The global steel sections market is estimated to reach USD 141.8 billion in 2025. It is likely to grow by USD 238.1 billion by the end of 2035, representing a CAGR of 6.5% during the forecast period between 2025 and 2035. The global steel sections market is set for a gentle recovery in 2025 following a 0.9% fall in demand in 2024.

Several pivotal drivers will drive the industry. Infrastructure spending continues to be the main growth driver, led strongly by emerging industries such as India, where steel demand rose 8% last year and is likely to keep its momentum going. Decarbonization and digital modernization projects will also stimulate demand as governments and companies across the globe invest in sustainable buildings and renewable energy ventures.

China's stabilizing property industries, as well as rate changes, should provide a phased revival. Increased developments in automation and Industry 4.0 technology will improve the demand for high-accuracy steel sections, especially in industry and manufacturing usage.

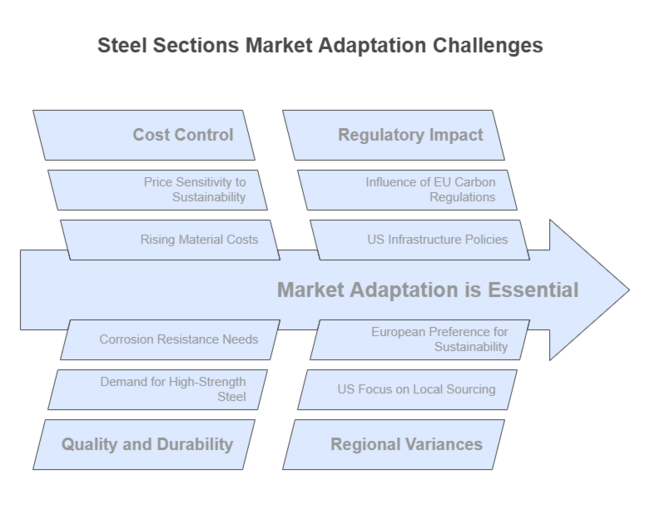

Despite the expected recovery, the steel sections market still faces several challenges. Economic uncertainty in advanced economies such as the United States, Japan, and Germany resulted in a 2% fall in demand in 2024, the industry is expected to make steady growth during the forecast period. While challenges including, high expenses and inflationary pressures remain a threat.

China's property industry is still vulnerable, and any further decline will have far-reaching consequences for world steel demand. Geopolitical tensions and trade barriers can interfere with supply chains, raising raw material costs and logistical intricacies.

| Attribute | Details |

|---|---|

| Estimated Value by 2025 | USD 141.8 billion |

| Projected Value by 2035 | USD 238.1 billion |

| CAGR (2025 to 2035) | 6.5% |

Explore FMI!

Book a free demo

The international steel sections market declined slightly in 2024 due to sluggish manufacturing demand, expensive financing, and geopolitical uncertainties. However, it will return to a moderate growth path in 2025. Major catalysts are normalizing real estate industries, investments in infrastructure, and loose monetary policies. India and infrastructure segments will be major players, whereas some other regions that depend on struggling manufacturing sectors, such as China and advanced economies, are likely to record slower growth.

Strengthen Supply Chain Resilience

Invest in diversified sourcing strategies and regionalized supply chains to mitigate geopolitical risks and raw material price fluctuations. Prioritize partnerships with reliable suppliers and explore alternative materials to enhance cost efficiency.

Align with Green Steel and Sustainability Trends

Capitalize on the growing demand for low-carbon steel by adopting cleaner production technologies and forming alliances with eco-conscious buyers. Secure incentives and regulatory advantages by integrating sustainability into operations.

Expand into High-Growth industries

Focus on India and other infrastructure-driven economies with rising steel demand. Strengthen local partnerships, enhance distribution networks, and consider strategic M&A to gain industry share in these expanding regions.

| Risk | Probability & Impact |

|---|---|

| Geopolitical Instability & Trade Restrictions | High - Supply chain disruptions, price volatility, and reduced exports/imports |

| Slow Recovery in Key Industries (China, EU, USA) | Medium - Prolonged demand weakness, overcapacity risks, and margin pressure |

| Rising Energy & Raw Material Costs | High - Increased production expenses, lower profitability, and pricing challenges |

| Priority | Immediate Action |

|---|---|

| Supply Chain Diversification | Run feasibility on alternative raw material sourcing to reduce dependency on volatile regions. |

| Sustainable Steel Adoption | Initiate OEM feedback loop on demand for low-carbon and recycled steel products. |

| Industry Expansion in High-Growth Regions | Launch aftermarket channel partner incentive pilot in India and Southeast Asia. |

To stay ahead, the client will need to prioritize supply chain resilience, ramp up investment in sustainable steel, and pursue high-growth industries aggressively, such as in India. With changing demand dynamics and geopolitical uncertainty, capturing alternative sources of raw materials and making strategic partnerships will become essential.

Aligning product offerings with sustainable trends and incentivizing downstream partners can also propel long-term growth. This kind of intelligence requires a reoriented roadmap-one that emphasizes operational flexibility, diversification in the marketplace, and anticipatory risk management to take advantage of new opportunities.

FMI Survey: Steel Sections Industry Dynamics (Q4 2024, n = 450)

| Country/Region | Policies, Regulations, and Mandatory Certifications |

|---|---|

| United States |

|

| European Union |

|

| India |

|

| Japan |

|

| South Korea |

|

The USA steel sections industry is poised for steady growth over the next decade, driven by substantial investments in infrastructure modernization and a resurgence in manufacturing activities. The implementation of the Infrastructure Investment and Jobs Act is expected to significantly boost demand for steel sections in transportation, energy, and public works projects.

Additionally, the trend toward reshoring manufacturing operations is likely to further stimulate industry growth. However, factors like raw material price volatility and tough environmental laws could affect profitability. Firms that emphasize sustainable production techniques and research and development are best suited to take advantage of opportunities that are likely to emerge.

FMI opines that the United States steel sections sales will grow at nearly 5.8% CAGR through 2025 to 2035.

The UK steel sections industry is forecast to grow moderately, driven by continuing infrastructure initiatives and an emphasis on sustainable building techniques. Government policies to reach net-zero carbon emissions by 2050 are stimulating the use of green building materials, such as environmental steel sections.

Uncertainty over post-Brexit trade strategies, however, is not certain to dissuade investment. The focus on home production and innovation allows industry momentum to grow. Those firms investing in energy-efficient technology and recycling methods will find themselves at an advantage.

FMI opines that the United Kingdom steel sections sales will grow at nearly 5.2% CAGR through 2025 to 2035.

French industry for steel sections is projected to increase consistently owing to urban construction projects and redevelopment of the country's transportation facilities. Increasing use of environmentally sustainable policies of the government will provide impetus for demand from low-carbon as well as recycled steel products.

The high price of energy remains a source of concern in addition to external pressures from cheap imported steel. The companies focused on innovative processes during production as well as ensuring regulatory compliance as required by French policy will excel amid these changes.

FMI opines that France steel sections sales will grow at nearly 5.0% CAGR through 2025 to 2035.

Germany's industry for steel sections is poised to grow moderately, supported by its strong industrial economy and investment in renewable energy plants. The country's Energiewende (energy transition) strategy is fueling the development of wind turbines and other renewable plants, which take huge steel sections.

Moreover, technological progress in automotive production, especially of electric vehicles, is supporting the steel demand. However, the industry is facing challenges pertaining to environmental issues and competition with other materials.

FMI opines that Germany’s steel sections sales will grow at nearly 5.0% CAGR through 2025 to 2035.

Italy's steel sections industry will exhibit modest growth on the back of recovery in construction and investment in public infrastructure. The drive toward seismic retrofitting of structures and creating environmentally sustainable urban settlements is the most pivotal factor.

However, industry pressure is encountered concerning volatility in economic times and overdependency on foreign raw materials. Entities with niche industry positioning, specialization in producing quality steel, and environmentally friendly ways of manufacturing and distribution stand good chances to experience good fortune.

FMI opines that the Italy’s steel sections sales will grow at nearly 4.9% CAGR through 2025 to 2035.

The steel sections industry in South Korea is expected to expand steadily, driven by technological progress in the shipbuilding, automotive, and electronics sectors. Government initiatives in support of smart city developments and green buildings also drive demand. The industry is challenged by international trade tensions and the necessity to meet strict environmental regulations. Investment in new, environmentally friendly production technologies will be essential to ensure competitiveness.

FMI opines that South Korean steel sections sales will grow at nearly 6.0% CAGR through 2025 to 2035.

Japan's industry for steel sections is expected to see moderate growth, driven by infrastructure renewal projects and preparations for hosting international events. Demand is driven by earthquake-resistant construction and energy-efficient buildings. However, the industry has to contend with issues like an aging population, which results in a declining domestic workforce, and competition from neighbouring nations. Focusing on automation and high-value, specialized steel products can counter these issues.

FMI opines that Japan steel sections sales will grow at nearly 4.7% CAGR through 2025 to 2035.

China's steel sections industry is forecast to slow, with demand flat or down modestly in 2025. The China Iron and Steel Association (CISA) reports apparent steel consumption for the first nine months of 2024 dropped 6.2% from a year ago, reaching 688 million metric tons.

The overall consumption in 2024 is expected to be less than 900 million tons, with an outlook for about 800 million tons until 2035. This is due to a long-term slump in the property industry and increasing risks to steel exports amid escalating trade tensions.

The proportion of steel consumption from the manufacturing sector is rising due to the extended recession in the real estate industry. Further, China's production of crude steel has fallen since 2021 as the government enforces limits on growth rates to control the amount of carbon released. There is a low concentration of China's steel sector vis-à-vis developed nations since only the first 10 manufacturers make up 40.9% of the industry share for the initial three quarters of 2024.

FMI opines that China steel sections sales will grow at nearly 7.2% CAGR through 2025 to 2035.

The Australian and New Zealand steel sections industry is set to grow moderately, spurred by infrastructure development schemes and an emphasis on sustainable construction. Urbanization and population increase in major cities create the need to expand transportation infrastructure and residential apartments, which drives steel demand.

Both nations' efforts to decrease carbon emissions promote the use of recycled and low-carbon steel products. However the industry is confronted with import competition and the necessity of technological improvement in manufacturing plants. Firms that invest in innovation and sustainability will likely be competitive.

FMI opines that the Australia steel sections sales will grow at nearly 5.5% CAGR through 2025 to 2035.

The hot-rolled steel sections will dominate the industry during the forecast period with their exceptional strength and durability. They are likely to expand at a CAGR of 6.8% by 2035. Steel is seamless for heavy industrial applications and large-scale construction projects, as the process involves heating it above its recrystallization temperature and then rolling it into shape.

The need for hot-rolled sections will be sustained by the rising demand for high-rise structures and infrastructure development, especially in areas that prioritize urbanization and growth. Cold-formed steel sections will continue to grow as they are lightweight and simple to install. These sections provide excellent precision and cost effectiveness because they are made from room-temperature steel.

They are especially well-suited for residential housing projects, modular construction, and prefabricated buildings. The demand for cold-formed steel sections across a range of industries will be further increased by the growing use of energy-efficient buildings and sustainable construction techniques. It is likely to expand at a CAGR of 6.2% by 2035.

As industries look for more affordable and specialized solutions for manufacturing and construction, welded steel sections will become more popular. They are a popular option for industrial facilities, bridges, and offshore applications because the welding process makes it possible to create intricate structures with precise specifications. The industry will grow as a result of increased productivity and efficiency brought about by the automation of welding technologies. It will grow at a CAGR of 6.5% by 2035.

Applications needing corrosion resistance and high pressure will see a rise in the demand for seamless steel sections. With their exceptional structural integrity and lack of welding or seams, these sections are crucial for heavy-duty engineering projects, power plants, and oil and gas refineries. Seamless steel sections will be essential for pipeline construction and infrastructure reinforcement as the world's energy demands continue to rise. The seamless steel sections will rise at a CAGR of 6.0% by 2035.

I-beams will continue to be an essential part of the construction industry due to their great load-bearing capacity and structural effectiveness. Constant demand will be generated by their extensive use in high-rise buildings, commercial buildings, and bridges. I-beams will continue to provide improved strength-to-weight ratios as steel manufacturing advances, allowing for more economical and environmentally friendly building options. I-beams will grow at a CAGR of 6.9% by 2035.

Large-scale projects needing exceptional strength and stability will use H-beams extensively. They are perfect for heavy machinery structures, bridges, and industrial buildings because of their wider flanges, which offer better support. Modern skylines and transportation networks will be significantly shaped by H-beams as industrialization grows and mega-infrastructure projects gain traction. H-beams will grow at a CAGR of 7.1% by 2035.

Channels will see an increase in demand in both commercial and residential construction due to their adaptability and simplicity of fabrication. These sections are essential to the real estate industry because they are used for building framing, reinforcement, and support structures. Their adoption in different regions will be further fueled by the trend toward modular construction and prefabricated building components. The section will rise at a CAGR of 6.3% during the forecast period.

Angles will remain crucial in steel frameworks as they provide stability and support in structural applications. They will rise to a CAGR of 6.0% by 2035. As infrastructure projects increase globally, their use in bridges, towers, and industrial plants will continue to be robust. High-strength, corrosion-resistant steel angles will become more and more in demand, especially in coastal and humid environments.

Hollow sections will become more popular in architectural and lightweight construction applications. Modern commercial buildings and creative bridge designs are among the aesthetically pleasing projects that benefit greatly from their high strength-to-weight ratio. Hollow sections will be used more often in environmentally and energy-efficient building techniques as sustainability and resource efficiency become top concerns. They will rise to a CAGR of 6.7% by 2035

Steel sections will continue to be in high demand due to residential buildings as housing projects grow and urbanization picks up speed. The use of steel in contemporary home construction will be encouraged by the desire for long-lasting and environmentally friendly building materials. The use of lightweight steel sections will be boosted by prefabricated housing and green building programs, especially in densely populated urban areas. They will rise to a CAGR of 6.2% by 2035

With rising investments in office buildings, shopping centers, and mixed-use projects, commercial buildings will continue to be a major area of growth. Steel sections will continue to be in high demand due to the need for flexible and strong building materials, especially in areas that are prone to earthquakes and strong winds. Long-term growth in this industry will be fueled by the development of business districts and smart city initiatives. They will rise to a CAGR of 6.7% by 2035

The need for steel sections for bridges and highways will increase as governments place a higher priority on infrastructure development. Large-scale transportation projects, such as railroad bridges and highway extensions, will need steel components that are strong and able to support heavy loads.

Using steel sections that are weatherproof and resistant to corrosion will guarantee long-lasting structures that require little maintenance, improving connectivity between areas. They will rise to a CAGR of 7.0% by 2035.

Steel sections are used extensively in industrial plants for storage facilities, machinery support, and structural frameworks. Demand in this industry will be maintained by the growth of logistics hubs, manufacturing hubs, and energy production facilities. The demand for precision-engineered steel components in cutting-edge industrial applications will only increase with the rise of automation and Industry 4.0. They will rise to a CAGR of 6.8% by 2035.

As oil and gas refineries depend on heavy-duty infrastructure, they will continue to be major end-users of steel sections. The demand for seamless and welded sections will be driven by the need for steel components that are resistant to corrosion and high pressure. Steel sections will remain essential for building pipelines, offshore rigs, and refinery expansions as the world's energy needs change and new extraction locations appear. They will rise to a CAGR of 5.9% by 2035.

The Global Steel Sections industry is moderately consolidated, with some big multinational players dominating substantial industry share and still leaving space for regional and specialist participants to compete competitively.

Leading players in the industry are mainly competing through a multi-faceted approach with an emphasis on technological advancement, strategic geographic growth, green manufacturing practices, and value-added differentiation of products. The major strategies are to invest in sophisticated manufacturing technologies, design high-strength and lightweight steel sections, and research green steel production processes.

Some recent developments in the industry:

Infrastructure projects, urbanization, and industrial expansion are key drivers.

Regulations on emissions, trade tariffs, and safety standards influence production and pricing.

Construction, transportation, oil and gas, and manufacturing lead in consumption.

Hot-rolled sections offer higher strength, while cold-formed ones provide precision and efficiency.

Recycling initiatives, carbon-neutral production, and green steel investments are shaping the future.

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Turbidimeter Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.