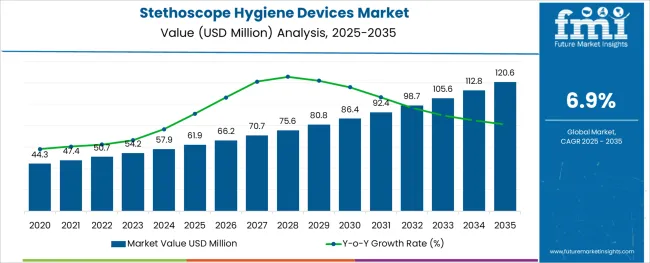

The Stethoscope Hygiene Devices Market is estimated to be valued at USD 61.9 million in 2025 and is projected to reach USD 120.6 million by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

The stethoscope hygiene devices market is gaining traction due to increased attention toward infection control practices and hospital acquired infection prevention across healthcare systems. With heightened awareness following global health emergencies and stricter hygiene mandates in clinical settings, the adoption of devices that prevent cross contamination has significantly risen.

The stethoscope, being a high contact instrument, is a known vector for microbial transmission, prompting demand for dedicated hygiene solutions. Advancements in materials, miniaturization, and integration with automated disinfection systems are driving product development.

Support from healthcare authorities and infection control guidelines has further validated the need for effective stethoscope hygiene practices. The market is expected to grow steadily as hospitals, clinics, and outpatient care providers prioritize safety and patient protection through innovative and easy to deploy disinfection technologies.

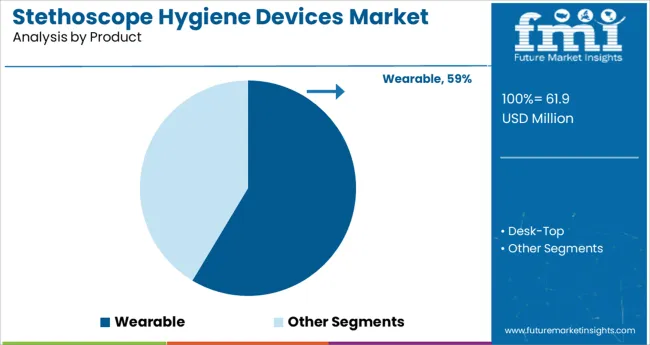

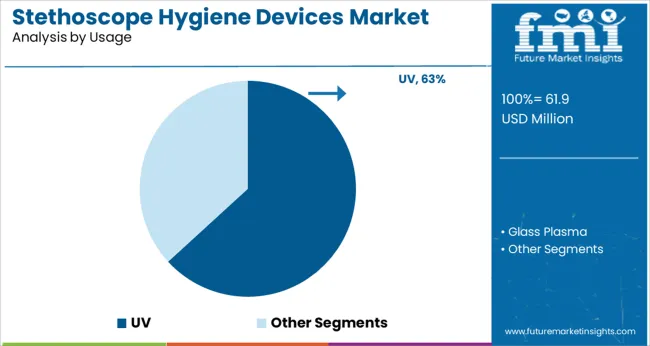

The market is segmented by Product, Usage, and End User and region. By Product, the market is divided into Wearable and Desk-Top. In terms of Usage, the market is classified into UV and Glass Plasma. Based on End User, the market is segmented into Hospitals, Clinics, Academic & Research Institutions, Ambulatory Care Centres, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wearable segment is projected to represent 58.60% of the total revenue by 2025 within the product category, making it the most dominant segment. This growth is fueled by its ability to provide continuous protection without interfering with routine stethoscope use.

Wearable hygiene devices are designed for seamless attachment, offering automated disinfection without requiring manual intervention, thus encouraging compliance among healthcare workers. Their discreet form factor and integration into everyday clinical practice have supported rapid adoption in hospitals and emergency care settings.

As institutions seek reliable and non intrusive solutions to minimize pathogen transmission, wearable products have become the preferred option due to their convenience, effectiveness, and adaptability to existing medical tools.

The UV usage segment is expected to account for 63.20% of total market revenue by 2025 under the usage category, establishing it as the leading method. This dominance is attributed to ultraviolet technology’s proven efficacy in eliminating a wide range of bacteria and viruses without the need for chemical agents.

UV based hygiene devices are favored for their rapid cycle times, low maintenance, and non corrosive properties, making them suitable for high frequency use in clinical environments. Furthermore, growing concerns about antimicrobial resistance have positioned UV as a safe and reliable alternative to traditional disinfectants.

As healthcare providers aim to adopt touch free, fast acting, and environmentally safe sanitation methods, UV based stethoscope hygiene devices continue to lead due to their superior performance and user acceptance.

The market value for the stethoscope hygiene devices market was approximately 1.9% of the overall ~USD 57.9 Billion of the global medical device cleaning market in 2024.

The Current Infectious Disease Reports, 2020 explored the role of environmental contamination in healthcare-associated infections (HAIs). Blood pressure cuffs, electronic thermometers, hemodialysis machines, stethoscopes, infusion pumps, and other medical devices can serve as potential reservoirs for nosocomial infections that can spread from healthcare workers' hands to patients if correct hand-washing practices are not followed.

HAIs have been linked to cross-transmission through the hands of healthcare workers who are infected either directly from patient contact or indirectly by touching contaminated ambient surfaces.

There is evidence that pathogens can move from the skin to the stethoscope and vice versa, making medical stethoscopes a possible source of contamination for a number of disorders. Despite the predominance of non-pathogenic organisms, potential pathogens like C. difficile, Pseudomonas, MRSA, and VRE have also been found.

A 2025 study conducted by Mayo Clinic at a Swiss university teaching hospital tested the bacterial load of stethoscopes and discovered that they were capable of transferring potentially dangerous pathogens, such as methicillin-resistant Staphylococcus aureus (MRSA). Modern antibiotics are unable to penetrate the bacterium's defenses, which have evolved through time.

Out of the sample population, the researchers discovered that stethoscope contamination increased significantly following just one patient's physical examination. They discovered that the degree of contamination was comparable to that of the doctor's dominant hand.

As a result of the aforementioned factors, the global stethoscope hygiene devices market is anticipated to expand at a CAGR of 6.9% from 2025 to 2035.

Due to the advancement of disinfection devices, the market is expected to display an opportunity-seeking stance. The introduction of products designed to provide several benefits from a single device would further accelerate the expansion.

For example, a product by the name of StetClean (LightProcess s.r.l) offers 4 in 1 solution for the disinfection of stethoscopes. This product prevents the rise in microbiological activity caused by the contamination of the stethoscope.

It facilitates the adoption of healthy hygienic habits and practices by physically disinfecting through the action of UV rays, without the use of any chemicals. This product is environmentally friendly because it doesn't utilize any toxic chemicals or generate any toxic waste.

During the foreseeable years, this is expected to provide lucrative opportunities for growth in the overall stethoscope hygiene devices market.

Although stethoscope hygiene performance has remained below average, researchers have noticed an increase in stethoscope hygiene attitudes. This indicates that while stethoscope hygiene is thought to be crucial, few practitioners actually use it.

Owed to these crucial factors, the market stethoscope hygiene devices market observes a decline in terms of product adoption and sales.

What Makes the USA a Large Market for Stethoscope Hygiene Devices?

The USA dominates the North American region with a total market share of about 75.3% in 2024 generating a revenue of close to USD 9.5 million and is expected to continue to experience the same growth throughout the forecast period.

According to the USA Centers for Disease Control and Prevention, more than 98,000 hospitalized patients (one in 17) yearly develop HCAIs while receiving treatment for other medical conditions. Healthcare personnel can improve their hygiene habits to stop the spread of illness through routine educational initiatives. This is a prime driver for the design and production of stethoscope hygiene devices within the country.

Italy holds a market share of nearly 5.3% in the global stethoscope hygiene devices market during the forecast period.

The makers of the first UV Stethoscope-specific disinfection device, LightProcess s.r.l, and egoHealth have their headquarters set up in the country providing the market there a good boost. The fact that one of the pioneers of this invention which uses UV light to maintain stethoscope hygiene will itself provide the market here a significant boost. Due to such developments, the market is being boosted towards growth.

China dominates the East Asian stethoscope hygiene devices market region with a total market share of about 58.7% in 2024 and is expected to continue to experience the same growth throughout the forecast period.

A 2024 BMC article explored the trend of medical graduates in China. Undergraduate medicine enrolment expanded from 30,500 to 94,600, with an average annual growth rate of 7.3 %, between 2002 and 2020, while the number of higher clinical medicine graduates surged drastically from 51,800 in 2002 to 182,900 in 2020. This will lead to a rise in the use of stethoscopes, which will further lead to good adoption of hygiene devices to maintain hygienic practices in order to avoid nosocomial infections.

