In 2024, the Stainless Steel Control Valve industry witnessed moderate yet steady growth, largely driven by increased demand across key industrial sectors such as oil and gas, water treatment, chemicals, and power generation.

Notably, the industry observed a significant uptick in demand from the oil and gas industry, where increased upstream exploration activities and infrastructure investments fueled the need for durable, high-performance valves. The chemical and petrochemical sectors also contributed to this growth due to the rising adoption of automated systems requiring highly reliable control valves.

On the technological front, 2024 saw advancements in valve design, with manufacturers incorporating more robust materials and enhanced corrosion resistance features, making this industry a top choice for critical applications. Additionally, some key players introduced smart valves equipped with IoT connectivity, improving monitoring and control capabilities, especially in industries with high safety standards.

Looking ahead to 2025 and beyond, the industry is expected to experience continued growth at a steady pace, with a forecasted CAGR of 5.9% with a value of USD 1,127.6 million. The accelerating trend toward industrial automation and the ongoing shift to more sustainable, energy-efficient solutions will further drive demand.

Moreover, industries such as pharmaceuticals and food processing are anticipated to increase investments in advanced control valve systems, expanding the industry's reach. Additionally, stringent regulatory standards for operational safety and reliability will likely boost the demand for high-quality stainless steel control valves.

Key Market Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 768.7 Million |

| Industry Value (2035F) | USD 1,127.6 Million |

| CAGR (2023 to 2033) | 5.9% |

Explore FMI!

Book a free demo

Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, industrial operators, and regulators in the USA, Western Europe, Japan, and South Korea

Regional Variance

High Variance

Convergent and Divergent Perspectives on ROI

75% of USA stakeholders viewed smart control valves as a worthwhile investment due to enhanced operational efficiency, while only 40% in Japan favoured traditional, mechanical valves.

Consensus

Stainless Steel Alloys: Selected by 80% globally for their corrosion resistance, strength, and ability to withstand extreme temperatures and pressures.

Variance

Shared Challenges

83% cited increasing raw material prices and supply chain disruptions as a primary concern.

Regional Differences

Manufacturers

Distributors

End-Users (Industrial Operators)

Alignment

70% of global manufacturers plan to invest in automated, IoT-enabled stainless steel control valves to enhance operational efficiency and predictive maintenance.

Divergence

High Consensus

Durability, compliance, and cost efficiency remain top priorities across the globe.

Key Variances

Strategic Insight

A regional approach is crucial for success. Emphasizing automation and smart technologies in the USA, sustainability in Europe, and cost-effective, compact designs in Japan and South Korea will allow manufacturers to tailor their offerings and capture diverse industry segments effectively.

| Countries | Government Regulations and Policies Impacting the Market |

|---|---|

| USA |

|

| UK |

|

| France |

|

| Germany |

|

| Italy |

|

| South Korea |

|

| Japan |

|

| China |

|

| Australia-NZ |

|

| India |

|

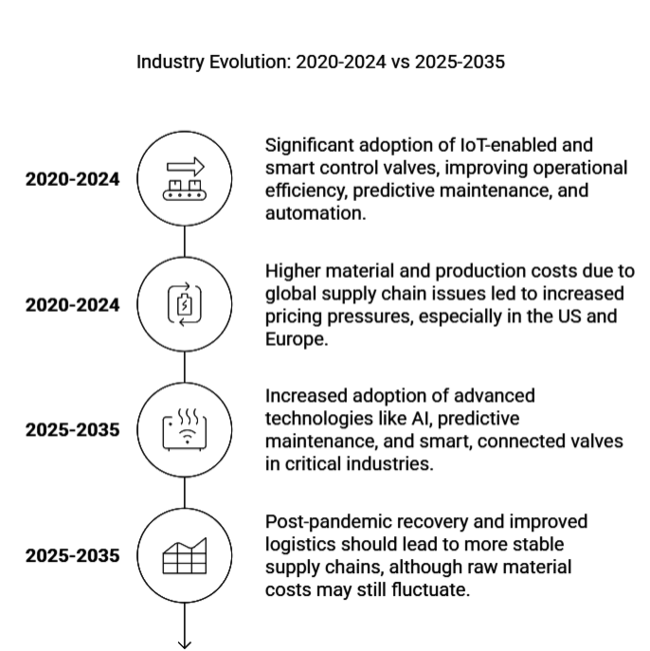

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry experienced steady growth, driven by demand from the oil & gas, chemical, water treatment, and power generation industries. | The industry is expected to expand at a CAGR of 5.9%, driven by industrial automation, increasing demand for energy-efficient solutions, and regulatory pressure. |

