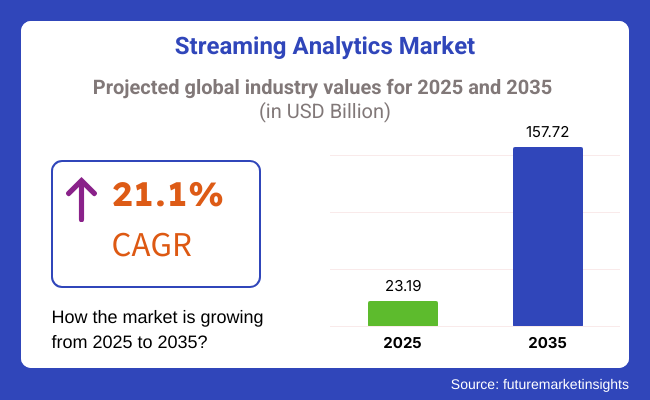

The streaming analytics market is expected to record strong growth in the 2025 to 2035 period with increased usage of real-time data processing, AI-driven insights, and IoT-based analytics. The growth is expected from USD 23.19 billion in 2025 to USD 157.72 billion in 2035 at a compound annual growth rate (CAGR) of 21.1% during the forecast period.

As the demands for real-time decision-making, AI-powered automation, and big data grow, organizations are increasingly implementing solutions for customer behavior analysis, fraud detection, predictive maintenance, and real-time monitoring.

Mergers of cloud-based analytics platforms, edge computing, and 5G networks are also further increasing uptake across industries. Further, developments in machine learning algorithms and event-driven architectures are fostering innovation in stream processing engines.

In addition, the intersection of AI, machine learning, and event-driven architectures is revolutionizing the way companies analyze and respond to real-time streams of data. Companies are using predictive analytics, automated anomaly detection, and real-time operational intelligence to streamline processes, improve customer interaction, and enhance risk management.

Explore FMI!

Book a free demo

Due to the ever-growing demand for using AI for predictive analytics, integration, and edge computing, the streaming analytics is witnessing a vigorous increase. Scalability, real-time data processing, and AI/ML integration are the top priorities for enterprises and cloud service providers to improve business intelligence and predictive analytics.

Data security and compliance are the main focuses of government and defense agencies in monitoring and cybersecurity applications. Real-time data processing is the most crucial part of the healthcare department, where the patient needs to be monitored, and predictive analytics should be done as quickly as possible in the decision-making process.

Retail and e-commerce companies use AI, cost-effectiveness, and scalability as the top three tools to enhance customer experience, combat fraud, and manage the supply chain. The growth of IoT, 5G, and cloud solutions has further shifted the demand for streaming analytics, which is expected to be more powerful, secure, and scalable to result in better generated operational efficiencies and data-driven decisions.

| Company | Contract Value (USD Million) |

|---|---|

| Confluent | Approximately USD 70 - 80 |

| Microsoft | Approximately USD 60 - 70 |

| IBM | Approximately USD 50 - 60 |

| Oracle | Approximately USD 80 - 90 |

| TIBCO Software | Approximately USD 55 - 65 |

In 2024 and early 2025, the industry witnessed robust growth driven by the escalating need for real-time data processing and actionable insights. Leading companies such as Confluent, Microsoft, IBM, Oracle, and TIBCO Software have secured pivotal contracts and strategic partnerships across various industries.

These developments underscore the market's commitment to leveraging streaming analytics solutions for enhanced operational efficiency, optimized decision-making, and accelerated digital transformation in an increasingly data-driven landscape.

Between 2020 and 2024, the streaming analytics market grew rapidly as real-time data processing became essential for industries like finance, healthcare, retail, and manufacturing. Businesses leveraged technology to detect fraud, monitor patient vitals, predict supply chain disruptions, and enhance customer experiences.

The surge in IoT and edge computing fueled demand for low-latency data processing, improving predictive maintenance, and industrial automation. Cloud-based solutions like AWS Kinesis, Google Cloud Dataflow, and Apache Kafka gained traction, offering scalability and seamless integration.

Despite advancements, challenges such as data security, processing complexity, and integration hurdles remained, prompting companies to invest in AI-driven automation and improved data governance. Between 2025 and 2035, there will be transformation by AI-driven autonomous insights, quantum-enhanced processing, and decentralized real-time intelligence.

