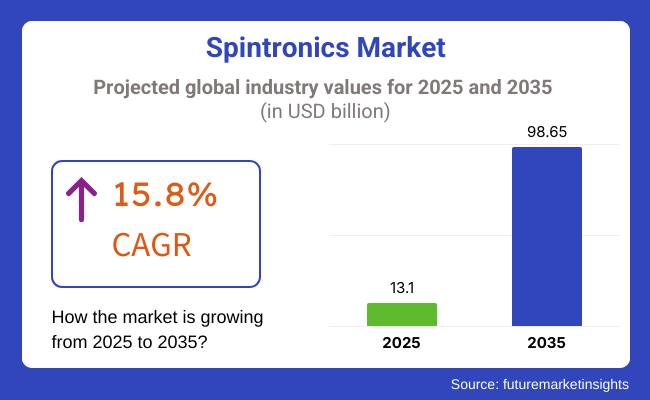

The spintronics market is anticipated to be USD 13.1 billion in 2025 and is expected to reach an amount of USD 98.65 billion in 2035 with a CAGR of 15.8% over the forecast period. With the increasing usage of spintronic-based devices like magnetoresistive random-access memory (MRAM), spin-transfer torque devices, and spin-based logic circuits, industry growth is driving.

Additionally, increasing investments in research and development and the increasing demand for miniature and low-power components are driving the expansion of this new technology field.

The industry is a nascent field of technology that takes advantage of the intrinsic spin of electrons as opposed to their charge to encode and control information. This technology is essential to enhanced consumer electronics, automotive sensor, industrial automation and data storage with increased data transmission, better storage capacity, and reduced power use.

New materials science discoveries, including topological insulators and 2D magnetic materials, continue to support product based solutions creating opportunities for disruptive applications in quantum computing and next generation semiconductors.

The increasing need for high-speed and efficient data processing applications is one of the industry's main drivers. The highly sought-after device is able to switch a lot faster and also consumes less power compared to traditional memory technology, like MRAM, spintronic devices. Also in the field of the auto industry, product-based sensors are being implemented very quickly, in particular for advanced driver assistance systems (ADAS) and autonomous vehicle applications. Further, the growth of IoT ecosystems and AI-driven applications is driving the demand for smaller, high-performance devices that product is fundamentally suggesting.

The industry continues to have a variety of challenges, despite its probable growth. High production costs and intricate manufacturing processes are obstacles to mass use. The compatibility of these new spintronic devices with conventional semiconductor technologies needs to be explored further, and we must develop technological innovations too.

Besides, the limited availability of commercial spintronic materials and components hinders the industry penetration. To overcome these impediments, we require sustained investment in R&D and cooperation among the industry, universities and developers.

Technological innovation and strategic industry alliances may be determining the industry future. Recent developments in quantum computing, flexible electronics, and neuromorphic computing are likely to further boost product applications. Increased investments in 2D materials and nanostructures are improving device performance and efficiency.

Moreover, rising government support for next-generation semiconductor technologies and energy-efficient computing solutions is driving the industry uptake. The most highlighted method in product is the manipulation of the spin of the electrons, which has the capability of making a range of technologies innovative by doing away with power-consuming storage solutions and devices that come with modern electronics.

Explore FMI!

Book a free demo

The industry is fast transforming thanks to its scope for increasing energy efficiency, the speed of processing data, as well as storing data in many industries. Its applications in storing data, e.g., MRAM (Magnetoresistive Random-Access Memory), are finding increasingly widespread usage since they are powered at low rates and are non-volatile and thus well placed to replace old memory technology.

In consumer devices, industry is enabling low-power, high-speed logic circuits in smartphones and wearables. Automotive uses magnetic sensors and advanced driver-assistance systems (ADAS) for vehicle safety and navigation.

Industrial automation is aided by spintronic-based sensors and logic that streamline efficiency and reliability in challenging environments. In the healthcare sector, Industry is being developed for biomedical imaging and biosensing, but cost considerations restrict mass application. The growing need for scalable and miniaturized electronics is likely to drive growth, especially with the continued research in neuromorphic engineering and quantum computing.

| Company | Investment Value (USD million) |

|---|---|

| NVE Corporation | Approximately USD 50-USD 70 |

| Everspin Technologies | Approximately USD 30-USD 50 |

| Crocus Technology | Approximately USD 40-USD 60 |

Large investments and collaborations also catalyzed impressive growth from the Industry in 2024 and early 2025. The expansion of NVE Corporation to address the growing demand for its spintronic components is estimated at USD 50 million USD 70 million. Financing approval for Everspin Technologies (e. g., usd.30.50m.) is to advance the next generation of Magnetic Random Access Memory (MRAM) that will be able to avoid data loss just like SSD hard disks because they utilize magnetic technologies.

The alliance with Crocus Technology to combine spintronic sensors with motor vehicle systems for about USD 40 million to USD 60 million is a critical step that will improve the safety and performance of automobiles. All of these announcements are part of an industry move to upgrade technologies for several industries such as the data storage and automotive industries in order to meet changing consumer demands.

Between 2020 and 2024, the industry experienced notable growth due to rising demand for high-speed, low-power data storage and processing. The expansion of AI, quantum computing, and IoT fueled the adoption of spintronic devices for improved memory and sensor efficiency.

Magnetoresistive random-access memory (MRAM), spin-transfer torque (STT), and domain-wall devices improved performance in consumer electronics, automotive, and industrial markets. Breakthroughs in quantum materials such as graphene and topological insulators underpinned research into high-performance spin-based computing.

Government support and funding for spin-based quantum computing fueled innovation, while semiconductor firms worked with research centers to apply the product to proven chip designs. Obstacles like intricate fabrication, expensive production, and low scalability were overcome with AI-aided design and scalable manufacturing methods, enhancing cost-effectiveness and manufacturing yields. From 2025 to 2035, the industry will be propelled by AI-driven design optimization, quantum spin-based logic, and neuromorphic computing applications.

Advances in spin-wave computing, spin transistors, and skyrmion memory will result in ultra-fast, energy-efficient, and high-density solutions. Quantum spintronics will release new paradigms of computation through spin-based qubits for effective processing. Photonics, spintronics, and 2D material hybridization will give rise to devices of opto-spintronics for the achievement of ultra-fast processing and data communication.

The overall aim will be sustainability with low-power spintronic devices saving energy, AI-optimized material synthesis, and eco-friendly fabrication. The product will also make hybrid electronic architectures for AI processing, medical imaging, and secure data encryption scalable and support long-term technological progress.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments funded spintronics research, semiconductor self-sufficiency initiatives, and spin-based quantum computing. | AI-enabled material optimization, sustainability requirements, and policy regulations for quantum-improved spintronic devices will influence governance. |

| MRAM, STT, and domain-wall devices started memory speed, energy efficiency, and endurance. | Quantum spin logic, skyrmion-based memory, and AI spin-wave computing will revolutionize high-speed, low-power semiconductor technology. |

| Spintronics was utilized in data storage, consumer electronics, and automotive sensor technologies. | AI neuromorphic spintronic computing, quantum spin processor-based technology, and high-speed optical spintronic devices will facilitate new market applications. |

| Semiconductor foundries combined spintronics with traditional silicon-based production processes. | Future adoption will be driven by AI-optimized spintronic manufacturing, quantum-aided design automation, and electronic-spin hybrid chip architectures. |

| High fabrication expenses and integration complexity restricted commercialization of the product. | AI-optimized material synthesis, quantum-aided defect detection, and energy-efficient fabrication will enhance sustainability and cost-effectiveness. |

| AI-guided defect analysis, real-time spintronic material optimization, and quantum modeling enhanced scalability. | AI-driven quantum spin simulation, real-time material discovery, and predictive performance modeling will revolutionize spin-based device development. |

| Expensive materials, complex manufacture, and limited commercial scalability were the impediments. | Supply chain logistics optimized with AI, decentralized spintronic component production, and blockchain-protected semiconductor distribution will facilitate greater accessibility. |

| Demand for quantum computing research and high-speed, low-power memory drove growth. | AI-driven quantum spin computing, ultra-low-power neuromorphic processors, and opto-spintronics-enabled high-speed processing will drive future growth. |

The industry is flourishing due to the need for quick, low-energy, and non-volatile memory solutions that have increased across various industries. However, exorbitant R&D expenses and technological problems are also major fiscal hazards. Scalable innovations, strategic alliances, and reduced manufacturing costs are the key areas of focus for those firms that intend to achieve the highest possible profit and stay competitive.

The major breakthroughs in quantum computing, AI, and the next-gen memory technologies pose the product being the obsolete risk. Corporations should ensure that they focus on continuous research and development, system designs that are modular, and technology that is adaptable for them to cope up with the industry trends and the demands of evolving computing.

Incorporating its components also adds to the challenge where the cybersecurity risk is concerned, as these components are integrated into the infrastructures of vital computing and data storage. Protecting the intellectual property, securing the supply chains, and putting into practice advanced encryption methods are the necessary steps in order to keep the data integrity and industry trust.

Compliance with regulations and the lack of standardization may affect the adoption of the industry, as different regions implement different requirements for new semiconductor technologies. Companies shall deal with changing laws, acquire necessary certifications, and collaborate with regulatory bodies to ensure compliance. The potential for the industry to thrive in the long run lies in the application of innovation, robust cybersecurity defense, and the implementation of a well-thought-out supply chain strategy.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

| UK | 6.8% |

| France | 6.9% |

| Germany | 7% |

| Italy | 6.5% |

| South Korea | 7.3% |

| Japan | 7.1% |

| China | 7.4% |

| Australia | 6.4% |

| New Zealand | 6.3% |

The CHIPS Act injects USD 52 billion into the domestic semiconductor industry, fueling its innovations. Intel, IBM, and Qualcomm lead next-generation spintronic devices, with a strong focus on AI-inspired applications and data centers. STT-MRAM growth continues to improve computational efficiency, propelling industry growth even further.

Collaboration between universities, industry, and government ensures the spintronics ecosystem. Emerging fabrication technologies, sparked by Stanford and MIT research, drive spin-based memory and logic chip science forward. Defense and aerospace high-performance computation requirements push the USA further into the leadership position in its innovation.

The University of Cambridge and the University of Oxford are at the forefront of spintronic material and power-low electronics research. The adoption of AI and cloud computing is driven by ultra-low-power consumption through the implementation of spintronics-based memory.

Strategic alliances between UK semiconductor firms and global industry leaders spur commercialization. ARM Holdings and Graphcore are some of the firms that embed spintronic technologies into chip designs to improve efficiency in consumer goods. The emphasis on green computing solutions by the UK also spurs industry entry.

Spin-orbitronics and skyrmion devices are the key areas of focus for France, and it is a world leader in next-generation memory solutions. STMicroelectronics and others are engaged in spintronic device development for automotive and IoT.

Growing demand for it to be utilized in electric vehicles and intelligent mobility solutions originates from France's burgeoning automotive sector. Government-industry stimulus-led low-power computing, and AI technology are propelling it in industry automation and smart electronics in the long run.

Fraunhofer Institute, Germany, and the Max Planck Society are at the forefront of research foundations in spintronics, with emphasis on spin-based quantum computation and MRAM technology. Germany is the epicenter of semiconductor innovation with the European Chips Act.

Companies like Infineon and Bosch integrate spintronic sensors and memory into automotive and industrial automation applications. Industry growth is fueled by demand for green and power-saving electronics, particularly in Industry 4.0 and smart manufacturing solutions.

Foreign technology firms, in collaboration with research institutions, drive Italy's semiconductor industry. Universities at Milan and Rome are major contributors to spintronic material development.

The country's need for consumer electronics and cars drives its adoption. Industry giant STMicroelectronics invests in spin-based memory technologies to provide energy-efficient computing. Increasing AI and IoT applications in Italy further warrant spintronic device adoption.

SK Hynix and Samsung are driving research on spintronic memory technology, viz., STT-MRAM and domain-wall devices. 4 trillion (USD 3.2 billion) state-funded program incited its R&D.

South Korea's nanotechnology and thin-film deposition capabilities enhance spintronic device production. The swift evolution of AI, 5G, and edge computing technologies is also propelling industry growth and the country's leading spintronics-based semiconductors in the world.

Japan's Ministry of Economy, Trade, and Industry (METI) offers ¥500 billion (USD 3.8 billion) for R&D in semiconductors to advance product research. Sony, Toshiba, and Tokyo Electron are the key promoters of spintronic memory solutions development.

Japan's strong foundation in materials science allows for product development, particularly for quantum computing and ultra-high-speed memory devices. Growing consumer and industrial industry demand for power-efficient electronics also continues to stimulate the application of the product.

A 7.4% CAGR between the forecasting period 2025 to 2035 is expected, the largest of all the big markets, driven by historic government expenditure on semiconductors and high-end domestic demand for advanced electronics. China's "Made in China 2025" initiative favors spintronics as a front-line technology, and spintronic memory and AI computing technologies are being researched and developed by companies like SMIC and Huawei.

China's rapid evolution of 5G, IoT, and cloud computing fuels the adoption of the product. The country's focus on semiconductor fabrication autonomy also propels industry growth and establishes China as a spintronic innovation hub.

Foundation research in the product is supported by Australian universities such as the University of Sydney and Monash University. Government focus on semiconductor self-sufficiency is a basis for industry growth.

Rising demand for Australia in quantum computing and AI stimulates spintronics-based memory demand. Companies investing in future computer technology integrate spintronic devices in data centers and high-performance computing facilities.

Auckland and Wellington universities have significant research focus on the product, namely in energy storage technology with increased efficiency. Technological development is accelerated through the government through funding incentives.

New Zealand's movement towards green electronics stimulates the adoption of the product in industrial and consumer use. The demand for fast computing and AI-based devices also stimulates the product use in data storage and processing devices.

By 2025, semiconductor-based spintronic devices will drive 57% of penetrated total industry demand, whereas metallic-based spintronic devices will contribute 43% to the overall industry.

Spintronics based on Semiconductors - These devices utilize the spin of electrons found in semiconductor materials to increase energy efficiency and processing speed. Non-volatile memory, such as MRAM (Magnetoresistive Random Access Memory), makes use of them.

Fine-tunability is extremely desirable because spintronic-based logic circuits present an avenue for high-performance computing and AI-driven applications, which are being developed by companies such as IBM and TSMC. Adoption is also being propelled by growing demand for energy-efficient data centers and quantum computing.

Spintronics Based on Metal consists of technologies such as Giant Magnetoresistance (GMR) and Tunnelling Magnetoresistance (TMR) used in HDD read heads, sensors, and automotive applications. Seagate and Western Digital have already begun using TMR technology for next-generation hard drives, making metallic-based spintronics integral to high-density data storage the 21st century's equivalent of the coins in your pocket.

The detection electronics of this revolution are already being adopted in many automotive safety systems, and companies such as NXP and Infineon are building spintronic sensors into their platform for ADAS (Advanced Driver Assistance Systems).

With the semiconductor industry moving to sub-nanometre technologies, novel computing paradigms such as spintronics, which are based on the electron's spin degree of freedom, are garnering considerable attention as the building blocks of a new class of electronic systems for low-power, high-speed computing. With the evolution of quantum computing and the development of neuromorphic engineering, the industry is expected to experience continuous innovation and adoption in a range of fields.

Spintronic magnetic sensors are changing several industries, as they combine high sensitivity and low power consumption while outdoing traditional sensors for many decades of lifetime. Additional information on MEMS Inertial Sensors Industry: MEMS-based sensors are extensively used in the automotive sector for ABS (Anti-lock Braking Systems) and ADAS (Advanced Driver Assistance Systems), enhancing vehicles' safety and efficiency.

In the EV (electric vehicle) sector, industry leaders such as Infineon, NXP, and Honeywell are at the forefront of innovation, providing technologies for contactless current sensing and navigation systems, which allow for precise energy management and improved battery longevity. As EVs and autonomous vehicles become more prevalent, demand for spintronic-based sensors will skyrocket, with the global magnetic sensor industry expected to surge beyond USD 6 billion by 2025.

Through technologies like Giga Magnetoresistance (GMR) and Tunnel Magneto Resistance (TMR), spintronics has also transformed data storage. One promising DRAM and SRAM alternative that is quickly ascending the horizon is MRAM (Magnetoresistive Random Access Memory), offering high-speed, non-volatile performance with low power overhead for IoT, AI, and edge computing applications.

MRAM adoption for AI-driven applications is up 30% at Everspin, with Samsung, TSMC, and Everspin Technologies all emphasizing investment in MRAM. While there are still challenges, devices that employ spintronic read heads have been built and, more importantly, added to HDD for working together, enhancing data density and performance immensely.

With the rise of AI-driven data centers, IoT, and autonomous systems, spintronic magnetic sensors and MRAM solutions will define the future paradigm of electronics to provide more efficient, reliable, and energy-efficient computing.

As these new computing paradigms continue to develop, the Industry is likely to see robust growth, driven by the demand for energy-efficient, high-speed memory solutions, as well as advances in next-generation computing and quantum technologies. This makes the storage and processing of data possible, thereby capitalizing on the different spin properties of the spintronic electron, bringing lower power usage and better performance in more products like MRAM (Magnetoresistive Random-Access Memory), sensors, and logic applications.

Global semiconductor companies and specialized research organizations, including NVE Corporation, Crocus Technology, and Spin Transfer Technologies, lead the industry and elevate spin-based transistors, tunnel magnetoresistance (TMR), and neuromorphic computing. New players and new research efforts target new spintronic materials and device integration, looking to broaden commercial relevance.

The major industry dynamics that are contributing to the STT-MRAM (spin-transfer torque MRAM) industry growth are IOT and automotive applications, spintronic sensors, and spin-based quantum computing prevalence. These companies focus on power efficiency and scalability, as well as material and innovative processes, in order to be competitive in the industry.

Their competitive landscape may vary based on emerging semiconductor industry developments, partnerships, and the growing demand for next-generation memory technologies. The companies that will achieve profitable growth will be those that have solutions based on breakthroughs in material science, integration with AI and neuromorphic computing, and scalable spintronic-based computing architectures.

Market Share Analysis by Company

| Company Name | Estimated Market share (%) |

|---|---|

| NVE Corporation | 20-25% |

| Crocus Technology | 15-20% |

| Spin Transfer Technologies | 10-15% |

| Everspin Technologies | 5-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| NVE Corporation | Develops MRAM and spintronic sensors, focusing on high-reliability industrial and military applications. |

| Crocus Technology | Specializes in TMR magnetic sensors, plus MRAM solutions for secure computing and IOT applications. |

| Spin Transfer Technologies | ST-Cloud develops STT-MRAM for high-speed, low-power memory applications. |

| Everspin Technologies | Provides discrete and embedded MRAM products for data center, aerospace and automotive use. |

Key Company Insights

NVE Corporation (20-25%)

Spintronic MRAM and spintronic sensors were invented by NVE Corporation. It is also a specialist in TMR and spin-transfer torque technology for industrial and defense applications.

Crocus Technology (15-20%)

Crocus Technology has deep expertise in high-performance TMR-based magnetic sensors and MRAM memory for secure computing and high-assurance IoT, smart devices, and other use cases.

Spin Transfer Technologies (10-15%)

Spin Transfer Technologies advances the evolution of STT-MRAM technology by optimizing for high endurance, fast switching speeds, and low power consumption for computing and data storage use cases.

Everspin Technologies (5-10%)

Everspin Technologies Everspin Technologies is a leading provider of MRAM solutions110, delivering discrete and embedded memory technologies110 to address the needs of aerospace110 automotive and enterprise storage markets.

Other Major Players (30-40% Combined)

The industry is expected to generate USD 13.1 billion in revenue by 2025.

The industry is projected to reach USD 98.6 billion by 2035, growing at a CAGR of 15.8%.

Key players include NVE Corporation, Crocus Technology, Spin Transfer Technologies, Everspin Technologies, IBM Research, Samsung Electronics, TSMC, Intel Corporation, and Western Digital.

North America and Asia-Pacific, driven by advancements in quantum computing, data storage, and next-generation semiconductor applications.

Magnetoresistive Random-Access Memory (MRAM) dominates due to its high-speed performance, low power consumption, and growing adoption in consumer electronics and automotive applications.

By device type, the industry covers semiconductor-based spintronics, metallic-based spintronics, and alloy-based spintronics, with semiconductor-based spintronics leading due to its widespread application in data storage and computing.

By application, the industry includes magnetic sensors, hard disks and MRAMs, electric vehicles, quantum computing, and others, with hard disks and MRAMs dominating due to increasing demand for high-speed and energy-efficient memory solutions.

By region, the industry covers North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa (MEA), with North America leading due to strong investment in quantum computing and next-generation memory technologies.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.