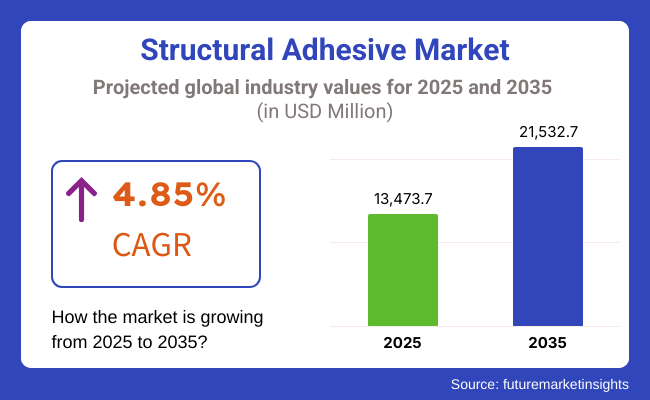

The global structural adhesive market is poised for steady growth, with its market size expected to increase from USD 13,473.7 million in 2025 to USD 21,532.7 million by 2035, reflecting a CAGR of 4.85% over the forecast period.

The growth of high performance bond solutions in automotive and aerospace along with construction & Electronics domain continue to drive this upward spiral. Some better factors impacting the market are increasing adoption of lightweight materials, development in formulation of adhesive materials and demand for strong and durable bonding products.

All these aspects have led structural adhesives market to prosper as they offer a bonding technology for various applications across multiple verticals. They are key for from automotive and aerospace to industrial applications, which let the devices extend life, offset the weight of the assembly and deliver total efficiency. As more industries require sustainable high-performing materials, your structured adhesives will enable next generation manufacturing and infrastructure.

The global structural adhesive market is majorly dominated by the manufacturers who are on the lookout for the alternatives for mechanical fasteners as well as welding. These bonding agents offer advantages like better endurance, lower mass, and more efficient load distribution, which are crucial for modern engineering applications.

Growth in the number of industries requiring sustainable, high-strength adhesives, such as automotive light weighting, aerospace assembly, and infrastructure projects, is also considered a major driver of this market. Demands from regulatory bodies to have low VOC and eco-friendly adhesives have also paved the way for industry trends.

Explore FMI!

Book a free demo

There is high demand for structural adhesive in aerospace, automotive, and construction sectors across North America. Key Market Players Leading manufacturers are operating across the region due to the early adoption of high-performance adhesive bonding for lightweight, durable application in the aerospace and automotive industry. EPA is very strict regarding environmental regulations, thus driving manufacturers towards sustainable and green adhesives with low VOCs.

In such a way, the presence of various advanced R&D facilities and technological innovations of the adhesive formulation often drive the market growth subsequently. In addition, the growing prevalence of electric vehicles (EVs) and renewable energy initiatives is creating new applications for high-performance bonding, especially in wind energy and battery assembly.

Across Europe, the structural adhesive market is large and flourishing, driven primarily by automotive, industrial manufacturing, and construction industries. Use of lightweight structural adhesives to increase application efficiency in vehicles and comply with EU carbon emissions legislation in major automotive manufacturers in Germany, France and USS.

Additionally, escalating shift towards sustainable and bio-based adhesives corresponds with the European Green Deal, which encourages manufacturers to adopt green substitutes. Even aerospace companies like Airbus are employing high-performance adhesives to join the pieces of their aircraft. In addition, the increasing investments in renewable energy infrastructure and modular construction techniques enhance the growth of the advanced bonding solutions market in the region.

Asia-Pacific holds the largest share of the market and it is anticipated as an emerging and fastest regional market for global structural adhesives market with its rapid industrialize and growing manufacturing industry. Countries/regions such as China, India, Japan, and South Korea are said to have increasing demand supported by sectors like automotive, electronics, and construction. The burgeoning EV market in China as well as India are generating opportunities for lightweight bonding innovations.

The booming infrastructure projects and government's investment on smart cities have also fueled the demand for structural adhesives in construction applications. In addition, growing foreign investments in high-tech manufacturing, aerospace, and renewable energy industries are projected to actively contribute to the Asia-Pacific's share of global adhesive production and usage over the decade.

In Rest of World, the structural adhesive market, which includes Latin America, the Middle East, and Africa, is witnessing moderate growth due to the expansion of industrial sector and infrastructural development. Latin America offers you demand stemming from growth in the automotive and construction industries, particularly in Brazil and Mexico.

High-performance adhesives for corrosion-resistant bonding applications are being adapted in the Middle East emerging oil & gas and aerospace and industries. The demand for durable and inexpensive adhesives is being driven by increasing investments in urbanization and infrastructure project across Africa. Nonetheless, the adoption of advanced manufacturing techniques and renewable energy projects further encourages long-term market growth.

