The global sports nutrition market is highly structured, with 55% dominated by top multinational corporations, 25% by regional leaders, 15% by startups and niche brands, and 5% by private labels.

The global market is dominated by a few big players, such as Optimum Nutrition (ON), MuscleTech, BSN, and MyProtein, with their large-scale manufacturing, wide distribution networks, and large product portfolios, showing the highest market penetration in North America and Europe through established retail and e-commerce channels.

Regional brands with a 25% share including Amway Nutrilite USA, Labrada USA, Bulk Powders of UK target small markets through peculiar formulations and regional pricing strategies where they are huge in the Asian-Pacific and the Latin American.

Startups and niche brands such as Transparent Labs, Redcon1, and Evlution Nutrition capture 15% of the market. These companies emphasize clean-label, organic, and specialty sports nutrition products and get significant traction with direct-to-consumer sales and social media marketing.

Explore FMI!

Book a free demo

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top Multinationals (Optimum Nutrition, MuscleTech, BSN, MyProtein, Glanbia Performance Nutrition) | 55% |

| Regional Leaders (Labrada, Amway Nutrilite, Bulk Powders, Scitec Nutrition, Garden of Life) | 25% |

| Startups & Niche Brands (Transparent Labs, Redcon1, Evlution Nutrition, Rule One Proteins, Grenade Nutrition) | 15% |

| Private Labels (Walmart Equate, Amazon Elements, Tesco Private Label) | 5% |

The market is moderately consolidated, headed by top global brands, which take 55% of the market, while smaller regional and niche brands are growing with changing consumer preferences.

The market is mostly plant-based, which accounts for 62% of the market. This segment encompasses a host of plant-derived ingredients, including soy, pea, rice, and other plant proteins as well as different plant-based carbohydrates, fats, and other nutrients.

Those plant-based ingredients are widely used because of their perception as healthy products with benefits towards sustainability and easy adaptation to vegan and vegetarian consumers.

Animal-based: This market has 38%, which consists of whey, casein, and other dairy-derived proteins as well as egg-based and meat-based ingredients. These are considered to have the highest quality proteins with excellent bioavailability and thus preferred for use by athletes and bodybuilders.

The sports nutrition market can be segmented based on function, wherein pre-workout supplements accept the biggest market share at 35%. These products are intended to maximize their performance, endurance, and focus on events.

Energizing products-with a 28% market share-provide energy and mental alertness for athletes and active people to maintain the desired level of intensity while participating in their activities.

Rehydration products account for 20% of the market and are designed to replace fluids and electrolytes lost during exercise. Recovery and weight management products make up 17% of the market, helping to repair muscles and manage weight.

The sports nutrition industry, in 2024, involved strategic product extensions, sustainability efforts, acquisitions, and digital transformation. The most impactful players reached out further through expansions, eco-friendly solutions, and tailoring their products according to the evolving needs of the consumer.

Personalized nutrition had a great upsurge with companies embracing AI-driven supplement recommendations to enhance the user experience. Plant-based formulations and functional nutrition trends rose especially in North America and Europe.

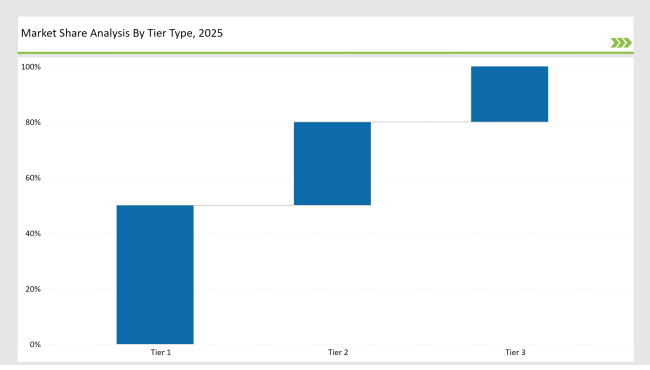

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Optimum Nutrition, MuscleTech, MyProtein, BSN, Glanbia |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Labrada, Transparent Labs, Amway Nutrilite, Redcon1, Garden of Life |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Regional brands, startups, niche DTC brands |

| Brand | Key Focus |

|---|---|

| Optimum Nutrition | Expansion into personalized AI-driven protein recommendations to customize sports nutrition for individual fitness goals. |

| MuscleTech | Collaboration with esports brands to launch gaming-specific sports supplements focused on endurance and cognitive function. |

| BSN | Investing in performance-driven hydration drinks, targeting athletes requiring rapid rehydration. |

| Glanbia | Acquisition of smaller functional food startups to expand their sports nutrition portfolio globally. |

| Transparent Labs | Expansion into Middle Eastern markets, responding to the rising fitness trends in UAE and Saudi Arabia. |

| Labrada Nutrition | Launching subscription-based protein supplement plans, ensuring customer retention and loyalty. |

| Redcon1 | Developing all-in-one performance packs, combining BCAAs, hydration, and multivitamins into a specific product. |

| Amway Nutrilite | AI-powered fitness coaching service, integrating real-time supplement recommendations based on user workouts. |

| Grenade Nutrition | Expansion into plant-based protein snacks, responding to rising vegan fitness trends. |

| MyProtein | Sustainability drives in packaging, shifting towards biodegradable and recyclable materials. |

DTC sales have now become the lifeline of sports nutrition brands. These sales do not rely much on traditional retailers and offer more significant margins. During the next decade, DTC subscription-based models will grow to include bulk protein sales with customized supplement kits, AI-driven recommendations, and even interactive digital coaching. Some of the current market leaders are already offering personalized product subscriptions such as Transparent Labs and MyProtein.

Increased adoption will be witnessed as the culture of fitness booms across Asia, especially in China, India, and Southeast Asia. The flavors and formulation need to be customized toward cultural nuances, say matcha-infused protein in Japan, Ayurveda-inspired supplements in India, and electrolyte-infused coconut-based sports drinks in Southeast Asia. Localized influence partnerships and branding will herald the coming of penetration into these markets.

The definition of sports nutrition will now shift from being a niche category for bodybuilders and professional athletes to being an everyday wellness and active lifestyle choice. Manufacturers will keep the spotlight on the oldest extant adult, office workers, and casual gym-goers with mild-intensity performance boosters, daily recovery supplements, and joint-support blends.

Brands will also need to enhance the palatability of their products, making them smoother, better tasting, and mixing easily with common beverages such as coffee and smoothies.

Brands can stand out by offering clean-label, highly transparent formulations, leveraging AI-driven personalized nutrition plans, and introducing hybrid functional products. Creating innovative delivery formats like gummies, effervescent tablets, and ready-to-drink shots can also capture new consumer segments.

Direct-to-consumer (DTC) sales via brand-owned websites, subscription models, and e-commerce marketplaces should be a primary focus. Additionally, brands should partner with gyms, fitness influencers, and specialty stores, while maintaining a presence in premium supermarkets for mainstream consumer accessibility.

To succeed in the plant-based segment, manufacturers should focus on diverse protein sources such as pea, rice, hemp, and pumpkin seed proteins, enhance taste and texture, and highlight sustainability benefits. Brands like MyProtein and Garden of Life have successfully marketed their vegan sports nutrition lines with carbon-neutral claims.

Eco-conscious consumers prefer brands that use biodegradable, recyclable, or compostable packaging. Switching to plastic-free pouches, refillable containers, and sugarcane-based bioplastic tubs will help brands align with sustainability goals. MyProtein and Grenade Nutrition have already made significant strides in reducing their carbon footprint through packaging innovations.

The future of sports nutrition will integrate AI-driven product recommendations, biometric-based supplement customization, and smart packaging that provides real-time tracking of intake and performance analytics. Investing in digital experiences such as virtual nutrition coaching and interactive apps will strengthen consumer engagement.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.