| Significant adoption of IoT-enabled and smart control valves, improving operational efficiency, predictive maintenance, and automation. | Increased adoption of advanced technologies like AI, predictive maintenance, and smart, connected valves in critical industries. |

| The COVID-19 pandemic caused production delays and disruptions in global supply chains, impacting valve manufacturing and distribution. | Post-pandemic recovery and improved logistics should lead to more stable supply chains, although raw material costs may still fluctuate. |

| Compliance with environmental and safety standards (e.g., EPA, CE marking, ATEX) was a key driver for demand, particularly in Europe and North America. | Increasingly stringent safety, environmental, and performance standards across regions (e.g., stricter EU emissions and safety policies). |

| Higher material and production costs due to global supply chain issues led to increased pricing pressures, especially in the USA and Europe. | While price sensitivity will remain, the trend toward automation and smart solutions will drive value-based pricing, especially in developed industries. |

| High adoption rates in developed regions (USA, Europe) for advanced, energy-efficient valves, while cost sensitivity in Asia led to slower uptake of newer technologies. | Greater penetration in Asia and developing industries as industries increasingly prioritize reliability, safety, and regulatory compliance, driving adoption. |

| Stainless steel remained the material of choice due to its durability, corrosion resistance, and ability to handle extreme conditions. | Demand for high-performance stainless-steel alloys (e.g., duplex) will grow, especially for highly corrosive and extreme temperature applications. |

| Demand was concentrated in industries like oil & gas, water treatment, and chemicals, with growing interest in automation and digital controls. | Expansion of demand into new sectors like pharmaceuticals, food processing, and semiconductor industries, with increased focus on automation. |

In the Stainless Steel Control Valve industry, pneumatic actuators dominate due to their reliability and versatility across industries like oil and gas, chemicals, and water treatment. However, electric actuators are seeing rapid growth due to their precision, lower maintenance, and compatibility with automation and smart systems.

Electric actuators are expected to grow the fastest as industries increasingly adopt automation, IoT, and real-time monitoring capabilities. Hydraulic actuators, though used in high-force applications, remain a smaller segment due to their complexity and higher costs. Rising environmental regulations and the push for energy efficiency are further accelerating the shift toward electric actuators.

The key valve types in this industry include globe valves, ball valves, gate valves, and check valves. Globe valves are favored for their ability to provide precise flow control, making them particularly suitable for applications in chemical processing and power generation. Ball valves, increasingly popular for on/off applications, are growing due to their compact design and ease of maintenance.

While globe valves will continue to dominate, the ball valve segment is expected to experience the highest growth, driven by the demand for efficient, space-saving, and energy-efficient solutions. Rising automation, stricter regulations, and advancements in smart valve technologies further fuel industry expansion.

The Stainless Steel Control Valve industry is driven by applications in oil and gas, chemicals, water treatment, power generation, and pharmaceuticals. The oil and gas sector remains a major consumer, while water treatment grows due to the demand for durable and corrosion-resistant valves. Rapidly-growing sectors like pharmaceuticals and food processing are driving the highest growth, thanks to regulatory demands for precision, hygiene, and automation.

Though oil and gas will remain key, sectors like pharmaceuticals and food processing are expected to outpace others in growth rates. Increasing adoption of smart valves, IoT integration, and sustainability initiatives further accelerate market expansion.

The stainless-steel valve industry in the United States is expected to grow at a CAGR of 4.8% from 2025 to 2035. Key growth drivers in the country include the continued expansion of the oil and gas sector, particularly in shale oil extraction, which requires durable and high-performance valves.

Additionally, increased investments in water treatment infrastructure and power generation plants are fuelling demand for reliable control valves. Regulatory pressures, such as stricter emissions standards and safety regulations, further push industries toward adopting advanced, energy-efficient valve solutions.

