The stuttering therapeutics industry is valued at USD 56 million in 2025. As per FMI's analysis, the industry will grow at a CAGR of 14% and reach USD 207.47 million by 2035.

In 2024, the stuttering or fluency disorder therapeutics industry experienced a surge in clinical trials and regulatory approvals, driven by increased awareness and funding. At the molecular level, the imbalance of neurotransmitters that causes fluency disorder was treated with new drug forms that have been written about in hundreds of publications by the biggest drug companies.

Additionally, the development of digital therapeutics and AI-backed speech therapy apps has accelerated, offering tailored treatment programmes. FMI research showed that more people were getting treatment because it was easier to get, mostly in North America and a few European countries where reimbursement models were improved.

As a result of ongoing R&D investments, FMI predicts that biotech firms will release new therapeutics through 2025 and beyond. Expansion into underdiagnosed speech disorders in emerging economies will open new revenue streams. These alliances between speech therapy centres and pharmaceutical companies will further optimise the treatment's benefits. Technological advancements and the growing public acceptance of speech therapy treatments are likely to continue as industry growth catalysts until 2035, according to FMI research.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 56 million |

| Industry Value (2035F) | USD 207.47 million |

| CAGR (2025 to 2035) | 14% |

Explore FMI!

Book a free demo

The industry for fluency disorder therapies is growing quickly thanks to progress in neurological science, digital therapies, and more people knowing about speech disorders. As demand grows, especially in North America and emerging economies, the FMI study found that drug companies, biotechnology companies, and speech therapy clinics will do well. Firms that employ only traditional speech therapy methodsrisk losing industry relevance if new approaches dominate.

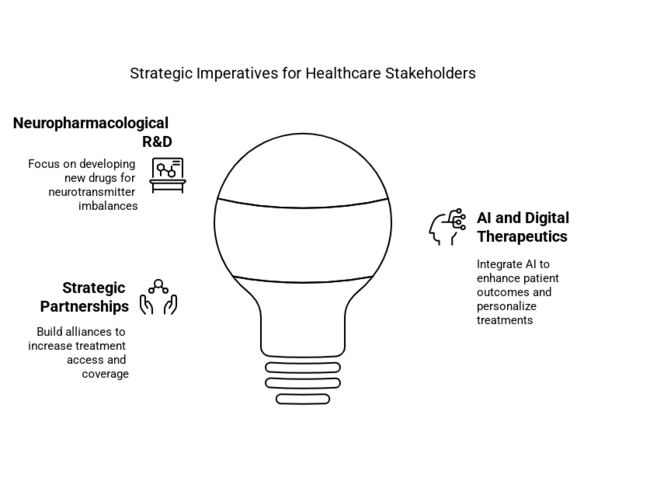

Move faster on neuropharmacological R&D investing

Executives must prioritize investments in novel drugs targeting neurotransmitter imbalances. The companies will be at the top of this new industry if they can expand clinical trials and get regulatory approvals.

Combine AI and digital therapeutics

As more people use speech therapy software that is powered by AI, patient outcomes and industry share will also grow. Companies will have to invest in collaborations with tech firms to develop personalised treatment plans based on data.

Increase industry access through strategic partnerships

Working together with healthcare providers, insurance companies, and speech therapists will make more treatments available and covered. According to an analysis by FMI, companies that use mergers and acquisitions as a way to acquire or partner with innovative startups will be able to stay competitive in the long run.

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays in Drug Approvals | High Probability-High Impact |

| Slow Adoption of Digital Therapeutics | Medium Probability-High Impact |

| Reimbursement and Pricing Challenges | High Probability-Medium Impact |

1-Year Executive Watch-list

| Priority | Immediate Action |

|---|---|

| Advancing Drug Development | Accelerate Phase II and III clinical trials for new therapies |

| Enhancing Digital Therapeutics Adoption | Expand partnerships with AI-driven speech therapy platforms |

| Strengthening Reimbursement Strategies | Engage with insurers to improve coverage for new treatments |

To stay ahead, companies need to quickly adapt to the growing need for stuttering treatments by focusing on neuropharmacological research and development, making it easier to use digital therapies, and coming up with better ways to get paid.

FMI observes that the companies that invest in speech therapy platforms with AI and future partnerships with biotech innovation startups will be the ones that win in the end. The next 12 months are crucial for securing regulatory approval and gaining global industry access. Executives must reshape their roadmaps to adapt to new consumer expectations and emerging technologies in order to stay competitive in the dynamic sector.

Regional Variance

High Variance

Divergent Views on ROI

While 69% of North American stakeholders found AI-powered therapy cost-effective, only 36% of Asia-Pacific providers expressed willingness to move away from traditional methods.

Consensus

68% of pharma companies focused on neuropharmacological drugs tailored towards neurotransmitter dysregulation.

Variance

Shared Challenges

86% identified increasing research and development costs as a leading concern in making drugs affordable.

Regional Differences

Pharmaceutical Companies

Developers of Digital Therapeutics

Alignment

73% of global stakeholders would invest in AI-driven and neuropharmacological treatments.

Divergence

North America

69% of pharmaceutical companies reported that more stringent FDA approval processes are a major challenge.

Europe

80% considered new EU pharmaceutical policies as a industry expansion opportunity for high-quality drugs.

Asia-Pacific

30% claimed the regulatory changes affected industry growth (based on low enforcement).

High Consensus

Efforts to improve drug efficacy, affordability, and technological integration are agreed to be important by stakeholders.

Key Variances

Strategic Insight

There is no one-size-fits-all policy-pharma companies need to tailor tactics around regional preferences, making timing affordable in price-sensitive industries and focusing on premium drug investment in high-income territories.

| Countries | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | Approval of fluency disorder medications by the FDA should be conducted under the New Drug Application (NDA) pathway. Funding plans also differ by state, and some speech therapies are covered under Medicaid. AI-based digital therapeutics fall under regulatory oversight per the 21st Century Cures Act. |

| United Kingdom | The UK Medicines and Healthcare Products Regulatory Agency (MHRA) regulates drug approvals. Through evidence-based therapies, the National Institute for Health and Care Excellence (NICE) has the power to influence reimbursement. Digital therapeutics need to comply with NHS Digital Standards. |

| France | The Agence Nationale de Sécurité du Médicament (ANSM) regulates pharmaceutical therapies. The digital solution, which has never been tested, can be used instead of therapy, and the Assurance Maladie promises to pay up to €16 back in part. AI-based therapeutic models must align with the Haute Autorité de Santé (HAS). |

| Germany | Drug approvals are run by the Federal Institute for Drugs and Medical Devices ( BfArM ). Speech therapy is eligible for reimbursement from statutory health insurance (GKV). Digital health apps must undergo DiGA Fast-Track Approval for integration into the national health system. |

| Italy | The Italian Medicines Agency (AIFA) conducts reassessments for fluency disorder drugs prior to their launch. The Servizio Sanitario Nazionale (SSN) covers regular speech therapy, but they haven't put in place detailed rules for digital medicines yet. AI can only be based on data that is compliant with GDPR's health data standards. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) oversees pharmaceuticals. Clinical validation for reimbursement by National Health Insurance (NHI) is required for stuttering medications. Regulators are beginning to focus on AI-based speech therapy but don't have established approval channels. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) oversees drug approval. Fluency disorder therapies are covered partially by Japan's National Health Insurance (NHI). Digital therapeutics should satisfy the conditions of the Act on Securing Quality, Efficacy and Safety of Pharmaceuticals and Medical Devices. |

| China | However, pharmaceuticals are overseen by the National Medical Products Administration (NMPA). Conventional hospitals provide speech therapy without specific insurance coverage. Digital health apps must comply with China’s Cybersecurity Law and the Medical Device Classification Regulation. |

| Australia-NZ | Approvals are conducted by the Therapeutic Goods Administration (TGA) (Australia) and Med safe (NZ). AI speech therapy must comply with Digital Health Standards (Australia) and Health Information Security Framework (NZ). Government support for reimbursement is limited. |

| India | The Central Drug Standard Control Organisation (CDSCO) handles pharmaceutical approvals. Most other speech therapy treatments require out-of-pocket payment, and most insurance plans have coverage limits. There is no clear reimbursement policy, though digital therapeutics are subject to the Medical Devices Rules, 2017. |

The United States industry for stuttering therapeutics is projected to grow at a CAGR of 15.2% from 2025 to 2035. The USA has strong healthcare infrastructure and supportive regulatory policies in the form of the FDA's New Drug Application process. According to FMI analysis, intense R&D investment and digital therapeutics are driving industry growth.

Pharmaceutical companies are working hard to come up with new neuropharmacological therapies, and insurance companies are supporting these new therapies more and more. As technology improves and patients become more aware, there are huge growth opportunities. However, issues like inconsistent reimbursement between states and expensive development need to be fixed.

Projections indicate a CAGR of 12.8% for the stuttering therapeutics industry in the United Kingdom from 2025 to 2035. The UK benefits from the coordinated support of the NHS, which is increasingly adopting novel digital and drug therapies. The FMI research found that the MHRA's regulatory monitoring and NICE's guidance ensure the adoption of only evidence-supported treatments.

The industry is strengthened by consistent evidence of ethical and sustainable drug development, even though data privacy and cost issues remain problems. Further investment in AI-facilitated teletherapy and streamlined approval continues to guarantee increased growth.

The French industry for fluency disorder therapeutics is projected to grow at a CAGR of 11.9% during 2025 to 2035. France's robust universal healthcare system and favourable reimbursement environment under Assurance Maladie support the continued growth of innovative therapies. The FMI analysis showed that regulatory oversight by the ANSM and assessments by HAS are very important for getting people to use advanced neuropharmacological therapies.

The industry is also cautiously interested in digital therapeutics, but interest is growing. However, GDPR compliance is making it hard to put these therapies into practice. Despite rural access constraints, industry opportunities are supported by ongoing advancements in research and development and ethical drug supply.

The German industry for stuttering therapeutics is anticipated to grow at a CAGR of 13.4% during the period 2025 to 2035. Germany has a strong reputation for having world-class healthcare and effective regulatory frameworks run by the BfArM that speed up the approval of drugs. FMI research discovered that the DiGA Fast-Track system is central to the integration of AI-based speech therapies into statutory insurance (GKV).

Germany's sophisticated clinical trial facilities and coopecentres environment between research centers and pharmaceutical firms contribute further towards innovation. Though rigorous drug pricing regulations and EU regulatory pressures pose difficulties, consistent investments in digitalisation and strong R&D are likely to propel sustained growth.

The fluency disorder therapeutics industry in Italy is projected to grow at a CAGR of 11.0% from 2025 to 2035. The Italian healthcare environment is increasingly adopting cutting-edge forms of treatment, led by the Italian Medicines Agency (AIFA) and backed by the ServizioSanitarioNazionale (SSN).

FMI research showed that the growing interest in neuropharmacological research and the use of digital therapies are both good signs for growth. Still, budget constraints and complicated legal requirements, like following GDPR for digital schemes, are big problems. By strategically investing in innovation and forming focused public-private partnerships, the Italian industry is well-positioned to gradually enhance treatment schemes and expand its industry reach.

The South Korean industry for stuttering therapeutics is projected to grow at a CAGR of 13.0% from 2025 to 2035. The Ministry of Food and Drug Safety (MFDS) and the rest of the government are fully behind the country's healthcare system, which is growing quickly. According to the FMI analysis, investments in clinical trial infrastructure and digital therapeutics are fuelling growth.

South Korea's healthcare professionals are using AI-powered speech therapy platforms more and more, and the country's reimbursement systems are changing to make room for more advanced therapies. Even with challenges arising from the lack of clear regulatory paths for digital use, ongoing strategic investment in innovation and cost-effective production is anticipated to maintain industry momentum.

Estimates indicate that the industry for fluency disorder therapeutics in Japan will grow at a compound annual growth rate (CAGR) of 12.5% from 2025 to 2035. The Pharmaceuticals and Medical Devices Agency (PMDA) manages Japan's robust regulatory framework, which ensures rigorous clinical evaluation and patient safety. According to an analysis by FMI, there is a lot of momentum behind creating new drug formulations and using digital therapeutics in clinical settings.

Because people are concerned about costs, the industry takes new technologies more slowly. However, steady investments in research and development keep the pace going. Improved reimbursement schemes under Japan's National Health Insurance are increasingly influencing patient demand for advanced modalities, facilitating overall industry growth.

The industry for stuttering therapeutics in China is projected to grow at a CAGR of 14.0% during 2025 to 2035. China's wide-ranging healthcare reforms and rising investment in biotechnology are driving industry growth. An analysis by FMI showed that the National Medical Products Administration's (NMPA) regulatory oversight is changing to make it easier for new neuropharmacological drugs to get approved more quickly.

Digital health products are coming online fast, yet observance of cybersecurity and data protection regulations will be a high priority. Public and private sources are investing more in R&D, and with that, the industry will experience a boom from traditional as well as digital treatments. Problems with regulations and getting into new industries will need to be solved through strategic collaboration and government stimulus.

In Australia-NZ, the therapeutics industry for stuttering is projected to grow at a CAGR of 12.0% between 2025 and 2035. The region enjoys the advantage of being highly regulated and supportive of healthcare, which is monitored by the TGA in Australia and Medsafe in New Zealand.

Strategic investments in AI-based speech therapy solutions were fuelling industry innovation and increasing patient access, as the FMI analysis determined. Reimbursement for digital therapeutics remains limited despite overall supportive healthcare systems, the increasing uptake of telehealth and the establishment of digital health standards are paving the way for improved treatment modalities.

Joint initiatives between government agencies and private organisations are likely to spur innovation, making both conventional and innovative therapeutic solutions more acceptable in the region.

Estimates indicate that the industry for fluency disorder therapeutics in India will grow at a CAGR of 10.5% between 2025 and 2035. India’s healthcare sector, regulated by the Central Drugs Standard Control Organisation (CDSCO), is increasingly adopting sophisticated treatments.

