The sports and athletic insoles market is poised for significant expansion between 2025 and 2035, fueled by increasing awareness of foot health, rising participation in sports and fitness activities, and continuous advancements in material technology.

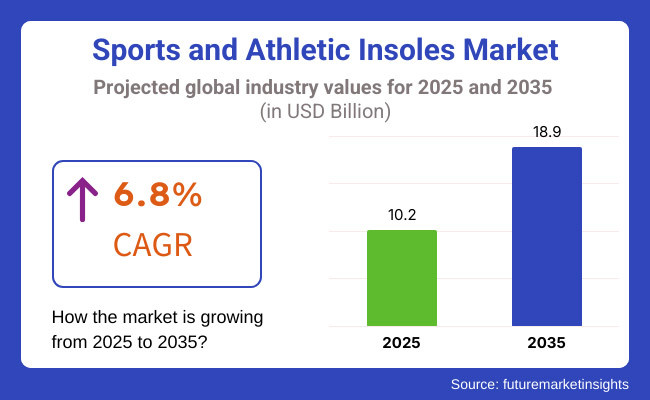

As more athletes and fitness enthusiasts prioritize comfort and injury prevention, demand for high-performance insoles continues to rise. Industry projections estimate the market will grow from USD 10.2 billion in 2025 to USD 18.9 billion by 2035, achieving a compound annual growth rate (CAGR) of 6.8% during the forecast period.

Manufacturers laboriously introduce to meet evolving consumer demands, introducing orthotic insoles, smart insoles with bedded pressure detectors, and sustainable accoutrements. The expansion of e-commerce and direct- to- consumer deals channels significantly enhances availability and customization, allowing consumers to elect insoles acclimatized to their specific requirements.

Inventions similar as smart insoles with biometric shadowing allow druggies to cover gait patterns, weight distribution, and real-time bottom pressure, offering precious perceptivity for injury forestalment and performance optimization. Also, eco-friendly and biodegradable insoles gain traction as sustainability enterprises push brands to develop environmentally responsible products.

Explore FMI!

Book a free demo

North America will continue leading the sports and athletic insoles request, driven by wide participation in sports and fitness conditioning. Consumers prioritize high-quality, performance-driven insoles that help bottom affections and musculoskeletal diseases. Direct-to-consumer deals strategies and athlete signatures play a pivotal part in boosting request penetration.

The rise of smart insoles integrated with biomechanics analysis tools attracts professional athletes and sports brigades looking for cutting-edge performance-enhancing results. Brands in North America concentrate on decoration and custom orthotic insoles, strengthening their base in the high- value member of the request.

Europe’s request will witness steady growth as consumers decreasingly conclude for high-performance and ergonomic footwear accessories. Sustainability remains a crucial focus, with biodegradable and eco-friendly insoles gaining traction in response to strict environmental regulations. The expansion of the sportswear assiduity and growing mindfulness of bottom health produce economic openings for manufacturers.

Collaborations with physiotherapists and podiatrists enhance product credibility and encourage lesser relinquishment of technical insoles. Brands emphasize ergonomic designs and medical-grade accoutrements to attract consumers seeking both comfort and functionality.

Asia-Pacific will witness the fastest growth, fuelled by rising disposable income, rapid urbanization, and adding participation in sports and fitness conditioning. Countries like China, Japan, and India drive demand for sports and athletic footwear, leading to a swell in insole relinquishment. E-commerce platforms and the influence of global sports brands accelerate request penetration, making ultra-expensive insoles more accessible to consumers.

Original manufacturers introduce cost-effective and region-specific insole results to feed to different requirements, icing affordability without compromising on quality. The region’s booming fitness culture further amplifies demand for performance-enhancing insoles.

Challenges

Despite strong request growth, challenges persist. Premium and custom orthotic insoles remain precious, limiting relinquishment among budget-conscious consumers. also, numerous implicit buyers warrant mindfulness of the long-term health benefits of high-quality insoles, decelerating request expansion.

The presence of fake and low-quality druthers also threatens assiduity credibility. Companies must invest in educational marketing juggernauts and targeted mindfulness programs to inform consumers about the advantages of decoration insoles for sports performance and injury forestalment.

Opportunities

The integration of smart technology in insoles represents a major occasion for growth. Smart insoles with bedded pressure detectors and gait analysis tools gain fashionability among professional athletes and fitness suckers, offering real-time performance perceptivity.