The integration of smart technologies, IoT, and automation in manufacturing processes is expected to drive growth, enabling predictive maintenance and improved system efficiencies. Despite steady growth, the USA industry faces challenges from cost pressures, supply chain disruptions, and a maturing industrial landscape.

Sales in the United Kingdom are anticipated to grow at a CAGR of 3.4% from 2025 to 2035.A key driver of growth in the UK is the stringent environmental and safety regulations they work within - particularly in critical sectors such as water treatment, chemical processing and power generation.

The need for energy efficiencies and sustainable solutions in all industries encouraged the government to push the demand for low-power valve technologies. Upgrading water systems and renewable energy are examples of types of infrastructure projects that will drive demand for stainless steel control valves to remain steady, but growth is slow due to stringent regulations as well as a trend towards cost-effective solutions in some more minor industries.

The Chinese industry is projected to grow at a strong CAGR of 7.4% by 2025 to 2035. This growth will be primarily driven by the country’s rapid industrialization and infrastructure construction focus. High-performance control valves are in increasing demand in the key industries of chemicals, oil and gas, and water treatment, among others.

The Chinese government's investment in smart manufacturing, automation, cleaner energy, and stricter environmental regulations is driving up demand for stainless steel valves. Moreover, a rise in China’s middle class and urbanization are pressuring the need for upgraded infrastructure, especially in wastewater treatment and power generation, driving a steady increase in valve demand.

Japan industry is projected to grow at 6.1% CAGR through 2025 to 2035. Demand will continue to be driven mainly by Japan's industrial sectors, especially electronics and automotive and chemical manufacturing. Furthermore, since the country focuses on precision and quality control systems, coupled with sustainable and energy-efficient solutions, the adoption of advanced valve technologies is facilitated.

The aging infrastructure in Japan and a commitment to environmental regulations also contribute to the demand for durable, high-performance valves in water treatment and power generation. The continued drive towards industrial automation and the growth of the smart factory helps support greater industry growth via greater monitoring of systems for preventative maintenance of reported faults.

The industry in South Korea is projected to grow at a compound annual growth rate (CAGR) of 6.4% during the period 2025 to 2035. This growth is largely tied to the country's booming heavy industries such as semiconductor manufacturing, petrochemical, and automotive. These Industries are Investing In Automation, which Increase Demand of High-Performance Control Valves to Maintain Precision & Reliability of Critical System Behind It.

The government of South Korea is also placing a strong emphasis on improving energy efficiency and sustainability within sectors, thus fostering an ideal platform for the proliferation of advanced valve solutions. Ongoing growth in infrastructure projects across urbanization and water treatment will also underpin demand for durable, corrosion-resistant stainless-steel valves.

The industry in France is projected to achieve a stable CAGR of 5.9%. The high-quality control valves demand will be driven by France’s healthy industrial sectors as well including energy, chemical processing, and manufacturing. Government regulations on sustainability and minimizing emissions will continue to drive industries toward adopting more energy-efficient valve technologies.

Decarbonization policies and plans in France (with a focus on wind and solar energy) will further drive demand for advanced valve solutions in the power generation sector as well. The country’s commitment to renewing infrastructure, including modernizing water treatment facilities, will drive growth in the industry as well.

Germany’s stainless steel valve industry is forecast to grow at a CAGR of 5.9% from 2025 to 2035. As one of the largest industrial hubs in Europe, Germany’s strong manufacturing and chemical sectors drive demand for stainless steel valves. The country’s focus on sustainability and green energy, backed by stringent environmental regulations, is encouraging industries to invest in more energy-efficient and environmentally friendly valve solutions.

Additionally, the German industry is benefiting from increased automation in manufacturing and industrial processes, driving the need for smart and precise control valves. The ongoing need for infrastructure upgrades, particularly in water treatment and power generation, will further support the industry's expansion.

The stainless-steel valve industry in Italy is projected to grow at a CAGR of 5.9% from 2025 to 2035. Italy’s manufacturing sector, which includes automotive, chemical processing, and energy, remains a key driver for valve demand. The country’s push for sustainability and energy efficiency, in line with European Union regulations, supports the growth of advanced control valve technologies.

Moreover, Italy’s need to upgrade its aging infrastructure, especially in water management and power generation, will drive further demand. As automation and IoT technologies continue to evolve, Italian industries will increasingly adopt smart, connected valve solutions to optimize system performance and maintenance.

The stainless-steel valve industry in Australia and New Zealand is expected to grow at a CAGR of 5.9% from 2025 to 2035. The demand for stainless steel valves in these countries is driven by key industries such as mining, oil and gas, and water treatment. With a growing focus on sustainability and energy efficiency, Australian and New Zealand industries are adopting more advanced valve solutions, including those with IoT and automation capabilities.

Additionally, the countries’ emphasis on upgrading their infrastructure, particularly in water and wastewater treatment facilities, will drive the need for durable and corrosion-resistant stainless-steel valves. The industry growth will also be supported by the expansion of renewable energy projects, requiring efficient control valves for power generation systems. The increasing need for advanced, high-performance valves in agricultural applications and smart technologies will continue to drive demand in these regions.

The stainless-steel valve industry is competitive, with major players like Emerson Electric Co., Flowserve Corporation, Kitz Corporation, IMI Plc, and Schneider Electric dominating the sector. Emerson continues to hold a strong position, driven by innovations in automation and smart valve technologies. Flowserve, with its wide product range, focuses on industrial and oil and gas sectors, while IMI Plc maintains a robust presence in Europe, offering advanced valve solutions for various industries.

In 2024, Flowserve Corporation expanded its industry presence through the acquisition of Nova Rotary Engineering, a move to bolster its position in the oil and gas industry, particularly in the Middle East and Asia-Pacific. This acquisition complements Flowserve's existing valve portfolio, enabling it to offer more comprehensive solutions. (Source: Flowserve Press Release, January 2024).

Emerson Electric Co. partnered with Schneider Electric in 2024 to integrate control valve solutions with Schneider’s EcoStruxure automation platform. This collaboration focuses on improving efficiency and performance for industries such as chemical processing, with a clear emphasis on digital transformation and IoT-enabled solutions. (Source: Emerson Press Release, February 2024).

Kitz Corporation unveiled a new series of high-performance stainless steel ball valves in 2024. Designed for the chemical and petrochemical industries, these valves feature advanced corrosion-resistant coatings, enhancing durability. The new products cater to emerging industries in Southeast Asia, where demand for such advanced valves is rising. (Source: Kitz Corporation Press Release, March 2024).

IMI Plc introduced a new range of automated control valves in 2024. These valves are integrated with digital controllers that use predictive analytics for real-time monitoring. This innovation targets industries requiring high precision, such as aerospace and energy, reinforcing IMI’s leadership in smart valve technologies. (Source: IMI Plc Annual Report, April 2024).

Schneider Electric focused on expanding its presence in the Asia-Pacific region, especially in China and India, by offering localized stainless steel valve solutions. This expansion strategy is part of Schneider’s broader effort to capture a larger share of the rapidly growing industrial industries in these countries.

These developments reflect a trend of innovation and geographic expansion, as leading valve manufacturers invest in automation, digital solutions, and strategic acquisitions to meet the evolving needs of industries worldwide.

Industry Share Analysis

Emerson Electric Co.

Estimated Share: ~20-25%

A global leader in automation, Emerson dominates with its Fisher brand. Focuses on digital valve technologies and IoT integration, serving oil and gas, chemical, and power generation industries.

Armstrong International Inc.

Estimated Share: ~5-8%

Specializes in steam and fluid control solutions. Focuses on energy efficiency and sustainability, serving pharmaceuticals, food and beverage, and HVAC industries.

Christian Burkert GmbH & Co. KG.

Estimated Share: ~3-5%

Provides precision stainless steel valves for pharmaceutical, chemical, and food industries. Known for automation and hygienic design in critical applications.

Pentair Plc.

Estimated Share: ~6-9%

Offers stainless steel valves for water treatment, energy, and industrial applications. Focuses on sustainable solutions and advanced technologies.

General Electric Co.

Estimated Share: ~7-10%

Provides high-performance valves for oil and gas, power generation, and water treatment. Focuses on digital solutions and predictive maintenance.

Samson AG

Estimated Share: ~5-8%

Specializes in control valve technology for chemical, petrochemical, and power generation industries. Known for innovation and quality.

Richard Industries, Inc.

Estimated Share: ~2-4%

Focuses on precision-engineered valves for pharmaceutical, food and beverage, and chemical industries. Emphasizes hygienic design and compliance.

Schlumberger (Now SLB)

Estimated Share: ~10-15%

Provides advanced control valves for oil and gas through its Cameron division. Focuses on digital transformation and offshore energy solutions.

CIRCOR International Inc.

Estimated Share: ~4-6%

Offers stainless steel valves for energy, aerospace, and industrial industries. Known for innovation and customer-specific solutions.

Flowserve Corporation

Estimated Share: ~15 to 20%

A leading provider of high-performance valves for oil and gas, chemical, and water treatment. Focuses on sustainability and strong aftermarket services.

The Stainless Steel Control Valve industry falls under the broader industrial valves category, which encompasses the design, manufacturing, and application of valves used to regulate the flow of fluids and gases across various industries, including oil and gas, chemical processing, power generation, water treatment, and manufacturing.

From a macroeconomic perspective, the industry is influenced by global industrialization, urbanization, and infrastructure development. As industries increasingly focus on automation and digital transformation, the demand for high-performance, durable control valves rises, especially for sectors requiring precise fluid regulation. Growth in renewable energy, environmental regulations promoting sustainability, and investments in aging infrastructure further boost industry demand.

Additionally, rising industrial safety standards and the adoption of IoT and smart technologies are key drivers. Economic fluctuations, such as raw material price variations and supply chain disruptions, may pose challenges, but overall, the industry is expected to expand steadily due to its essential role in critical industrial processes.

This industry is experiencing growth driven by advancements in automation and the increasing demand for precise fluid regulation across various industries. Industries such as oil and gas, chemical processing, and power generation are investing heavily in automation and digitalization, driving the need for high-performance control valves.

The shift toward smart manufacturing and IoT-enabled systems is enhancing operational efficiency, making advanced control valves integral to modern industrial processes. Furthermore, the rising focus on sustainability and energy efficiency is pushing the adoption of corrosion-resistant, durable valves, especially in industries like water treatment and renewable energy.

To seize these opportunities, companies should focus on developing IoT-integrated valve solutions that offer real-time monitoring and predictive maintenance capabilities. Innovation in energy-efficient and corrosion-resistant materials will be crucial to meeting evolving environmental regulations.

Expanding into emerging industries, particularly in Asia-Pacific and Africa, where industrialization is rapidly growing, presents significant potential. Additionally, building strategic partnerships with automation technology firms and enhancing regional manufacturing capabilities will strengthen industry position and ensure faster delivery times. By addressing these trends, stakeholders can capitalize on the expanding demand for stainless steel control valves.

Automation, IoT integration, precision flow control, energy efficiency, and sustainability are key drivers.

Oil and gas, chemical processing, power generation, water treatment, and renewable energy industries benefit most.

Durability, corrosion resistance, precise flow regulation, and reliability in harsh environments.

Advancements in automation, IoT, and predictive maintenance improve efficiency and enable real-time monitoring.

Corrosion resistance, high temperature tolerance, durability, and reduced maintenance costs.

The industry is divided into manual control valves, pneumatic control Valves, hydraulic control valves, electric control valves

The landscape is segmented into ball control valves, butterfly control valves, cryogenic control valves, globe control valves, others

It is divided into power generation, oil and gas, chemical industry, semiconductor and electronics manufacturing, wastewater management, others

The industry is studied across into North America, Latin America, Europe, Asia Pacific, The Middle East & Africa (MEA)

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Western Europe Cathodic Protection Market Trend Analysis Based on Solution, Type, Application, and Countries 2025 to 2035

Western Europe Electric Sub-Meter Market Analysis by Product, Phase, Application and Country: Forecast for 2025 to 2035

Japan Electric Sub-Meter Market Analysis & Forecast by Product, Phase, Application, and Region Through 2035

India Vibration Isolation System Market Analysis & Forecast by Product Type, End-Use and Region through 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.