The Structured Product Label (SPL) Management market is expanding rapidly as pharmaceutical and life sciences organizations adopt digital compliance solutions to meet stringent regulatory requirements.

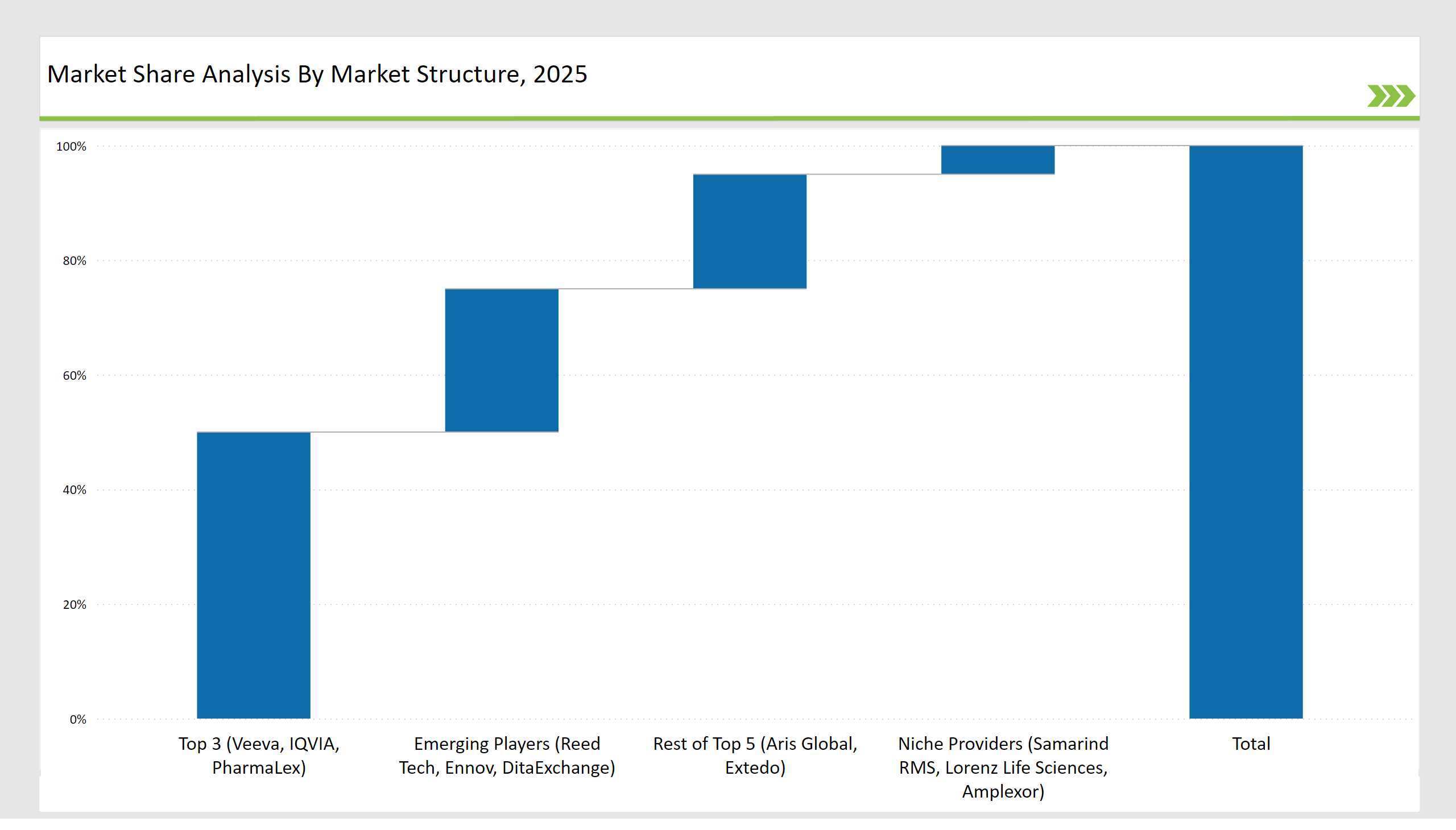

Leading vendors, including Veeva Systems, IQVIA, and PharmaLex, control 50% of the market by providing cloud-based SPL solutions and regulatory workflow automation. Aris Global and Extedo hold 20% of the market, specializing in global regulatory compliance.

Emerging players such as Reed Tech, Ennov, and DitaExchange account for 25%, focusing on AI-driven document structuring and XML conversion. Niche providers, including Samarind RMS, Lorenz Life Sciences, and Amplexor, cater to specialized regulatory and labeling needs, holding 5% of the market.

With the increasing demand for compliance automation and structured labeling, the SPL Management market will grow at a 12.8% CAGR, reaching USD 3.4 billion by 2035.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 3.4 billion |

| CAGR (2025 to 2035) | 12.8% |

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 (Veeva, IQVIA, PharmaLex) | 50% |

| Rest of Top 5 (Aris Global, Extedo) | 20% |

| Emerging Players (Reed Tech, Ennov, DitaExchange) | 25% |

| Niche Providers (Samarind RMS, Lorenz Life Sciences, Amplexor) | 5% |

| Market Concentration | Assessment |

|---|---|

| High (> 60% by top 10 players) | Medium |

| Medium (40-60%) | High |

| Low (< 40%) | Low |

Structured Product Labeling Software leads the global market with a 35% share. Veeva Systems, IQVIA, and Aris Global dominate this segment by offering cloud-based SPL authoring and automation tools.

XML Compliance and Conversion Tools follow closely with 30%, led by Reed Tech, Ennov, and DitaExchange, which provide real-time regulatory submission tools. Vendors must integrate AI-driven automation to ensure compliance with evolving FDA and EMA standards.

The pharmaceutical sector accounts for 45% of the SPL Management market due to its critical need for structured regulatory submissions and FDA labeling compliance. Leading vendors such as IQVIA offer advanced SPL tools that ensure seamless compliance with global health authorities.

The medical devices industry holds a 25% market share, focusing on UDI (Unique Device Identification) and structured labeling compliance. Companies like Extedo and Amplexor specialize in regulatory reporting and label management solutions. As regulations evolve, industries must adopt scalable SPL tools to maintain compliance and operational efficiency.

Veeva Systems: Veeva expanded its RegulatoryOne platform, integrating advanced AI-powered SPL management tools. The company introduced real-time validation features, enabling pharma companies to detect compliance risks before submission. Veeva also strengthened cloud-based collaboration for global regulatory teams.

IQVIA: IQVIA enhanced its SPL services by incorporating machine learning models that automate structured labeling and regulatory submissions. The company launched a new compliance module that aligns with FDA, EMA, and Health Canada requirements, improving workflow efficiency.

PharmaLex: PharmaLex improved its structured content authoring tools, enabling life sciences companies to optimize global regulatory submissions. The firm expanded its compliance consulting services, supporting companies in adapting to regulatory changes.

Aris Global: Aris Global upgraded its LifeSphere Regulatory platform, enhancing XML conversion capabilities and structured labeling validation. The company also introduced cloud-based SPL tracking to ensure real-time compliance monitoring.

Reed Tech: Reed Tech diversified its SPL portfolio by introducing automated compliance workflows for small and mid-sized pharma firms. The company also expanded dark web monitoring capabilities for regulatory document security.

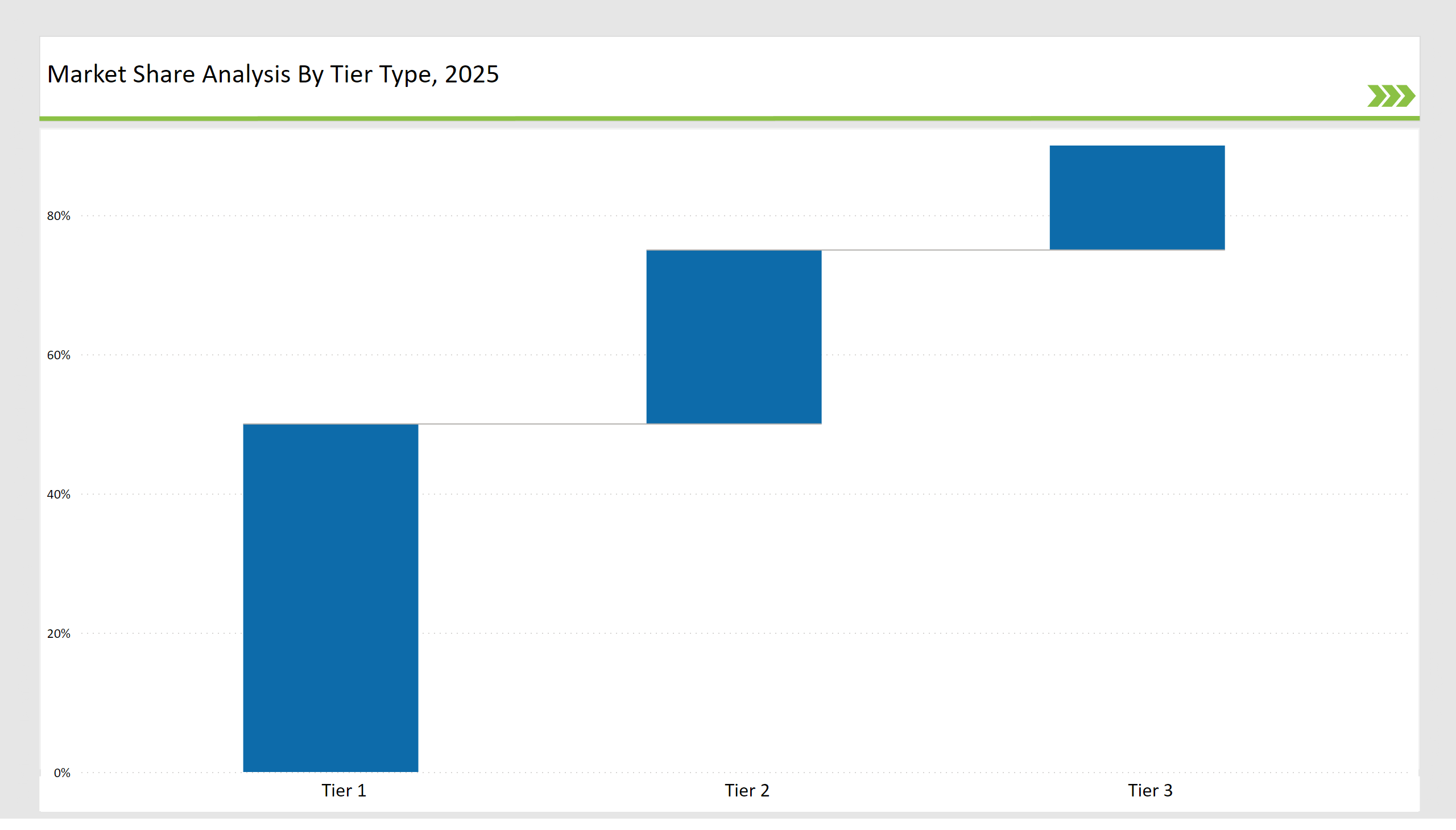

| Tier | Tier 1 |

|---|---|

| Vendors | Veeva, IQVIA, PharmaLex, Aris Global |

| Consolidated Market Share (%) | 50% |

| Tier | Tier 2 |

|---|---|

| Vendors | Reed Tech, Ennov, DitaExchange |

| Consolidated Market Share (%) | 25% |

| Tier | Tier 3 |

|---|---|

| Vendors | Samarind RMS, Lorenz Life Sciences, Amplexor |

| Consolidated Market Share (%) | 15% |

| Vendor | Key Focus |

|---|---|

| Veeva Systems | Advancing AI-driven SPL automation and real-time compliance validation. |

| IQVIA | Enhancing regulatory submission automation with machine learning-driven solutions. |

| PharmaLex | Expanding regulatory consulting and structured content management capabilities. |

| Aris Global | Improving cloud-based SPL tracking and structured content authoring. |

| Reed Tech | Innovating compliance automation tools for mid-sized pharma and medical device companies. |

To enhance compliance efficiency, vendors must refine machine learning models for SPL validation, reducing manual intervention and improving submission accuracy. Training programs, webinars, and regulatory workshops will help organizations maximize tool adoption. Expanding into emerging markets such as Asia-Pacific and Latin America presents additional growth opportunities.

Vendors must also focus on seamless ecosystem integrations with existing regulatory systems to strengthen compliance operations. By prioritizing innovation, regulatory alignment, and global reach, SPL Management vendors will maintain a competitive edge in the evolving compliance landscape.

Veeva Systems, IQVIA, and PharmaLex collectively hold 50% of the market share by offering cloud-based SPL solutions and regulatory workflow automation.

Emerging players such as Reed Tech, Ennov, and DitaExchange hold approximately 25% of the market, focusing on AI-driven compliance and structured content management.

Niche providers, including Samarind RMS, Lorenz Life Sciences, and Amplexor, control around 5% of the market, catering to specialized regulatory and labeling needs.

The top five vendors (Veeva Systems, IQVIA, PharmaLex, Aris Global, and Extedo) control approximately 70% of the market, reflecting high market concentration among key players.

The market concentration in 2025 is categorized as high for the top 10 players controlling more than 60% of the market, medium for 40-60% market share, and low for players controlling under 30% of the market.

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Induction Motors Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.