The specialty oils market is expected to reach a valuation of USD 137.6 billion by 2025 and USD 182.6 billion by 2035 at a CAGR of 3.3%. Revenue from the specialty oils market will continue to grow steadily from 2025 to 2035, owing to demand from key end-use industries including automotive, manufacturing, and personal care.

The global specialty oils industry increased steadily in 2024, due to increasing demand from automotive, manufacturing, and food processing sectors. The segment recorded a recovery trend from coronavirus-induced supply chain disruptions, where producers focused on sustainable sourcing solutions, product innovations, and capacity expansions.

Increasing environmental concerns have driven demand for bio-based, low-emission specialty oils, particularly in industrial and automotive applications. However, the segment is witnessing a growing trend in the use of high-performance lubricants and bio-based specialty oils owing to businesses becoming focused on sustainability and efficiency.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 137.6 billion |

| Industry Value (2035F) | USD 182.6 billion |

| CAGR (2025 to 2035) | 3.3% |

As industries become more eco- conscious, demand for specialty oils continues to grow. Important specialty oils such as white oil are increasingly being used in power transmission, pharmaceuticals, and cosmetics.

Additionally, their increasing use for equipment reliability, lubrication, and insulation is supplementing the growth of this industry. Improvements in biodegradable and vegetable oil-based fluids are reducing the environmental hazards of oils.

The demand for specialty oils in green and low-emission vehicles is being driven by regulatory policies promoting eco-friendly and zero-emission transportation. Manufacturers are ramping up R&D efforts to align with government and industry-driven sustainability mandates. This has resulted in the development of new products that comply with strict environmental regulations, without sacrificing performance.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Moderate growth due to industrial expansion | Steady growth driven by sustainability and innovation |

| Rising demand in automotive & manufacturing | Increased adoption of bio-based & high-performance oils |

| Development of synthetic & specialty blends | Focus on biodegradable & eco-friendly formulations |

| Stringent emissions & safety regulations | Stronger push for sustainable & low-carbon alternatives |

| Cost-effective & performance-based oils | Preference for sustainable, efficient, & clean oils |

| Automotive, power, pharmaceuticals | Expanding to renewable energy, food processing |

| R&D in synthetic oils & performance enhancers | Higher investments in green chemistry & bio-based solutions |

| Dominance of Asia-Pacific & North America | Growth in emerging economies & sustainable industries |

To accurately analyze and forecast data pertaining to specialty oils, Future Market Insights (FMI) of new approach has been implanted in which an extensive survey has been conducted with key stakeholders in the specialty oils landscape, including manufacturers, suppliers, distributors, and end-users in various sectors such as automotive and pharmaceuticals, as well as in power transmission.

Survey respondents indicated that growth in specialty oils, both in formulating and final application, is being fueled by a demand for higher performance lubrication, better energy efficiency, and sustainability. Due to an increase in regulatory pressure and consumer demand for eco-friendly alternatives, bio-based and biodegradable specialty oils emerge as the segment develops.

Interviewed experts across the study strongly highlighted innovations that are shaping the future of specialty oils. Investment in R&D has accelerated, especially in respect of synthetic and plant-based oils that provide improved viscosity, oxidation stability and more effective service life.

Additionally, the demand patterns are shifting with the transition toward electric vehicles and renewable energy sources to meet the changing needs of the industry, new formulations are needed.

The survey also highlighted regional differences in industry growth. North America and Europe are adopting sustainable specialty oils at an increasing rate owing to stricter environmental regulations, while the demand in Asia-Pacific is persistent, primarily driven by industrialization and automotive production.

Geopolitical uncertainties and volatile raw material prices were also identified by participants as challenges that could constrain industry expansion through the next decade. However, the FMI survey highlights how companies are adapting through strategic sourcing, supply chain diversification, and investment in sustainable alternatives, providing a comprehensive outlook on the future trajectory of the specialty oils market.

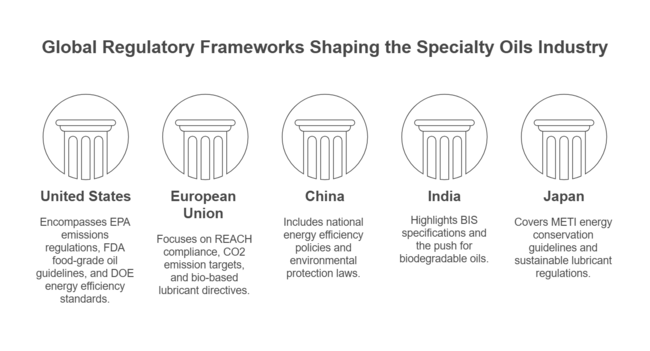

| Country/Region | Key Regulations |

|---|---|

| United States | EPA regulations on emissions and hazardous chemicals, FDA guidelines on food-grade oils, and DOE energy efficiency standards. |

| European Union | REACH compliance for chemical safety, stringent CO2 emission targets, and directives promoting bio-based lubricants. |

| China | National energy efficiency policies, environmental protection laws restricting toxic substances, and automotive fuel efficiency standards. |

| India | BIS (Bureau of Indian Standards) specifications for industrial and automotive lubricants, government push for biodegradable oils. |

| Japan | METI energy conservation guidelines, focus on sustainable industrial fluids, and automotive lubricant regulations. |

| Brazil | ANP (National Agency of Petroleum) standards for specialty oils, environmental protection rules for oil disposal. |

| Australia | Environmental Protection Act for safe chemical handling, guidelines on biodegradable industrial fluids. |

| Middle East | Oil and gas industry regulations on lubricant standards, government policies promoting sustainable energy. |

The demand for specialty oils industry is highly correlated with industry of chemicals and lubricants, as well as the sectors or vertical like automotive, power transmission, manufacturing, pharmaceuticals, personal care etc. It falls under the industrial oils and specialty chemicals category, meeting specialized demands for high-performing, customized lubrication and formulation solutions.

The growth of the specialty oils industry is interconnected with industrial growth, energy demand, regulatory frameworks, and technologies from a macroeconomic standpoint.

Global economies are gradually recovering from the pandemic, and the increasing industrialization, particularly in emerging nations such as China, India, and Southeast Asia, is significantly fueling the demand for specialty oils in power generation, machinery maintenance, and automotive lubrication sectors.

Furthermore, the current energy transition and sustainability trend are driving industries to transition to bio-based and eco-friendly specialty oils, in line with stringent emission laws in regions such as the EU and North America.

Additionally, changes in crude oil prices, trade policies, and geopolitical tensions affect raw material availability and pricing. However, the industry is expected to fuel growth due to increasing infrastructure investments, rising automotive production (especially EVs), and increasing demand for high-performance lubricants. Driven by innovation, regulatory support, and industrial modernization, the specialty oils industry is projected to grow at a steady CAGR of 3.3% through 2035.

Top players in the specialty oils market are engaging in cost-based competition to innovate, expand, and form strategic alliances. Few players are leveraging a cost leadership strategy to win bulk buyers in the automotive and industrial manufacturing domains by proposing competitively priced offerings.

Some are focusing more on differentiation with high investments in R&D, supporting the development of high-performance and bio-based specialty oils that meet evolving sustainability requirements. Mergers and acquisitions (M&A) are also a focus, with larger firms acquiring smaller, specialized players to broaden product offerings and fortify their segment presence.

Sector collaborations with OEMs, chemical manufacturers, and renewable energy companies are streamlining supply chain processes and product customization further optimizing supply chains and enabling greater product customization.

Top companies growing every day are aggressively expanding both production capacity and distribution networks around the world. Others are making multibillion-dollar bets on developing industries such as Asia-Pacific and Latin America, where industrialization and vehicle ownership are on an upward trajectory.

Sustainability continues to be a central tenet of growth strategies, with firms increasingly focused on greener formulations and minimizing carbon footprints while adhering to more rigorous environmental regulations. Moreover, automation is making an impact, since businesses are adopting AI-powered predictive maintenance and smart manufacturing to maximize operations, directing them to keep their competitive edge in the changing landscape of specialty oils.

The specialty oils industry is concentrated, with the leading five players, AAK AB, Bunge Limited, Cargill Incorporated, Mewah International Inc., and Wilmar International, controlling over 58.8% of the industry share collectively.

These companies focus on innovation in products, partnerships, regional expansion, and sustainability initiatives as major strategies for sustaining their superiority. Innovations continue being researched on and invested in, with health and sustainability-focused products taking precedence.

For example, the acquisition of IOI Loders Croklaan by Bunge Limited complemented the specialty oils portfolio and diversified its product offering in the specialty oils segment and met the increasing consumer trends.

This process led to Adani Wilmar, now the largest refiner of consumer-packed edible oils in India, a joint venture between Wilmar International and Adani Group. Likewise, companies are widening their geographical footprint to leverage emerging industries for example, Synthite’s expansion spans India, China, Brazil, the USA, Vietnam, and Sri Lanka.

Firms are innovating palm oil alternatives and focusing on responsible sourcing to satisfy growing environmental concerns among consumers. Industry leaders are anticipated to invest in such growth to consolidate their position.

Market Share Analysis of Leading Companies

| Company Name | Industry Position & Offerings |

|---|---|

| Exxon Mobil Corporation | A global leader offering a diverse range of specialty oils for industrial applications. |

| Chevron Corporation | Provides high-quality specialty oils for automotive and industrial uses. |

| Royal Dutch Shell plc | Extensive portfolio serving automotive, manufacturing, and power generation sectors. |

| BP Plc. | Offers specialty oils under the Castrol brand, focusing on performance and sustainability. |

| Total Energies | Supplies specialty oils across automotive, aerospace, and energy industries. |

The growing applications in pharmaceuticals, cosmetics, and food industries are projected to drive the demand for specialty oil. By product type, the transformer oils segment is anticipated to expand at a significant CAGR of 8.0% by value and is likely to hold industry share of 51% over the forecast period.

This, along with high purity, nontoxic nature- makes it a crucial component in spices, personal care products, medicinal formulations & food grade lubricant. The automotive sector will continue to be significant, bolstered by the growing automotive sector and the growing demand for high-performance lubricants that improve engine efficiency and service existence.

The moisture retention property of liquid paraffin finds a sustained demand in the personal care industry as well as pharmaceuticals and food applications, in addition to its medicinal properties. Rubber process oil will play an essential role in production of various types of tires and rubber products, enhancing elasticity and resistance.

Due to its protective and moisturizing properties, petroleum jelly is a versatile substance that will continue to be widely used in skincare, healthcare, and industrial applications. Other specialty oils will still have a place for certain niche applications, with increased customization of formulations for specific industrial and commercial purposes.

The automotive end-use segment will account for significant demand for specialty oils due to the increased usage of high-performance lubricants by vehicle manufacturers to enhance fuel efficiency and reduce emissions.

FMI predicts the automotive segment is to register a CAGR of 1.8% during the forecast period with 34.8% industry share. As it stands, electricity generation is still the largest consumer of transformer and industrial oils, with utilities and renewables projects demanding premium lubricants to enhance the transfer of energy and operational efficiency.

From pharmaceuticals, specialty oils like white oil, liquid paraffin will be used in medicinal formulations, topical treatments, fabrication of drugs. Personal care and cosmetics will drive demand for high-purity white oils and petroleum jelly as consumers increasingly adopt skincare, haircare, and beauty products that clean and protect the skin and hair and offer a high degree of safe efficacy.

However, specialty oils will increasingly be used within the food and beverage field for food processing, food packaging, and machinery lubrication due to the need for compliance with safety regulations. Manufacturing will continue to be a significant segment as industrial oils help to improve the functioning and lifespan of machinery.

Grease and specialty oils are needed to allow heavy engineering equipment to continue high-load operations without mechanical failures. High performing transformer oils to support stable and efficient grids will be needed across transmission and distribution networks. Other industries are going to drive further innovation through new formulations, and applications, contributing to the growth of specialty oils designed for specific operational requirements.

Driven by increasing sustainability concerns, companies are shifting to renewable raw materials, with bio-based and eco-friendly specialty oils expected to transform the industry. Stringent laws governing emissions and disposal of generation waste are expected to impel the production of biodegradable and low-carbon specialty oils, paving way for immense opportunities for manufacturers.

In addition, the growing EV industry will increase the need for advanced lubricants and thermal management fluids, making specialty oils integral to next-gen transportation solutions. The industry will also be driven by the cosmetics and personal care industries, as high-purity oils gain greater consumer preference for use in skincare and medicinal products.

To take advantage of these trends, businesses should prioritize innovation, sustainability, and strategic partnerships. Focusing efforts on R&D to develop high-performance, eco-friendly specialty oils will be key to the sector's compliance with regulations and their fulfillment of consumer expectations.

The rise of industrial and automotive activities in regions like Asia-Pacific and Latin America presents an opportunity to increase the production capacity in these high-growth locations, which will help improve industry penetration.

As for manufacturing processes, companies need to further expand on the digitalization and automation front. Building strategic partnerships with end-user industries, including automotive manufacturers and renewable energy companies, can facilitate the development of customized solutions that address industry-specific needs.

In addition to these innovative strategies, fortifying supply chain resilience will also take on new importance for ensuring a secure raw material supply that allows competitive edge in this changing landscape.

The United States is a key player in the specialty oils industry, accounting for 19.6% of the global industry share. The dominance is fueled by its robust industrial base, developed automotive sector, and increasing needs for sustainable lubricants.

The USA Environmental Protection Agency (EPA) has launched several sweeping, new environmental policies, putting pressure on manufacturers along the lines of bio-based and biodegradable specialty oils.

The growth of the renewables sector, coupled with the increasing production of electric vehicles (EVs) and advancements in battery infrastructure, is further driving demand for specialty oils.

In addition to that, the growing pharmaceutical and personal care industries are driving the consumption of high-purity white oils. Players in the industry will need to make strategic investments in R&D and manufacturing capabilities.

FMI opines that the United Kingdom specialty oils sales will grow at nearly 3.5% CAGR through 2025 to 2035.

Sustainability compliance and net-zero transition drive the UK specialty oils industry.Government initiatives towards electric mobility and renewable energy are expected to create demand for specialty transformer oils. The cosmetics and personal care industry is also driving the demand for high purity white oils and liquid paraffin. Due to increasing industrial and heavy engineering activities the industry for lubricants will also grow.

Growth in investments in eco-friendly formulations and collaboration with automotive and energy firms to create next-generation specialty oils are likely to be beneficial for industry players.

FMI opines that the United Kingdom specialty oils sales will grow at nearly 2.9% CAGR through 2025 to 2035.

The industry for specialty oils in France is defined by its emphasis on sustainability, strict environmental regulations, and industrial innovation. The government's pledge to cut carbon emissions is promoting the use of biodegradable specialty oils, especially in power generation and transmission.

There is a rise in demand for white oil and petroleum jelly in the cosmetics and pharmaceutical sectors. Moreover, the growth of the economy is expected to generate demand for advanced automotive and transformer oils within the country’s burgeoning electric vehicle sector. Key stakeholders: Companies investing in bio-based specialty oil production and supply chain optimization will hold a strong competitive share in the French industry.

FMI opines that the France specialty oils sales will grow at nearly 3.2% CAGR through 2025 to 2035.

Germany holds the 5.3% industry share of global specialty oils industry, buoyed by a robust manufacturing and automotive sector. The shift to electric mobility is raising demand for specialty lubricants in EV parts. Germany's transition to a renewable-integrated power grid is also driving demand for transformer oil.

The demand for high-purity specialty oils is fueled by the country’s top pharmaceutical and cosmetics industries.

Manufacturers are being driven to innovate and provide sustainable solutions due to increasingly rigid environmental standards. Players in the industry investing in R&D or expanding local production capacity stand to benefit from an advanced industrial landscape in Germany.

FMI opines that Germany specialty oils sales will grow at nearly 4% CAGR through 2025 to 2035.

Italy’s specialty oils industry is aided by its strong manufacturing, automotive and personal care industries. The country’s thrust towards energy efficiency and sustainability is also spurring the demand for transformer oils in power transmission networks.

White oils and petroleum jelly are being driven by the cosmetics industry, especially premium skincare and beauty products. Furthermore, the food and beverage sector in Italy is propelling the utilization of specialty oils for processing and packaging activities.

With high barriers to entry in the premium and eco-friendly formulations industries, companies focusing on sustainable solutions will gain a competitive edge as consumer and industrial demand shifts toward sustainability.

FMI opines that Italy specialty oils sales will grow at nearly 2.8% CAGR through 2025 to 2035.

Thanks to its advanced electronics, automotive, and power industries, the specialty oils industry in South Korea is continuously growing. South Korea’s efforts for energy security and transition to renewable power generations are driving demand for specialty transformer oils.

The growing cosmetics & personal care industry is also adding to the demand for good quality white oils. The increasing demand for high-performance lubricants is driven by South Korea’s automotive industry, particularly the rapid growth of its EV production and adoption. Businesses that invest in innovative, sustainable solutions will leverage South Korea’s high-tech industrial ecosystem and deepening regulatory focus on environmental responsibility.

FMI opines that Italy specialty oils sales will grow at nearly 5.2% CAGR through 2025 to 2035.

Japan holds 6.2% of the global specialty oils market, driven by technological advancements, the rapid expansion of its automotive sector, and the development of energy-efficient delivery systems. The automotive and manufacturing sectors of the country are fueling demand for high-performance industrial oils, including synthetic lubricants.

Stringent environmental regulations in Japan are driving the consumption for bio-based and low-emission specialty oils. White oils are increasingly being utilized in the cosmetics and pharmaceuticals industries owing to their innovation and quality standards.

With Japan's commitment to promote carbon neutral emissions and sustainable solutions, industry players who invest in R&D and optimization of eco-friendly manufacturing solutions will enjoy a competitive advantage.

FMI opines that Italy specialty oils sales will grow at nearly 2.5% CAGR through 2025 to 2035.

As the most industrialized, fastest growing automotive producer, and one of the largest energy sectors in the world, China remains the leading and highest growth specialty oils industry. The China specialty oil industry is expected to grow at a CAGR of 4.1% in the period of 2025 to 2035. The country’s transition to electric vehicles drives demand for high-performance lubricants and transformer oils.

The increasing consumption of white oil is also fueled by the rapid expansion of the cosmetics and pharmaceutical industries. Government policies in China underwrite and encourage green energy and environmental sustainability, affecting specialty oil formulations. As industrialization progresses, the need for specialty oils in heavy machinery and manufacturing will increase. Firms developing production near sales industries, supply chains and sustainability will prosper in this competitive industry.

FMI opines that China specialty oils sales will grow at nearly 4.8% CAGR through 2025 to 2035.

India’s specialty oils industry is poised for robust growth between 2025 and 2035 and expected to grow at a CAGR of 4.6 %, driven by the rapid expansion of industrial sectors, increasing demand for high-performance lubricants, and a strong push for sustainability. The country’s booming automotive industry, coupled with the transition toward electric vehicles (EVs), is expected to drive demand for advanced automotive and industrial oils.

The growing power sector, with significant investments in grid infrastructure and renewable energy, will further boost the consumption of transformer oils. Government regulations promoting environmentally friendly and biodegradable oils are expected to reshape the industry.

Policies supporting green energy and reducing carbon emissions will encourage manufacturers to invest in bio-based specialty oils.With India’s focus on industrial growth, sustainability, and technological advancements, companies that prioritize product innovation and eco-friendly solutions will have a competitive edge in this rapidly growing industry.

The growing demand for high-performance lubricants in the automotive, manufacturing, and power generation industries is a key factor driving industry expansion. Additionally, the shift toward bio-based and eco-friendly oils, growing industrialization in emerging economies, and stringent environmental regulations are fueling demand.

Sustainability concerns are encouraging the adoption of biodegradable and bio-based specialty oils. Industries are transitioning to low-emission formulations to comply with stringent environmental regulations, particularly in regions like North America and the European Union.

Automotive, power generation, pharmaceuticals, cosmetics, and food processing industries are the largest consumers. Transformer oils are vital for electricity grids, while high-purity white oils are extensively used in personal care and medical applications.

The rise in electric vehicle adoption is driving increased demand for advanced lubricants, such as thermal management fluids and high-performance greases, which are essential for battery cooling and efficient component operation.

Government regulation affects the specialty oils industry in terms of emissions, waste management, and product sustainability. Renewable energy projects and electric vehicle uptake further influence demand for special oils applied in transformers and industrial use.

White Oil, Automotive Oil, Transformer Oil, Industrial Oil, Liquid Paraffin, Rubber Process Oil, Petroleum Jelly, Other Product Types

Automotive, Power Generation, Pharmaceutical, Personal Care & Cosmetics, Food & Beverages, Manufacturing, Heavy Engineering Equipment, Transmission & Distribution, Other End Users

North America, Latin America, Europe Industry, East Asia Industry, South Asia & Pacific Industry, Middle East & Africa (ME&A) Industry

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Polyurethane Foam Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.