The strapping tapes market is growing, with manufacturers looking towards durable high-strength economical packing solutions for the bundling, reinforcing, and securing of shipments. Construction, logistics, and industrial packaging demand greater high-tensile-strength materials, green reinforcement fibers, and solvent-free adhesive, thus influencing manufacturers. For improved reliability and performance, manufacturers are using products like cross-weave patterns, UV-resistant finishes, and custom-branded logos.

To attain consistent quality and lessen the environmental footprint, manufacturers are implementing AI-based quality control, automated production lines, and new adhesive technologies. The industry is moving toward lightweight, high-performance tapes that leave a smaller environmental footprint while maximizing bond strength.

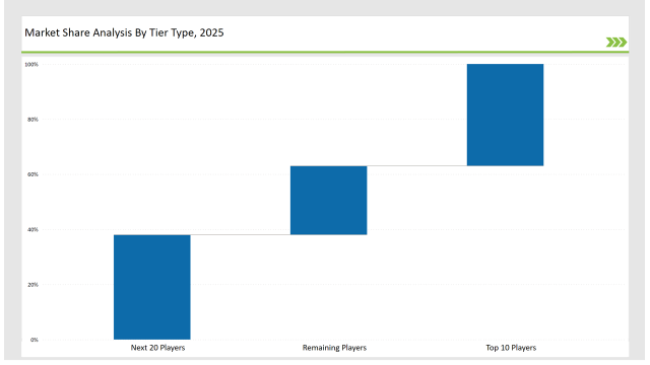

Tier 1 companies like 3M, Tesa SE, and Intertape Polymer Group, who claim market share dominance for their high superiority in industrial-strength tapes, advanced adhesive solutions, and reach with global channels, have put together a great share of 37%.

Tier 2 companies like Avery Dennison, Scapa Group, and Berry Global create 38% of the market share for strapping tapes through affordable yet flexible and high-durability products for numerous applications.

Tier 3 involves regional and specialty players with expertise in tamper-evidence, biodegradable, and reinforced strapping tapes accounting for 25% market share. It consists of local manufacturers, specialized applications, and other green packaging solutions.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (3M, Tesa SE, Intertape Polymer Group) | 19% |

| Rest of Top 5 (Avery Dennison, Scapa Group) | 10% |

| Next 5 of Top 10 (Berry Global, Saint-Gobain, Nitto Denko, Shurtape Technologies, Sekisui Chemical) | 8% |

Market Concentration (2025E)

The strapping tapes market addresses various industries where strength, adhesion, and dependability are imperative. Businesses are designing high-performance tapes to meet industrial and consumer requirements. They are integrating reinforced fiber structure to increase load-carrying capacity. In addition, manufacturers are maximizing adhesive formulations to increase bonding on rough and uneven surfaces.

By using eco-friendly adhesives, manufacturers are optimizing strapping tapes with reinforced fiber structures and high-performance coatings. Their tear resistance is being further enhanced by cross-weave fiber technology. In parallel, these companies improve flexibility to suit various industrial applications while maintaining tensile strength. Further, heat-resistant coatings are being adopted by businesses to ensure performance under extreme environmental conditions.

Sustainability and innovation are transforming the strapping tapes industry. Companies are adopting AI-powered defect detection, automation in slitting and coating processes, and lightweight reinforcement materials to improve performance. Businesses are developing fiber-based reinforcements to replace synthetic components. Manufacturers are introducing tamper-evident, high-visibility tapes to enhance security. Moreover, companies are incorporating RFID technology into strapping tapes to enhance tracking and authentication in packaging use. They are also using anti-static coatings to hinder the accumulation of dust and enhance product longevity. In addition, companies are creating biodegradable tape products to respond to growing environmental controls and sustainability objectives.

Technology suppliers should focus on automation, eco-friendly adhesives, and digital tracking solutions to support the evolving strapping tapes market. Partnering with logistics, manufacturing, and e-commerce companies will drive innovation and adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | 3M, Tesa SE, Intertape Polymer Group |

| Tier 2 | Avery Dennison, Scapa Group, Berry Global |

| Tier 3 | Saint-Gobain, Nitto Denko, Shurtape Technologies, Sekisui Chemical |

Leading manufacturers are advancing strapping tape technology with AI-powered quality control, sustainable adhesives, and high-performance reinforcements. They are enhancing adhesive bonding strength to improve durability under extreme conditions. Additionally, companies are integrating self-repairing adhesive layers to extend product lifespan. Manufacturers are also developing ultra-light strapping tapes with reinforced fiber technology to maintain strength while reducing material usage.

| Manufacturer | Latest Developments |

|---|---|

| 3M | Launched solvent-free, high-tensile strapping tapes in March 2024. |

| Tesa SE | Developed UV-resistant and waterproof strapping tapes in April 2024. |

| Intertape Polymer | Expanded eco-friendly strapping tape portfolio in May 2024. |

| Avery Dennison | Released tamper-proof strapping tapes with branding in June 2024. |

| Scapa Group | Strengthened high-strength, cross-weave strapping tapes in July 2024. |

| Berry Global | Introduced lightweight, heavy-duty strapping tapes for logistics in August 2024. |

| Saint-Gobain | Pioneered flame-retardant strapping tapes in September 2024. |

The strapping tapes market is evolving as companies invest in sustainable adhesives, AI-driven defect detection, and advanced reinforcement technologies. They are enhancing impact resistance to improve performance in high-stress applications. Additionally, manufacturers are working with heat-activated adhesives to improve bond strength in extreme temperatures. Fiber-reinforced backings for extra durability and tear-resistance are being integrated. Water-based adhesive formulations are also being adopted to mitigate the impact on the environment. The companies are also working with very thin strapping tapes of high tensile strength to keep the strength but minimize the usage of material.

Manufacturers will continue to adopt AI-based quality control, biodegradable adhesives, and advanced fiber reinforcements. Firms will streamline lightweight, high-strength design to minimize material loss. Enterprises will increase tamper-proof and digital authentication features for secure usage. Digital printing and automated manufacturing lines will reinforce branding and productivity. Intelligent tracking with RFID-embedded tapes will advance logistics security. AI-based predictive analytics along with their intelligent machines will bring about automation in manufacturing, reduce costs and give better accuracy. On the other hand, the industries will also involve investment in advanced thermal bonding technology for better adhesive strength and durability. Besides this, some manufacturers are engaged in the production of hybrid strapping tapes that combine several reinforcement technologies to enhance strength and flexibility.

Leading players include 3M, Tesa SE, Intertape Polymer Group, Avery Dennison, Scapa Group, Berry Global, and Saint-Gobain.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 37%.

Key drivers include sustainability, high-tensile strength, automation, and digital branding.

Explore Packaging Consumables and Supplies Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.