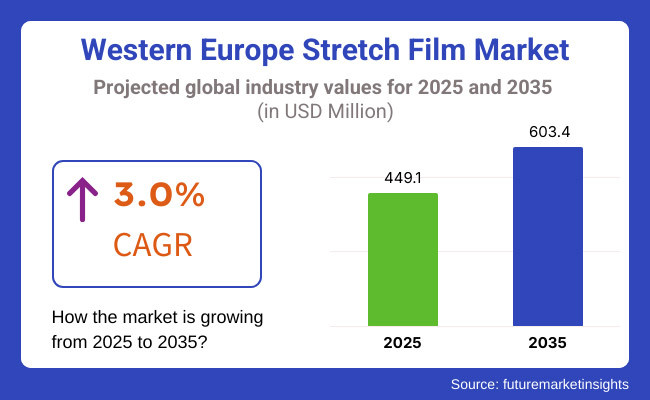

The Western Europe stretch film market is anticipated to be valued at USD 449.1 million in 2025. It is expected to grow at a CAGR of 3.0% during the forecast period and reach a value of USD 603.4 million in 2035.

Western Europe’s stretch films are highly stretchable plastics used in warehousing, logistics, food packaging, and industrial applications to secure palletized goods, prevent damage, and ensure load stability. There is a growing preference for sustainable and recyclable packaging, which is leading the retail, e-commerce, and manufacturing industries to more and more adopt advanced films to gain increased efficiency and do justice to wastage.

The manufacture and supply of stretch films for packaging and logistics comprises the Western Europe stretch film market. Growth in the market is driven by flourishing e-commerce businesses, enhanced automation in warehousing, and the need for sustainable packaging solutions. The most important influencing factor in the industry has been the shift toward biodegradable and recyclable films.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady demand in logistics, food packaging, and industrial applications, with emphasis on load stability, product protection, and transportation efficiency. | Environmental issues and sustainability will lead to a move towards biodegradable, recyclable, and compostable stretch films to minimize plastic waste. |

| Petroleum-based stretch films were the norm because they were cheap, flexible, and strong at holding pallet loads together. | Companies will increasingly embrace bio-based polymers, recyclable high-performance films, and light materials with retained strength while minimizing environmental footprints. |

| The European Union (EU) established early plastic waste reduction measures, but enforcement was slow, with single-use films remaining widespread. | Increased EU regulations on plastic packaging waste, carbon neutrality, and extended producer responsibility (EPR) will drive the uptake of sustainable stretch films. |

| Stretch film recycling was slowed by contamination, material complexity, and poor waste collection infrastructure. | Sophisticated recycling technologies and closed-loop systems will maximize reuse, enhancing recyclability and supporting circular economy models. |

| Cost efficiency and reliability in the supply chain remain important factors that inhibited the adoption of eco-friendly films. | Green packaging cost savings will be realized in the long run, leading companies to transition to green alternatives to meet legislation and prevent fines. |

| Stretch films of food grade became popular in maintaining product freshness, avoiding contamination, and maintaining shelf life. | Biodegradable and antimicrobial stretch films supported by sophisticated barrier technologies will predominate food packaging, enhancing safety and sustainability. |

| E-commerce boom stimulated demand for pallet stretch films for bulk purchasing and last-mile delivery. | Retail and e-commerce leaders will increasingly use biodegradable wraps, reusable pallet wraps, and smart-tracking technologies to streamline supply chains. |

| Automated packaging helped to increase efficiency, reduce waste material, and improve operational speeds. | AI-driven stretch films with RFID and IoT sensors will transform packaging, allowing real-time tracking, supply chain visibility, and automatic waste elimination. |

Ultra-Thin and High-Stretch Films Reducing Material Waste

Western Europe's stretch film industry is moving towards ultra-thin, high-stretch films that maximize packaging efficiency without harming the environment. Industry players are creating multi-layered films that are more elastic and puncture-resistant, enabling companies to reduce material usage without affecting load stability. This helps brands meet stringent EU packaging regulations while improving logistics and warehousing effectiveness.

Customizable and Smart Films Enhancing Brand Identity

Personalization and intelligent technology are revolutionizing the market. Companies are incorporating custom printing capabilities, such as logos, QR codes, as well as promotional designs, making stretch films marketing tools.

RFID-enabled films and tamper-evident seals enhance tracking and authentication, improving supply chain transparency. UV-resistant and color-changing films also provide added protection while improving product appeal.

| Metric | Value |

|---|---|

| Top Manufacturing Process | Cast Stretch Film |

| Market Share in 2025 | 64.5% |

The cast stretch film segment in Western Europe is expected to hold a 64.5% market share in 2025, reinforcing its dominance in the industry. The cast process creates thin films of high transparency with satisfactory tensile strength and is therefore suited for pallet wrapping and industrial packaging.

It comprises forcing molten resin through a flat die and fast cooling on a chill roll, which yields a consistent thickness, satisfactory stretchability, and puncture resistance.

