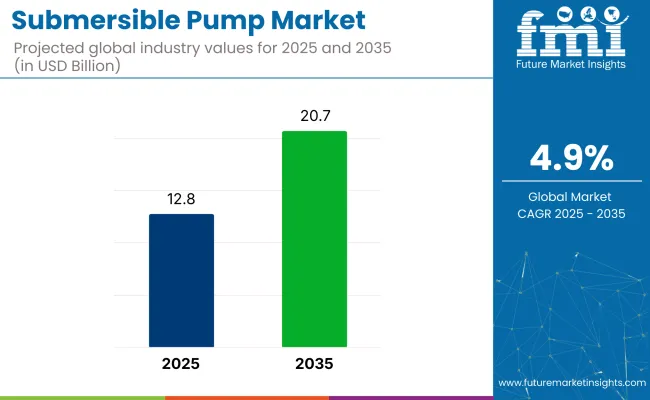

The global submersible pump market is estimated to generate sales of USD 12.8 billion in 2025 and is projected to reach USD 20.7 billion by 2035, reflecting a CAGR of 4.9% over the forecast period. Market expansion is being supported by ongoing upgrades to wastewater infrastructure and increased consolidation across pump manufacturing enterprises.

Notable M&A activity has shaped the competitive landscape in recent quarters. In November 2024, Baker Manufacturing finalized the acquisition of A.Y. McDonald’s pump division to expand its vertical and horizontal pump offerings for municipal and irrigation applications. Operational continuity and technical support for the acquired product lines were retained under the Baker Water Systems division.

In October 2024, Tencarva Machinery completed the acquisition of Detroit Pump & Mfg. Co. to enhance its capabilities in grinder, lift station, and packaged wastewater systems. Both integrations were structured to preserve existing distribution and service networks, ensuring minimal customer disruption.

Product innovation has remained a core focus. In April 2024, Grundfos introduced the SE Range of submersible wastewater pumps, rated from 1.5 to 15 HP. These pumps were designed for municipal and industrial wastewater systems, with a focus on high-efficiency motors, simplified installation, and prolonged service intervals under continuous duty.

To improve reliability and reduce lifecycle costs, advanced materials have been incorporated in impellers and stators to withstand corrosion and abrasion in slurry-laden applications. Across retrofitted utility systems, deployment of submersible pumps with enhanced monitoring and remote diagnostics has gained momentum. IoT-enabled systems have been increasingly used to issue performance alerts and enable condition-based maintenance, especially in energy-sensitive regions where variable frequency drives and permanent magnet motors offer efficiency gains.

OEMs have emphasized modular repair kits, predictive analytics, and lifecycle service contracts to strengthen aftermarket offerings. Mobile servicing units have also been deployed by distributors to reduce equipment downtime and site-level disruptions during maintenance operations.

Overall, growth in the submersible pump market is being driven by sanitation and flood control projects, urban water infrastructure upgrades, and regional regulatory compliance. Continued consolidation and digital integration are expected to redefine supply strategies and operational models through 2035.

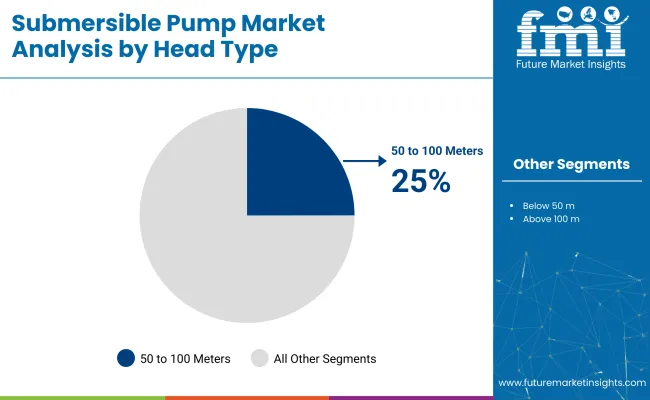

Submersible pumps with a head capacity ranging from 50 to 100 meters accounted for 25% of the global market share in 2025 and are projected to grow at a CAGR of 5.1% through 2035. This head range served a broad spectrum of applications including borewell water extraction, rural water supply schemes, and small-scale irrigation systems.

In 2025, pump selection in this category was driven by compatibility with medium-depth aquifers and optimal energy consumption across 3 to 7.5 HP motor ratings. These units were commonly used in regions with seasonal groundwater reliance, such as India, Brazil, and parts of Southeast Asia.

Manufacturers offered stainless steel and cast-iron variants with enhanced corrosion resistance, motor protection systems, and efficient impeller configurations. Demand was also supported by electrification of rural water access programs and subsidies on pump procurement under government-backed irrigation initiatives.

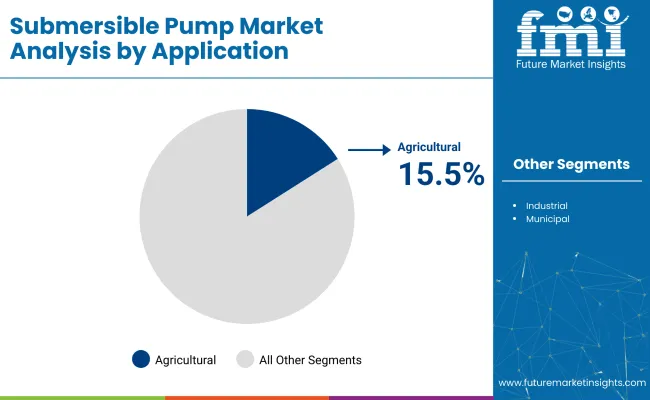

Agricultural usage accounted for 15.5% of the global submersible pump market in 2025 and is forecast to grow at a CAGR of 4.2% through 2035. Farmers adopted submersible pumps for water-lifting needs in both open well and borewell irrigation systems, particularly in areas with depleting surface water sources.

In 2025, usage was concentrated in water-intensive crop regions across India, China, and parts of Africa, where shallow-to-mid-depth installations supported flood, drip, and sprinkler irrigation methods. The segment benefited from financial assistance through agricultural modernization programs and energy-saving pump replacement schemes.

Technological improvements in motor insulation, thrust bearing durability, and overload protection enhanced product longevity in field conditions. As grid-connected and solar-powered pump systems expanded in rural areas, submersible pump adoption remained consistent within medium to small farm holdings seeking dependable irrigation infrastructure.

Employee Spending and Profitability Efficiency

The Submersible Pump Market is facing challenges due to increasing operational costs, maintenance challenges, and efficiency issues. Submersible pumps are found in applications in wastewater treatment, oil & gas, mining and agriculture, and all require the use of materials and engineering able to endure challenging and complex environments. Yet, rising energy pricing and repeated pump breakdowns because of corrosion, clogging and wear have also emerged as challenges for ambitious operators. Maintaining top-notch efficiency while keeping costs minimum is also a daunting task.

Manufacturers are therefore pushed to create such innovative, efficient with costly materials capable of providing reliable services, though they must also implement predictive maintenance methodologies that anticipate and address potential malfunctions before they occur, while also focusing on the integration of environmentally friendly materials with a lower propensity for corrosion to dramatically lower overall operating costs over the life of the device.

Smart Pumping Technologies and Sustainability Initiatives Expansion

Organizations are investing highly in automation and sustainability which provides huge opportunities for Submersible Pump Market. As a result, industries are progressing towards smart pumping systems that come with enhanced and real-time monitoring, automatic pressure adjustments, and remote diagnostics to help reduce downtime and improve efficiency. Moreover, Governments and environmental agencies are advocating sustainable management of water-driven activities which in turn is resulting in higher uptake of energy-efficient and solar-powered submersible pumps.

New developments in AI-based flow optimization and smart control systems are further opening the door to energy savings and greater system reliability. Market dynamics are likely to favour companies that invest in digital transformation, digitisation of pumping solutions, and sustainable practices.

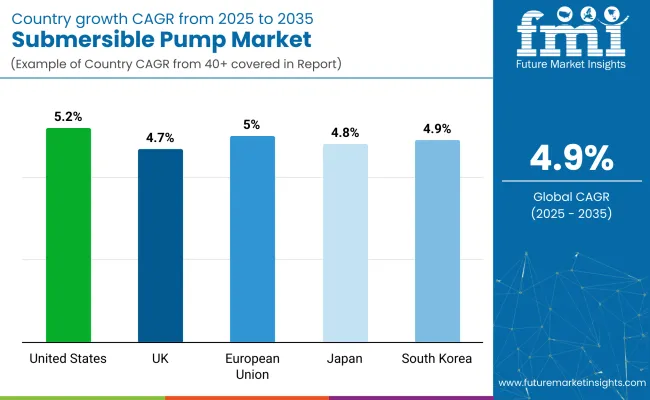

The United States submersible pump market is anticipated to observe lucrative growth over the given timeframe, during which, factors such as escalating demand for municipal water supply installations, increasing investments for wastewater treatment plants and growing oil & gas exploration activities would help drive USA submersible pump industry growth. Increasing adoption of high-efficiency submersible pumps due to industrial water recycling and wastewater management regulation by the Environmental Protection Agency (EPA)

A major consumer of these devices are the agricultural sector (especially in California and several states in the Midwest) that uses submersible pumps for irrigation and water extraction. Moreover, the oil & gas sector is implementing submersible pumps for deep-well and offshore drilling applications.

The USA submersible pump market is anticipated to grow steadily over the coming years, as the technology in variable speed drives (VSD) and smart pump monitoring systems advance.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

The United Kingdom submersible pump market is supported by the surging investments in wastewater treatment, the rising flood control measures and the growing adoption in industrial applications. Rising offerings of US Water Industry Research (UKWIR) programs are driving the upgrade of municipal water infrastructure in turn boosting the demand for the efficient submersible pumps.

Construction and mining sectors are also major consumers and have high-performance dewatering pumps used for underground operations. Hydraulic suits for driving these loads and installation further drive the market for submersible pumps in subsea applications.

With continuous development in energy-efficient and corrosion-resistant pump technologies, the UK submersible pump market is likely to grow at a steady pace in the upcoming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

The European Union submersible pump market is exhibiting a stable growth, attributed to stringent water conservation policies, increase in industrial automation as well as strong demand from agriculture industry. Germany, France, and Italy are major adopters, where Germany overtakes the game in these sustainable solution for wastewater treatment as well as sustainable water management.

The EU is driving manufacturers toward high-efficiency, low-energy submersible pumps as it continues to address carbon footprints across industrial operations. Moreover, growing smart cities along with industrial automation are fuelling the adoption of pumping solutions integrated with IoT and remote monitoring.

As the focus shifts towards water savings and sustainable industrial processes, the EU submersible pump market is set to exhibit a steady growth trajectory.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.0% |

Japanese submersible pump market is quite stable owing to high demand towards flood control systems, increasing industrial applications and expanding focus on energy-efficient water management. Japan’s use of submersible drainage and dewatering pumps for flood prevention and disaster management is also rising as the country experiences frequent typhoons and heavy rainfall events.

Aspects of industrialization, such as semiconductor and electronics manufacturing, demand high-precision submersible pumps for chemical and wastewater treatment procedures. Besides, aquaculture and irrigation sectors which are still unexplored, require high-performance submersible pump for fisheries and agriculture, and that is also a massive opportunity where agriculture and fisheries industry are very close to adopt this submersible pumps.

Manufacturers are heading toward steady growth in the Japanese submersible pump market space due to technological advancements in corrosion-resistant materials and energy-efficient motor designs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

South Korea submersible pump market is projected to grow gradually during the forecast period due to increasing urbanization, growing industrial infrastructure, and surging demand for water recycling technologies. Smart Water Management initiatives of the government are encouraging automation and efficiency enhancement in municipal and industrial water systems.

The construction industry is a key driver, needing dewatering pumps for a range of underground construction and tunnelling projects. Moreover, South Korea's emerging semiconductor and petrochemical industries have been gradually embracing sophisticated submersible pumps for chemical processing and waste water treatment.

Accordingly, the South Korean submersible pump market which invests mostly in the field of smart water infrastructure and industrial automation continues to be invested heavily and is steadily growing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The global submersible pump market is expanding on account of increasing demand for efficient water management solutions for a range of end use industries such as agriculture, wastewater treatment, oil & gas, mining, and construction end use industries.

For additional durability, performance, and cost-effectiveness, companies are also emphasizing AI-based pump monitoring, energy-saving motor technology, and corrosion-resistant materials. The submersible pumps market is made up of international pump manufacturers and equipment suppliers focused on a niche of industrial technologies in multi-stage, borewell, sewage, and slurry submersible pumps.

Grundfos Holding A/S (15-20%)

They are leaders in the submersible pump business providing AI-based smart pump solutions, efficient motor, toughest borewell submersible systems.

Xylem Inc. (12-16%)

Specializes in sewage, dewatering, and wastewater submersible pumps with low energy consumption and long service life.

Flowserve Corporation (10-14%)

Flowserve makes industrial-grade pumps for submersible applications, using advanced materials and high-pressure capabilities to withstand tough environments.

KSB SE & Co. KGaA (8-12%)

KSB builds dependable submersible pumps for flood control, municipal water systems and industrial drainage applications.

Sulzer Ltd. (5-9%)

Sulzer builds high-quality submersible pumps that maximize efficiency and performance for use in mining, oil & gas, and power plant applications

Other Key Players (40-50% Combined)

Several industrial pump manufacturers contribute to next-generation submersible pump innovations, AI-powered predictive maintenance, and energy-efficient motor solutions. These include:

The overall market size for Submersible Pump Market was USD 12.8 Billion in 2025.

The Submersible Pump Market expected to reach USD 20.7 Billion in 2035.

The demand for the Submersible Pump Market will be driven by the increasing need for efficient water management systems in residential, commercial, and industrial sectors. Growing demand for wastewater treatment, agriculture irrigation, and dewatering applications, along with advancements in pump technology, will further boost market growth.

The top 5 countries which drives the development of Submersible Pump Market are USA, UK, Europe Union, Japan and South Korea.

Below 50m and 50m-100m Head Submersible Pumps Drive Market Growth to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Submersible Pump Motor Market

Submersible dredge pumps market Size and Share Forecast Outlook 2025 to 2035

Electric Submersible Pumps Market Size, Growth, and Forecast 2025 to 2035

Southeast Asia Submersible Pumps Market Growth – Trends & Forecast 2025 to 2035

Multistage Electric Submersible Pump Market Size and Share Forecast Outlook 2025 to 2035

Oil And Gas Electric Submersible Pump Market Size and Share Forecast Outlook 2025 to 2035

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Pump Condiment Dispensers Market - Effortless Portion Control 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA