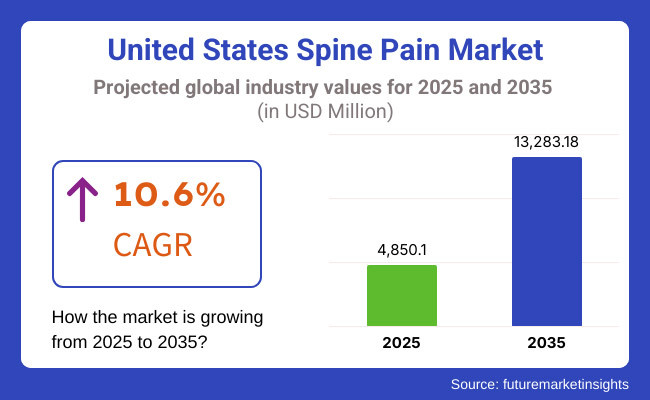

United States spine pain industry is anticipated to witness substantial growth from 2025 to 2035. This is attributed to the increasing incidence of musculoskeletal disorders, an aging population base, and an improvement in less invasive pain treatments. The market is anticipated to grow to nearly USD 4,850.1 million by 2025 and reach a size of nearly USD 13,283.18 million by 2035 with a compound annual growth rate (CAGR) of 10.6% during the projection period.

Key drivers for growth are the rising prevalence of chronic back pain, heightened demand for non-opioid pain management treatments, and rising usage of regenerative medicine for spinal health. The growth in robotic-assisted spine procedures, enhanced interventional pain management strategies, and increased investment in AI-driven diagnostics for spinal disorders are also boosting industry penetration.

Nevertheless, market growth would be hindered by challenges such as high expenditure in advanced pain relief treatments, robust regulatory adherence by medical devices, and constraints on insurance payments. The entry of wearable painkiller technologies, growing interest in telemedicine-centered spine treatment, and outreach into customized rehabilitation packages are big industry opportunities.

Glimpsing back to 2024, the spine pain industry was already witnessing a shift towards incorporating innovative treatment options, with the rising focus on non-opioid solutions and minimally invasive surgical methods. However, the industry was also encountering hurdles such as high upfront costs of new treatments and insurance limitation, eventually afflicting the sector growth speed.

Looking forward to 2025 and beyond, the industry will be enriched with the surging demand for regenerative treatments, along with the continued aim of minimizing patient recovery time and complications through minimally invasive processes.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Enforcement of tighter regulations for opioid prescriptions, encouraging the growth of non-opioid pain relief options. | The creation of robust regulatory systems will facilitate the approval and incorporation of new, non-addictive pain treatments, such as biologics and neuromodulation devices. |

| Introduction of minimally invasive surgical methods and improvements in spinal implants to enhance patient outcomes. | Construction of AI-based diagnostic devices, tailor-made medicine modalities, and regenerative strategies, including stem cell therapies, to increase the effectiveness of back pain management. |

| Growing knowledge of other pain management methods, resulting in greater demand for non-pharmacologic treatment, such as physical therapy and chiropractic treatment. | Increasing demand for comprehensive and integrative pain control strategies, including lifestyle changes, mental healthcare, and alternative therapies, fueled by an enlightened patient base demanding solutions that are lasting. |

| Increasing incidence of chronic back pain as a result of inactive lifestyles, aging population, and rising rates of obesity, combined with an escalating interest in enhancing quality of life. | Development of medical research, growth in healthcare spending, and public health measures focusing on prevention and early intervention of disorders in the spine will drive the growth of the industry. |

| Reliance on foreign suppliers of medical equipment and drugs combined with a push towards domestic production to counteract disruptions noticed during international events. | Development of local manufacturing capacities through government incentives and public-private collaborations, resulting in a robust supply chain and lower import dependency, with timely availability of key spine pain management inputs. |

The spinal care industry is part of the larger medical devices and healthcare services sector, more precisely under pain management, orthopedics, and neuromodulation. The market is driven by macroeconomic forces like healthcare spending, aging populations, technology development, and regulatory policies.

During 2025 to 2035, the industry will witness growth as there will be growing demand for sophisticated spinal treatments and pain management therapies. Growth in global healthcare expenditure, especially in developed economies, will fuel the uptake of innovative therapies, such as spinal implants, neuromodulation devices, and regenerative therapies. The increasing older population and higher incidence of chronic back pain will also fuel demand, as the elderly population is more prone to spinal disorders.

Level of disposable income and economic stability will also be essential in driving industry growth. Improved access to insurance coverage and enhanced healthcare affordability will drive higher use of spinal procedures. In contrast, investments and policies from governments will enhance availability of sophisticated spinal care, especially in the developing economies.

In addition, international supply chain resilience will play a critical role in maintaining the uninterrupted supply of spinal care products. The move toward local production and environmental conservation efforts will define future industry trends. In summary, robust macroeconomic fundamentals, along with advances in medicine, will propel long-term growth in the spinal care industry in the next ten years.

Spinal fusion devices are anticipated to experience consistent demand since they are instrumental in stabilizing spinal segments and managing diseases like degenerative disc diseases and spinal deformities. Developments in biomaterials and minimally invasive procedures are propelling adoption, guaranteeing efficient patient outcomes.

With an increase in cases of spinal degeneration, the industry is anticipated to expand at a CAGR of 7.5%. Spinal non-fusion devices are increasing in popularity as they can help maintain motion and minimize complications of conventional fusion methods. Patients requiring alternatives that provide spinal mobility, coupled with technological advancements in minimally invasive methods, are driving industry growth at a CAGR of 10.5%.

Vertebral body replacement systems are demanded to restore spinal stability after trauma or tumor removal. The systems ensure mechanical support without compromising spinal alignment and function. The rise in spinal injury and spinal cancers is fuelling industry growth at a CAGR of 10.6%.

Spinal cord stimulation is being identified as an emerging top-line treatment for the management of chronic pain, particularly for non-responding patients to standard treatments. Increased usage of neuromodulation devices and more sophisticated implantable devices is driving growth at a CAGR of 15.5%.

Transcutaneous electrical neuromuscular stimulation (TENS) is also gaining popularity as a non-surgical pain relief treatment for musculoskeletal and neuropathic pain. Increased demand for pain management without the use of drugs is driving growth at a CAGR of 13.0%.

Spinal epidural injections continue to be an important therapy for chronic pain, offering precise relief and facilitating mobility. Growing inclination towards non-surgical treatment is expected to drive the industry to grow at a CAGR of 13.1% through the forecast period.

Cervical pain is an emerging issue, usually caused by poor posture, degenerative processes, or trauma. The rising incidence of neck-related musculoskeletal disorders, coupled with the aging population requiring relief from pain, is fueling industry expansion. Improvements in treatment modalities are continually enhancing patient outcomes, propelling this segment to grow at a CAGR of 12.2% during the forecast period.

Thoracolumbar pain impacts a wide population based on spinal fractures, degenerative diseases, and trauma. With increasing awareness of effective treatments and availability of new therapies, demand for thoracolumbar pain management solutions keeps increasing. This segment is likely to grow at a CAGR of 8.9%.

Lumbar pain is one of the world's most prevalent reasons for doctor visits and disability. Sedentary lifestyle, obesity, and workplace injuries account for its severity. With enhanced minimally invasive treatments and localized pain management treatments, patients increasingly choose advanced options, fueling industry growth at a CAGR of 11.0%.

Sciatica pain, involving nerve-related pain between the lower back and legs, is a problem of major concern for healthcare practitioners. The increasing number of patients with sciatica caused by herniated discs, spinal stenosis, and other degenerative diseases is driving demand for efficient pain management treatments. This segment is expected to grow at a CAGR of 10.7% through the forecast period.

Hospitals continue to be the main treatment facilities for spinal disorders, providing a broad array of surgical and non-surgical treatments. The rising number of spinal procedures, combined with improvements in surgical methods and post-operative treatment, continues to drive industry growth. The segment is anticipated to grow at a CAGR of 7.1% during the forecast period.

Specialty clinics are becoming key contributors to spinal care, offering specialized services based on the specific needs of individual patients. As demand for personalized treatments and outpatient procedures increases, these clinics are drawing more patients who are looking for specialist consultation and minimally invasive procedures. The segment is expected to expand at a CAGR of 11.5%, indicative of the trend toward specialized spinal care.

Ambulatory surgical centers (ASCs) are emerging as favored locations for spinal surgeries, providing affordable, efficient, and minimally invasive treatment. The growing trend of outpatient spinal surgeries, advances in technology, and shorter recovery times are contributing to high growth in this segment. ASCs are likely to experience the highest growth at a CAGR of 14.6% through the forecast period.

The spine pain industry of South Carolina is observing a consistent surge in demand for spinal interventions in response to population aging and escalating rates of chronic back pain. The state is seeing growth in minimally invasive surgery and spinal cord stimulation as a reflection of the progress of pain management products.

Higher investment in healthcare and the availability of specialized spinal centers are also fuelling industry growth. Furthermore, the use of regenerative medicine and neuromodulation methods is anticipated to drive segment growth. The industry will grow at a CAGR of 9.9% as healthcare infrastructure continues to evolve and innovative treatments become more popular.

Florida is proving to be a leading region for spinal care due to its large population of older individuals and high rate of spinal disorders. The state is at the frontline of adopting new spinal fusion and non-fusion technologies, and this is stimulating investments in specialty clinics and ambulatory surgical centers.

The use of sophisticated pain management treatments, such as spinal cord stimulation and minimally invasive surgery, is also on the increase. Florida's increasing emphasis on outpatient surgical centers and rehabilitation facilities is also driving industry growth. With a robust healthcare infrastructure and a growing patient base looking for effective spinal care, the segment is expected to expand at a CAGR of 11.3%, demonstrating high demand for both surgical and non-surgical spinal procedures.

Virginia is experiencing a rising need for spinal care products, especially in major cities that have sophisticated health centers. Virginia's focus on increasing neuromodulation treatment and minimally invasive spinal treatment is driving business growth. Availability of high-grade hospitals and specialist clinics with sophisticated spinal treatments is driving patient inclination towards cutting-edge care.

Also, rising awareness regarding alternative pain management and a rise in spinal surgeries are driving segment growth. With more clinical trials and research studies being performed on spinal health, Virginia is set to grow further. The segment will increase at a CAGR of 10.7% led by technology developments and rising awareness about alternative options for pain management.

North Carolina is facing an increase in cases of spinal disorders, leading to surge in demand for both surgical and non-surgical intervention. With the growing number of specialty clinics and hospitals incorporating novel spinal care interventions, the industry is growing. The presence of robust research centers and the expansion of the state's medical tourism industry drive new spinal treatment methodologies adoption.

Expanding access to minimally invasive surgery and robotic-assisted procedures is enhancing patient recovery and outcomes. Moreover, the growing geriatric population and the incidence of spinal conditions like degenerative disc disease and spinal stenosis are major industry drivers. The segment is expected to expand at a CAGR of 10.4%, aided by an expanding patient population and technology advances in spinal care.

California continues to be among the key regions for spinal treatments with an established healthcare infrastructure and a robust research and development focus. Advanced spinal surgeries, regenerative medicine, and neuromodulation technologies have their center of excellence in the state.

As investments into healthcare innovation and accessibility increase, the California spinal care is anticipated to expand at a CAGR of 11.7% through the forecast period. The fact that major medical device companies and research organizations are present there drives the technology advances.

The incorporation of artificial intelligence and robotics into spinal surgery is also increasing treatment accuracy and patient outcomes further. California's focus on outpatient and minimally invasive spinal care will likely determine the future of spinal treatment in the state and will be an important force in the future of spinal treatment.

The recent FMI survey collected information from the most influential stakeholders in the spinal care industry, such as healthcare providers, medical device manufacturers, regulators, and patients. The survey reported an increasing preference for minimally invasive and non-fusion spinal procedures due to patient demand for reduced recovery time and complications.

Stakeholders also stressed that AI-based diagnostics and regenerative medicine will play important roles in influencing future spinal therapies. Companies highlighted increased investments in neuromodulation and biomaterial-based implantations, and regulators emphasized more defined approval paths for novel treatments.

Physicians similarly noted a move away from opioids in pain control, with spinal cord stimulation and biologic-based therapies becoming increasingly popular. Nonetheless, budget restrictions and reimbursement difficulties may affect broader use of the technologies, especially in ambulatory surgical centers (ASCs).

Patients showed high interest in integrative pain management strategies, such as physical therapy, lifestyle modifications, and psychological support. The stakeholders believe that telemedicine, remote monitoring, and AI-enabled care will become crucial in the coming decade. The survey reached a conclusion that cooperation among industry leaders, regulators, and clinicians will be imperative to develop spinal treatments and enhance patient outcomes.

| Regulation | Impact on the Spinal Care Industry |

|---|---|

| FDA Approval Process for Medical Devices | Stringent approval procedures guarantee the safety and effectiveness of spinal implants and neuromodulation devices, but prolonged approval times may postpone industry introduction of innovative treatments. |

| Medicare and Medicaid Reimbursement Policies | Spinal procedure coverage impacts patient access to care, with trends toward value-based models encouraging cost-effective and outcome-oriented therapy. |

| 21st Century Cures Act | Promotes the expedited approval of innovative medical devices, which will advance the development and commercialization of sophisticated spinal technologies. |

| Opioid Prescription Regulations | Tighter controls on opioids are fueling demand for non-opioid pain management options, including spinal cord stimulation and regenerative medicine. |

| Medical Device Excise Tax (Repealed in 2020) | The elimination of this tax has decreased financial pressures on spinal device companies, enabling greater investment in research and development. |

| HIPAA and Digital Health Regulations | Guarantees patient information protection in telemedicine and remote spinal care monitoring, impacting adoption of AI-based diagnostics and digital health solutions. |

| Affordable Care Act (ACA) | Affects patient access to spinal care but raises cost pressures for hospitals and clinics, promoting efficiency and innovation in the delivery of care. |

The spinal care industry has high growth prospects fueled by the evolution of minimally invasive procedures, growing demand for non-opioid pain management therapies, and higher incidence of spinal conditions. The use of AI-based diagnostics and regenerative therapies like stem cell therapy will augment patient outcomes and increase industry scope.

Also, the growing trend of outpatient procedures at ambulatory surgical centers offers possibilities for cost-efficient and effective treatment options. New sectors with developing healthcare infrastructure, especially in the Asia-Pacific and Latin America regions, also pose potential for sector growth.

To take advantage of these opportunities, firms need to invest in research and development to fuel innovation in spinal implants, neuromodulation devices, and non-fusion technologies. Strategic alliances with healthcare providers and technology companies will enable quicker uptake of new therapies.

Diversification of manufacturing capabilities and supply chain localization will reduce risks tied to global disruption. Regulatory adherence needs to continue as a top concern, aligning with new directions in non-opioid pain management and approval of devices.

Companies must also prioritize patient awareness and education efforts to facilitate increased adoption of emerging treatments. As industry stakeholders seize the benefits of technological innovations and strategic partnerships, they can cement their position in the marketplace and fuel sustainable expansion.

The spinal care industry saw massive mergers and acquisitions, defining the competitive scenario. Stryker diversified its portfolio with the acquisition of Vertos Medical, a pioneer in minimally invasive spinal stenosis treatments for the lumbar spine, and Nico Corp., a neurosurgical technology specialist.

These acquisitions enhanced Stryker's dominance in cutting-edge spinal care solutions. Likewise, Zimvie made strategic mergers and alliances to strengthen its industry share and expand its product portfolio.

Another significant development was the Globus Medical and NuVasive merger, bringing together their spinal technology expertise to fuel innovation and simplify product development. These mergers are indicative of the industry's emphasis on broadening technological capabilities and maximizing patient care.

Looking toward to 2025, new players in the spinal care industry are adopting strategic strategies to make their presence felt. Most are focusing on technology innovation by creating high-end minimally invasive surgical instruments and AI-based diagnostic platforms to enhance treatment efficiency.

Strategic partnerships with established medical device companies and healthcare providers are also being prioritized, enabling new entrants to tap into existing distribution channels and clinical experience. Further, firms are closely collaborating with regulators to speed up product approvals and maintain alignment with changing healthcare standards.

Another trend is the focus on patient-driven solutions, including non-surgical and holistic care strategies like physical therapy and pain management. Such strategies are geared towards placing new entrants favorably in an accelerating industry while meeting changing patient needs amidst an increasingly complicated regulatory landscape.

Increasing spinal disorders, minimally invasive procedures, and non-opioid pain solutions are key factors.

AI diagnostics, robotic surgeries, and regenerative medicine enhance precision, recovery, and treatment options.

Stricter guidelines ensure safety, accelerate approvals, and support innovation in non-opioid treatments.

AI, biologics, and minimally invasive solutions offer entry points, with partnerships and digital tools aiding growth.

Demand for non-invasive, personalized, and holistic treatments is driving innovation in surgical and non-surgical care.

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Bone Regeneration Market Analysis - Size, Share & Forecast 2025 to 2035

Manometry System Market Overview - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.