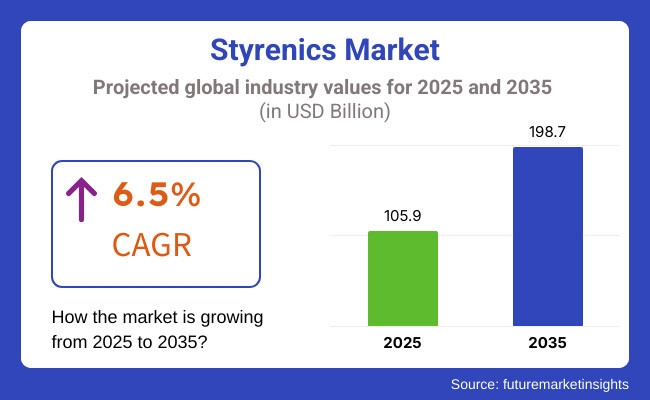

The global styrenics market is projected to reach USD 105.9 billion by 2025 and is expected to expand at a CAGR of 6.5%, reaching approximately USD 198.7 billion by 2035. This growth is driven by rising demand across key industries such as automotive, construction, packaging, and electronics, where styrenics are widely used for their lightweight and durable properties.

Advancements in technology, increased investment in research and development (R&D), and the shift toward sustainable alternatives are further propelling market expansion. However, the consumption of styrenic polymers is expected to decline due to the growing preference for eco-friendly and recyclable materials, particularly in Asia-Pacific, North America, and Europe.

Key products in the styrenics industry include polystyrene (PS), acrylonitrile butadiene styrene (ABS), styrene acrylonitrile (SAN), and expanded polystyrene (EPS), valued for their versatile properties, such as exceptional molding capabilities, thermal stability, and impact resistance.

To meet stringent environmental regulations and reduce carbon footprints, companies are increasingly adopting bio-based styrenics materials. With expanding industrial applications and continuous technological advancements, the industry is well-positioned for sustained and rapid growth in the coming years.

Explore FMI!

Book a free demo

The global styrenics market has experienced steady growth in the past few years (2020 to 2024), primarily owing to increasing demand from the automotive and construction sectors. Polystyrene (PS) and acrylonitrile butadiene styrene (ABS) were widely used in the production of lightweight automotive parts and sturdy construction materials.

Styrenics were also one of the key drivers of the packaging industry, which offers features like versatility, cost-effectiveness, and protective characteristics. Throughout this time, technological improvements allowed for greater production efficiencies along with new specialized styrenics polymers designed to meet a wide range of industrial needs.

Still, environmental consequences and plastic waste management started to direct the sector towards greener solutions, thereby paving the basis for the next developments.

Between 2025 and 2035, the styrenics sector is seeing near-exponential changes mostly related to environmental concerns and sustainability, which will define its future. As companies endeavor to follow tight environmental regulations and lower their carbon footprints, bio-based and recyclable solutions have clearly overtaken traditional styrenics.

New recycling technologies will help the circular economy of styrenics by allowing materials to be utilized again and reducing waste output. Additionally, new technologies for using styrenics polymers in areas of renewable energy, such as wind turbine parts and electric vehicle infrastructure, are expected to open up new business opportunities.

The growing need for extra regulatory help forces companies to concentrate on providing more sustainable, efficient substitutes for conventional styrenics, which increases the need for research.

Volatile crude oil prices have always been a challenge for the styrenics industry, as fluctuations directly impact production costs and profit margins. In addition, increasing awareness and pressure initiated by respective governments around increasingly stricter policies has made the global styrenics market face another issue or challenge: rising surplus overcapacity, which made manufacturers increasingly fight below cost by even forcing others into costly price wars.

Further, alternative materials and the trend of increased bio-based products continue to threaten traditional styrenics, hence calling for innovation and adaptation by the industry at large.

The styrenics sector presents considerable opportunities, particularly in the development of recyclable and bio-based materials, aligning with global sustainability trends. New recycling technologies can promote a more circular economy by enabling the reuse of styrenic products, thereby reducing environmental impact.

Emerging applications for the new renewable energy and electric vehicle industries can provide avenues for further growth because lightweight and durable materials are required by these industries. Finally, increasing urbanization and industrialization will add high demand in these developing regions.

| Key Drivers | Key Restraints |

|---|---|

| Rising demand in packaging, construction, and automotive industries | Environmental Concerns Over Styrene Emissions |

| Growth in disposable consumer products and electronics | Volatility in raw material prices |

| Advancements in sustainable and bio-based styrenics | Regulatory restrictions on styrene use |

| Increasing infrastructure development in emerging economies | Competition from alternative polymers |

| Expanding applications in medical and healthcare sectors | Recycling and waste management challenges |

| Key Drivers | Impact Level |

|---|---|

| High Demand in the Packaging Industry | High |

| Growth in Automotive Sector | High |

| Advancements in Recycling Technologies | Medium |

| Expansion in Construction & Infrastructure | High |

| Rising Adoption in Consumer Electronics | Medium |

| Key Restraints | Impact Level |

|---|---|

| Environmental and Health Concerns | High |

| Fluctuating Raw Material Prices | High |

| Competition from Alternative Materials | Medium |

| Stringent Government Regulations | High |

| Supply Chain Disruptions | Medium |

Due to its lightweight, cost-effective character, polystyrene (PS), which constitutes a significant portion of overall consumption for uses in packaging and consumer goods, will remain leading this industry.

Styrene Butadiene Rubber (SBR) is expected to experience higher demand as it is being increasingly directed toward the manufacturing of tires in the automotive industry, owing to its durability and abrasion resistance.

Acrylonitrile Butadiene Styrene (ABS) appears to be more promising in terms of growth because of the increasing applications of this material in automotive parts and electronic devices since it possesses a high impact resistance and is easy to process.

Unsaturated Polyester Resin (UPR) might grow, especially in the construction and marine sectors, because of its excellent mechanical properties and corrosion resistance. Styrene Acrylonitrile (SAN) and Styrene-Butadiene Block Copolymers (SBC) are two other Styrenic polymers that will help the styrenics market. These polymers & plastics are useful in many different industries.

From 2025 to 2035, the applications for styrenics polymers are expected to expand tremendously. The automotive sector is anticipated to increase the use of styrenics materials for interior and exterior components due to a growing need for lightweight and fuel-efficient vehicles. The electrical and electronics industry is expected to see increased demand for styrenics, while the construction industry will utilize styrenic forms, such as in insulation panels and piping systems, to enjoy their durability and easy installation.

The packaging industry is likely to continue as one of the key consumers of styrenics based on the demand for efficient and cost-effective packaging solutions. In contrast, Consumer products, from household appliances to toys, are expected to use styrene polymers and will have further aesthetic appeal and design flexibility. Other applications will include medical systems.

The USA's styrenics market is set for robust expansion between 2025 and 2035, with a projected CAGR of 6.7%. This growth is largely attributed to the increasing demand for packaging materials and automotive components, where styrenics play a crucial role due to their lightweight, flexible, and durable properties.

The Canadian styrenics market is poised for steady expansion, fueled by the construction and packaging sectors. The country is increasingly incorporating styrenic materials into sustainable building solutions and eco-friendly packaging.

The UK's styrenics industry is expected to grow at a CAGR of 7.6%, driven by the automotive and electronics markets. The push for electric vehicles (EVs), energy-efficient devices, and recyclable plastics is shaping industry growth.

France’s styrenics market is undergoing significant transformation, primarily driven by sustainability-focused regulations, the packaging sector, and green building initiatives.

Germany, with its strong automotive and industrial base, is expected to see steady growth in the styrenics market.

With a CAGR of 8.5%, South Korea's styrenics market is expanding rapidly, driven by the electronics and automotive industries.

Japan’s styrenics market is experiencing growth at a CAGR of 7.5%, supported by its electronics and automotive industries.

China’s styrenics industry is growing at a CAGR of 6.9%, backed by urbanization, industrial expansion, and strong demand in construction and packaging sectors.

India’s styrenics market is on a high-growth trajectory, fueled by expanding automotive, construction, and e-commerce industries.

Tier 1 companies in the global styrenics industry hold 90% of the market share, resulting in a highly concentrated market. This concentration implies that a small number of powerful companies dominate the using substantial resources and well-established distribution networks to hold onto their shares. This leads to intense competition, even though market entry remains challenging.

Some of the key players are INEOS Styrolution, BASF SE, Trinseo S.A., and SABIC and other highlights include the launch of INEOS Styrolution’s NAS® ECO line using BASF’s biomass-balanced styrene, underscoring sustainability and low-carbon output in 2024 collaborated further to produce styrene from chemical and renewable materials together. These initiatives align with circular economy trends and demonstrate industry leaders' commitment to innovation and sustainability.

The styrenics market in the Asia-Pacific region is growing rapidly, led mainly by China and India. The flourishing construction sector and government policies supporting green energy resources, including wind energy that relies on styrene-derived products, are responsible for this growth. Companies are increasingly eyeing this region to get close to the growing demand and secure a commanding position in the industry.

The consolidated nature of the styrenics market indicates dominance by a few key players, leading to limited competition and high entry barriers, as prominent players undertake strategic developments and regional growth tendencies emerge, which is set to be dynamic and evolving in the upcoming years.

INEOS Group (INEOS Styrolution) - Market Leader: INEOS (via its Styrolution division) is widely recognized as the largest global styrenics supplier, focusing on styrene monomer, polystyrene, ABS, and specialties.

It holds the #1 position globally in styrenics; industry analyses often cite INEOS as the market leader by revenue and capacity. In the general-purpose polystyrene segment alone, INEOS (Styrolution) is among the top producers - the top three companies (led by players like INEOS) account for roughly 33% of the global GPPS market.

This suggests INEOS’s share of the overall styrenics market is on the order of low double digits (percentage-wise), making it the single largest stakeholder worldwide.

TotalEnergies - Top 3 Producer: TotalEnergies (formerly Total SA) is another major styrenics producer, especially in polystyrene and styrene monomer. Total is typically ranked among the top three global suppliers of polystyrene, alongside INEOS.

For example, in the GPPS segment, Total (including its joint ventures) is one of the leading producers worldwide. TotalEnergies also has significant EPS and ABS operations (often via joint ventures like Hanwha Total in Asia), contributing a high single-digit share of the global market.

BASF SE - Key Player (via JV): BASF has historically been a leading styrenics company; it co-founded INEOS Styrolution in 2011 by merging its styrenics business with INEOS. Today, BASF remains influential mainly through joint ventures and regional production.

It is still listed among the key global styrenics players and retains significant styrene monomer capacity in Europe. Notably, BASF operates a 550 kT/year styrene plant in Germany (Ludwigshafen) and a joint venture (ELLBA with Shell) in the Netherlands, ensuring BASF a substantial share of styrenics feedstock. Along with INEOS and Total, BASF’s output helps place it among the top three polystyrene producers globally.

SABIC (Saudi Basic Industries Corp.) - Major ABS & Monomer Producer: SABIC is a leading Middle Eastern chemical company with notable styrenics businesses. It produces ABS (inherited from its acquisition of GE Plastics) and polystyrene and is a major styrene monomer supplier (e.g., via its petrochemical complexes).

SABIC is consistently listed among the top global styrenics companies. While its exact global market share is in the high single digits, SABIC’s influence is significant - for instance, its joint venture SADAF (with Shell) was a large styrene producer, and SABIC is involved in Americas Styrenics (through its stake in the Cos-Mar styrene JV). SABIC’s presence is particularly strong in ABS resins and in supplying styrene within Asia and the Middle East.

Trinseo S.A. - Leading Styrenics Specialist: Trinseo (formerly Styron, a Dow Chemical spin-off) is a major producer of polystyrene, ABS, and synthetic rubber. It has a strong market position in both North America and Europe. Trinseo co-owns Americas Styrenics (AmSty) - a 50/50 joint venture with Chevron Phillips Chemical - which is one of North America’s largest polystyrene producers.

Globally, Trinseo is often ranked among the top 5-6 styrenics suppliers. Along with its JV output, Trinseo’s share of the global styrenics market is significant (mid-single-digit percentage). It is frequently cited as a key competitor in styrenics, leveraging its legacy Dow technologies in PS and ABS.

Chevron Phillips Chemical (CPChem) - Americas Styrenics JV: CPChem itself does not produce styrenic polymers independently at a large scale, but through Americas Styrenics LLC (the JV with Trinseo), it is a major player in polystyrene. AmSty gives CPChem a substantial share of the North American styrenics market, making CPChem one of the noteworthy global players.

CPChem’s effective market share comes via AmSty’s output (polystyrene and styrene monomer) - AmSty is North America’s largest PS producer, which implies CPChem’s portion of that business is around 5% of global styrenics by itself. Additionally, CPChem’s joint venture in Saudi Arabia (SCP) produces styrene, further bolstering its position. Overall, CPChem ranks among the top tier mainly due to these partnerships.

Asahi Kasei Corporation - Asian Styrenics Leader: Asahi Kasei (Japan) is a leading Asian producer of styrenic resins, notably ABS and styrene-acrylonitrile (SAN) polymers, as well as synthetic rubber. It’s recognized as a key player in the global styrenics market. Asahi Kasei’s ABS capacity (under the “Stylac” brand) and its regional market share make it a top competitor, especially in Asia.

While its global share is a few percent, it holds strong positions in Japan and ASEAN markets. Asahi Kasei also engages in innovative styrenics (e.g., certified sustainable SBR), reinforcing its presence. It typically appears in lists of the top 10 styrenics companies worldwide.

LG Chem Ltd. - Top ABS Producer: LG Chem (South Korea) is one of the world’s largest ABS manufacturers and also produces polystyrene. It is frequently named among the major global styrenics players. LG Chem’s ABS output (for example, its plant in Yeosu), combined with its PS/EPS business, gives it a sizable market share, particularly in Asia-Pacific. Industry sources rank LG Chem alongside companies like INEOS, SABIC, and Trinseo in the styrenics sector.

By some measures, LG Chem has been the #2 ABS producer globally (after Taiwan’s Chi Mei Corp.), which translates to a mid-single-digit percentage of the total styrenics market. LG’s strong sales in automotive and electronics plastics contribute significantly to the Asia-Pacific styrenics supply.

LyondellBasell Industries - Major Styrene Monomer Supplier: LyondellBasell is a petrochemicals giant whose relevance to styrenics comes mainly from styrene monomer production. LyondellBasell operates and co-owns large styrene plants - for instance, it jointly operates Europe’s largest single styrene facility (700 KTA in the Netherlands) with Covestro.

In North America, LyondellBasell also has a major styrene unit (e.g., in Channelview, TX). While LyondellBasell’s direct sale of styrenic polymers is limited, its upstream role makes it critical to the supply chain. It is often listed among top styrene producers.

By providing monomer to polymer producers, LyondellBasell indirectly holds influence corresponding to a few percent of global styrenics volume. One of its JV plants feeds INEOS and Total’s polymer production in Europe.

Overall, the top 5-6 companies (e.g., INEOS, TotalEnergies, BASF, SABIC, Chi Mei, Trinseo) likely account for a substantial portion of global styrenics sales (on the order of ~40-50% combined). The top 10 companies - which include all those described above - control an even larger majority of the market.

This is evident from the GPPS data, where dozens of smaller producers together held ~67% (meaning the top players dominated the rest). The market is therefore led by a few giants with a long tail of regional and specialized producers.

Growth is driven by the increasing demand for lightweight and durable materials in the automotive, packaging, and electronics industries.

Leading players are looking to increase sustainability through investment in recycling technologies, bio-based alternatives, and a circular economy.

Asia-Pacific is witnessing the fastest growth due to rapid industrial expansion and supportive regulatory advancements, while North America and Europe also experience strong demand.

Manufacturers also face challenges such as fluctuating raw material prices, environmental concerns, and strict regulations.

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.