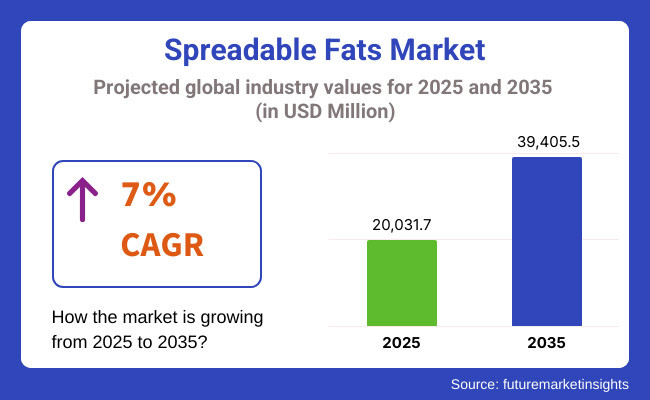

Global spreadable fats market was USD 17,637.8 million in 2023. Year-over-year consumption of spreadable fats increased 4.5% in 2024, therefore the global market will be USD 20,031.7 million in 2025. Global sales will have a 7% CAGR and worth USD 39,405.5 million through 2025 to 2035.

There are numerous drivers pushing spreadable fats into the limelight. Expansion resulted from increased demand for natural, organic, and reduced-fat margarine and butter. Healthy foods are still in vogue, and lower-calorie items, reduced-trans fat foods, and natural foods continue to be highly sought after. Smart Balance and Earth Balance ride on the trend with non-GMO, organic, and plant-based products to appeal to health-focused consumers.

Second, convenience is one of the contributors to the success of the industry because people just love products that are convenient and do not need to be processed further. The demand for spreadable to be applied on bread, crackers, and other foods directly without processing has helped widen the market for spreadable fats.

Apart from this, increasing demand for plant-based alternative versions of standard margarine and butter is propelling market forces. Plant-based components such as olive oil and avocado fats are on a trend on a mass level and are being incorporated into spread fat products for supporting vegan and dairy-free consumers.

As a case, companies like Flora and Stork are embracing recycles packaging and promoting sustainable procurement of the ingredients. The shift to sustainability is prompted by increasing consumer demands for green and responsible products.

The below table is a comparative study of variation in six-months CAGR from the base year (2024) to the current year (2025) for the spreadable fats market globally.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.5% |

| H2 (2024 to 2034) | 6.8% |

| H1 (2025 to 2035) | 6.8% |

| H2 (2025 to 2035) | 7.0% |

The analysis presented below gives significant variations in performance and indicates trends in realization of revenue, hence giving a better insight to stakeholders about the growth trend for the year. Half-yearly, or H1, is January-June. The second half, H2, is July-December.

The firm during the first half (H1) of the period 2025 to 2035 would be expanding at the CAGR of 6.8%, whereas during the second half (H2) of the period the expansion would be higher at the rate of 7.0%. Looking ahead to the next horizon, H1 2025 to H2 2035, the industry CAGR will rise to 6.8% in H1 and would be very high at 7.0% in H2. In H1, there was an industry expansion of 30 BPS and a company decline of 20 BPS in H2.

Spreadable fats business is transforming with changing consumer attitudes, one certain trend being vegetable-based, natural, and healthy foods. These trends would have to be pursued by the manufacturers with new products hitting the lines based on consumer demands for health as well as sustainability. Survival in the face of challenges in the form of perception for health as well as competition will be crucial for long-term growth in the business.

Global Leaders - They are leaders in brands with high brand equity, widespread distribution channels, and sophisticated product innovation. They lead the retail, foodservice, and industrial supply chains with a broad sweep of spreadable fat offerings. Unilever PLC (UK/Netherlands), As leaders in vegetable spreads and margarine globally, Unilever brands such as Becel, Rama, and Flora belong to the group.

The company has moved towards non-dairy, healthier, and sustainable spreads in response to customers' requirements for functional and clean-label spreads. Arla Foods (Denmark), Known for its superior dairy spreads, Arla makes functional and butter-based spreads under the Lurpak and Buko brands. Arla takes premium, natural ingredients and sustainable milk farming to establish and develop its leadership in Europe and international markets.

Regional Powerhouses - Successful homegrown players, competing level by level with global players with a focus on local taste, functional products, and specialty spreads. Lactalis Group (France), Lactalis, through the brands President and Galbani, provides a range of butter and spread cheese items.

Lactalis boasts wide distribution channels across Europe, North America, and Asia and supplies customers seeking high-quality dairy spreads. Britannia Industries (India), India's biggest dairy and bakery player, Britannia sells spreadable butter, ghee spreads, and margarine under its Dairy and NutriChoice brands. Low price positioning and intensive retail penetration are used.

Emerging Innovators - They are inclined toward innovation, plant-based, and organic ingredients targeting health-aware, vegan, and gourmet consumers. Miyoko's Creamery (USA), one of the leaders in the vegan butter sector, Miyoko's Creamery formulates plant-based, organic, and artisanal dairy replacers by processes based on cashew-based and fermented cultures.

They cater to upscale plant-based consumers. Naturli’ Foods (Denmark), Specializing in vegan and organic spreads, Naturli’ offers dairy-free butter alternatives made from almonds, shea, and coconut oils. The brand is expanding its footprint in European and global plant-based markets.

Increased Demand for Plant-Based & Dairy-Free Alternatives

Shift: The global shift towards ethical consumerism, veganism, and lactose intolerance is propelling the demand for vegan spreadable fats. Lactose-free butter substitutes like those made with soy, nut, oat, coconut, and avocado oils are being consumed by consumers in huge quantities. In a 2023 survey, it was found that 67% of millennials are consuming plant-based substitutes. The trend has support from concerns of animal welfare, the environment, and health hazards in the form of dairy consumption.

Secondly, health-consumer and flexitarian segments also embrace the plant-based spread into their practice although they shall never abandon dairy completely. Plant-based spread trend in Europe and North America is on the rise since in-store dairy-free sales are on the increase. Soya-based spread is trendy in Asia since the product is culturally compliant and nourishes.

Strategic Response: Miyoko's Creamery launched cashew-based butter that mimics dairy butter in texture and taste and achieved a 40% expansion of the USA market.Upfield (Flora, Becel) shifted to 100% plant-based spreads free of dairy residues to appeal to the vegan and flexitarian culture.

Country Crock launched a line of plant butters made with avocado and olive oils and realized a 20% first-year sales growth. Violife and Nutiva moved into the sunflower oil and coconut oil-based spreads market to serve keto diet and nut allergy consumers. Tesco and Whole Foods supermarket retailers offered extra shelf space for vegan and dairy-free spreads based on demand for healthy futures.

Health & Wellness-Driven Reformulations

Shift: Today's consumers are more interested in heart health, weight, and functional nutrition and, therefore, are looking for cholesterol-lowering, omega-enriched, and fortified spread fats. Due to growing cardiovascular diseases, 72% of today's consumers worldwide are searching for functional foods that promote well-being. It is also driven by government policy against trans fat and compulsory nutrition labeling laws.

Therefore, low-fat, trans-fat-free, and cholesterol-lowering spreads containing plant sterols, omega-3s, probiotics, and vitamins are gaining momentum. In the USA, Benecol plant sterol spreads lowered LDL cholesterol by 12% in frequent consumers without side effects. Similarly, omega-3-supplemented spreads appeal to aging baby boomers and health-conscious millennials eager to reduce heart disease risk.

Strategic Response: Benecol launched a plant sterol spread that was clinically shown to reduce cholesterol, and the outcome was 22% market share increase. Smart Balance redesigned margarine with additional healthy monounsaturated fat, attracting weight-watchers concerned about health.

Flora ProActiv launched omega-3-enriched spreads to target heart health-conscious consumers and drive sales up by 18% in Europe. Nutiva coconut spread has MCT oil, of special interest to paleo and keto diet enthusiasts, and growth is 24% annually in sales. North American and European Union government policies on low-fat, heart-healthy spreads are driving demand, coupled with food labeling standards improving take-up.

Premiumization & Artisanal Offerings

Shift: Customers like spreads that are flavor, organic, and premium versus regular margarine and butter. Premium and artisan spread is currently in vogue, with the infused butters (truffle, garlic, honey) and organic, grass-fed dairy replacers being trending. Premium butter brand sales across the globe grew 19% as customers will pay for legacy, excellence, and authenticity.

Grass-fed butter is highly sought after with its higher concentration of omega-3 and lower processing label, particularly in North America and the EU. At the same time, specialty and infused spread are retailing to city and millennial consumers who demand home kitchen imagination.

Strategic Response: Kerrygold and Président grew their grass-fed butter share of market, holding 35% of premium category. Lurpak introduced garlic, truffle, and herb butters, driving European luxury spread volume up 28%. Vermont Creamery was focusing on artisanal, small-batch butters and positioning towards the artisan food culture.

High-end food retailers like Whole Foods and Marks & Spencer are increasing shelf space for high-end butter alternatives. Organic and farm-to-table designation are becoming critical to positioning such premium spreads as clean-label, healthy indulgences.

Sustainability & Ethical Sourcing Trends

Shift: With the increased environment concern, consumers are demanding environmentally friendly, ethically produced, and palm oil-free spread fats. As an indicator of reality that 71% of global shoppers are purchasing from sustainable brand consumers, enterprises are forced to adopt carbon-free, regenerative, and deforestation-free manufacture. Palm oil, widely applied in spreads and margarine, is presently hated with deforestation and loss of forests.

Consumers are also getting worried about packaging material, and companies are shifting to recyclable and biodegradable packaging material. European and North American legislation is also restricting non-sustainable palm oil usage, and companies are being forced to re-formulate.

Strategic Response: Upfield (Flora, Becel) committed to the use of 100% sustainable palm oil, reducing its carbon footprint by 25% Earth Balance and Nutiva launched palm oil-free margarines, and sales jumped by 32% from green shoppers. Cashew-based butter substitutes that are carbon-neutral certified were launched into the market by Miyoko's Creamery as a leader in sustainable spreads.

Supermarket giants Tesco and Aldi are pressuring their suppliers to include deforestation-free palm oil in their business, leading to reformulation across the board. They are also switching to compostable packs, and Lurpak and Président introduced plastic-free butter wrappers, reducing plastic by 40% per pack.

Growth in E-Commerce & Direct-to-Consumer (D2C) Sales

Shift: The growth of D2C sales models and online food shopping is revolutionizing the spreadable fats market. Buying specialty and plant-based spreads online is becoming more commonly done by consumers, particularly on subscription and e-commerce giant platforms.

Spreadable fat e-commerce sales grew 18% in 2024 as consumers choose convenience and access to special items. D2C retailing allows brands to customize propositions, provide packs, and penetrate specialist health-focussed niches. Specialist and functional spreads (gourmet, fortified, or plant spreads) are the highest through direct consumer engagement through digital channels.

Strategic Response: Violife and Country Crock established Amazon and Walmart's web stores and generated online sales by 26%. Miyoko's Creamery introduced a D2C subscription platform that retailed its plant butter with a loyal customer base. Benecol and Smart Balance launched customizable health-focused spreads online to specialty diet segments.

Whole Foods and Target retailers expanded click-and-collect on butter and margarine, responding to e-commerce demand. Social media advertising and influencer marketing also propelled online purchases, with brands leveraging direct customer engagement for market expansion.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of spreadable fats through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 6.9% |

| Germany | 7.3% |

| China | 5.6% |

| Japan | 8.0% |

| India | 5.2% |

Markets for spreadable U.S fats are expanding thanks to increasing consumer interest in vegetable, lower fat, and cholesterol-free spreads. The request for functional dairy alternatives, heart-healthy margarine, and fortified spreadable fats is increasing, resulting in significant market innovation.

Moreover, the emphasis on non-GMO, organic, and trans-fat-free formulations is driving the demand for butter alternatives and nut-based spreads and omega-3-fortified margarine. Another trend being seen in the USA market is the growth of clean-label, dairy-free and allergen-friendly spreads aimed at the vegan and lactose intolerant consumers.

Related government regulations around lowering saturated fat in the diet and the elimination of trans fats have stimulated investment in plant-based oil blends, low-sodium spreads and functional butter substitutes fortified with vitamins and minerals.

The market is being driven primarily by EU regulations prohibiting the use of saturated fats that also encourage manufacturers to invest in organic recreational dairy spreads, as well as the growing popularity of functional plant-based alternatives. Clean-label foods are on the upward trend, as is high-oleic oil-based margarine and functional nut butters, driving the demand for reduced-fat, non-GMO, and high-fiber spreadable fats.

Increased interest in fats that are good for the heart and help to lower cholesterol levels has prompted German manufacturers to invest in fortified butter-like spreads, sustainable palm -oil-based spreads and omega-3 extracts developed from plants, among other things.

With disposable income on the rise and an increasing demand for Western-style breakfast options, as well as the growing segment of functional dairy and non-dairy spreads, the Chinese spreadable fats market is expanding at an impressive rate. The rise of premium margarine, artisanal butter and healthful plant-based spreads is driving demand for fortified and specialty spreadable fats.

And with nutrition campaigns backed by the government recommending healthy fats, Chinese manufacturers are increasingly turning out low-fat butter, calcium-enriched margarine and cholesterol-lowering spreads.

Japan’s spreadable fats market benefits from the country’s emphasis on longevity, cardiovascular health, and fermented dairy products. Japanese customers choose low-sodium, probiotic-made, and enzyme-processed spreads for daily nutrition, metabolism assistance, and immune system activity.

Japan’s knowledge of functional dairy technology and plant-based fermentation is creating a demand for high-quality, naturally flavored, and health-enhancing spreadable fats.

Butter helps moreover to the expanding focus on ghee, strengthened margarine, and herb-based margarine substitutes in India's market for spreadable fats. Traditionally used in Indian cooking and bakery products, melt and spray oil and margarines can find potential applications as functional food ingredients as well.

Indian manufacturers are investing in cost-effective, vitamin-enriched, and regionally flavored spreadable fats due to government policies promoting dairy processing and edible oil fortification.

| Segment | Value Share (2025) |

|---|---|

| Butter & Margarine (By Application) | 70.2% |

Comprising the largest market share over shelves the butter and margarine category is driven by the fact that consumers have a higher preference towards conventional spreads and dairy based products and trans-fat free margarine. Meanwhile, shoppers are looking for cleaner-label, higher-end butter and functional margarine with omega-3s, vitamins and probiotics. This trend is being fueled by health concerns and increasing demand for more premium, naturally derived ingredients.

With so many consumers seeking lower-fat and cholesterol-busting spreads, food companies are focusing on functional dairy spreads, non-GMO margarine, and even butter alternatives made plants. The scope of offerings is also growing due to technological advancements in formulation utilizing sustainable ingredients and allergen-free substitutes. Furthermore, the increasing number of vegan and flexitarian consumers is driving the demand of plant-based spreads, besides, the urge to spend on products that resemble the taste and texture of traditional butter is facilitating brands to institute.

The segment is projected to exhibit robust growth in Europe and North America, where is estimated to account for 70.2% value share in 2025. Health- and sustainability-oriented functional dairy products and plant-based margarine substitutes are increasingly in demand, spurred by consumer demand for health- and environmentally conscious food options.

| Segment | Value Share (2025) |

|---|---|

| Nut Butters, Flavored Spreads & Cooking Fats (By Application) | 29.8% |

As consumers discover a taste for high-protein nut butters, flavored functional spreads, and heart-healthy cooking fats, the market has already started to grow into almond butter, cashew spreads, infused ghee and dairy-free margarine for cooking. That's brought a demand for an evolution of spreads in the likes of clean-label, organic and fortified spreadable fats and new blends that promise indulgence and health benefits in one nutrient-dense nutrition offering.

Demand has also been fueled by the proliferation of nut-based, protein-enriched and fortified spreads. With culinary and functional food brands searching for trans-fat-free and sustainably available fats, we expect demand to rise for palm-oil-free margarines, high-MCT spreads, and probiotics-enhanced butters. With keto, paleo, and plant based diets becoming more popular, causing innovation among spreadable fats, as brands launch new formulations to match changing consumer demand.

This segment accounted for a value share of 29.8% in 2025, with the demand being particularly strong in Asia-Pacific and North America, where premium flavored spreads as well as organic cooking fats is growing mainstream.

The competitive landscape for the spreadable fats market includes various players focusing on fat formulations (sustainable fats), plant-based dairy alternatives, applications in the functional nutrition sector, which is expected to drive the growth of the market over the forecast period. Companies are pouring resources into omega-3-enhanced spreads, cholesterol-lowering butter substitutes and nut butters with inventive new formulations.

