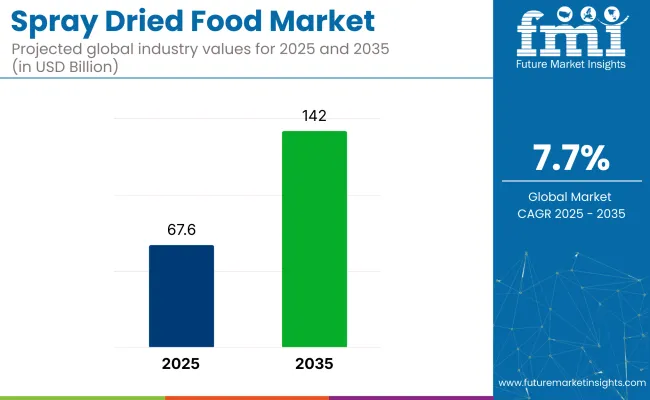

The global spray dried food market is valued at USD 67.6 billion in 2025 and is projected to reach USD 142 billion by 2035, registering a CAGR of 7.7%.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 67.6 billion |

| Projected Value (2035) | USD 142 billion |

| CAGR (2025 to 2035) | 7.7% |

Market expansion is driven by increasing demand for convenient, long-shelf-life, and nutrient-preserving food ingredients in various sectors such as the food and beverage industry, nutraceuticals, and pharmaceuticals. The growth is further supported by advancements in spray drying technologies, which preserve flavors, aroma, and nutritional value of food products while extending their shelf life.

The market holds 5%-8% of the food and beverage industry, where spray-dried ingredients play a key role in convenience foods, beverages, and dairy products. It contributes around 6%-10% of the food processing market, supported by the widespread use of spray drying for preservation and quality enhancement.

Within the nutraceuticals segment, it holds roughly 4%-6%, while in the convenience foods market, it captures a larger share of about 10%-15%, driven by the growing demand for ready-to-eat and shelf-stable products.

Government regulations for the spray-dried food market focus on food safety, labeling, and processing standards to ensure product quality and consumer health. Regulatory bodies such as the FDA (USA), EFSA (EU), and FSSAI (India) mandate compliance with hygiene practices, permissible additive usage, and residual solvent limits in spray drying processes.

These regulations also cover Good Manufacturing Practices (GMP), Hazard Analysis and Critical Control Points (HACCP), and proper declaration of nutritional content. Additionally, export-focused manufacturers must meet international food safety certifications such as ISO 22000 or BRC to access global markets, ensuring transparency and safety across the supply chain.

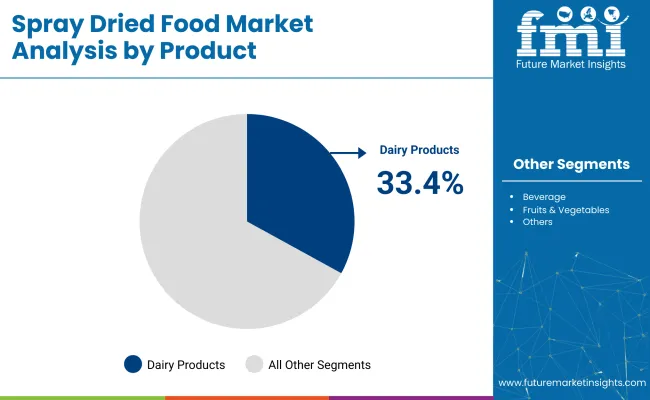

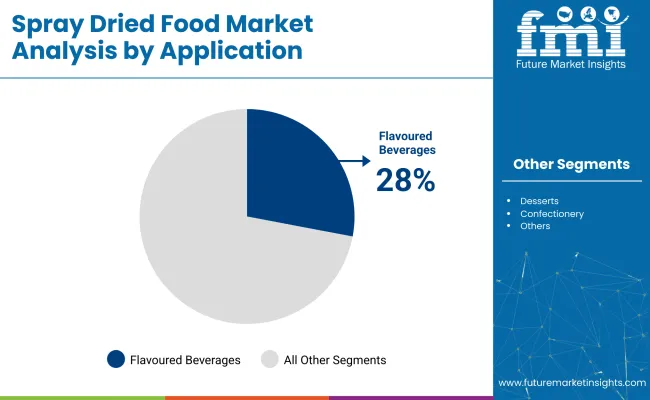

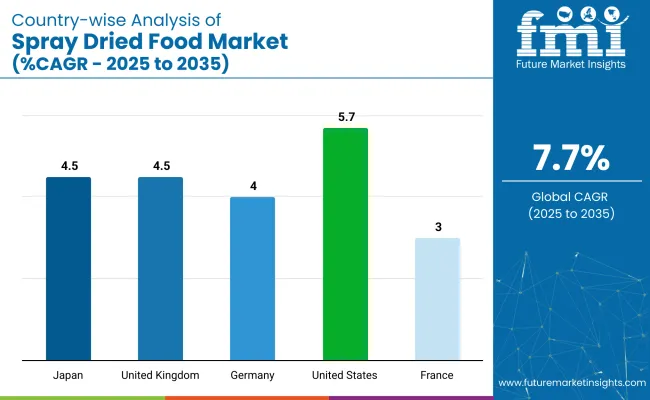

The USA is projected to be the fastest-growing market, expanding at a CAGR of 5.7%. The dairy industry will lead the product type segment, with nearly 33.4% of the market share. Meanwhile, flavoured beverages will be the largest application segment, accounting for 28% of the market share. The UK and Japan closely follow this growth with CAGRs of 4.5%.

The global spray dried food market is segmented into various product types, distribution channels, applications, and regions. By product type,the market includes fruits and vegetables, beverages, dairy products, fish, and others (including nuts, spices, and herbs).

Based on distribution channel, the market is segmented into B2B, food service, and B2C. By application,the market is categorized intodesserts, confectionary, baked goods, flavoured beverages, and baby food. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

Dairy products are projected to lead the product segment, accounting for 33.4% of the global market share by 2025. Dairy-based powders are widely used due to their long shelf life, convenience, and nutritional value.

B2C is expected to lead the distribution channel segment, accounting for 45% share in 2025, driven by the increasing popularity of online retail and direct-to-consumer sales.

Flavored beverages are projected to lead the application segment, accounting for 28% of the global market share in 2025 due to the growing demand for instant beverages, functional drinks, and powdered nutritional beverages.

Recent Trends in the Spray Dried Food Market

Challenges in the Spray Dried Food Market

The market is experiencing diverse growth rates across key countries. The United States leads with a CAGR of 5.7%, driven by strong dairy consumption and an increasing focus on nutraceuticals and ready-to-eat products. The United Kingdom follows with a CAGR of 4.5%, fueled by demand for convenience foods and plant-based ingredients.

Germany has a slightly lower CAGR of 4.0%, with growth driven by the demand for organic and sustainable food options. France is growing at a slower CAGR of 3.0%, mainly influenced by dairy and confectionery demand. Japan also has a CAGR of 4.5%, driven by high consumption of dairy powders and functional foods.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA is projected to remain the largest market for spray-dried food products, with the dairy sector, particularly milk powders, driving demand. The spray dried food revenuein the USA is projected to grow at a CAGR of 5.7%, primarily fueled by rising consumer awareness regarding the nutritional value of powdered products and an increasing preference for convenient, ready-to-eat foods. The USA market will continue to thrive, bolstered by a strong food manufacturing base and the adoption of advanced spray-drying technologies.

The sales of spray-dried food in the UK are expanding at a CAGR of 4.5%, supported by a shift toward healthier eating habits and increasing demand for functional foods. Government support for sustainability initiatives and reduced food waste is further promoting the adoption of spray-dried food products in both domestic and international markets.

The spray dried food marketinGermany holds a prominent position in the European spray-dried food market, with significant exports of dairy and fruit powders. The salesof spray dried food in Germany are growing at a CAGR of 4.0%, driven by the country’s strong engineering and food processing industries. Consumers' growing preference for nutritious and natural food options is further fueling the demand for spray-dried ingredients across the food, beverage, and nutraceutical industries.

In France, the spray dried food market is growing at a CAGR of 3.0%, with steady growth in the demand for functional and fortified foods. French manufacturers are focusing on enhancing product offerings with high-quality, functional ingredients, such as fortified powders and dairy alternatives, in response to increased consumer interest in health and wellness.

The spray dried food revenue in Japan is growing at a CAGR of 4.5%, supported by strong consumer demand for instant and ready-to-eat foods. With a well-developed food processing industry and high per capita consumption of dairy and beverage powders, Japan stands as a key market in Asia. Innovation in food packaging and nutritional product development is driving new opportunities, especially in the nutraceuticals and dietary supplements sectors.

The market is moderately consolidated, with several global leaders accounting for a significant share of revenues. Tier-one companies like Nestlé, Unilever, Döhler GmbH, Kerry Group, and Ajinomoto are competing based on product innovation, sustainability initiatives, and strategic partnerships. These companies focus on enhancing product quality, expanding their product portfolios, and improving supply chain efficiencies to maintain a competitive edge.

Top companies in the spray dried food market are competing through a combination of pricing strategies, product innovation, and strategic partnerships. They are investing in research and development to create new products that meet changing consumer preferences, such as plant-based and functional foods.

Additionally, these companies are forming partnerships with local suppliers and distributors to expand their market reach and improve supply chain resilience. Sustainability is also a key focus, with many companies implementing initiatives to reduce their environmental impact and meet consumer demand for eco-friendly products.

Recent Spray Dried Food Industry News

In September 2024, Ajinomoto and Danone inked a deal to decrease greenhouse gas emissions from the dairy sector.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 67.6 billion |

| Projected Market Size (2035) | USD 142 billion |

| CAGR (2025 to 2035) | 7.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Kilotons |

| By Product Type | Fruits & Vegetables, Dairy Products, Beverage, Fish, and Others (including nuts, spices, and herbs) |

| By Distribution Channel | B2B, B2C, and Food Service |

| By Application | Desserts, Confectionery, Baked Goods, Flavo u red Beverages, Baby Food |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, the Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Nestlé, Döhler GmbH, Unilever, Kerry Group, Ajinomoto, AZO GmbH & Co. KG, Delecto Foods, Mercer Foods, Foods & Inns, Givaudan SA |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

As per product type industry has been categorized into Fruits and Vegetables, Beverages, Dairy Products, Fish, and others

This segment is further categorized into Desserts, Confectionary, Baked Goods, Flavoured Beverages, Baby food, and others.

Different distribution channels include B2B, Food Service, B2C(Supermarkets and Hypermarkets, Independent Retailers, Specialist Retailers, Online Stores)

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 67.6 billion in 2025.

The market is forecasted to reach USD 142 billion by 2035, reflecting a CAGR of 7.7%.

The dairy products segment is expected to hold approximately 33.4% of the global market share in 2025.

Flavoured beverages will dominate the application segment with a 28% share in 2025.

The USA is anticipated to be the fastest-growing country with a CAGR of 5.7% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Spray Dried Food Market Analysis – Size, Share & Forecast 2025-2035

Spray Polyurethane Foam Market Size and Share Forecast Outlook 2025 to 2035

Spray Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Spray Painting Machine Market Size and Share Forecast Outlook 2025 to 2035

Spray Caps Market Size and Share Forecast Outlook 2025 to 2035

Spray Booth Ventilation System Market Size and Share Forecast Outlook 2025 to 2035

Spray Covers Market Size and Share Forecast Outlook 2025 to 2035

Spray Foam Insulation Market 2025 to 2035

Spray Cheese Market Analysis by Flavours, Distribution Channel and Region through 2035

Spray Dryer Market Growth – Trends & Forecast 2025-2035

Spray Nozzle Market Growth – Trends & Forecast 2024-2034

Sprayer Cap Market Growth & Trends Forecast 2024-2034

Spray Washer Market

Spray Drying Equipment Market

Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Mini Spray Bottles Market Size and Share Forecast Outlook 2025 to 2035

Mist Sprayer Pumps Market by Pump Type & Application Forecast 2025 to 2035

Competitive Breakdown of Mist Sprayer Pumps Providers

Nasal Sprays Market Analysis - Size, Share, and Forecast 2025 to 2035

Dermal Sprays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA