The stereotactic surgery devices market is valued at USD 28.54 billion in 2025. As per FMI's analysis, the stereotactic surgery devices will grow at a CAGR of 4.1% and reach USD 42.66 billion by 2035.

This is attributed to the transition towards minimally invasive surgical procedures, rising prevalence of neurological disorders and growing demand for accuracy-based treatments. Industry growth is driven by the increasing burden of diseases that include Parkinson’s, brain tumors and epilepsy, as well as technological innovations. Moreover, growth is driven by rising awareness and improvements in healthcare infrastructure in emerging economies.

During 2024, the industry for stereotactic surgery devices saw steady growth due to the expanding use of robotic-assisted interventions, the evolution of image-guidance systems, and the expanding incidence of neurological conditions.

Frameless stereotactic systems were in higher demand in hospital and specialty neurosurgery units because they were more accurate and made patients more comfortable.

Robots that use artificial intelligence (AI) are being used more and more in brain tumor biopsies and deep brain stimulation (DBS) for Parkinson's disease. Due to sophisticated healthcare systems, North America and Europe remain the leading regions and the Asia-Pacific (APAC) is growing at a faster rate.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 28.54 billion |

| Industry Size (2035F) | USD 42.66 billion |

| CAGR (2025 to 2035) | 4.1% |

Explore FMI!

Book a free demo

Technological advancements in stereotactic surgery systems including robotic-assisted stereotactic neurosurgery as well as artificial intelligence (AI)-based imaging technology and increasing prevalence of neurological disorders are the factors driving the growth of the stereotactic surgery devices segment.

Potential beneficiaries include firms selling medical devices, hospitals purchasing sophisticated surgical instruments and patients who want safer and more effective therapies, whereas traditional open-surgery approaches may witness declining demand. With healthcare systems globally transitioning towards precision medicine and automation, the organisations which provide disruptive stereotactic solutions that maximise affordability, include AI, and revolutionise precision will benefit the most.

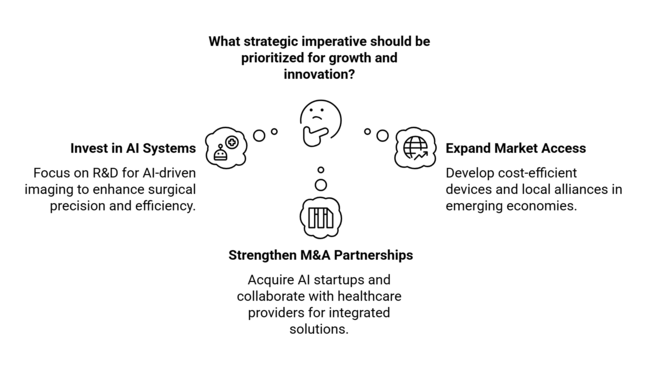

Invest in AI-Integrated Stereotactic Systems

Executives should focus R&D on AI-driven imaging and navigation for improved surgical precision and efficiency. Collaborating with AI and robotics companies will drive innovation and provide competitive differentiation.

Expand Market Access in Emerging Economies

Keeping pace with the increasing need for neurosurgical solutions in Asia-Pacific and Latin America, firms need to create cost-efficient, high-precision devices and form local manufacturing or distribution alliances to access underserved sectors.

Strengthen M&A and Strategic Partnerships

To remain in the lead, companies need to venture into acquiring AI-based surgical startups, partnerships with healthcare providers, and collaborations with imaging and radiation therapy firms. This will create an integrated ecosystem for next-generation stereotactic procedures and propel long-term segment leadership.

| Risk | Probability & Impact |

|---|---|

| Regulatory Hurdles & Compliance Challenges | Medium Probability-High Impact |

| High Cost of Advanced Stereotactic Systems | High Probability-Medium Impact |

| Technological Disruptions & Competitive Pressure | Medium Probability-High Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| AI-Driven Surgical Navigation Integration | Conduct feasibility study on AI-powered imaging and robotics adoption |

| Industry Expansion in Emerging Economies | Establish local partnerships and assess regulatory pathways for entry |

| Cost Optimization & Affordability Strategies | Initiate R&D on lower-cost stereotactic systems for budget-conscious sector |

To stay ahead in the stereotactic surgery devices sector, the company must, prioritize AI-driven precision, affordable innovation, and international segment growth. Putting money into robotics and surgical navigation powered by AI will make procedures more accurate, and making solutions that are affordable for emerging sectors will open up new revenue streams.

Strategic mergers and acquisitions with AI and imaging startups can accelerate innovation, and partnerships between hospitals and OEMs will help them stand out in the segment. This shift requires a transition to holistic, data-driven operating rooms, ensuring long-term competitiveness in an evolving healthcare landscape.

Regional Variance

High Variance

Divergent Perspectives on ROI

74% of USA hospitals viewed AI-enhanced stereotactic surgery tools as worth the investment, while 36% in Japan still relied on traditional frame-based stereotactic systems.

Consensus

Carbon Fiber & Titanium: 68% of respondents preferred lightweight, non-magnetic materials to reduce imaging artifacts in MRI/CT-guided procedures.

Regional Variance

Common Concerns

89% cited rising R&D and material costs (titanium up 25%, carbon fiber up 15%) as a major industry challenge.

Regional Differences

Manufacturers

Distributors

End-Users (Hospitals & Neurosurgeons)

Alignment

76% of manufacturers plan to increase R&D spending on AI-driven surgical guidance systems.

Divergence

USA

69% of stakeholders viewed state-level health policy changes (e.g., Medicare reimbursements for robotic surgeries) as a key market driver.

Western Europe

82% believed the EU Medical Device Regulation (MDR) 2024 framework would boost demand for high-compliance, precision surgical devices.

Japan/South Korea

Only 34% felt government regulations had a strong influence on purchasing decisions, citing weaker enforcement compared to Western sector.

High Consensus

Global priorities include regulatory compliance, AI-driven precision, and cost concerns, shaping purchasing decisions.

Key Variances

Strategic Insight

A one-size-fits-all approach will not succeed. Companies must adopt region-specific strategies-high-tech AI-assisted systems in the USA, sustainable solutions in Europe, and compact, cost-effective devices in Asia-to gain a competitive edge.

| Country/Region | Policies, Regulations & Certifications Impacting the Market |

|---|---|

| United States (USA ) |

|

| Western Europe (EU) |

|

| Japan |

|

| South Korea |

|

The USA is still the biggest and most technologically advanced sector for stereotactic surgery devices. This is because of the large number of neurosurgery procedures, the speed with which AI and robotics are being adopted, and the country's favorable reimbursement policies. The stringent regulatory oversight exercised by the FDA leads to high-quality innovations, but it does come with a price longer approval timelines for AI-driven and robotic-assisted systems.

The rising prevalence of neurodegenerative diseases, such as Alzheimer’s and Parkinson’s, is driving demand for targeted deep brain stimulation (DBS).High equipment costs as well as hospital financial pressures may prevent uptake by smaller centers. Future growth will rest on strategic partnerships with AI startups and steep Increased federal funding for precision medicine.

FMI opines that United States stereotactic surgerydevices sales will grow at nearly 4.5% CAGR through 2025 to 2035.

The report says that the UK sector is growing slowly. This is because the National Health Service (NHS) is encouraging the use of robotic-assisted surgeries and precision medicine. Guided by the MDR-equivalent regulations of the post-Brexit UK, the UK Medicines and Healthcare Products Regulatory Agency (MHRA) is extremely stringent in its compliance for stereotactic devices.

An aging population and an increase in brain cancer cases are driving demand for frameless stereotactic procedures. Delays in NHS funding approval and budget cuts in public hospitals slow down the pace of industry expansion. New investments from private healthcare providers and academic research partnerships are expected to fuel growth. Adoption will be sped up by government digital health programs and a focus on lowering surgical errors through automation.

FMI opines that United Kingdom’s stereotactic surgery devices sales will grow at nearly 3.8% CAGR through 2025 to 2035.

The industry for stereotactic surgery in France is slowly growing. This is mostly because of programs to modernize healthcare that are paid for by the government and a focus on minimally invasive therapies. Stereotactic devices are regulated by the High Authority of Health (HAS) and ANSM (French Health Products Safety Agency) with stringent safety demands. Public hospitals are reluctant to invest in robotic-assisted systems due to high costs.

On the other hand, many private hospitals and research centers are buying AI image guidance systems. Stereotactic radiosurgery (SRS) is used to treat brain tumors and vascular malformations. The high demand is driven by the French government’s initiative to reduce hospital wait times and enhance precision oncology treatments. Regional disparities in healthcare budgets affect AI adoption, but increased AI integration is expected to drive growth.

FMI opines that France's stereotactic surgery devices sales will grow at nearly 3.7% CAGR through 2025 to 2035.

Germany is a leading market in Europe due to high hospital infrastructure investments, strong medical device manufacturing, and growing AI-driven neurosurgical innovations. The Federal Joint Committee (G-BA) confirms the approval of G-BA-eligible medical devices, adhering to strict EU MDR requirements. Stereotactic robotic-assisted surgery systems are actively invested in by private and university hospitals in Germany, particularly for the treatment of brain metastases and movement disorders.

It isa leader in artificial intelligence-enabled neurosurgery, with companies such as Brain lab and Siemens Healthineers driving innovation. The government’s push for digitization in hospitals paves the way for the use of AI-assisted surgical tools. There are still worries about rising prices and long reimbursement periods, but Germany was one of the first countries to use cutting edge surgical technologies, which will ensure steady industry growth.

FMI opines that Germany stereotactic surgerydevices sales will grow at nearly 4.2% CAGR through 2025 to 2035.

There are a lot of things that are helping the Italy stereotactic surgery devices industry grow. Key growth drivers include an aging population, rising brain cancer cases, and increased government-funded healthcare improvements. However, public hospitals have not widely adopted robotic-assisted surgery systems due to financial constraints. The Italian Ministry of Health and the National Health Technology Assessment (HTA) program are in charge of regulating stereotactic devices. This means that manufacturers and devices must follow EU MDR guidelines.

The private healthcare sector, particularly on the northern side, is increasingly utilizing AI-based surgical navigation systems. Even though Italy has some of the most technologically advanced infrastructure for neurosurgery, growth has been slowed by the time it takes for hospitals to get medical equipment. The government spending on digital healthcare solutions will drive adoption in the next decade.

FMI opines that Italy stereotactic surgery devices sales will grow at nearly 3.5% CAGR through 2025 to 2035.

South Korea's sector is expanding rapidly due to government incentives for robotic surgery and AI integration in healthcare. The Ministry of Food and Drug Safety (MFDS) has made it easier for AI-embedded stereotactic systems to get approved, more high-end hospitals are using them.

South Korea's aging population and rising stroke incidence rates drive the demand for deep brain stimulation (DBS) and stereotactic radiosurgery (SRS). Korea is a leader in digital neurosurgical solutions because private hospitals and research centers there have spent a lot of money on tele-surgery and remote planning software. Despite reimbursement challenges and cost concerns, the NHI has limited coverage for new, advanced robotic surgeries.

FMI opines that South Korea stereotactic surgery devices sales will grow at nearly 4.4% CAGR through 2025 to 2035.

Stereotactic surgery is becoming more popular in Japan, but it's not easy to get started because the equipment is expensive and the government takes a long time to make rules. Japan also has strict rules about safety and effectiveness that are enforced by the Pharmaceutical and Medical Devices Agency (PMDA) and Japan Industrial Standards (JIS). These rules make it take even longer for AI-assisted devices to get approved.

Japan has a rising demand for deep brain stimulation (DBS) and frameless stereotactic procedures due to its aging population and increasing Parkinson’s cases. Conversely, private hospitals appear to be pioneering the use of AI-enabled neuro-navigation systems, while public hospitals under investing in these expensive robotic systems. More government-funded AI projects and looser rules on reimbursement will encourage a lot of people to use AI systems, which will be good for the industry.

FMI opines that Japan stereotactic surgery devices sales will grow at nearly 3.6% CAGR through 2025 to 2035.

The rapid expansion of China in the global stereotactic surgery sector is primarily due to substantial government investment in AI-supported healthcare technology, an increasing number of brain cancer cases, and a growing healthcare infrastructure. To reduce reliance on imported goods, the National Medical Products Administration (NMPA) is speeding up the review and approval of domestic robotic stereotactic systems.

China’s program is encouraging homegrown innovation in AI-based surgical tools. However, the adoption of AI-based surgical tools is lagging behind in rural hospitals, whereas demand is increasing in urban areas. China's growing middle-class healthcare consumption and the government's continued investment in AI-based precision surgery will drive the growth.

FMI opines that China stereotactic surgery devices sales will grow at nearly 5.2% CAGR through 2025 to 2035.Australia &

Government funding propels robotic neurosurgery and AI integration in the region, exhibiting moderate and steady sector growth in both Australia and New Zealand. In Australia, stereotactic surgery devices are regulated by the Therapeutic Goods Administration (TGA), while Medsafe is the authority in New Zealand. Both ensure high safety standards are met. Public hospitals are slowly starting to use surgical navigation tools that are powered by AI, but private hospitals are the first to use robots to help with surgery.

The adoption of stereotactic radiosurgery (SRS) and deep brain stimulation (DBS) is increasing due to the rise in brain cancer and neurodegenerative diseases. High costs and meager reimbursement for robotic-assisted procedures continue to be barriers.

FMI opines that Australia & New Zealand stereotactic surgery devices sales will grow at nearly 3.9% CAGR through 2025 to 2035.

The Indian stereotactic surgery devices sector is expected to grow rapidly owing to factors such as booming medical tourism in the country. Rising prevalence and incidence rates of neurological disorders, increasing number of advanced hospitals and clinics with state-of-the-art facilities, and various government initiatives for the research and development of the product.

India is observing a rapid growth in the demand for minimally invasive neurosurgical procedures (MINPs) including Deep Brain Stimulation (DBS), Stereotactic Radiosurgery (SRS), and frameless neuro navigation systems. Approvals under the Central Drugs Standard Control Organization (CDSCO) are subject to delays, particularly for AI-based devices. Government healthcare reforms and investments in AI-driven neurosurgery will promote growth-making India among the fastest growing sectors in the upcoming decade.

FMI opines that India’s stereotactic surgery devices sales will grow at nearly 5.0% CAGR through 2025 to 2035.

The CAGR for the by product segment in stereotactic surgery devices is 4.3% (2025 to 2035).The segment for stereotactic surgery devices is growing with the increasing usage of Gamma Knife, LINAC, PBRT, and Cyber Knife technologies. These devices offer precision, minimally invasive, high-technology treatment options, especially in neurology and oncology. Gamma Knife is still the gold standard for treating brain disorders, and LINAC-based equipment can be used to treat tumors in any part of the body.

Proton Beam Radiation Therapy (PBRT) is gaining popularity due to its improved dose distribution and reduced side effects. It is often preferred for treating children and radiation-sensitive tumors. It is now the treatment of choice for children and tumors that are sensitive to radiation. With its robotics and real-time image guidance, Cyber Knife is changing radiosurgery by making treatments frameless and painless.

The CAGR for the by application segment in the stereotactic surgery devices segment is 4.2% (2025 to 2035).Stereotactic surgery equipment is growing in various clinical fields, such as liver, breast, prostate, lung, and colorectal cancer therapies. As the incidence of liver cancer increases, stereotactic body radiotherapy (SBRT) is on the horizon as a non-surgical option for traditional surgery.

These devices are making partial breast irradiation (PBI) more accurate so that less damage is done to nearby tissues during treatment for breast cancer. New stereotactic techniques that use real-time image guidance and dose modulation are making prostate cancer treatment easier.

Lung cancer clinicians increasingly use stereotactic radiosurgery to treat inoperable tumors and metastatic lesions, achieving high local control rates. Better patient outcomes and shorter recovery times fuel the increased demand for colorectal cancer therapy using non-invasive stereotactic methods.

Leading companies in the sector for stereotactic surgery devices are competing very hard with each other. To get ahead in the segment, companies are changing their pricing strategies, coming up with new technologies, working together strategically, and expanding into new areas. Top companies are putting a lot of money into research and development (R&D) to make imaging more accurate, robotics more useful, and AI-assisted treatment planning easier.

Partnerships and acquisitions are emerging as key drivers of industry expansion. Big companies are teaming up with hospitals, research centers, and government health departments to make their technologies part of standard medical procedures. As part of expansion efforts, regional manufacturing facilities are set up to cut costs and follow local rules.

Market Share Analysis

Key Developments

Recent Mergers & Acquisitions

New Product Launches

Regulatory Approvals & Partnerships

Emerging Trends

Technological improvements in imaging, growing incidence of cancer and neurological diseases, and growing demand for minimally invasive treatment options are key drivers of adoption.

Some of the recent advancements are AI-adaptive radiotherapy, robotic treatment delivery, real-time motion monitoring, and better dose modulation strategies for greater accuracy and patient protection.

North America and Western Europe are at the forefront of adoption because of developed healthcare infrastructure, whereas Asia-Pacific is growing rapidly with rising healthcare investments and technology availability.

AI supports treatment planning, enhances imaging precision, streamlines workflows, and facilitates real-time monitoring for improved precision and results.

High upfront expenses, reimbursement complexity, regulatory approvals, and the necessity for specialized training are major obstacles toward wider adoption.

It is segmented into Gamma Knife, LINAC, PBRT, and Cyber Knife

It is segmented into Liver, Breast, Prostate, Lung, and Colon

It is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Automated Sample Storage Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.