Challenges

Volatile Raw Material Prices and Supply Chain Disruptions

Moreover, the fluctuations in petroleum gross materials which are a vital source of raw material for key raw material impurities such as epoxy resins, acrylics and polyurethanes are forming a mild challenge for the structural adhesive market in terms of its cost. Geopolitical instability, trade restrictions, and supply chain disruptions that prevent access to critical materials can all increase production costs.”

In addition, rending and aviation problems increase manufacturing pressure, and place constraints on pricing strategies and profit. To mitigate risks, companies have to look for alternative raw materials, bio-based adhesives, and localized supply chains. Maintaining compliance on environmental elements of EHS adds another degree of complexity in trade cost for the material, feedstock impact (sustainable and renewable feedstock’s), and environmental compliance.

Stringent Environmental Regulations and Compliance Issues

With exposure to hazardous chemicals in adhesives becoming a point of concern, the government regulations regarding VOC emissions are only tightening further due to an increasing focus on environmental impact and sustainability. Also, regulations like the EPA (USA), REACH (Europe) and China’s environmental standards are restricting conventional adhesive formulations, which result in manufacturers developing low-VOC and solvent-free alternatives.

These regulations often require significant R&D investments, reformulation of products, and lengthy certification processes, resulting in increased costs and longer time-to-market. Although eco-friendly adhesives offers a wider growth opportunity, transitioning to such sustainable production processes without compromising the performance and durability is a challenge ahead for market participants.

Opportunities

Rising Demand for Lightweight and High-Performance Adhesives

The increasing preference for lightweight material in automotive, aerospace, and industrial applications is creating demand for structural adhesives with high strength properties and low weight. Car makers are eager to replace mechanical fasteners and welding with higher-tech adhesives to achieve better fuel efficiency and vehicle performance. In aerospace, the move toward composite materials in aircraft manufacturing is an additional driver for adhesive use.

Moreover, industries like electronics and renewable energy also require long-lasting and reliable high-performance bonding solutions. This is a great opportunity for the adhesive manufacturers to introduce the next-generation adhesives formulations with better thermal resistance, flexibility, and load-bearing capacity.

Growth of Bio-Based and Eco-Friendly Adhesives

Bio-based and low-VOC structural adhesives are creating new opportunities with a push for sustainability and green manufacturing. Around the world, governments and regulatory bodies are implementing more stringent environmental policies, pushing industries to shift toward more sustainable alternatives. Novel biodegradable, water-based and solvent-free glues are starting to take hold, especially in the construction, packaging and automotive industries.

This growing market trend, through bio-based polymers and nanotechnology-enhanced adhesives, creates opportunities for companies to invest. Moreover, concerning the green and sustainable chemistry and manufacturing sourcing, end-users are becoming more aware of these factors and will drive the demand for non-toxic and recyclable bonding solutions in particular, making way for manufacturers to be placed strategically for long-term competitive edge within the target market.

The global structural adhesives market is extremely lucrative and has experienced an impactful growth from the year 2020 to 2024 which is primarily due to growing demand of the adhesives from various end-use industries like automotive, aerospace, construction, electronics, etc.

Key trends driving market growth include: rapid adoption of synthetic light weight material in manufacture, strict legislation related to environment: encouraging the use of sustainable types of adhesives, technological developments in bonding solutions.

The smart adhesives will benefit greatly from the general rise in demand witnessed between the years 2025 and 2035, which is also led by nanotechnology and interest in green formulations. Moreover, expansion of high-performance adhesives resistant to extreme conditions is predicted to create new opportunities for market growth.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Narrow acceptance of stringent VOC emission regulations. |

| Technological Advancements | Development of new hybrid adhesives for better performance. |

| Industry-Specific Demand | Strong demand from automotive, construction and electronics sectors. |

| Sustainability & Circular Economy | Increased emphasis on low VOC, bio-based adhesive products. |

| Production & Supply Chain | Global supply chain disruptions affected the availability of raw materials. |

| Market Growth Drivers | Adoption of lightweight material and industrial automation. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Tighter sustainability targets and circular economy initiatives. |

| Technological Advancements | Increased adoption of nanotechnology-based adhesives and self-healing adhesives. |

| Industry-Specific Demand | Adoption within renewable energy applications and next gen aerospace designs. |

| Sustainability & Circular Economy | Increased use of recyclable, biodegradable, and bioengineered adhesives. |

| Production & Supply Chain | AI-powered forecasting and localized production to bolster supply chain resilience. |

| Market Growth Drivers | Growth in electric vehicles, 3D printing applications, and robotics manufacturing. |

The USA structural adhesive market is driven by innovation in aerospace, automotive light weighting, and infrastructure projects. Other key growth driver is the growing penetration of high-performance adhesives in the manufacturing processes of EVs as well as aerospace applications.

However, sustainability trends favour bio-based adhesives, and regulatory compliance with VOC emissions impacts market preference. Key manufacturers and the continuous research and development (R&D) in bonding technologies also contribute to the growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

This growth is also due to increasing applications in aerospace, renewable energy, and sustainable construction in the UK structural adhesive market. Strengthening environmental regulations along with the push for light weighting has been fostering demand in automotive manufacturing for lightweight materials.

So the development of environmentally friendly high strength adhesives is also a big highlight, such as wind energy industry. Domestic innovations gleaned from Brexit-related regulatory changes may change trading dynamics.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

Stringent policies in the European region support the low-VOC segment adhesive market, which is one of the top segments held in the market and is driving a surge in the EU market. The automotive and construction industries are significant consumers, and innovations that reduce environmental impact with bio-based adhesives are gaining traction.

Adhesives developments are influenced by the Green Deal policies and REACH regulations encouraging investment in environmentally friendly solutions. The use of sophisticated applications in aerospace and rail transport also drives demand in the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.6% |

Technological progresses in high-performance adhesives for electronic, automotive and robotics industries are driving Japan's market growth. Demand is being fueled by the country’s concentration on precision engineering and miniaturization, especially for use in semiconductors and EV batteries.

Moreover, sustainability initiatives are driving research and development (R&D) activities in biodegradable adhesives. The development of high-tech manufacturing technology is in line with the development of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

The growth of electronics, shipbuilding and automotive sectors is driving growth in South Korea's structural adhesive market. One major trend in the global smart adhesive market is the rising adoption of smart adhesives in semiconductor manufacturing and EV production.

Additionally, government initiatives and policies that encourage the use of hydrogen fuel cell vehicles as well as the development of renewable energy infrastructure are also driving demand. Market growth is shaped by strategic investments in high-performance bonding solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

Epoxy has the largest share in the structural adhesives market owing to their high bonding strength, chemical resistance and durability. The adhesive through your intuitive sense has high performance under high extreme conditions widely used in aerospace, automotive, and construction and other aspects. These are widely used in structural bonding due to their good adhesion to metals, composites and plastics.

The growing use of lightweight materials in transportation increasing the demand for robust, flexible adhesives, are also driving demand. However, regulatory challenges regarding volatile organic compound (VOC) emissions in solvent-based epoxies and limitations in curing time hinder the growth of this market, with manufacturers innovating fast-curing and environmentally-friendly formulations.

Acrylic-based structural adhesives are gaining popularity due to their rapid curing, excellent impact resistance, and ability to bond dissimilar substrates. They are commonly used in the automotive and electronics industries where strong, durable bonded joints are required that can withstand vibration and temperature extremes.

Because of their low surface preparation requirements and extremely high toughness they are superior to more traditional fastening and welding. The rising need for lightweight, fuel-efficient vehicles accelerates their usage. But their growth is hampered by factors including odour concerns and limited heat resistance. Newer hybrid acrylic formulations are designed to overcome these disadvantages, enabling better performance.

Moreover, the transportation sector is the top consumer of structural adhesives, led by the automotive, aerospace, and marine segments. Instead, structural adhesives eliminate the use of welding and mechanical fastening, which helps create lightweight vehicle designs that improve both fuel efficiency and performance. Widely used epoxy, acrylic, and polyurethane adhesives such as in car bodies, aircraft interiors, and ship parts that bond metal, plastic, and composite materials.

The transition to electric vehicle (EVs) and a need for vibration-resistant, crash-resistant, and extreme-bonding solutions will also help propel demand. Stringent safety and environmental regulations are a persistent challenge for the market, forcing manufacturers to move toward sustainable and low-emission adhesive solutions.

Within the construction industry, structural adhesives are playing an increasingly important role in applications ranging from panel bonding to façade assembly and flooring. Adhesives offer superior strength, moisture resistance, and flexibility, and lessen the need for mechanical fasteners and welding. Highly conducive environment for energy-efficient and sustainable buildings has resulted in the growing adoption of eco-friendly-bonding that also generate the lesser VOC emissions.

Adhesives like epoxy and polyurethane are extensively used in the construction of infrastructure projects due to their efficient strength. Other factors contributing to the adoption include growth in urbanization, smart city developments, and prefabricated construction. Yet, volatile raw material price fluctuations and regulations restrict the use of solvent-based adhesives, which affect the growth of the market.

The structural adhesive market is experiencing significant growth, driven by increasing demand across industries such as automotive, aerospace, construction, and electronics. Leading industry players are also concentrating on product innovations and sustainability along with high-performance formulations to improve adhesion strength and durability.

There is an increasing adoption of lightweight materials in automotive and aerospace sectors, leading to technological advancements in hybrid adhesive formulations. Consolidation within the market via mergers and acquisition is also transforming the competitive landscape.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Henkel AG & Co. KGaA | 14-18% |

| 3M Company | 12-16% |

| Sika AG | 10-14% |

| H.B. Fuller Company | 8-12% |

| Arkema S.A. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Henkel AG & Co. KGaA | Manufacturer of high-performance adhesives for automotive and industrial use. Sustainability and low-VOC formulations are a focus. |

| 3M Company | Focus on structural adhesives for aerospace, electronics and construction sectors. The green and high-strength formulations are at the core of the strategy. |

| Sika AG | Develops bonding solutions for construction and transportation sectors. Emphasizes energy-efficient and durable adhesive technologies. |

| H.B. Fuller Company | Provides structural adhesives for packaging, automotive and engineering applications. Specializes in cutting-edge, sustainable product innovation. |

| Arkema S.A. | Provide technical and adhesive solutions for many industries. Invest in compatibility of bio-based and lightweight materials. |

Key Company Insights

Henkel AG & Co. KGaA

Henkel AG & Co. KGaA is a global leader and high-performance structural adhesive provider across major markets, including automotive, electronics, and industrial manufacturing. The company specializes in sustainable production and also low-VOC adhesives and energy-efficient methods.

Henkel, for example, has invested extensively in R&D to produce high performance adhesive solutions that improve durability and bonding strength. Hybrid adhesive technologies for bonding multiple substrates are you name some recent inventions. Henkel's focus on tech and sustainability has given it an edge, as it is a global brand and is constantly expanding into new markets.

3M Company

3M Company is an important manufacturer in structural adhesives market with high-performance bonding solutions for aerospace, construction, and electronics The company leads with innovation, spending great deals on research to create cutting-edge adhesives designed for demanding industry requirements. In another example, 3M is also doubling down on sustainability, with solvent-free and eco-friendly adhesive formulations.

With a vast network for global distribution and quality commitment, it captures the market significantly. The company continues to expand its product offerings, leveraging advanced material science to provide durable and efficient bonding solutions for complex industrial applications.

Sika AG

The global structural adhesive market is characterized by the presence of major players such as Sika AG, which focuses on bonding solutions for multiple sectors including construction, transportation, and industrial. The firm specializes in energy-efficient high-performance adhesion technologies that enhance the durability and structural integrity of the same.

Sika actively invests to broaden its product portfolio, and its hybrid adhesives deliver performance on a wide range of substrates. The company is focused on delivering exceptional value and solutions to its customers worldwide, ensuring they can streamline their operations and improve their processes with world-class structural bonding applications. Sika's sustainability initiatives also shape its product development strategies.

H.B. Fuller Company

H.B. Fuller Company is a top-tier supplier of structural adhesives, especially for packaging, automotive, and engineering applications. It specializes in creating advanced, high-strength adhesives that offer excellent performance in extreme conditions.

H.B. Fuller also invests in sustainable product development such as bio-based adhesives and other formulations to reduce the environmental impact. Strategic acquisitions have solidified its market presence, enabling it to internationalize its customer base. The continuous improvements in adhesive formulations made possible due to the company’s focus on R&D enable industrial applications that are more efficient and reliable.

Arkema S.A.

Arkema S.A. is one of the major manufacturers of structural adhesives as well as specialty chemicals and materials science. The other focus is on bio-based adhesives and hybrid bonding technologies as the trend in the industry continues moving toward bio-based products. Arkema being compatible with lightweight materials makes it the material of choice for aerospace and automotive applications.

The company is broadening its international reach within the adhesives industry by focusing on sustainability and adherence to regulations. However, key developments in technology and partnerships allow Arkema to have a strong foothold in the structural adhesive industry.

The global Structural Adhesive market is projected to reach USD 13,473.7 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.85% over the forecast period.

By 2035, the Structural Adhesive market is expected to reach USD 21,532.7 million.

The Epoxy-based Structural Adhesive segment is expected to dominate the market, due to their superior bonding strength, durability, chemical resistance, and versatility across industries like automotive, aerospace, and construction, ensuring long-term structural integrity in demanding applications.

Key players in the Structural Adhesive market include Henkel AG & Co. KGaA, 3M Company, Sika AG, H.B. Fuller Company, Arkema S.A.

In terms of Product Type, the industry is divided into Epoxy-based Structural Adhesive, Acrylic-based Structural Adhesive, Polyurethane-based Structural Adhesive, Cyanoacrylates, Others

In terms of Application, the industry is divided into Transportation Sector, Building & Construction Sector, Energy Sector, Others

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.