The rise of substantiated and 3D- published insoles allows consumers to pierce knitter-made results for specific bottom conditions, enhancing comfort and effectiveness. Brands that concentrate on invention, ergonomic design, and sustainability will gain a competitive edge in the evolving business.

| Country | Population (millions) |

|---|---|

| United States | 345.4 |

| China | 1,419.3 |

| Germany | 84.1 |

| United Kingdom | 68.3 |

| Japan | 123.2 |

| Country | Estimated Per Capita Spending (USD) |

|---|---|

| United States | 12.80 |

| China | 6.70 |

| Germany | 11.30 |

| United Kingdom | 10.90 |

| Japan | 9.50 |

The USA USD 4.41 billion market thrives on demand from athletes and active consumers seeking foot support and injury prevention. Retail stores, e-commerce, and podiatrist-recommended insoles contribute to sales growth.

China’s USD 9.51 billion market is expanding due to rising fitness awareness and increased participation in sports. Local brands and international manufacturers benefit from growing demand in urban and rural areas.

Germany’s USD 950 million market sees strong demand from professional athletes and everyday users. Orthopaedic and custom insoles gain popularity, with sports brands integrating foot health into product offerings.

The UK’s USD 744 million market benefits from increased participation in running, hiking, and gym workouts. Online platforms and retail sports stores drive accessibility and consumer adoption.

Japan’s USD 1.17 billion market thrives on innovation, with advanced shock-absorbing and biomechanical support insoles gaining traction. The growing elderly population also boosts demand for supportive footwear solutions.

The sport and athletic insole market is perpetually on an upswing, driven by rising awareness for foot care, growing active sport and fitness behaviour, and demand for tailored comfort solutions. Observations from a look at a 250-response survey of athletes, fitness shoppers, and everyday consumers bring into view prevailing trends within the marketplace as well as consumer sentiments.

Safety and injury protection constitute the majority of purchases, as 72% put shock absorption and arch support first when deciding on insoles. 58% of athletes and runners would like insoles that alleviate foot fatigue and safeguard against injuries such as plantar fasciitis and shin splints. Customers over the age of 35 (46%) who have pain in their feet particularly prefer orthopaedic and custom-fit insoles.

Material innovation is also affecting consumer choice, and 63% of consumers opt for gel-based or memory foam insoles for comfort, while 37% opt for carbon fibre or rigid support insoles for extra stability. Gym enthusiasts and sportspersons use lightweight, breathable material (55%) for comfort during intense activity.

Brand awareness and price sensitivity also differ across consumer groups. While 41% are brand loyal to traditional brands such as Super feet, Dr. Scholl's, and Power step, 39% are willing to try out new brands offering sophisticated performance features at a reasonable price point. In comparison, 66% of price-sensitive consumers prefer insoles priced less than USD 50, and 34% are willing to pay a premium for premium or custom-fit products.

Direct-to-consumer and online platforms are leading the way, as 57% of customers opt to buy insoles online for convenience and instant availability of reviews. However, 43% opt to buy from stores, especially for custom-fit insoles where expert advice is utilized. Subscription-based and customized insole products are also drawing serial users.

As consumers are looking for increased performance, comfort, and injury protection, the market for athletic and sports insoles will likely expand. Companies can take advantage of this opportunity by providing innovative materials, bespoke fit, and expanding their web-based retail to meet changing consumer needs.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Brands introduced gel, memory foam, and carbon-fiber insoles for enhanced comfort and shock absorption. AI-driven gait analysis tools improved insole customization. |

| Sustainability & Circular Economy | Companies adopted biodegradable, recycled, and plant-based materials. Subscription-based insole recycling programs gained traction. |

| Connectivity & Smart Features | IoT-enabled smart insoles tracked foot pressure, running patterns, and posture. Bluetooth-enabled models provided real-time feedback via mobile apps. |

| Market Expansion & Consumer Adoption | Rising participation in sports and fitness activities fueled demand for performance-enhancing insoles. E-commerce and direct-to-consumer (DTC) sales saw rapid growth. |

| Regulatory & Compliance Standards | Stricter regulations on ergonomic footwear led to higher safety and performance standards. Certifications for medical-grade insoles gained importance. |

| Customization & Personalization | Brands introduced AI-driven foot scanning technology to create customized insoles for different arch types and sports needs. 3D-printed insoles gained popularity. |

| Influencer & Social Media Marketing | Sports influencers, podiatrists, and athletes promoted high-performance insoles. YouTube and Instagram fueled trends in foot health and athletic performance optimization. |

| Consumer Trends & Behaviour | Consumers prioritized injury prevention, comfort, and durability. Demand surged for moisture-wicking and antibacterial insole technologies. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered smart insoles provide real-time biomechanical feedback for injury prevention. Self-adjusting insoles optimize arch support and impact absorption based on activity levels. |

| Sustainability & Circular Economy | Zero-waste, 3D-printed insoles become industry standard. AI-driven material selection ensures long-lasting, sustainable performance with minimal environmental impact. |

| Connectivity & Smart Features | AI-integrated insoles sync with wearable fitness trackers to optimize athletic performance. Blockchain ensures transparency in sustainable material sourcing and production. |

| Market Expansion & Consumer Adoption | Emerging markets drive adoption with affordable, AI-integrated insole solutions. AI-driven analytics refine product recommendations based on activity type, foot shape, and gait pattern. |

| Regulatory & Compliance Standards | Governments mandate carbon-neutral, orthopaedic-certified insoles. Block chain enhances compliance tracking and quality assurance in sports footwear. |

| Customization & Personalization | AI-powered dynamic insoles adapt to changing foot biomechanics in real-time. On-demand 3D printing enables ultra-personalized sports insoles based on real-time gait analysis. |

| Influencer & Social Media Marketing | Virtual fitness influencers and met averse-based gait analysis experiences redefine engagement. AR-powered foot scanning lets consumers visualize insole benefits before purchase. |

| Consumer Trends & Behaviour | Biohacking-inspired insoles integrate muscle activation and circulation-boosting properties. Consumers embrace AI-driven, hyper-personalized insoles for superior athletic performance and foot health. |

The USA sports and athletic insoles request is witnessing strong growth, driven by adding participation in sports and fitness conditioning, rising mindfulness of bottom health, and advancements in insole technology. Major players include Superfeet, Dr. Scholl’s, and Power step.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.4% |

The UK sports and athletic insoles request is expanding due to the growing trend of handling, hiking, and out-of-door conditioning, along with adding demand for bottom pain relief products. Leading brands include Sorbothane, Enactor, and Foot Active.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.1% |

Germany’s sports and athletic insoles requests is growing, with consumers fastening on high-quality, durable, and orthopaedic- approved insoles. crucial players include Bauerfeind, Sidas, and Pedag.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.3% |

India’s sports and athletic insoles request is witnessing rapid-fire growth, fueled by adding sports participation, rising mindfulness of bottom posture correction, and growing interest in performance footwear accessories. Major brands include Bacca Bucci, Neeman’s, and Doctor Sole.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.8% |

China’s sports and athletic insoles request is expanding significantly, driven by a growing middle- class population, adding investment in fitness and sports structure, and rising demand for innovative bottom support results. crucial players include Li- Ning, Xtep, and Scholl China.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.0% |

Athletes and fitness suckers laboriously seek performance-enhancing insoles that ameliorate comfort, stability, and injury forestalment. High- impact conditioning put immense pressure on the bases, making shock-absorbing accoutrements and custom orthotic insoles essential for precluding conditions like plantar fasciitis, thigh slivers, and knee pain.

Manufacturers concentrate on developing insoles with advanced arch support, superior energy return, and targeted bumper, feeding to the requirements of runners, weightlifters, and sports professionals. The demand for custom-fit insoles is also rising, as consumers look for substantiated results that align with their bottom structure and athletic performance conditions.

Sustainability is getting a crucial precedence for both brands and consumers in the athletic footwear assiduity. Eco-conscious buyers prefer insoles made from recycled froth, factory-grounded gels, and biodegradable accoutrements, reducing environmental impact without compromising performance.

Leading brands invest in low-waste product styles and renewable material sourcing, icing that insoles remain both durable and environmentally responsible. The growing emphasis on sustainability pushes companies to exclude dangerous chemicals, use water-grounded bonds, and apply recyclable packaging, strengthening their position among environmentally apprehensive consumers.

Online shopping has converted the way consumers buy sports and athletic insoles. E-commerce platforms and direct-to-consumer ( DTC) brands give expansive product selections, detailed specifications, and AI-powered recommendations, making it easier for guests to find the perfect fit. Retailers integrate virtual bottom surveying technology and 3D imaging tools to help druggies determine the stylish insoles for their requirements.

These advancements enhance customization options, streamline the buying process, and ameliorate client satisfaction. Also, subscription- grounded insole services are arising, offering consumers accessible reserves and periodic upgrades grounded on wear and tear- and- gash analysis

The integration of smart technology in athletic insoles is revolutionizing sports performance and injury forestallment. Detector-equipped insoles with gait analysis capabilities and real-time pressure monitoring give athletes pivotal data on their bottom movement patterns, weight distribution, and balance.

These high-tech insoles help describe biomechanical imbalances, help sports- related injuries, and optimize training rules. Fitness apps and wearable technology seamlessly sync with smart insoles, allowing druggies to track performance criteria, admit substantiated guiding perceptivity, and acclimate their fashion consequently. As demand for data-driven performance optimization grows, brands will continue instituting to offer smarter, more intuitive insoles.

The global sports and athletic insoles request is witnessing strong growth, driven by adding mindfulness of bottom health, rising participation in sports and fitness conditioning, and advancements in insole technology. Consumers are demanding customized, high-performance insoles for enhanced comfort, injury forestallment, and better athletic performance.

Crucial players in the request focus on invention, offering ergonomic designs, humidity-wicking accoutrements , and smart insoles with shadowing capabilities. The growing trend of e-commerce and direct-to-consumer deals further energies request expansion, as brands influence online platforms to reach a wider followership.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Superfeet | 18-22% |

| Dr. Scholl’s | 15-19% |

| Powerstep | 10-14% |

| Sof Sole | 8-12% |

| Currex | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Superfeet | Specializes in high-performance, ergonomic insoles for athletes and outdoor enthusiasts. Focuses on sustainability with plant-based materials and recyclable insoles. |

| Dr. Scholl’s | Offers mass-market insoles for sports, work, and everyday wear. Leverages strong brand recognition and retail presence in pharmacies and supermarkets. |

| Powerstep | Provides podiatrist-recommended insoles designed for foot alignment and injury prevention. Expands custom orthotic solutions for runners and athletes. |

| Sof Sole | Develops moisture-wicking and shock-absorbing insoles. Focuses on affordability and accessibility for casual athletes and fitness enthusiasts. |

| Currex | Specializes in dynamic, activity-specific insoles tailored for running, cycling, and hiking. Uses biomechanical research for optimized foot support. |

Strategic Outlook of Key Companies

Superfeet (18-22%)

Superfeet leads the decoration insole member with high-performance products feeding to professional athletes and out-of-door comers. The company invests in sustainable manufacturing, using eco-friendly accoutrements and recyclable packaging. Superfeet also expands its presence in e-commerce and specialty sports retail, strengthening its global distribution network.

Dr. Scholl’s (15-19%)

Scholl’s dominates the mass- request insole order, offering affordable, extensively available products. The brand leverages its strong retail hookups with apothecaries, supermarkets, and online commerce. Dr. Scholl continues to introduce by integrating gel bumper, antimicrobial treatments, and substantiated fit technologies into its products.

Power step (10-14%)

Power step focuses on podiatrist- recommended insoles designed for injury forestalment and bottom alignment. The company expands its product range with custom orthotic results and collaborates with sports conventions and physiotherapists. Digital marketing and direct- to- consumer deals drive brand visibility and request penetration.

Sof Sole (8-12%)

Sof Sole offers humidity- wicking and shock- absorbing insoles at an affordable price point. The brand targets fitness suckers and casual athletes, expanding its retail presence in sporting goods stores. Sof Sole enhances product continuity and comfort through exploration- driven design advancements.

Currex (6-10%)

Currex differentiates itself with exertion-specific insoles optimized for running, cycling, and hiking. The company uses biomechanical exploration to develop products that ameliorate bottom stability and stir control. Currex strengthens its e-commerce strategy and mates with elite athletes to promote its technology- driven insoles.

Other Key Players (30-40% Combined)

Numerous niche and emerging brands contribute to market diversity by focusing on customization, performance, and sustainability. Notable companies include:

The Sports and Athletic Insoles industry is projected to witness a CAGR of 6.8% between 2025 and 2035.

The Sports and Athletic Insoles industry stood at USD 9.8 billion in 2024.

The Sports and Athletic Insoles industry is anticipated to reach USD 18.9 billion by 2035 end.

Asia-Pacific is set to record the highest CAGR of 6.3% in the assessment period.

The key players operating in the Sports and Athletic Insoles industry include Superfeet, Dr. Scholl’s, Sorbothane, Powerstep, Spenco, and Currex.

Gel Insoles, Foam Insoles, Custom Orthotics, Heated Insoles, and Others.

Supermarkets/Hypermarkets, Specialty Stores, Online, Pharmacies/Drug Stores, and Others.

Running, Walking, Basketball, Soccer, Hiking, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.