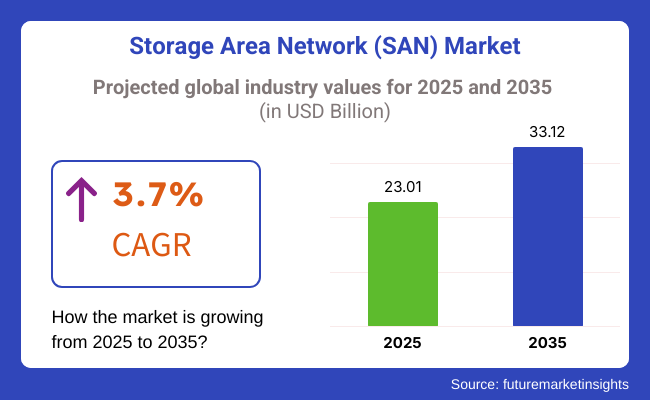

The storage area network (SAN) market is expected to grow steadily from 2025 to 2035, driven by increasing demand for high-speed data storage, enterprise cloud infrastructure, and AI-powered storage management solutions. It is projected to reach USD 23.01 billion in 2025 and expand to USD 33.12 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.7% during the forecast period.

With the rising volume of enterprise data, growing adoption of hybrid cloud storage, and increasing need for high-performance computing (HPC) solutions, SAN technologies are evolving to support hyper converged infrastructure, software-defined storage, and NVMe-over-Fabric solutions. The integration of AI-driven predictive analytics, automated storage management, and enhanced cybersecurity features is further improving performance and efficiency.

Furthermore, the integration of AI-driven storage optimization, automated data tiering, and next-generation network protocols is revolutionizing the architectures. Businesses are increasingly investing in edge computing, flash-based storage, and real-time data replication technologies to enhance performance, security, and scalability.

Explore FMI!

Book a free demo

The rapidly transforming Storage Area Network (SAN) Market is a result of the growing need for high-speed, secure, and scalable data storage solutions throughout the industries. The first preference of enterprise data centers and cloud service providers is performance, which is augmented with speed, scalability, and security.

The features are most critical to support a huge number of workloads and the cloud connectivity connection. Government and defense sectors require high-security aspects and encryption of data, whereas healthcare facilities emphasize secure and prompt recovery of electronic health records (EHRs).

Small and medium-sized businesses (SMEs) are mainly concerned about their affordability and ease of administration, thereby opting for the most affordable but scalable offerings. Coupled with the growth in data volume, AI-based analytics, and cloud computing adoption, there is a shift towards software-defined storage, hyper-converged infrastructure (HCI), and NVMe-based solutions offering stellar performance, security, and efficiency.

| Company | Contract Value (USD Million) |

|---|---|

| Dell EMC | Approximately USD 80 - 90 |

| Hewlett Packard Enterprise (HPE) | Approximately USD 70 - 80 |

| NetApp | Approximately USD 60 - 70 |

| IBM | Approximately USD 90 - 100 |

| Hitachi Vantara | Approximately USD 75 - 85 |

In 2024 and early 2025, the Storage Area Network (SAN) Market experienced significant momentum, driven by the rising need for scalable, high-performance data storage solutions across diverse industries. Leading companies such as Dell EMC, HPE, NetApp, IBM, and Hitachi Vantara have secured strategic contracts and partnerships, underscoring their commitment to enhancing data management, ensuring business continuity, and enabling efficient IT operations in an increasingly digital landscape.

Between 2020 and 2024, the storage area network (SAN) market grew rapidly as enterprises prioritized high-performance storage solutions to handle massive datasets, optimize workloads, and enhance security. The shift to hybrid and multi-cloud storage increased demand for scalable and flexible SAN architectures, with NVMe-over-Fabric (NVMe-oF) improving data transfer speeds.

AI and big data analytics drove the adoption of all-flash SAN systems, ensuring faster processing for real-time applications. Cybersecurity concerns also accelerated the deployment of encrypted SAN solutions and blockchain-backed data authentication. However, challenges such as high implementation costs and storage complexity led companies to adopt software-defined storage (SDS) and AI-powered automation for improved efficiency.

Between 2025 and 2035, there will be an evolution with AI-driven automation, quantum-ready storage, and sustainable data infrastructures. AI-powered predictive analytics will optimize storage allocation, automate performance tuning, and enhance anomaly detection.

Quantum computing will demand ultra-fast, post-quantum encrypted architectures, ensuring secure data processing. Edge computing and 6G networks will drive AI-optimized, low-latency storage for IoT and autonomous systems. Sustainability will be a key focus, with enterprises adopting energy-efficient storage, green data center solutions, and recyclable SSD technologies to align with global environmental goals.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter data privacy regulations (GDPR, CCPA, HIPAA) required SAN solutions to implement enhanced encryption, access control, and compliance auditing. | AI-driven, quantum-secure SAN architectures autonomously ensure real-time data encryption, blockchain-based access verification, and regulatory-compliant storage automation. |

| AI-assisted storage management improved workload balancing, predictive maintenance, and automated data tiering for enterprise storage. | AI-native, self-optimizing SAN solutions dynamically allocate resources, autonomously detect anomalies, and self-heal storage inefficiencies in real-time. |

| Enterprises adopted hybrid SAN architectures to bridge on-premise storage with cloud environments for scalable and cost-effective data management. | AI-powered, decentralized SAN platforms enable seamless multi-cloud integration, intent-based storage orchestration, and adaptive data migration for real-time scalability. |

| NVMe-over-Fabrics accelerated data access, improving storage performance for AI, big data analytics, and real-time applications. | AI-enhanced NVMe-based SAN ecosystems enable ultra-low latency, self-adjusting data pipelines, and AI-driven workload acceleration for next-gen computing environments. |

| Enterprises integrated software-defined SAN solutions for greater flexibility, scalability, and automated resource provisioning. | AI-driven, intent-based SAN architectures provide autonomous resource scaling, self-optimizing storage allocation, and predictive performance tuning for hybrid IT ecosystems. |

| Distributed edge SANs optimized low-latency data processing for IoT, smart cities, and industrial automation. | AI-powered, edge-native SAN solutions autonomously manage real-time storage workloads, enabling ultra-fast AI inference, autonomous system operations, and edge intelligence. |

| AI-driven security tools monitored SAN traffic for anomalies, preventing ransomware attacks and unauthorized access. | AI-native, zero-trust SAN security frameworks autonomously detect cyber threats, implement real-time anomaly prevention, and ensure tamper-proof, quantum-resistant storage environments. |

| Faster network speeds improved SAN performance, enabling real-time storage access and AI-driven analytics. | AI-integrated, 6G-powered SAN solutions provide hyper-fast data synchronization, real-time workload replication, and distributed AI-driven storage optimization. |

| Enterprises optimized SAN power efficiency and adopted energy-efficient data centers to reduce operational carbon footprints. | AI-driven, carbon-neutral SAN infrastructures leverage renewable-powered storage, energy-aware data tiering, and self-regulating cooling technologies for sustainable high-performance computing. |

| Enterprises explored blockchain-based SAN models for enhanced data integrity, traceability, and immutable audit trails. | AI-enhanced, decentralized SAN ecosystems enable trustless data transactions, real-time consensus-based storage verification, and secure, distributed file-sharing architectures. |

The industry is susceptible to various risks, including technological obsolescence, cybersecurity attacks, infrastructure expenses, regulatory requirements, and supply chain interruption. The primary risk is the rapid rate of technological change. As cloud storage, hyper-converged infrastructure (HCI), and software-defined storage (SDS) develop, the conventional SAN can be subject to diminishing demand.

In order to stay competitive, companies must continually upgrade their storage infrastructure. The expense of deployment and maintenance is also very high. SAN infrastructure involves expensive components, manual management, and skilled personnel. Businesses need to balance between the two aspects by making investments in scalable, energy-efficient solutions.

Compliance and regulatory risks are most applicable to healthcare, finance, and government sectors where SANs are used. Therefore, companies must comply with data privacy laws (GDPR, HIPAA, CCPA) and adhere to safe data handling processes in a bid to avoid penalties and legal frustrations.

Ultimately, supply chain disruption can cause hardware shortage of SAN devices such as but not restricted to network switches, fiber channels, and storage arrays with high performance. By having diverse suppliers and turning to cloud-based solutions can help avoid these risks. By addressing these concerns, organizations will be able to advance in security solutions, storage performance, and overall competitiveness in the SAN marketplace.

| Countries/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 10.3% |

| UK | 9.9% |

| European Union | 10.1% |

| Japan | 9.8% |

| South Korea | 10.5% |

Increasing demand for scalable enterprise storage, hybrid cloud storage, and AI-powered storage management will drive the SAN industry in the USA SAN solutions let them centralize their data, fortify security, and boost real-time analytics.

Federal Government & large tech companies are just regulating future fiber channel nets, AI storage automation & NVMe-over-Fiber solutions that raise the workload of data. However, the growing deployment of multi-cloud storage, edge computing, and AI-based predictive analytics will propel the growth even further.

Industry giants like Dell Technologies, Hewlett Packard Enterprise (HPE), and NetApp are constantly innovating for SAN technology, creating automated data recovery mechanisms and AI-based SAN management solutions to help enterprises make better use of storage resources. The USA industry is expected to expand at a 10.3% CAGR during the forecast period, according to FMI.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Storage Optimization powered by AI | AI helps enterprises in managing storage workloads, setting storage performance, automating data lifecycle management and reducing downtime with predictive analytics. |

| Hybrid SAN Adoption | Data integration, data migration, and cloud storage use SAN with a cloud. Cloud storage solutions are often hybrids. |

UK is growing due to increasing investment in digital transformation, rising number of data centers, and the increasing demand for AI-enabled storage solutions. The top data generation across businesses like Finance, Healthcare, and Manufacturing has led enterprises to focus on scalable SAN architectures.

Through DCMS, the UK government is working on securing cloud storage and data lifecycle management with AI and end-to-end SAN security solutions. The growing implementation of automated disaster recovery, combined with AI-based real-time analytics to improve visibility, is further driving the expansion.

Vendors such as IBM, Pure Storage, and Cisco Systems are at the forefront of new advances in SAN platforms integrated with the cloud, high-speed NVMe networks, and techniques for using AI to optimize data. The UK industry will grow at a 9.9% CAGR during the forecast period, according to FMI.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| AI-Enhanced Data Management | AI powers analytics which makes data fetching, storage utilization and backup automation efficient. |

| Secure Enterprise Storage | Strong security with end-to-end encryption and cybersecurity measures |

Stringent data protection regulations, growing investments in artificial intelligence-backed storage solutions, and rising adoption of hybrid cloud storage are driving the SAN industry in the European Union. As a result of these initiatives, the EU’s GDPR and Digital Strategy have driven greater demand for SAN architectures that are both secure and high-performance.

Germany, France, and the Netherlands are paving the way for AI-driven storage automation, scalable SAN solutions, and software-defined storage networks. Trends like edge computing, AI-driven SAN analytics, and hybrid cloud SAN infrastructure are defining the landscape in the region.

Major players in the industry are Hitachi Vantara, Fujitsu, and Broadcom, which are investing in cloud-integrated fiber channel networks, intelligent SAN orchestration, and predictive maintenance for the enterprise. The European Union industry will grow at a 10.1% CAGR during the forecast period, according to FMI.

Growth Factors in the EU

| Key Drivers | Details |

|---|---|

| GDPR Compliance & Security | All over the EU, businesses are moving towards data storage and encryption that complies with European regulations. |

| AI-Powered Storage Automation | AI use cases in the Data Center space include using AI to optimize SAN performance and predictive maintenance. |

Japan’s SAN market is evolving rapidly, driven by government-backed smart infrastructure projects, AI-powered enterprise storage adoption, and high-speed data processing demands. Japan is focusing on AI-driven storage automation, robotics, and software-defined SAN solutions to modernize its data ecosystem.

The Ministry of Internal Affairs and Communications (MIC) is actively promoting secure enterprise storage, real-time predictive analytics, and cloud-integrated SAN platforms. With growing reliance on AI for data lifecycle management, businesses are integrating NVMe-based SAN architectures for ultra-fast storage access.

Technology leaders such as Toshiba, NEC, and NTT Data are pioneering AI-assisted SAN optimization, hybrid cloud storage management, and software-defined storage solutions to enhance enterprise efficiency. FMI anticipates Japan's industry to grow at a 9.8% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI-Integrated Data Management | Predictably, AI-driven SAN analytics optimizes storage utilization, reduces latency, predicts failures, etc. |

| NVMe-Based Storage Innovation | Enterprise computing and AI applications are driven by high-velocity data transfer |

Growth in South Korea’s SAN market is being driven by the government’s Smart Infrastructure Initiative, the rise of AI in enterprise IT, and new 5G cloud storage capabilities. In South Korea, advanced AI-powered SAN monitoring, predictive storage analytics, and hybrid cloud solutions are converging with enterprise IT infrastructures.

Ministry of Science and ICT (MSIT) also focuses on real-time SAN analytics and AI aid storage automation services and fast data center interconnection. Samsung Electronics, SK Hynix, and LG CNS are making inroads in the realm of artificial intelligence-based storage intelligence, NVMe-over-TCP SAN solutions, and automated data recovery technologies. FMI anticipates South Korean industry to grow at a 10.5% CAGR during the study period.

| Key Drivers | Details |

|---|---|

| AI-Powered SAN Intelligence | Storage efficiency optimization and predictive failure analytics via AI-driven automation. |

| High-Speed 5G-Enabled Storage | 5G connectivity enhances cloud-integrated SAN performance and real-time data access. |

The hardware segment is projected to dominate the SAN industry with a 63.2% share in 2025, driven by the increasing adoption of high-performance storage solutions. Storage Area Network (SAN) hardware consists of disk arrays, host bus adapters (HBAs), Fiber Channel switches, and controllers, and they play an important role in managing large quantities of enterprise data.

The hardware segment is gaining traction due to the increasing need for high-speed, scalable storage infrastructure in sectors including BFSI, IT & telecom, and healthcare. For example, recent offerings by the likes of Dell Technologies, Hewlett Packard Enterprise (HPE), and NetApp have been driven by continued demand for high-throughput data applications capable of delivering fast backup and disaster recovery.

This transition to all-flash and hybrid storage arrays is also driving innovation by providing better performance and lower latencies. Meanwhile, the company's software segment leads with a 36.8% share and is forecast to experience considerable growth driven by increased investments in software-defined storage (SDS) and virtualization technologies.

These SAN software solutions improve data management, automation, and security features. The major SAN providers, including IBM, VMware, and Microsoft, have also been focused on SAN management and orchestration to improve storage utilization, reduce downtime, and enable cloud-based storage environments.

The rising need for SAN software solutions, however, only reflects the growing performance-based nature of the hardware infrastructure boom in the market as enterprises strap themselves to scale down their operational costs, enhance accessibility to data, and achieve added functionality.

Out of all the different segments of the Enterprise Server San, the segment is anticipated to account for the largest share, recording 58.4% by 2025, due to rapid increase in enterprise data workloads, increase in trends such as cloud computing, and high demand for enterprise server SAN solution with high security.

Enterprise-grade SAN solutions are utilized in BFSI, healthcare, and IT & telecom industries for mission-critical applications, data redundancy, and storage optimization. Leaders in this space include Dell Technologies, Hewlett Packard Enterprise (HPE), and NetApp, who provide scalable, high-performance, and secure SAN architectures.

Enterprise Server SANs are specifically important for large-scale enterprises and data centers, offering key benefits, including low-latency data access, high availability, and seamless scalability. Enterprise Adopts New Storage Technologies: The multiplying power of NVMe-over-Fibre Channel (NVMe-oFC), all-flash is making enterprises more efficient and performant in storage networks.

Hyperscale Server SAN is expected to cover the largest share of 41.6% in 2025, and the market for hyperscale server SAN is driven by the increasing demand for cloud computing, big data analytics, and AI-driven applications. Hyperscale cloud providers like AWS, Google Cloud, and Azure will also invest in next-generation SANs to offer scalable, software-defined, distributed storage infrastructures.

As edge computing and hybrid cloud strategies expand, hyperscale SAN solutions are becoming ever more critical for organizations searching for economical, high-capacity data storage solutions.

The SAN industry is witnessing rapid expansion as enterprises and data centers increasingly demand high-speed, scalable, and secure storage solutions. The growing need for real-time analytics, cloud integration, and AI-powered storage management is driving advancements in centralized storage infrastructure.

Companies are focusing on NVMe-over-Fabric (NVMe-oF), software-defined storage (SDS), and hyper-converged architectures to enhance performance, reduce latency, and improve cost efficiency. Market leaders such as Dell Technologies, Hewlett Packard Enterprise (HPE), and NetApp dominate with cutting-edge SAN solutions that integrate AI-driven automation, high-speed flash storage, and hybrid cloud compatibility. IBM and Cisco Systems further strengthen competition with enterprise-grade storage platforms and network-optimized SAN infrastructures.

The competitive landscape is evolving with the increased adoption of multi-cloud storage, AI-driven data tiering, and cybersecurity-enhanced storage frameworks. As enterprises prioritize low-latency, scalable, and cost-efficient storage solutions, companies that emphasize automation, hybrid cloud flexibility, and performance-driven SAN innovations will gain a strategic edge in the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dell Technologies | 20-25% |

| Hewlett Packard Enterprise (HPE) | 15-20% |

| NetApp Inc. | 12-16% |

| IBM Corporation | 10-14% |

| Cisco Systems Inc. | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dell Technologies | Specializes in scalable SAN solutions with PowerMax, NVMe, and AI-powered automation. |

| Hewlett Packard Enterprise (HPE) | Focuses on high-performance storage with HPE Alletra, 3PAR, and AI-driven analytics. |

| NetApp Inc. | Innovates in hybrid cloud SAN architectures, NVMe-based storage, and data management. |

| IBM Corporation | Provides enterprise-grade storage solutions with FlashSystem and AI-powered optimization. |

| Cisco Systems Inc. | Develops networking solutions for SAN infrastructure with Fibre Channel and NVMe-oF. |

Key Company Insights

Dell Technologies (20-25%)

Dell has the world's best SAN market with its cutting-edge storage infrastructure, which provides PowerMax and Unity XT solutions with AI-driven optimization and multi-cloud capabilities.

Hewlett-Packard Enterprise (HPE) - 15-20%

HPE is a leader in intelligent SAN storage. It has an HPE Primera and Alletra platform that provides scalable, high-speed, and AI-powered data management.

NetApp Inc. (12-16%)

NetApp is leading hybrid cloud SAN designs with cloud storage plus high-speed NVMe technology for enterprise use cases.

IBM Corporation (10-14%)

IBM is a high-performance storage leader, providing enterprise SAN solutions using FlashSystem and Spectrum Virtualize to improve data mobility and protection.

Cisco Systems Inc. (6-10%)

Cisco leads the networking solution market for SAN infrastructure, optimizing data center performance with fiber channel switching and NVMe-oF solutions.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 23.01 billion in 2025.

The industry is predicted to reach a size of USD 33.12 billion by 2035.

Key companies include Dell Technologies, Hewlett Packard Enterprise (HPE), NetApp Inc., IBM Corporation, Cisco Systems Inc., Pure Storage, Hitachi Vantara, Broadcom (Brocade), Western Digital (SanDisk & HGST), and Fujitsu Ltd.

South Korea, driven by increasing data center deployments, cloud computing advancements, and enterprise storage demand, is expected to record the highest CAGR of 10.5% during the forecast period.

Hardware is widely used, including storage devices, switches, and adapters, due to increasing enterprise data storage requirements and the adoption of high-performance storage solutions.

The market includes hardware, software, and services (consulting, system integration, support & maintenance).

The market covers Hyperscale Server SAN and Enterprise Server SAN.

The market comprises Fibre Channel (FC), Fibre Channel Over Ethernet (FCoE), InfiniBand, and iSCSI Protocol.

The market spans BFSI, IT & Telecom, Energy & Utility, Government, Military & Defense, Healthcare, Manufacturing, Retail & e-Commerce, and Others.

The market covers North America, Latin America, Western Europe, Eastern Europe, and Asia Pacific, excluding Japan (APEJ), Japan, and the Middle East & Africa (MEA), including GCC countries.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.