AI-powered platforms will self-learn from data patterns, enabling proactive decision-making in finance, healthcare, and cybersecurity. Quantum computing will accelerate data analysis, supporting ultra-fast fraud detection and high-frequency trading.

6G-powered edge analytics will enable near-zero latency for autonomous systems, while blockchain-secured analytics will enhance data privacy and regulatory compliance. Sustainability will also be a key focus, with energy-efficient processing techniques and carbon-neutral algorithms minimizing environmental impact.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter regulations (GDPR, CCPA, HIPAA) required organizations to adopt secure, compliant platforms with encrypted data processing and real-time monitoring. | AI-driven, blockchain-backed streaming analytics ensures real-time compliance, decentralized data governance, and automated audit trails for secure, privacy-first analytics ecosystems. |

| AI-powered analytics optimized real-time data processing, enabling faster anomaly detection, predictive modeling, and decision automation. | AI-native, self-learning analytics platforms autonomously refine models, predict market trends, and self-optimize data pipelines for real-time business intelligence and hyper-personalized insights. |

| Businesses migrated to cloud-native solutions for scalability, cost-efficiency, and integration with hybrid cloud environments. | AI-powered, edge-native analytics ecosystems autonomously process real-time IoT, sensor, and transaction data at the source, reducing latency and optimizing distributed computing efficiency. |

| Manufacturers and energy companies leveraged real-time analytics for predictive maintenance, optimizing operations and reducing downtime. | AI-integrated, self-healing analytics systems autonomously detect failures, optimize asset performance, and enable AI-powered industrial automation for next-generation smart factories. |

| Enterprises adopted event-driven streaming analytics for fraud detection, dynamic pricing, and instant customer engagement. | AI-enhanced, real-time decision engines autonomously process event data, enabling ultra-fast risk assessment, adaptive pricing models, and real-time hyper-personalization for user experiences. |

| 5G adoption accelerated real-time analytics applications, improving data ingestion and low-latency decision-making. | AI-powered, 6G-enabled streaming analytics provides real-time, sub-millisecond data processing, enabling autonomous AI ecosystems, predictive urban planning, and immersive metaverse analytics. |

| AI-powered analytics solutions monitor network traffic in real-time, identifying potential cyber threats and preventing security breaches. | AI-native, quantum-secure threat detection platforms autonomously predict and neutralize cyber threats, ensuring real-time network security and self-healing enterprise defenses. |

| Companies optimized streaming analytics frameworks to reduce energy consumption and improve environmental sustainability. | AI-driven, carbon-conscious streaming analytics dynamically adjust compute resources, minimizing energy usage while maintaining ultra-fast, real-time insights for sustainable operations. |

| Businesses deployed AI-powered analytics to automate real-time decision-making, reducing human intervention in high-frequency trading, logistics, and operations. | AI-enhanced, fully autonomous cognitive analytics systems provide real-time self-learning models, adaptive intelligence, and autonomous AI decision-making at scale. |

| Organizations explored blockchain-integrated analytics for transparent, tamper-proof, and secure data processing. | AI-integrated, decentralized streaming analytics enable trustless real-time transaction validation, predictive blockchain intelligence, and self-regulating, decentralized financial ecosystems. |

The industry is not only faced with the problem of market competition but also with data privacy, infrastructure scalability, real-time processing reliability, and regulatory compliance.

One major problem is managing the surplus of real-time data from sources such as IoT devices, financial transactions, and social media. The companies should provide the low-latency process and to do it they must avoid the data bottlenecks and the falling of the system.

Besides, there are major data security and privacy risks owing to the involvement of continuous data flow from several sources. For example, unauthorized access, data breaches, and compliance violations like GDPR, CCPA, and HIPAA can kick back financial penalties and reputational damage. A must-function to minimize risks is the implementation of encryption from end-to-end, identity access management (IAM), and AI-based anomaly detection.

A significant concern is the scalability of the infrastructure, especially for companies moving from conventional batch processing to real-time analytics. The scalability of cloud-based solutions is, at the same time, a strength and weakness, as it creates the need to depend on cloud providers and poses vendor lock-in risks.

The regulatory risks are still adapting, especially in the industries dealing with sensitive data, such as healthcare, finance, and telecommunications. Companies are to comply with the data governing frameworks, which ensure legal compliance.

Through addressing those challenges, companies secure not only reliable real-time analytics but also boost security and stay ahead in the streamlining analytics sector that is constantly changing.

| Countries/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 12.8% |

| UK | 12.4% |

| European Union | 12.6% |

| Japan | 12.3% |

| South Korea | 13.0% |

With the high penetration of real-time business intelligence solutions, AI-enabled streaming analytics, and cloud-native streaming platforms, the USA is witnessing a high growth rate in AI and streaming analytics software and services.

Streaming analytics has enabled organizations to monitor live data flows and detect anomalies in real-time, as well as to make real-time decisions. Among other efforts, the NIST and large cloud service providers are invested in real-time AI-enhanced data processing, automated decision-making solutions, and scalable analytics infrastructure.

Streaming analytics are used by financial services for fraud detection and by retail for real-time analysis of customers to improve engagement. The healthcare sector also employs predictive analytics to enhance patient monitoring.

Innovations in elliptical reporting in real-time, edge-based configuration machine learning, and high-speed data visualization have become the means to grow businesses by contributing enterprise operations implemented with cloud AI over Ephemeral cloud environments on behalf of leading technology companies like Microsoft, United Technologies, and IBM, with AppAtlas and Google Cloud. FMI anticipates that the USA is slated to grow at 12.8% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Artificial Intelligence Analytics in Real-time | AI processes enormous amounts of live data for businesses, allowing for predictive decision-making. |

| Fraud Detection and Cybersecurity | Fraud prevention systems powered by AI scrutinize financial transactions in real time. |

The UK is growing steadily as businesses are focusing on AI-driven business intelligence, the utilization of IoT-driven analytics, and real-time risk management techniques. Organizations utilize streaming analytics to streamline operations, identify threats, and enhance customer experiences.

Through its AI Strategy and Data Ethics Framework, the UK government encourages the widespread use of secure real-time analytics, AI-based event monitoring, and automated business intelligence solutions. The banking sector - real-time fraud mitigation, AI-driven supply chain analytics, and industrial IoT data analytics are all driving market growth.

Therefore, enterprise analytics capabilities are being transformed by using AI-assisted data flow analysis, streaming visualization platforms, and automated decision support tools (companies like Amazon Web Services (AWS), SAS, and Oracle are investing in this space). FMI anticipates that the UK is slated to grow at 12.4% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Artificial Intelligence In Business Intelligence | Organizations use artificial intelligence in business intelligence and real-time analytics to improve operational efficiency and customer engagement. |

| Fraud Detection and Transaction Security | Fraud detection and transaction security continue to evolve and are powered by AI analytics. |

The European Union is also flourishing as a result of increased investment in AI governance (51.4%) and cybersecurity analytics (25.2%), as well as comprehensive cloud-based data infrastructure and advanced analytics capabilities. EU Digital Strategy, as well as GDPR policies, encourage ethical and secure real-time data processing.

Germany, France, and the Netherlands are at the forefront of implementing AI-enhanced industrial monitoring, real-time traffic analytics, and automated financial fraud detection. The market penetration of AI-based supply chain analytics, smart factory automation, and predictive maintenance solutions is supported by increasing demand.

Prominent tech companies like SAP, Bosch, and Siemens make significant investments in real-time decision support systems, AI-based operational intelligence, and cloud-connected data streaming offerings to drive business success. FMI anticipates that the European Union is slated to grow at 12.6% CAGR during the study period.

Growth Factors in the EU

| Key Drivers | Details |

|---|---|

| AI-enhanced cybersecurity | Detects security breaches and stops cyber threats using real-time analytics. |

| Compliance for Streams Under GDPR | Data protection by EU laws with secure, real-time data processing. |

Government investments in innovative data analytics through AI, real-time IoT analytics systems, and ultra-fast event processing platforms are contributing to the growth of the streaming analytics market in Japan. Japan's emphasis on smart cities, autonomous systems, and predictive intelligence is reshaping business analytics strategies.

Companies increasingly use real-time customer sentiment analytics, AI-driven financial analytics, and predictive maintenance solutions. Companies like Fujitsu, NEC, and Hitachi spearhead advancements in intelligent machine learning insights, edge-based real-time analytics, and AI-driven data security that improve operational efficiency. FMI anticipates that the Japanese streaming analytics market is slated to grow at 12.3% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Predictive Insights With the Help of AI | Companies utilize machine learning to predict trends and improve decision-making. |

| Smart Infrastructure Based on IoT | Real-time data helps transportation, healthcare, and urban planning work better. |

The South Korea Streaming Analytics Market is experiencing huge growth, driven by AI-based IT infrastructure, increased adoption of 5G, and the need for ultra-responsive data processing. Streaming Analytics adoption by sector Industry 4.0 initiatives of South Korea and smart city projects drive Streaming Analytics adoption across various sectors.

The Ministry of Science and ICT (MSIT) is focusing their investment areas into AI-powered cloud streaming, predictive models, and real-time business intelligence systems for preventing fraud detection. AI-powered analytics are also leveraged for 5G-based IoT data monitoring, automated customer engagement, and high-speed cybersecurity analytics for organizations.

Advanced companies like Samsung SDS, LG CNS, SK Telecom, etc. are leading the development of AI-assisted multi-cloud streaming platforms, real-time performance monitoring systems, and predictive business intelligence solutions to improve enterprise agility. FMI anticipates that the South Korean Streaming Analytics Market is slated to grow at 13.0% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| AI-Powered IT Infrastructure | AI augments real-time data processing in smart cities, telecommunications, and enterprises. |

| 5G-Enabled Data Streaming | Enterprises use ultra-fast connectivity for high-speed data analytics.

AI-driven cybersecurity and fraud detection analytics enhance fraud prevention and cybersecurity resilience in real time. |

The platform segment is expected to account for the largest 24.1% market share, driven by the increasing demand for cloud-native storage platforms, AI-driven automation, and improved data security. This is why enterprises are moving towards platform-based SAN solutions, which enable them to efficiently and securely leverage their data backup and disaster recovery capabilities while integrating multi-cloud for data access and retention.

Numerous top IT companies, including Dell Technologies, NetApp, and IBM, are developing software-defined storage (SDS) solutions that help improve performance, security, and automation. To give you an example, IBM Spectrum Storage also facilitates storage optimization across hybrid environments through AI-powered data orchestration.

Hybrid SAN, the largest segment, accounting for 75.9% of the overall market socio - offers businesses scalability, data redundancy, and cost efficiency by combining aspects of both features of on-premise storage and cloud-based storage. For unstructured big data, fast-paced computing, rapid analytics, and data security compliance, enterprises prefer hybrid SAN architectures.

The numbers for the hybrid SAN market also include tech giants such as AWS, Microsoft Azure, and HPE, which cater to industries such as BFSI, healthcare, and IT & telecom. For instance, AWS Storage Gateway enables organizations to integrate on-premise storage directly with cloud environments, which allows them to achieve the best possible availability and disaster recovery of their data.

With digitalization becoming faster, the hybrid SAN market will flourish even more as a result of edge computing, 5G networks, and AI-based analytics, thus remaining the go-to solution for organizations that need to regulate complex data workflows.

The other major beneficiary is the advertising and marketing sector, with a market share of 38.7% in the SAN market, which has been driven mainly by the growing adoption of data-driven marketing strategies, the use of AI for customer engagement, and real-time analytics.

Media companies, Digital marketing agencies, and e-commerce platforms utilize the SAN-based infrastructure to effectively store and read consumer data, behavior insights, and targeted campaigns. San architecture has become invaluable for leading firms as they embraced programmatic advertising and AI-driven personalization, enabling companies like Google, Meta, and Adobe to utilize SAN solutions for improving the speed of data processing, facilitating efficient advertising, and increasing overall marketing efficiency.

For best in class example, Google Ads’ RTB system processes petabytes of data every day, which means it is critical to have high-performance storage networks for seamless delivery of ads & compatibility with customer engagement.

The financial analytics segment holds the largest market share of 61.3%, with the most significant use cases reported to be risk management, fraud detection, and real-time financial transactions that require a need for secure and high-performance storage of data.

Conclusion: SAN architecture is commonly used by BFSI institutions, investment banks, and fintech firms to process complex financial models, maintain regulatory processing requirements, and improve AI-based trading strategies.

Top investment banks like JP Morgan, Goldman Sachs, and Visa use enterprise SAN systems for predictive modeling of securities, customer credit risk, and fraud prevention. San storage at high speed, for example, Visa needs this to support its AI-based fraud detection system to analyze transaction patterns in real-time and execute secure and efficient money operations.

The growth of the streaming analytics market is spurred by organizations across sectors adopting real-time data processing capabilities to favor their operational efficiency, decision-making, and automation. Rising demand for instantaneous insights, adoption of AI-based analytics, and the increasing prominence of event-driven architectures are seen as elements in the ever-growing evolution of the market.

Cloud-native streaming platforms, AI analytics, and edge computing are the domains under which major players like Microsoft, Google Cloud, IBM, AWS, and SAS Institute dominate. On the other side, the newcomer and niche providers work to build competition through low-latency data processing, open-source frameworks, and industry-specific streaming solutions.

Real-time business intelligence, AI joining forces with streaming data, hybrid cloud analytics, and many more are defining factors for trends driving yet another level of market evolution. These emerging trends are 5G-edge analytics, real-time fraud detection, and IoT demand data streams.

Competition is considered strategic on the basis of scalability, integration of ease, and AI-accentuated automation. The companies that provide the fastest, most secure, and cost-effective platforms would become more competitive.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Microsoft Azure Stream Analytics | 20-25% |

| Google Cloud Dataflow | 15-20% |

| IBM Streams | 12-16% |

| AWS Kinesis | 10-14% |

| SAS Streaming Analytics | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft Azure Stream Analytics | Provides cloud-based real-time data processing, AI-powered analytics, and IoT integration. |

| Google Cloud Dataflow | Specializes in fully managed real-time stream processing, scalable data pipelines, and AI-driven insights. |

| IBM Streams | Focuses on real-time analytics for large-scale enterprise data processing, AI, and IoT. |

| AWS Kinesis | Innovates in scalable, real-time data streaming solutions for video, logs, and AI applications. |

| SAS Streaming Analytics | Develops AI-powered, real-time data analytics solutions for industries like finance, healthcare, and retail. |

Key Company Insights

Microsoft Azure Stream Analytics (20-25%)

Microsoft leads the market with an AI-enabled cloud solution that empowers enterprises with predictive analytics in addition to real-time data processing and IoT-driven insights.

Google Cloud Dataflow (15-20%)

Google is reinventing real-time data analytics using Cloud Dataflow to offer fully managed and scalable data pipelines, turning data into AI-powered insights-transgressed automation.

IBM Streams (12-16%)

IBM is the best in maximizing streaming and real-time big data analytics, delivering AI-driven insights in real time for industry cases such as banking, supply chain, and smart cities.

AWS Kinesis (10-14%)

AWS is another big name in real-time video streaming analytics, offering very scalable solutions that power applications with data processing tasks such as live video processing and AI-driven decision-making.

SAS Streaming Analytics (6-10%)

AI-powered streaming analytics, targeting industry-specific solutions with precision for acting upon real-time insights, has been the hallmark of SAS Streaming Analytics.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 23.19 billion in 2025.

The industry is predicted to reach a size of USD 157.72 billion by 2035.

Key companies include Microsoft Azure Stream Analytics, Google Cloud Dataflow, IBM Streams, AWS Kinesis, SAS Streaming Analytics, Oracle Stream Analytics, TIBCO Software, Splunk, Apache Kafka (Confluent), and SAP Streaming Analytics.

South Korea, driven by the increasing adoption of real-time data processing in IT, finance, and telecom, is expected to record the highest CAGR of 13.0% during the forecast period.

Software solutions, such as Microsoft Azure Stream Analytics, Google Cloud Dataflow, and Apache Kafka (Confluent), are widely used due to their scalability, real-time processing capabilities, and integration with cloud platforms.

The market includes platforms (cloud-based, on-premises, hybrid) and services (managed services, professional services, including consulting services, integration & implementation, and support & maintenance).

The market covers advertising & marketing, financial analytics, supply chain management, demographic location intelligence, fraud intelligence, customer experience monitoring, and others.

The market comprises large enterprises and small & medium enterprises (SMEs).

The market spans IT & Telecom, Media & Entertainment, Retail & E-commerce, Manufacturing, Banking, Financial Services & Insurance (BFSI), Healthcare, Government, Education, and Others.

The market covers North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

Mid-infrared Lasers Market Analysis - Growth & Trends 2025 to 2035

POS Receipt Printers Market Trends - Growth & Forecast 2025 to 2035

Multi-Axis Sensors Market Insights - Trends & Forecast 2025 to 2035

Personal CRM Market Report - Growth & Forecast 2025 to 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

Photonic Integrated Circuit & Quantum Computing Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.