Cast stretching films are also preferred due to their cost-effectiveness and greater cling strength. Their application across industries and logistics also drives market expansion. Additionally, increasing environmental issues have prompted the creation of environmentally friendly cast films, driving the shift toward sustainable packaging solutions.

| Metric | Value |

|---|---|

| Top End-use | Food and Beverages |

| Market Share in 2025 | 27.2% |

As per FMI analysis, the food and beverages segment is projected to account for a 27.2% market share in 2025, led by the growing demand for safe, clean packaging solutions.

Stretch films safeguard perishable products, keep them free from contamination, and ensure product freshness during storage and transportation. Growth in ready-to-eat meals, fresh fruits and vegetables, and beverage packaging also drives demand for sophisticated stretch films.

Industry players are moving towards new-generation stretch films with better barrier functionality, antimicrobial treatment, and biodegradability to address the changing requirements of the industry. Such developments improve food safety and meet sustainability requirements as well as European Union policies on packaging waste and recyclability.

The Western Europe stretch film market is dominated by polyethylene (PE)-based materials, particularly low-density polyethylene (LDPE) and high-density polyethylene (HDPE), due to their flexibility, durability, and superior stretchability. These products are used extensively in numerous industries because they can wrap and cover products tightly while transporting and storing them.

Greater environmental regulations in Western Europe create opportunities for recyclable and biodegradable stretch film demand. Bio-based PE and high-performance recycle films are seeing increased popularity from innovations in the field of environment-friendly polyethylene formulations.

While PP and PVC are also in use, PE is the most popular material taken up due to its affordability, versatility, and ability to pass the tough standards of the environmental regulations of the region.

The Western Europe stretch film industry is fragmented. Leading companies such as Berry Global, Mondi Group, and Manuli Stretch dominate production, focusing on advanced packaging solutions. These firms invest in research and development to enhance product performance, ensuring superior stretchability and durability while maintaining cost efficiency for various industrial applications across the region.

Sustainability drives innovation, with manufacturers prioritizing recyclable and biodegradable materials. Companies adopt energy-efficient production methods and circular economy strategies to reduce environmental impact.

Regulatory compliance plays an important role, pushing firms to develop eco-friendly alternatives. These efforts align with stringent European Union regulations, fostering a shift toward greener packaging solutions in multiple industries.

The logistics and retail sectors significantly influence stretch film demand, with growing e-commerce fueling the need for secure, high-performance packaging. Stretch films ensure product protection during transit, reducing damage and improving handling efficiency. Companies continuously develop lightweight yet strong films to optimize shipping costs and enhance operational sustainability across supply chains.

Technological advancements improve stretch film functionality, with producers integrating nanotechnology and multi-layered film structures for enhanced performance. Features such as superior puncture resistance, increased elasticity, and tamper-proof properties cater to diverse industrial needs. These innovations support sectors such as food packaging, pharmaceuticals, and automotive, ensuring reliable and effective load stability solutions.

Despite market fragmentation, dominant players maintain their competitive edge through strategic acquisitions, product diversification, and sustainability initiatives. As industry regulations evolve, companies focus on expanding their portfolios with bio-based and recycled materials. The ongoing emphasis on innovation, efficiency, and sustainability underscores the dynamic nature of the Western Europe stretch film industry.

The Western European stretch film market is experiencing steady growth, driven by increasing demand for efficient packaging solutions across various industries. This trend is fueled by the need for secure and cost-effective methods to protect goods during transportation and storage.

Technological advancements have led to the development of high-performance stretch films with enhanced durability and elasticity. These innovations cater to diverse industrial applications, meeting the evolving requirements of sectors such as food and beverage, pharmaceuticals, and consumer products.

Environmental sustainability is a growing concern, prompting manufacturers to adopt eco-friendly materials and production processes. This shift aligns with global trends toward reducing plastic waste and promoting recyclable packaging solutions, reflecting the industry's commitment to environmental responsibility.

The competitive landscape features both domestic and international players striving to expand their market share. Companies are focusing on product innovation, strategic partnerships, and improved distribution networks to meet the increasing demand and maintain a competitive edge in the market.

The Western Europe stretch film market is expected to reach USD 449.1 million in 2025 and grow to USD 603.4 million by 2035 at a CAGR of 3.0%.

Western Europe stretch film product sales are driven by increasing demand for sustainable packaging, e-commerce expansion, and advancements in high-performance stretch films.

Key manufacturers of Western Europe stretch film include Italdibipack Group, Coveris, Inc., Smurfit Kappa Group, Vishakha Polyfab, Four Star Plastics, Griff Paper and Film, CS Hyde Company, International Plastics Inc., Bagla Group of Companies, Polymer Group, Inc., Berry Global Group, Inc., AEP Industries, Inc., Sigma Stretch Film Corp.

The food and beverage segment is expected to lead the industry, holding a projected market share of 27.2% in 2025.

The market is segmented by material into polyethylene (PE), polyvinyl chloride (PVC), polypropylene (PP), and others.

Based on the manufacturing process, the market is bifurcated into cast stretch film and blown stretch film.

The market are categories based on end-use, including constructions, food and beverages, pharmaceutical, consumer product, paper, textile, and chemicals & fertilizers.

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Medical Transport Box Market Trend Analysis Based on Material, Capacity, End-User and Regions 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.