Desktop stethoscope hygiene device is expected to present high growth at a CAGR of 6.7% by the end of the forecast period, with a market share of about 86.6% in the global stethoscope hygiene devices market in 2024. Desktop devices can easily sit atop any table as well as can be kept and carried anywhere, as they are light in weight. In addition, most of the products available in the market are available in desktop form, hence the lucrative figures.

The UV technology holds a revenue share of around 80.3% in 2024 and the segment is expected to display gradual growth over the forecast period, with an estimated CAGR of 6.9% in 2035. Ultraviolet technology or UV technology is the most commonly used technology when it comes to disinfection. Hence, most of the manufacturers of stethoscope disinfection are integrating this technology into their products to create a useful disinfection device.

Hospitals hold the highest market share value of 30.6% during the year 2024. The presence of a large number and variety of healthcare professionals has driven this segment to be a dominant fragment, propelling sales of the overall stethoscope hygiene devices market. These individuals range from medical students to doctors of all specializations.

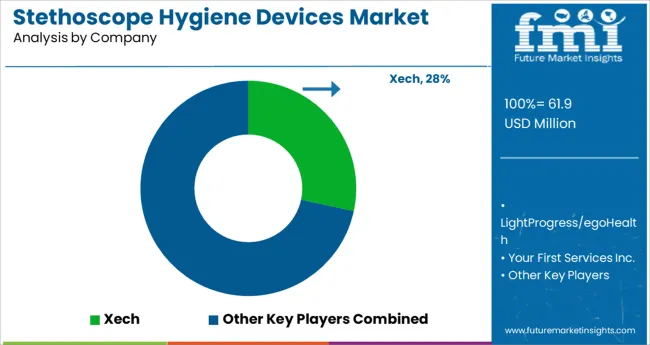

The production of stethoscope hygiene equipment is dominated by a few producers, which has led to market concentration. These businesses are employing strategies including alliances and collaborations, new product launches, and partnerships in order to satisfy consumer demand and increase their client base.

Instances of key developmental strategies by the industry players in the stethoscope hygiene devices market are given below:

Similarly, recent developments related to companies manufacturing stethoscope hygiene devices, have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, UK, Germany, Italy, Russia, Spain, France, BENELUX, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Turkey, GCC Countries, North Africa, and South Africa |

| Key Market Segments Covered | Product, Technology, End User, and Region |

| Key Companies Profiled | LightProgress/eHealth; Xech; Your First Services Inc.; Vioguard; Edmund Optics; Parsons; UV Smart; Tangshan UMG Medical Instrument Co., Ltd. |

| Pricing | Available upon Request |

The global stethoscope hygiene devices market is estimated to be valued at USD 61.9 million in 2025.

It is projected to reach USD 120.6 million by 2035.

The market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types are wearable and desk-top.

uv segment is expected to dominate with a 63.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stethoscope Market – Growth, Demand & Forecast 2025 to 2035

Digital Stethoscope Market Report - Trends, Innovations & Forecast 2025 to 2035

AI-Powered Stethoscope Market Size and Share Forecast Outlook 2025 to 2035

Electronic Stethoscope Market Growth – Industry Forecast 2024-2034

Hygiene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Hygiene Packaging Market Trends & Industry Outlook 2025 to 2035

Women Hygiene Care Product Market Growth, Trends and Forecast from 2025 to 2035

Dental Hygiene Instrument Market Analysis by Product, Application, Usage, End User, and Region through 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Patient Hygiene Aids Market – Demand & Forecast 2024 to 2034

Feminine Hygiene Product Market Analysis – Growth & Forecast 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Tissue and Hygiene Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Products Market Analysis by Product Type, Sales Channel, and Region through 2025 to 2035

Disposable Hygiene Footwear Market

Tissue and Hygiene Paper Packaging Market

Cleaning and Hygiene Product Market Report – Demand & Trends 2024-2034

Clinical Hand Hygiene Products Market – Trends, Growth & Forecast 2025 to 2035

Men's Intimate Hygiene Products Market Size and Share Forecast Outlook 2025 to 2035

BRICS Disposable Hygiene Products Market Analysis – Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA