The increasing demand for pharmaceutical, food, and consumer goods packaging that ensures product protection and extended shelf life is driving the strip pack laminates market. Companies are focusing on product innovation, sustainability, and advanced manufacturing techniques to enhance efficiency and reduce waste.

Regulatory compliance, consumer safety concerns, and the shift toward lightweight, high-barrier materials are also driving market expansion.

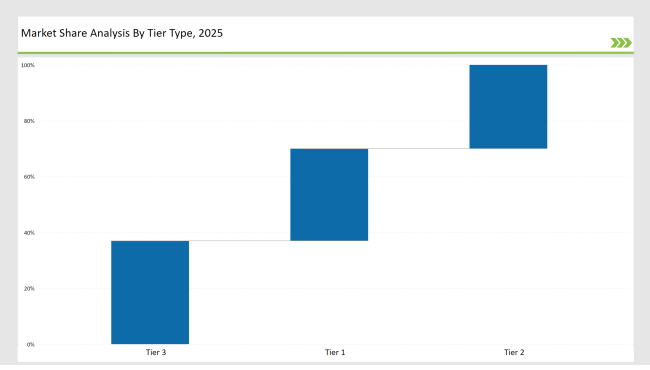

Tier 1: Leaders of the Market Amcor, Huhtamaki, and UFlex possess 33% of market share. Such organizations rely on excellent production methodologies, global supply networks, and on-going R&D to continue being in competition with others.

Tier 2: Companies that possess 30% of market include Constantia Flexibles, Glenroy, and Winpak. These cater to mid-size industries by delivering solutions that ensure good performance while still being adaptable for meeting specific industrial needs.

Tier 3: consists of the remaining 37%, mainly regional and niche manufacturers concentrating on pharmaceutical and industrial applications. These players focus on tailored packaging designs, cost-effective production, and localized distribution networks.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Huhtamaki, UFlex) | 15% |

| Rest of Top 5 (Constantia Flexibles, Glenroy) | 10% |

| Next 5 of Top 10 (Winpak, Sonoco, Clondalkin Group, ProAmpac, Wipak) | 8% |

These offer lightweight, flexible, and highly barrier packaging which extends the life and safety of products for distribution across industries, making the laminate-based strip packs appealing. Its demand for ecologically friendly alternatives from manufacturers due to the trend for sustainability creates biodegradable solutions.

Advancements in track-and-monitor applications due to greater acceptance of intelligent packaging technology continue to be introduced within the entire supply chain system.

Manufacturers are achieving improvements in efficiency, sustainability, and barrier properties through the inclusion of high-performance materials and automation of production. Eco-friendly coatings that enhance recyclability without protection loss are being used.

Stripping pack laminates are improving strength and flexibility due to innovations in multilayer lamination technology, bettering their appropriateness to diverse applications.

Manufacturers in the current times are investing in automation, material innovation, and AI-driven quality control to meet industry standards. Key players focus on sustainability, waste, and functionality on improving packaging performance.

Hence, they are focusing on blockchain technology to help overcome traceability issues. The development in nanotechnology has further enabled the use of ultra-thin high-strength laminates with excellent barrier properties.

Technology providers should enhance automation, sustainability, and customization in strip pack laminate solutions. Partnering with manufacturers and material suppliers will drive cost efficiency and innovation.

Manufacturers are expanding production capacity, integrating sustainable materials, and enhancing safety features to meet industry demands. They are also incorporating smart manufacturing techniques to optimize production efficiency and reduce waste. In addition, investments in innovative material science are enabling the development of ultra-thin, high-barrier laminates with improved durability

|

Manufacturer |

Latest Developments |

|---|---|

|

Amcor |

March 2024: Launched a 100% recyclable strip pack laminate solution. |

|

Huhtamaki |

August 2023: Developed ultra-lightweight, high-barrier laminates. |

|

UFlex |

May 2024: Introduced aluminum-based strip packs for pharmaceutical use. |

|

Constantia Flexibles |

November 2023: Expanded medical packaging offerings with new materials. |

|

Glenroy |

February 2024: Enhanced paper-based strip packs for eco-conscious brands. |

|

Winpak |

April 2024: Developed moisture-resistant laminates for specialty products. |

|

Sonoco |

June 2024: Launched innovative flexible packaging solutions. |

The strip pack laminates market remains competitive with companies focusing on automation, sustainability, and improved compliance measures to sustain their position. Manufacturers are also investing in digital tracking solutions to enhance the transparency of the supply chain and improve operational efficiency.

Advances in high-barrier materials are also enhancing the protection of sensitive pharmaceutical and food products. Companies are also integrating AI-driven defect detection systems to ensure consistent quality in laminated packaging.

Growth will be driven by manufacturers who will use smart packaging technologies, invest in sustainable materials, and optimize their production efficiency. Growing demand from pharmaceutical, food, and e-commerce industries will continue to spur growth in the market.

Companies are increasingly incorporating AI-driven analytics into packaging processes to minimize waste and optimize these processes. Furthermore, innovations in active and intelligent packaging solutions will ensure improved product freshness and security. The rise of digital printing technologies is also enabling cost-effective and high-quality customization for strip pack laminates.

Leading players include Amcor, Huhtamaki, UFlex, Constantia Flexibles, and Glenroy.

The top 3 collectively control 15% of the global market.

Medium concentration, with top players holding 33%.

Sustainability, automation, material advancements, and regulatory compliance.

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Ventilated FIBC Market Growth - Demand & Forecast 2025 to 2035

Telescopic Tool Boxes Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.