The global stainless steel welded pipe market is projected to grow at a CAGR of 5.0%, reaching USD 34 billion by 2035. The growth of the market is mainly attributed to the increased adoption of corrosion-resistant and durable stainless steel pipes across various industries such as construction, oil & gas, petrochemicals, and water distribution.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 34 billion |

| CAGR during the period 2025 to 2035 | 5.0% |

Industrial infrastructure modernization, fast urbanization, and stringent regulatory norms regarding sustainable pipeline solutions have experienced growth in the adoption of stainless steel welded pipes. The focus on light-weight, high-strength piping systems in automotive as well as power generation applications has also driven growth in this market.

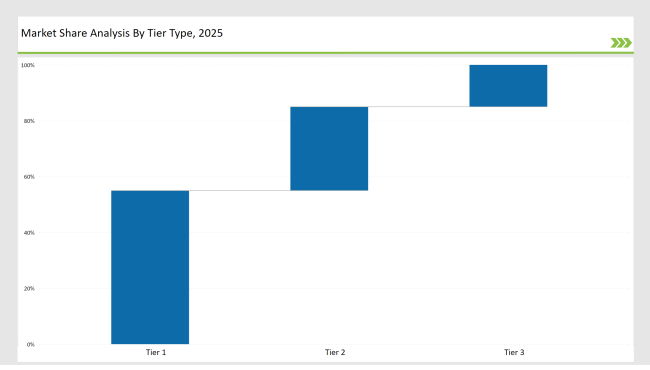

The market remains moderately consolidated, with Tier 1 players (Sandvik AB, ArcelorMittal S.A., Nippon Steel Corporation, Outokumpu Oyj, and ThyssenKrupp AG) collectively holding 57% of the market share. Among grade classifications, the 300 series dominates with a 43% market share, while by application, oil and gas applications lead with 32% market demand, due to the high-pressure handling and corrosion-resistant properties of stainless steel welded pipes.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

| Category | Industry Share (%) |

|---|---|

| Top 3 Players (Sandvik AB, ArcelorMittal S.A., Nippon Steel Corporation) | 32% |

| Next 2 of 5 Players (Outokumpu Oyj, ThyssenKrupp AG) | 38% |

| Rest of the Top 10 | 30% |

The market is fairly consolidated, with leading firms investing in lightweight stainless steel alloys, advanced welding techniques, and high-strength corrosion-resistant pipes for industrial applications.

Several key players contributed to market advancements in 2024

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier | Examples |

|---|---|

| Tier 1 | Sandvik AB, ArcelorMittal S.A., Nippon Steel Corporation |

| Tier 2 | Outokumpu Oyj, ThyssenKrupp AG |

| Tier 3 | Regional and niche players |

Increased Demand for Corrosion-Resistant Stainless Steel Piping

Advanced anti-corrosive stainless steel grades are being developed for oil & gas, chemical, and power industries.

Expansion of Smart Piping Systems

AI-driven leak detection, corrosion monitoring, and real-time fluid analysis are improving pipeline management.

Growth in Modular and Prefabricated Stainless Steel Piping Solutions

Industries are adopting modular welded pipe systems for quick installation and reduced maintenance costs.

Technological Advancements in Welding and Fabrication Techniques

Advanced laser welding, orbital welding, and automated precision bending are enhancing the efficiency of stainless steel pipe manufacturing.

| Company | Initiative |

|---|---|

| Sandvik AB | Developed nickel-based stainless steel welded pipes for offshore oil extraction. |

| ArcelorMittal S.A. | Launched 900 series stainless steel pipes for high-temperature industrial use. |

| Nippon Steel Corporation | Introduced high-strength stainless steel pipes for automotive applications. |

| Outokumpu Oyj | Expanded pipeline-grade stainless steel solutions for petrochemical industries. |

| ThyssenKrupp AG | Focused on municipal water distribution stainless steel piping solutions. |

Invest in Advanced Welding Technologies for Enhanced Performance

Innovations in welding techniques, such as laser and friction stir welding, are improving the strength, precision, and reliability of stainless steel welded pipes. These advancements enhance efficiency, reduce defects, and support critical applications in oil & gas, construction, and manufacturing.

Expand High-Capacity Stainless Steel Pipe Production Facilities

Scaling up stainless steel welded pipe manufacturing ensures higher output to meet growing industry demands. Advanced production lines improve consistency, reduce lead times, and offer cost-effective solutions for industries requiring durable and corrosion-resistant piping systems.

Enhance Corrosion-Resistant Coatings for Extreme Environments

Developing superior coatings, such as epoxy and powder coatings, extends the lifespan of stainless steel welded pipes. These coatings enhance durability in harsh environments, making them ideal for offshore oil rigs, chemical plants, and infrastructure projects.

Target Growth in Oil & Gas, Petrochemical, and Industrial Sectors

Expanding stainless steel welded pipe applications in oil & gas, petrochemicals, and industrial projects capitalizes on rising demand for high-strength, corrosion-resistant materials, ensuring reliable performance in critical operations and long-term infrastructure development.

The stainless steel welded pipe market will change due to the developments in welding automation, smart monitoring systems, and high-performance alloys by 2035. Production efficiency, material waste, and the overall quality of welded pipes will be improved as a result of these innovations.

Automated welding technologies will include laser and friction stir welding to ensure the joints are highly accurate and defect-free, and real-time monitoring systems will enhance production by detecting errors and reducing failure rates.

An important shift towards digitally manufactured and predictively maintained equipment is likely to give the industry further change. IoT-enabled sensors and AI-driven quality control systems will help manufacturers monitor the performance of pipes, predict potential failures, and adjust maintenance cycles. The demand for strong, corrosion-resistant stainless steel grades is likely to increase as various industries require high-quality oil & gas, petrochemical, and infrastructure applications.

Sandvik AB, ArcelorMittal S.A., Nippon Steel Corporation holds significant share in stainless steel welded pipe market.

300 series is dominating the grade segment in stainless steel welded pipe market.

Regional and domestic companies hold nearly 35% of the overall market.

Market is fairly consolidated, representing top 10 players commanding significant share in the market.

Oil and Gas companies offers a significant growth potential to the market players.

Explore Automation Auxiliary Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.