The sector is dominated by leading manufacturers whose expertise ranges from butter and margarine innovation (Unilever, Land O’Lakes, Upfield, Conagra Brands) to plant based spreadable fats (Fonterra) to global dairy supply chains. The demand for healthy and functional spreads is soaring in Asia-Pacific and Europe, prompting many corporations to expand their operations in the regions.

Partnerships with dairy cooperatives to develop, accelerate production investment in non-GMO fat alternatives, as well as development of high-quality, minimally disposed disseminated fats are among key strategies. In addition, manufacturers are focused on low-carbon footprint production and sustainable palm oil sourcing.

For instance:

The market includes various dairy and plant-based products such as butter, cheese, cream, plant-derived spreads, and other related products.

These products are derived from both plant and animal sources. Plant-based options include soya milk, peanut, and hazelnut, while animal sources include cow milk, camel milk, goat milk, and buffalo milk.

The market serves both commercial establishments and domestic consumers, catering to diverse needs.

Products are available through multiple distribution channels, including hypermarkets and supermarkets, convenience stores, online stores, and other retail formats.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global spreadable fats industry is projected to reach USD 20,031.7 million in 2025.

Key players include Unilever; Wilmar International limited; ASSOCIATED British foods plc; ADM (Archer Daniels Midland company).

North America is expected to dominate due to high demand for functional and plant-based spreads.

The industry is forecasted to grow at a CAGR of 7% from 2025 to 2035.

Key drivers include rising demand for functional dairy alternatives, increased health awareness, and advancements in fat processing technology.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2017 to 2033

Table 6: Global Market Volume (MT) Forecast by Source, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-user, 2017 to 2033

Table 8: Global Market Volume (MT) Forecast by End-user, 2017 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 10: Global Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 14: North America Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Source, 2017 to 2033

Table 16: North America Market Volume (MT) Forecast by Source, 2017 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End-user, 2017 to 2033

Table 18: North America Market Volume (MT) Forecast by End-user, 2017 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 20: North America Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Source, 2017 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Source, 2017 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End-user, 2017 to 2033

Table 28: Latin America Market Volume (MT) Forecast by End-user, 2017 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2017 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 34: Europe Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Source, 2017 to 2033

Table 36: Europe Market Volume (MT) Forecast by Source, 2017 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by End-user, 2017 to 2033

Table 38: Europe Market Volume (MT) Forecast by End-user, 2017 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 40: Europe Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Country, 2017 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 44: East Asia Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Source, 2017 to 2033

Table 46: East Asia Market Volume (MT) Forecast by Source, 2017 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by End-user, 2017 to 2033

Table 48: East Asia Market Volume (MT) Forecast by End-user, 2017 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 52: South Asia Market Volume (MT) Forecast by Country, 2017 to 2033

Table 53: South Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 54: South Asia Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 55: South Asia Market Value (US$ Million) Forecast by Source, 2017 to 2033

Table 56: South Asia Market Volume (MT) Forecast by Source, 2017 to 2033

Table 57: South Asia Market Value (US$ Million) Forecast by End-user, 2017 to 2033

Table 58: South Asia Market Volume (MT) Forecast by End-user, 2017 to 2033

Table 59: South Asia Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 60: South Asia Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 61: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 62: Oceania Market Volume (MT) Forecast by Country, 2017 to 2033

Table 63: Oceania Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 64: Oceania Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 65: Oceania Market Value (US$ Million) Forecast by Source, 2017 to 2033

Table 66: Oceania Market Volume (MT) Forecast by Source, 2017 to 2033

Table 67: Oceania Market Value (US$ Million) Forecast by End-user, 2017 to 2033

Table 68: Oceania Market Volume (MT) Forecast by End-user, 2017 to 2033

Table 69: Oceania Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 70: Oceania Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 72: MEA Market Volume (MT) Forecast by Country, 2017 to 2033

Table 73: MEA Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 74: MEA Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 75: MEA Market Value (US$ Million) Forecast by Source, 2017 to 2033

Table 76: MEA Market Volume (MT) Forecast by Source, 2017 to 2033

Table 77: MEA Market Value (US$ Million) Forecast by End-user, 2017 to 2033

Table 78: MEA Market Volume (MT) Forecast by End-user, 2017 to 2033

Table 79: MEA Market Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 80: MEA Market Volume (MT) Forecast by Distribution channel, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-user, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 11: Global Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Source, 2017 to 2033

Figure 15: Global Market Volume (MT) Analysis by Source, 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End-user, 2017 to 2033

Figure 19: Global Market Volume (MT) Analysis by End-user, 2017 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 23: Global Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Source, 2023 to 2033

Figure 28: Global Market Attractiveness by End-user, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 41: North America Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Source, 2017 to 2033

Figure 45: North America Market Volume (MT) Analysis by Source, 2017 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End-user, 2017 to 2033

Figure 49: North America Market Volume (MT) Analysis by End-user, 2017 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 53: North America Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Source, 2023 to 2033

Figure 58: North America Market Attractiveness by End-user, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Source, 2017 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Source, 2017 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End-user, 2017 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by End-user, 2017 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End-user, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by End-user, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Source, 2017 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Source, 2017 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by End-user, 2017 to 2033

Figure 109: Europe Market Volume (MT) Analysis by End-user, 2017 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Source, 2023 to 2033

Figure 118: Europe Market Attractiveness by End-user, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distribution channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End-user, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 131: East Asia Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Source, 2017 to 2033

Figure 135: East Asia Market Volume (MT) Analysis by Source, 2017 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 138: East Asia Market Value (US$ Million) Analysis by End-user, 2017 to 2033

Figure 139: East Asia Market Volume (MT) Analysis by End-user, 2017 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 142: East Asia Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 143: East Asia Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 148: East Asia Market Attractiveness by End-user, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Distribution channel, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 153: South Asia Market Value (US$ Million) by End-user, 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 155: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 161: South Asia Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia Market Value (US$ Million) Analysis by Source, 2017 to 2033

Figure 165: South Asia Market Volume (MT) Analysis by Source, 2017 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 168: South Asia Market Value (US$ Million) Analysis by End-user, 2017 to 2033

Figure 169: South Asia Market Volume (MT) Analysis by End-user, 2017 to 2033

Figure 170: South Asia Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 171: South Asia Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 172: South Asia Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 173: South Asia Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 174: South Asia Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 175: South Asia Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 176: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia Market Attractiveness by Source, 2023 to 2033

Figure 178: South Asia Market Attractiveness by End-user, 2023 to 2033

Figure 179: South Asia Market Attractiveness by Distribution channel, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Source, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by End-user, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 191: Oceania Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: Oceania Market Value (US$ Million) Analysis by Source, 2017 to 2033

Figure 195: Oceania Market Volume (MT) Analysis by Source, 2017 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 198: Oceania Market Value (US$ Million) Analysis by End-user, 2017 to 2033

Figure 199: Oceania Market Volume (MT) Analysis by End-user, 2017 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 203: Oceania Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Source, 2023 to 2033

Figure 208: Oceania Market Attractiveness by End-user, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Distribution channel, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 213: MEA Market Value (US$ Million) by End-user, 2023 to 2033

Figure 214: MEA Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 215: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 217: MEA Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 221: MEA Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 222: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: MEA Market Value (US$ Million) Analysis by Source, 2017 to 2033

Figure 225: MEA Market Volume (MT) Analysis by Source, 2017 to 2033

Figure 226: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 227: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 228: MEA Market Value (US$ Million) Analysis by End-user, 2017 to 2033

Figure 229: MEA Market Volume (MT) Analysis by End-user, 2017 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 233: MEA Market Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 234: MEA Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 235: MEA Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 236: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 237: MEA Market Attractiveness by Source, 2023 to 2033

Figure 238: MEA Market Attractiveness by End-user, 2023 to 2033

Figure 239: MEA Market Attractiveness by Distribution channel, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Algae Fats Market Trends - Sustainable Fat Innovations 2025 to 2035

Yellow Fats Market Size and Share Forecast Outlook 2025 to 2035

Filling Fats Market Size, Growth, and Forecast for 2025 to 2035

Healthy Fats Low Carb Market Trends - Demand & Consumer Shifts 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Confectionery Fats Market

Edible Oils and Fats Market Analysis by Product Type, Source, and Distribution Channel Through 2035

Interesterified Fats Market Growth - Food Processing & Health Trends 2025 to 2035

Normal and Specialty Fats Market Analysis by Type, Application, End Use and Region through 2035

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA