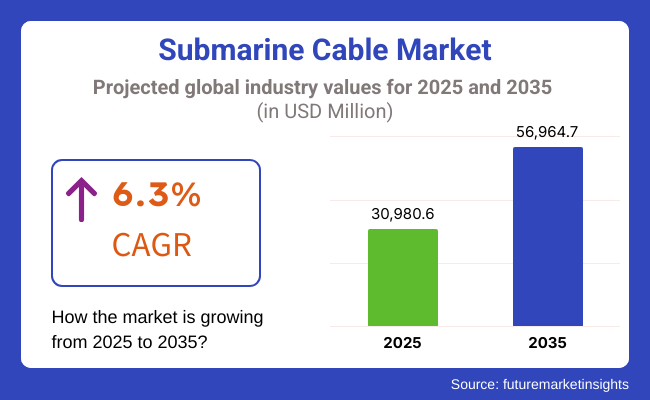

The global sales of submarine cables are estimated to be worth USD 30,980.6 million in 2025 and are anticipated to reach a value of USD 56,964.7 million by 2035. Sales are projected to rise at a CAGR of 6.3% over the forecast period between 2025 and 2035. The revenue generated by Submarine Cable in 2024 was USD 29,150.0 million. The industry is anticipated to exhibit a Year-on-year growth of 6.3% in 2025.

The submarine cable global market is expanding with a high growth rate owing to key drivers such as rising requirements for high-speed internet, cloud enterprise, and offshore energy programs. Submarine fiber-optic cables form the backbone of data communication across the globe, connecting global telecommunication networks, hyperscale data centers, and also 5G deployment.

At the same time, submarine power cables enable offshore wind power transmission and cross-border electricity trade. Growing investments from telecommunication operators, hyperscales (Google, Microsoft, Amazon), and governments are driving growth.

There are also technological developments in fiber capacity, strength, and installation technology to improve efficiency and reliability. Also, there are challenges of high installation expenses, maintenance complexity, and geopolitical tensions on cable routes.

The submarine cable business entails the manufacture, design, deployment, and maintenance of subsea power and fiber-optic cables that enable worldwide telecommunications and power transmission. Such cables are the backbone infrastructure for power transmission offshore, data exchange, and high-speed internet, connecting continents and remote locations.

It is driven by demand for increasing need for high-bandwidth communication, cloud computing, and data center growth. The most important equipment are fiber-optic cables, repeaters, branching units, and cable landing stations.

Submarine power cables also facilitate intercontinental electricity transfer and offshore wind farms. Key players are telecom operators, cloud service providers, energy majors, and governments. Cable technological advancements, enhanced longevity, and increasing investments in submarine infrastructure are driving expansion, rendering the cables critical to international digital and energy connectivity.

Explore FMI!

Book a free demo

Driving by growing internet bandwidth requirements, the global market is experiencing notable growth, the addition of cloud services, and the new offshore communications. Receiving high-capacity, low-latency cables to meet climbing data needs is a priority for telecom operators.

The gas & oil sector is closely tied with reliable and long-lasting cables for floating facilities, allowing them to stand after a round of cuts under subpar conditions to their connectivity. Security, durability, and risk mitigation are highlights of the government and defense sectors for communication and intelligence through secure channels.

Cloud service providers are after high-performance and low-latency cables that would allow for the proper working of data centers as well as the global networking infrastructure. At the same time, academic research institutions are very interested in technical progression and the long life span of equipment during sea research and oceanographic studies. The industry is changing due to the use of fiber optics, the application of AI-driven monitoring systems, and the implementation of sustainable deep-sea installation techniques.

| Company/Entity | Contract Value (USD Million) |

|---|---|

| Meta (formerly Facebook) | Approximately USD 10,000 |

| European Commission & Various Partners | Approximately USD 150 |

| Balfour Beatty & Prysmian | Approximately USD 2,000 |

| Unitirreno Submarine Network S.p.A. | Not specified |

Between 2020 and 2024, the market experienced strong growth, driven by the rising demand for high-speed internet, cloud services, and intercontinental data transmission. Tech giants like Google, Facebook, and Amazon invested heavily in private cable networks to improve data capacity and reduce latency.

The expansion of 5G networks and increasing global internet penetration further spurred demand for new cable paths. Advances in fiber optic technology enhanced cable efficiency and transmission capacity, enabling faster data speeds over longer distances.

Key players were not deterred by issues like geopolitical tensions, high installation expenses, and environmental concerns; instead, they focused on increasing cable lifespan and installing real-time monitoring systems. During the period from 2025 to 2035, market expansion will be powered by AI-facilitated network optimization, quantum communications, and environmentally friendly cable production.

AI systems will continuously track and optimize network performance in real-time, reducing downtime and enhancing data transmission. Quantum encryption will advance data security by ensuring secure delivery over global networks. Eco-friendly materials and methods of installation will minimize environmental effects, and cable designs based on modules will streamline maintenance and upgrading. High-capacity, low-latency

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Escalating geopolitical tensions and national security issues prompted tighter controls on cable deployments. Governments tightened the scrutiny of foreign investment in undersea infrastructure. | Enhanced global alliances and regional partnerships promote more diversified investments. Cybersecurity requirements demand stricter data sovereignty regulations, and these affect cable routing possibilities. |

| Space-division multiplexing (SDM) technology, integrated into networks, maximized data capacity while minimizing power consumption. Optical amplification technologies boosted the transmission range. | Artificial intelligence-based network optimization and quantum encryption improve performance and security. Next-generation fiber optics and hollow core fibers become a reality, minimizing latency and maximizing bandwidth. |

| Spurt in internet traffic and cloud service worldwide resulted in new deployments of trans-oceanic cables, fueled mainly by technology giants. | Artificial intelligence-controlled network slicing allows dynamic real-time bandwidth allocation, accommodating changing enterprise requirements. Multi-core fiber cables extend data capacity to new levels. |

| Technology companies such as Google, Facebook, and Amazon invested in proprietary cables to minimize reliance on legacy telecom operators. | Automated, self-healing cable networks become the norm, minimizing downtime and maintenance expenses. Public-private partnerships are expanding further for regional connectivity initiatives. |

| Geopolitical incidents, anchor drags, and natural calamities highlighted the need for route diversification and improved cable protection mechanisms. | Artificial intelligence-powered predictive maintenance and self-repair drones minimize outages. Cables are tougher and less environmentally disruptive with new material. |

| These are the first steps towards reducing undersea cable energy consumption, but sustainable infrastructure is still in early development. | The combination of renewable-powered landing stations and AI-optimized power distribution reduces carbon footprint. Deep-sea environmentally friendly cable coatings reduce environmental disruption. |

| Increasing demand for low-latency connectivity in cloud computing, financial trading, and gaming propelled high-speed cable initiatives. | Metaverse and international AI applications are enabled by improvements in submarine infrastructure. Ultra-low-latency cables are employed by high-frequency trading exchanges. |

| International digitization, expansion in data center connectivity, and more intercontinental connectivity needs called for immediate deployment needs. | International connectivity is enabled by satellite- and submarine-cable-based hybrid networks. AI-driven autonomous network management reduces costs and improves performance. |

The global sales of submarine cables face risks such as geopolitical tensions, natural calamities, cybersecurity instances, and regulatory concerns. They are specifically vulnerable to the acts of infiltration, destruction, and political confrontation that take place between two countries, as submarine cables are the lifeline of the transnational phone and data transmission of the world.

Natural disasters, such as underwater earthquakes or tropical storms, are the main and direct threat to cable systems. The impact of fishing, damaged anchor lines, and other marine traffic may also break the services down and lead to expensive reparatory costs and losses for businesses that depend upon the global networks' connectivity.

The issue of cybersecurity risks has now turned important as submarine cables are responsible for carrying over 95% of the internet traffic globally. The eventual outcomes may affect security, such as hacking, the interception of signals, or cyber warfare. On the contrary, the best option is to secure every data with ultra-modern encryption and effective monitoring systems.

Overcoming regulatory issues is not always easy, with countries having very tough rules on the issue of data sovereignty and foreign investments. These companies have to deal with issues such as the need for compliance, getting permits, and air and water regulatory assessment, which all may end up affecting the time frame and also adding costs to the operational levels.

Tier 1 Companies like Prysmian Group, Nexans, and NKT Group are recognized as Tier 1 players in the industry. These firms have established a comprehensive global presence, offering a wide range of solutions for both power transmission and telecommunications.

Their extensive experience, robust financial performance, and continuous investment in research and development enable them to lead large-scale projects worldwide. For instance, Prysmian Group and Nexans have been involved in significant offshore wind farm connections and intercontinental data transmission projects, underscoring their leadership in the industry.

Tier 2 Companies such as Sumitomo Electric Industries, ZTT International Limited, and Hengtong Optoelectronics fall into Tier 2. These firms have a strong regional influence and are expanding their international footprint. They offer competitive products and services in the sector, often focusing on specific industries or regions.

For example, ZTT and Hengtong Optoelectronics have secured substantial shares in Asia-Pacific, contributing to regional infrastructure development. Their growing technical capabilities and strategic partnerships are enabling them to compete more effectively on a global scale.

Tier 3 SubCom, Alcatel Submarine Networks (ASN), LS Cable & System, and Furukawa Electric Co., Ltd. are categorized as Tier 3 players. These companies specialize in specific niches, or are emerging competitors aiming to increase their share. For instance, ASN, recently nationalized by France, focuses on strategic manufacturing of submarine telecom cables, highlighting its importance in national infrastructure.

SubCom is known for its expertise in undersea communications technology, while LS Cable & System and Furukawa Electric have been expanding their capabilities in both power and telecommunications cables. These companies are poised for growth as they leverage their specialized expertise to capture new opportunities in the evolving landscape.

The section below covers the industry analysis for different countries. The market demand analysis on key countries in several countries of the globe, including the USA, France, the UK, China, and India, is provided.

The United States is expected to remain at the forefront in North America, with a value share of 65.8% in 2025. In South Asia & Pacific, India is projected to witness a CAGR of 6.3% during the forecasted period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

| France | 5.4% |

| UK | 5.6% |

| China | 6.8% |

| India | 7.2% |

The USA plays an outsized role in the production of submarine cables, driven primarily by heavy investments from tech giants like Google, Microsoft, Meta, and Amazon. These are companies building private and consortium subsea cable networks to bolster cloud services and provide ultra-low-latency data transmission across continents.

Rising demand for high-speed internet owing to the extensive implementation of 5G and increasing digital transformation initiatives is also acting as a catalyst for growth. Moreover, the USA government is focused on providing vital national security and economic interests through secure and resilient infrastructure.

The United States remains one of the world's top technology and innovation-led economies, with the deployment of advanced fiber-optic cable systems and high-capacity subsea networks to satisfy soaring data connectivity demand. The USA industry is expected to expand at a 5.2% CAGR during the forecast period, according to FMI.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Tech Giants' Investments | Private projects are now part of the existing landscape to expand the global cloud infrastructure of companies such as Google, Microsoft, and Amazon. |

| 5G and Data Demand Growth | Mitigating these challenges through high-capacity subsea routes will be paramount in ensuring these unbroken connections are enabled by the rising adoption of 5G and growing internet traffic. |

France is a major hub for submarine cable, accounting for a significant portion of data traffic across the Atlantic, Mediterranean, and around Europe. Owing to the country's strategic geography, it can connect Europe to Africa, the Middle East, and the Americas, allowing it to be a nexus for the transmission of global data.

The cable announcement comes at a time when global tech giants and telecom companies like Orange and Alcatel Submarine Networks are also pouring funds into next-generation fiber-optic cable projects to satisfy the growing need for cloud computing, AI, and 5G services.

Concerns over security and sovereignty have also spurred additional regulation, as well as domestic investments in infrastructure. The France industry will expand at a 5.4% CAGR during the study period, according to FMI.

Growth Factors in France

| Key Drivers | Details |

|---|---|

| Strategic Position in Europe | France provides connective data transit across transatlantic, Mediterranean, and intra-European networks, enabling data connectivity worldwide. |

| Investment from the government on digital infrastructure | National strategies support increased high-speed access and submarine cable capabilities. |

The UK is a key producer of submarine cables. It is a leading financial center and a transatlantic data traffic gateway. The country is a major landing point for many high-capacity cables between Europe, North America, and other regions of the world.

As a global financial and business capital, London requires ultra-reliable, low-latency connectivity, which has led to investments in subsea cable projects. It also places a high priority on digital infrastructure investments to support the rollout of 5G, cloud computing, and artificial intelligence, among others.

Security concerns about foreign-owned subsea networks have culminated in regulatory actions designed to protect national cybersecurity. Consequently, the UK has become a critical point of transit for global data and, importantly, a leader in cable expansion. The UK industry will grow at a 5.6% CAGR during the forecast period, according to FMI.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Strategic geopolitical position | The UK is a critical transatlantic data node connecting Europe to North America. |

| Financial Sector Demand | The role must be ultra-low-latency, high-capacity connectivity, and London as a global financial hub. |

As a news-driven capital and state-funded economy, China is rapidly building submarines under its own name. Looking to work with companies such as China Mobile, Huawei Marine Networks (HMN Tech), and Hengtong Optoelectronics, the Chinese government is working to develop the large-scale subsea cable systems necessary to enhance global data connectivity.

Multiple submarine fiber optic projects under the Belt and Road Initiative (BRI) have also been introduced, serving to connect Asia, Africa, and Europe while cementing China's geopolitical foothold. China is in the process of building its own cable manufacturing and deployment capabilities to develop less dependency on Western infrastructure providers.

Neither is the speedy growth of China's digital economy, the 5G rollout, and the need for improved global trade connectivity that are driving the demand for new subsea cable routes. But the expanded stocktaking of submarine cables is coming alongside mounting geopolitical scrutiny of China by Western states, which poses challenges for its global expansion in the submarine cable industry. FMI anticipates China industry to grow at a 6.8% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| State-Backed Infrastructure | Projects sponsored by governments are the reason behind many of these submarine cable deployments for international links. |

| Digital Economy Growth | The growth of China's digital economy and cloud services demand speed and low latency in subsea data transmission. |

India emerges as a major player when it comes to submarine cable production, presenting key benefits such as rapid digital expansion, high data consumption, and investments made by global tech companies. The government's Digital India drive, coupled with rising dependence on cloud computing, is generating an immense need for improved connectivity.

India's positioning between the Middle East, Southeast Asia, and Europe allows it to be a major hub for new cable builds. Reliance Jio, Bharti Airtel, Google, and Amazon, build higher-capacity subsea pipes to enhance connectivity between international markets. A huge, fast-growing internet user base, expanding 5G networks, and stringent data localization policies are also fueling investments in cable systems.

With the demand for seamless, high-speed data transmission increasing continuously, India is set to strengthen its place in the world of subsea cables. The Indian industry is expected to expand at 7.2% CAGR during the forecast period, according to FMI.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| The strategic geographical placement | Due to its location, India has long been a popular hub for cable routes connecting to major global markets. |

| Growing Internet Penetration | Growing demand for broadband access and digital services fuel investments in subsea infrastructure. |

| Filling Type | Share (2025) |

|---|---|

| Oil/Fluid Filled Cables | 62.4% |

In 2025, submarine cables filled with an oil/fluid will have a 62.4% share, being the only one to have superior performance in UHV and long-distance power transfer. Due to their high insulation properties and minimal transmission losses, these cables are widely used in deep-sea power grids, offshore wind farms, and intercontinental electricity trading.

Comparative examples such as the North Sea Link (UK-Norway) and EuroAsia Interconnector indicate that oil/fluid-filled cables are the solution chosen for stable and high-capable energy transmission. Some concerns are raised about the environmental impact of cooling fluid leakage, prompting the development of oil-free, eco-friendly insulation material that balances performance and environmental friendliness.

Solid-filled underwater cables will capture 37.6% share in 2025 owing to low maintenance requirements, simple installation, and environmental friendly operation. The flexibility, reduced cost and strong demand for nearshore and shallow-water projects make these cables more and more popular among medium-key, low-voltage applications.

Advancements in this segment comprise cross-linked polyethylene (XLPE) insulation, which replaces the liquid insulation and delivers improved thermal resistance. As an example, the Celtic Interconnector (France-Ireland) is using solid-filled cables for HVDC system. However, their narrow capacity for voltage limits their use on long-distance, high-power transmission, where lead is still held by oil/fluid-filled cables.

| End Use | Share (2025) |

|---|---|

| Telecommunications | 54.3% |

The deployment of 5G, the growth of cloud infrastructure, and the explosion of global data consumption are propelling the industry's telecommunications segment, which is expected to hold the greatest share of 54.3% in 2025.

Hyperscale data centers have driven tech giants such as Google, Microsoft and Amazon to build their own cables to cut out latency and improve data security. The increasing demand for high-bandwidth, low-latency connectivity is evident in high-profile projects like Google’s Equiano cable (joining Africa and Europe) and Meta’s 2Africa cable (linking 46 locations).

One of the key segments within the growing industry is renewable energy, which is expected to hold 31.8% of the share in 2025 due to investments worldwide in offshore wind farms and transnational electricity grids.

Wind farms such as the Dogger Bank Wind Farm (UK), Hornsea Project (Denmark), and Vineyard Wind (USA) require high-voltage cables to transport the electricity they create to land, and governments in Europe, China, and the USA have prioritized such offshore wind projects. These projects complement net-zero goals and will boost demand for HVDC cables, which deliver higher efficiency over greater distances.

In the submarine cable market, key players include Prysmian Group, Nexans and NKT Group in the power transmission cables space, as well as a telecom infrastructure focus represented by SubCom and Alcatel Submarine Networks (ASN).

Also, aggressive expansion by Chinese manufacturers such as Hengtong Optoelectronics and ZTT International is intensifying the competition. While geopolitical factors are affecting global fuel pricing, technological adjustments such as fiber optics deployment and HVDC invention will continue to transform the market condition.

As the demand for fast internet, cloud computing, and intercontinental data transmission worldwide increases, the submarine cable market is on the course of rapid growth. The interconnectivity of data centers is following suit due to hyperscale cloud deployments and 5G backhaul system investments in new transoceanic and regional cable networks.

The industry is primarily driven by companies such as SubCom, NEC Corporation, Alcatel Submarine Networks, Prysmian Group, and Nexans S.A., which have extensive knowledge of cable manufacturing, network deployment, and undersea infrastructure management.

The increasing interest of technology giants like Google, Meta, Microsoft, and Amazon in funding private projects is aimed at serving their growing cloud and digital services. Fiber optics technology, including space division multiplexing (SDM), repeaterless cable systems, and ultra-low-loss fibers, provides higher bandwidth and lower latency, thus driving evolution.

Besides, increasing geopolitical concerns along with regulatory restrictions are affecting the ownership, security, and routing of submarine cables. Of strategic interest are also rising investments in new cable routes, especially in Asia-Pacific, Africa, and Latin America, to improve global connectivity.

Companies are prioritizing several areas, including AI-driven network monitoring, automated cable maintenance, and robust multi-route architecture for increased reliability. The market is quite competitive as organizations use strategic partnerships, Government-assisted initiatives, and modern technology to retain their leadership in the ever-evolving global submarine cable ecosystem.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| SubCom LLC | 20-25% |

| NEC Corporation | 15-20% |

| Alcatel Submarine Networks (ASN) | 15-20% |

| Prysmian Group | 10-15% |

| Nexans S.A. | 8-12% |

| Other Companies (Combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| SubCom LLC | Premier supplier of subsea fiber-optic cable systems, network management systems, and transoceanic infrastructure. |

| NEC Corporation | Provides advanced cable systems, high-speed optical transmission technology, and deep-sea deployment expertise. |

| Alcatel Submarine Networks (ASN) | Has expertise in high-capacity undersea cables, repeaters, and network installation for global connectivity. |

| Prysmian Group | Provides power and telecom submarine cables for data transmission and offshore energy uses. |

| Nexans S.A. | Focused on subsea power cables and fiber-optic solutions for telecommunications and renewable energy projects. |

Key Company Insights

SubCom LLC (20-25%)

SubCom is a leader in deploying global undersea fiber-optic networks, specializing in high-speed and low-latency trans-Atlantic as well as transpacific cable systems.

NEC Corporation (15-20%)

NEC was among the first in high-bandwidth submarine cable systems that rely on breakthroughs in optical transmission and deep-sea engineering.

Alcatel Submarine Networks (ASN) (15-20%)

ASN is a key player in next-generation submarine networks, providing high-capacity, AI-driven undersea communication solutions.

Prysmian Group (10-15%)

The company Prysmian emphasizes development mainly in subsea power and telecom cable infrastructure that supports data centers, offshore wind farms, and global broadband networks.

Nexans S.A. (8-12%)

Nexans is a leader in the fiber-optic submarine cabling of telecom and energy markets, helping drive offshore growth in renewable energies.

Other Key Players (20-30% Combined)

February 2025: Meta Plans Launch of World's Biggest Ever Subsea Cable 'Waterworth Project,' which basically covers over 50,000 km in longitude and makes it the longest subsea cable ever. This cable contains 24 fiber pairs, which will connect the USA to Brazil, South Africa, India, and other areas, thus making global digital infrastructure more complete.

November 2024: Ofgem, United Kingdom's energy regulator, was announced to have approved a funding package amounting to USD 2.58 billion for the Eastern Green Link 1 project. The project covers the construction of nearly 200km of subsea and underground cables from Scotland to northeast England, tapping into wind power from the North Sea and meeting the broader objectives for a cleaner, greener Britain in 2030.

April 2024: Google plans to invest USD 1 billion in developing a new subsea cable, enabling further global connectivity and future expansion of its cloud services.

The industry is slated to reach USD 30,980.6 million in 2025.

The industry is predicted to reach a size of USD 56,964.7 million by 2035.

Key companies include Prysmian Group, Nexans, NKT Group, Sumitomo Electric Industries, ZTT International Limited, Hengtong Optoelectronics, Sub Com, Alcatel Submarine Networks (ASN), LS Cable & System, and Furukawa Electric Co., Ltd.

India, slated to grow at 7.2% CAGR during the forecast period, is poised for the fastest growth.

Telecommunications is among the most widely used submarine cable segments.

The market is segmented by solution into product (MVAC electrical cables, HVAC electrical cables, HVDC electrical cables, loose tube type fiber optic cables, tight buffered type fiber optic cables, metal tube type fiber optic cables, hybrid/composite cables, umbilical cables) and service (consultation and advisory services, commissioning and deployment services, maintenance and testing services, upgrade services).

By filling type, the market includes oil/fluid-filled cables and solid-filled cables.

By end use, the market includes oil and gas, renewable energy, telecommunications, and defense.

In terms of region, the market spans North America, Latin America, Western Europe, Eastern Europe, South Asia, the Pacific, East Asia, and the Middle East and Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.