FMI research revealed that growing R&D expenditures and enhanced public-private collaborations are fuelling industry growth, even with the prevalence of out-of-pocket expenditures. Insufficient reimbursement models and infrastructural limitations constrain the industry's ability to scale up digital therapeutics.

Nevertheless, strategic efforts to reduce costs and encourage generic formulations are providing a supportive environment for innovation. The therapeutics industry will slowly grow as the government raises regulatory standards and puts money into healthcare infrastructure.

From 2025 to 2035, projections indicate a CAGR of 13.0% for the stuttering therapeutics industry in France by treatment modality. This category integrates traditional speech therapy with cutting-edge fluency disorder aids, cognitive behaviour therapy, parent-child interaction methods, and pharmacotherapy. Speech therapy remains a reliable treatment due to its proven effectiveness, while fluency disorder devices and digital augmentations are rapidly gaining popularity among tech-forward providers.

Cognitive behavioural therapy and parent-child interaction are changing as extra therapies that combine family support with behavioural findings. Advances in neuropharmacology propel drug therapy to high levels of investment, thereby strengthening the portfolio.

Collectively, augmented R&D and varied reimbursement schemes reward these modalities, according to FMI research. Industry forces prefer to resolve issues with solutions that provide quantifiable, near-term results. Merging digital technologies with traditional methods maximises patient involvement and treatment adherence, fostering robust, sustained expansion in an increasingly competitive industry.

In France, the industry for fluency disorder medicines will grow at a rate of 11.5% CAGR from 2025 to 2035, based on the type of stuttering. Developmental fluency disorder and neurogenic stuttering represent the segments bifurcated in the context of a treatment imperative. Children and adolescents primarily experience developmental stuttering, which they address through early intervention programmes and extensive speech therapy.

Head injuries or neurological conditions typically cause neurogenic stuttering, necessitating advanced drug treatment and rehabilitative therapy. According to a study by FMI, developmental fluency disorder still has a large base of traditional therapy, while neurogenic stuttering is seeing faster adoption of new digital and drug therapies.

Industry pressures, fuelled by technological innovation and focused clinical trials, are increasingly closing treatment gaps. The two-pronged approach allows for targeted therapies, requiring both public and private funding. This ensures steady and strong growth across a wide range of patient groups.

In France, the stuttering therapeutics industry by end user is projected to grow at a CAGR of 12.0% from 2025 to 2035. This end-user industry includes hospitals, specialty clinics, and home care, each with distinct growth patterns. More and more, hospitals and specialty clinics are using advanced drug therapies and digital platforms to track how well treatments are working in real time. An analysis by FMI showed that these institutions have strong regulatory support and well-developed infrastructure.

On the other hand, homecare services are growing quickly thanks to better telehealth support and patient-based care models. The use of AI-based speech therapy solutions within clinical environments has enhanced diagnostic accuracy and personalised care, providing a competitive edge.

Homecare, specifically, is expected to grow as digital therapeutics cut down on the necessity for regular in-person consultations, hence improving accessibility and convenience. Together, these end users are revolutionising care delivery by making innovative treatments available to a wider patient population and achieving sustainable industry growth.

There is fierce competition among the major players in fluency disorder therapies in terms of pricing, innovation, collaboration, and tactical expansion. According to FMI research, major players invest heavily in R&D to enhance treatment effectiveness by integrating digital platforms with traditional therapies. They can enhance their product by combining optimised production and scale, which provides competitive pricing. Rapid industry penetration and regional expansion are driven by collaborations with healthcare providers and technology companies.

Companies do mergers and acquisitions to expand their product portfolios and increase geographical reach. The longer-term plans are aimed at speeding up the creation of new products, meeting regulatory requirements, and expanding the company's global industry share in both high-end and low-cost segments.

Industry Share

Jazz Pharmaceuticals

Novartis AG

Roche Holding AG

Pfizer Inc.

AbbVie Inc.

Major developments in 2024

Demand is being driven by more people knowing about speech disorders, progress in neuropharmacology, and the coming together of digital solutions.

The industry is expected to grow quickly, thanks to better technology, more people getting health insurance, and more effective treatments.

Major players are Signum Biosciences, Fluent Therapeutics, NeuroSpeech Inc., SpeechEase Technologies, and Stutter Solutions Inc.

The core treatment is speech therapy, supplemented by stuttering aids, cognitive -behavioural therapy, parent-child interaction, and drug therapy.

The industry is projected to reach USD 207.47 million by 2035, with significant growth expected.

The industry is segmented into speech therapy, stuttering devices, cognitive behavioral therapy, parent-child interaction and drug therapy

It is segmented into developmental stuttering and neurogenic stuttering

It segmented among hospitals, specialty clinics and homecare

The industry is studied across North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.