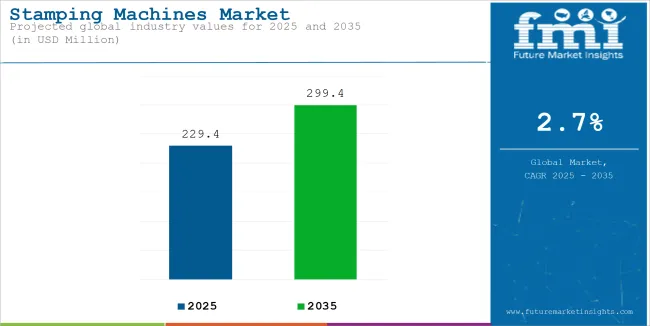

The global sales of stamping machines are estimated to be worth USD 229.4 million in 2025 and anticipated to reach a value of USD 299.4 million by 2035. Sales are projected to rise at a CAGR of 2.7% over the forecast period between 2025 and 2035. The revenue generated by stamping machines in 2024 was USD 226.0 million. The industry is anticipated to exhibit a Y-o-Y growth of 2.5% in 2025.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 226.0 million |

| Estimated Size, 2025 | USD 229.4 million |

| Projected Size, 2035 | USD 299.4 million |

| Value-based CAGR (2025 to 2035) | 2.7% |

The primary driving force for stamping machines by the automotive industry is due to the growing need for electric vehicles and lightweight high-strength parts. Ongoing production of electric vehicles by players such as Tesla, Ford, and BMW calls for more extensive heavy-duty stamping machines for creating large and intricate parts, for example, aluminum body panels, battery enclosures, and structural components with great precision. Some of the things that can be produced in cars more effectively and safely.

The requirement of such door panel, dashboard and trim parts amongst others by the one more growth segment of automotive interior stamping machine will fuel the market for stamping machines by the automobile industry worth USD 122 million in 2025 due to demands from the manufacturer for high end energy saving stamping technologies besides the new requirements in EV markets.

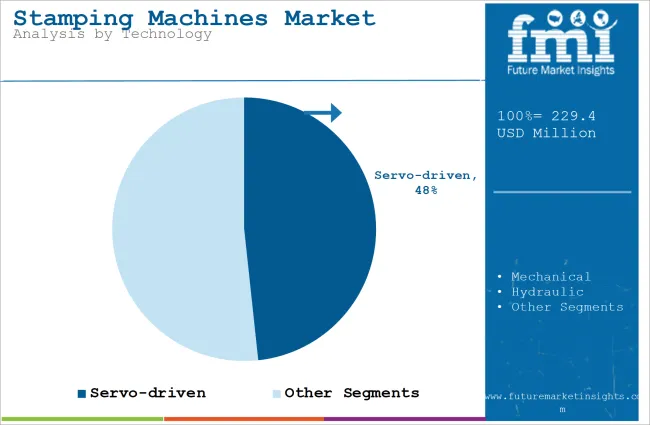

Servo-driven stamping machines have high demand because they provide energy efficiency and precision in various applications for the high-precision application within the automobile, electronics, and medical devices industries. There is a vast application of servo-driven stamping machines in complex components such as automotive body panels, battery enclosures for electric vehicles, and intricate parts used in medical device manufacturing.

Therefore, there is a notice of advancement regarding the control system, allowing potential adjustments for quick effect, savings in materials as well as saving material while at the same time keeping it relatively reduced in standby conditions.

Many functionalities can be covered in just a single machine resulting in more effectiveness in terms of operation. Thus, it is estimated to be around about USD 102.3 million by the year 2025 for the market of servo-driven stamping machines, based on the requirement of the production applications in automobile with lightweight parts, high-precision medical devices, and complex components for consumer electronics.

The below table presents the expected CAGR for the global stamping machines market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 2.0%, followed by a higher slight high growth rate of 3.4% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 2.0% (2024 to 2034) |

| H2 | 3.4% (2024 to 2034) |

| H1 | 1.9% (2025 to 2035) |

| H2 | 3.5% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease to 1.9% in the first half and increase to 3.5% in the second half. In the first half (H1) the market witnessed a decrease of 10 BPS while in the second half (H2), the market witnessed an increase of 10 BPS.

The section contains information about the leading segments in the industry. By application, automobiles are projected to grow at a CAGR of 2.2% through 2025 to 2035. Additionally, automotive end uses are predicted to grow at a CAGR of 2.5%.

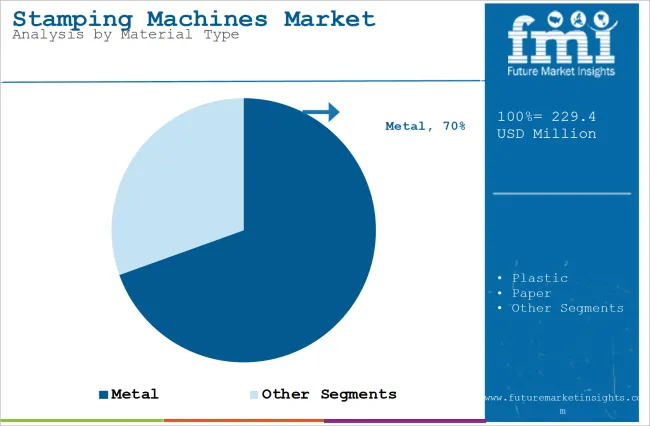

| Material Type | Metal |

|---|---|

| Value Share (2035) | 69.5% |

High-strength steel and aluminum will be the metals that will dominate the stamping machines market since these are very vital in the automobile, aerospace, and industrial sectors. In the automobile industry, there are several car manufacturers that rely on stamping machines to produce large and complex metal parts such as body panels, chassis, and structural elements, like Ford and Volkswagen.

These are critical for lightweight strength, such as that preferred by electric vehicles (EVs), where aluminum is increasingly used to make body panels and enclosures for the battery pack. High-strength steel stamping machines for safety-critical parts, such as crash-resistant parts, are also required.

Aerospace industry usage also includes metal stamping for aerospace precision parts and aircraft structure parts. As these industries remain focused on efficiency, safety, and lightweight materials, the metal segment will probably continue dominating the market.

| Technology | Servo-driven |

|---|---|

| Value Share (2035) | 48.3% |

Servo-driven stamping machines are the most preferred technology for the reason of delivering exceptional precision, flexibility, and energy efficiency. The machines are most valued in automotive, electronics, and medical devices, where the need for high-quality, intricate parts is imperative.

In the automotive sector, servo-driven machines are applied for the manufacturing of complex body panels and enclosures for the batteries of electric vehicles (EVs), for example, in places where accuracy and minimal waste is critical.

The advanced control system of servo-driven machines permits alteration in speed and force sufficiently rapidly to optimize production and avoid or reduce any time loss. Flexibility and high efficiency make them the first line of choice by manufacturers who try to meet that demand for mass production with much higher precision in minimal waste processes in various types of industries.

Rising Demand for Holographic Stamping Machines in Anti-Counterfeit Applications

Given the increasing production of luxury goods, pharmaceuticals, and government-issued documents, advanced stamping machines that could be used for the creation of holographic designs are required. The hologram is very effective as an anti-counterfeit because they cannot easily be duplicated, hence so important for security in products and documents.

For example, the Indian government adopted holographic stamps on excise and tax documents to avoid forgery and authenticity. This measure, therefore, fueled the need for stamping machines that would successfully create holographic features on paper, plastic, or foil. Most firms that produce secure documents, including passports, driving licenses or branded products, use such advanced stamping machines.

The future trends will be more security and authenticity needs of consumer goods and official documents, and the growth trend will be higher for holographic stamping machine in the future.

Automotive Shift to Electric Vehicles Drives Demand for Advanced Stamping Machines

Demand from the automotive industry for electric vehicles is the biggest driver for the demand of light and robust parts, many of which are stamped metal parts. Companies like Tesla have significantly increased the production level of their Model 3 EVs, and so the demand for precision stamping machines that can make large, complex metal parts with minimal waste has increased.

EVs require light weight for maximum energy efficiency, yet they also need parts that are strong enough to ensure the vehicle meets safety standards. One such mass application of stamped aluminum is in the use for body panels, structural members, and battery enclosures in EVs.

The strength-to-weight ratio makes them a good fit here. Industry reports that Tesla is producing lighter cars as an increase in stamping aluminum parts has made it more important for advanced stamping technologies. Not limited to Tesla, other manufacturers like Ford and General Motors are embracing stamping machines that can cater to the peculiar demands of making components for EVs, hence fueling the growth of the market.

Challenges of Stamping High-Strength Steel Impact Automotive and Construction Industries

For automotive and construction, high-strength steel (HSS) offers a whole new set of stamping machine challenges. HSS has become quite prominent in car body panels, structural components, and safety-related features because of its superior strength and durability. However, because of higher hardness, the material is difficult to stamp without a very high tool wear and deformation.

This process requires special dies and tools for installation on stamping machines. High force, which is often needed in forming HSS, may also compromise the material's integrity, thereby making it indispensable to have some tight control over stamping parameters. It typically means that more tools have to be changed and more money is spent on maintenance. Material deformation during stamping may also cause costly delays and problems with quality control.

Such factors do not come free, and thus the cost is imposed on the manufacturer in terms of operational cost, and also this restriction limits the mass use of stamping machines by industries relying more on HSS, which includes construction and automotive.

The global stamping machines industry recorded a CAGR of 1.5% during the historical period between 2020 and 2024. The growth of the stamping machines industry was positive as it reached a value of USD 226.0 million in 2024 from USD 213.0 million in 2020.

The global demand for light-weighted and durable parts continues to grow and is rising mainly from automotive, packaging, and consumer goods industries, thereby fueling the global market for stamping machines. Auto manufacturers, especially EVs, have increased their usage of stamping machines to produce high-precision metal parts like aluminum body panels and enclosures for the batteries.

Customized stamping solutions, for example, are on great demand among the packaging industry. Holographic stamping is becoming inevitable for luxury good and pharmaceutical counterfeiting prevention. Another dimension to the growing market has come in the direction of more energy-efficient, servo-driven stamping technology. So, it continues to be a manufacturing investment.

There are expected growth factors in stamping machines mainly associated with high complexity in the types of materials employed, for instance, HSS, with requirements for highly security and customization stamps across a broader business spectrum.

A higher stamping machine is envisaged, electric vehicles to cater to a far more complex item with an average amount of materials wasted during a stamping procedure. There is an increasing demand for stamping solutions in the production of eco-friendly packaging and secure government documents mainly because of rising regulatory pressure on counterfeiting and sustainability.

Innovation in stamping technologies will remain centered on automation, precision, and reduced downtime as companies continue to invest in highly specialized, high-precision systems to meet the changing needs of these industries.

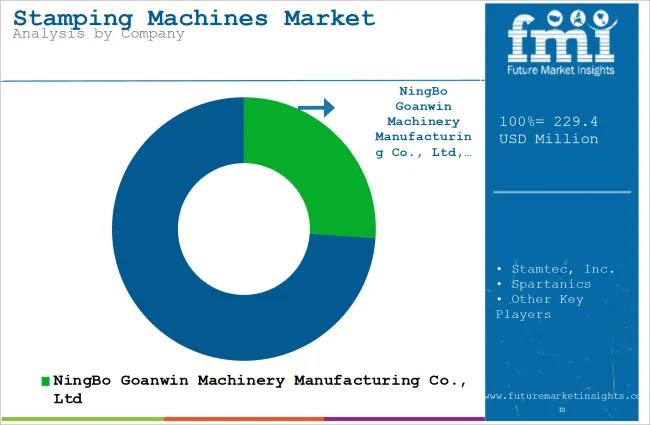

Tier 1 company leaders are characterized by high production technology and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within Tier 1 include Stamtec, Inc., Komatsu America Industries LLC, Aida Engineering, Ltd., and Amada America, Inc.

Tier 2 companies are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in Tier 2 include NingBo Goanwin Machinery Manufacturing Co., Ltd., Spartanics, Precision Machines & Automation, D&H Industries, Inc., Sanson Machinery, Innovative Automation, Inc., and Beckwood Corporation.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the industry analysis for the stamping machines market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. USA is anticipated to remain at the forefront in North America, with a CAGR of 3.1% through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 5.5% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.1% |

| Canada | 2.4% |

| Brazil | 4.0% |

| Argentina | 3.5% |

| Germany | 2.5% |

| China | 5.0% |

| India | 5.5% |

Automotive is one of the major end-use industries for the USA stamping machines market. The demand for lightweight and high-performance components is one of the primary growth drivers in this segment. Large automobile manufacturers such as General Motors and Ford are increasingly using advanced stamping machines to produce complex metal parts for electric vehicles (EVs).

For instance, Ford's electric SUV Mustang Mach-E is dependent on precision-stamped aluminum body panels. These require highly accurate stamping machines that would not weaken material strength by punching out complex shapes.

The additional requirement of HSS parts for structural beams and crash-resistant applications is further stimulating the demand for stamping machines that can adapt to increased hardness in these types of materials.

With constant development in improving the energy efficiency and safety standards for the automobile firm, it is highly crucial that the emphasis was on stamping technologies where reduction of waste increases the production speed. The big investment trend into servo-driven and robotic-assisted stamping systems will satisfy changing demands of the automotive industry in the USA.

The market of stamping machine in Germany strongly depends on the automotive sector with the precision part of luxury high-performance vehicles mainly. Companies, such as BMW and Mercedes-Benz, play a leading role in adopting such advanced stamping technologies in order to manufacture quite complex components - body panels, structural parts, and chassis components.

These car firms utilize stamping machines to create light yet very strong aluminum and high-strength steel (HSS) parts, which play an important role in achieving a high safety standard capability and good fuel efficiency. BMW, for instance, that built the 7 Series sedan needs to have a very precise stamping process wherein relatively complex metal parts can be produced with minimal waste amounts and high material integrity.

Electric vehicles rise in Germany, giving them the upper hand, and consequent demand for those specialized stamping machines that can produce large and complex parts such as in the enclosures that house batteries or any other specific vehicle components. Therefore, with a focus on automation and use of servo-driven systems, manufacturers will be forced to take it further by increasing efficiency and reducing downtime in stamping.

Key players operating in the stamping machines market are investing in the development of innovative sustainable solutions and also entering into partnerships. Key stamping machines providers have also been acquiring smaller players to grow their presence to further penetrate the stamping machines market across multiple regions.

Recent Industry Developments in the Stamping Machines Market

In August 2024, The micro precision stamping company Ditron, Inc. (“Ditron” or the “Company”) was acquired by CORE portfolio company PrecisionX Group, according to a statement released by CORE Industrial Partners, a private equity group that focuses on manufacturing, industrial technology, industrial services, and consumer goods.

In terms of material type, the industry is divided into below metal, plastic, paper, and foil.

In terms of technology type, the industry is segregated into mechanical, hydraulic, and servo-driven.

By application, the market is divided into paper & plastic cards, ribbons, holograms, automobiles, and packaging.

The market is classified by end use such as food and beverages, automotive, building & construction, cosmetics and personal care, military and other security purposes, and pharmaceuticals and medical devices.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa have been covered in the report.

The global stamping machines industry is projected to witness CAGR of 2.7% between 2025 and 2035.

The global stamping machines industry stood at USD 226.0 million in 2024.

The global stamping machines industry is anticipated to reach USD 299.4 million by 2035 end.

South Asia & Pacific region is set to record the highest CAGR of 3.4% in the assessment period.

The key players operating in the global stamping machines industry include NingBo Goanwin Machinery Manufacturing Co., Ltd, Stamtec, Inc., Spartanics, Precision Machines & Automation, D&H Industries, Inc., and Sanson Machinery.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hot Stamping Foil Market Size and Share Forecast Outlook 2025 to 2035

Metal Stampings, Forgings, and Castings Market Growth – Trends & Forecast 2025 to 2035

Metal Stampings Market Growth - Trends & Forecast 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Market Growth - Trends & Forecast 2025 to 2035

Pigment Hot Stamping Foil Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Pigment Hot Stamping Foil Manufacturers

Metallic Hot Stamping Foils Market

Lathe Machines Market

Sorter Machines Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Spinning Machines Market Size and Share Forecast Outlook 2025 to 2035

Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Twist Tie Machines Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA