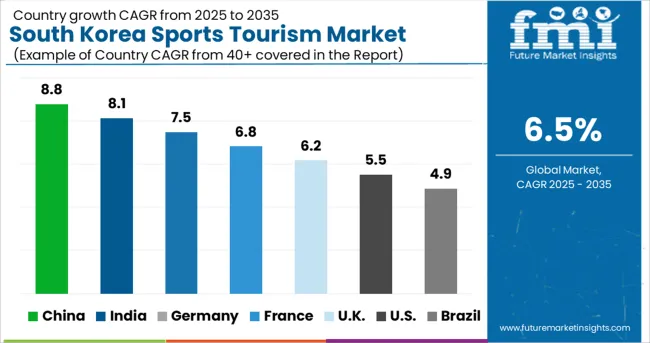

The South Korea Sports Tourism Market is estimated to be valued at USD 8.6 billion in 2025 and is projected to reach USD 16.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The South Korea sports tourism market is experiencing a substantial growth trajectory supported by the country’s expanding infrastructure, international event hosting capabilities, and increasing global visibility in sports entertainment. Government initiatives to promote tourism through large-scale sporting events and public-private investments in multipurpose stadiums and training facilities have significantly elevated the nation’s profile as a sports tourism hub.

Increasing inbound travel linked to fan engagement, team merchandising, and club partnerships has reinforced South Korea's position in the global sports tourism map. Rising disposable income, the popularity of K-league football, and growing participation in wellness and outdoor sports activities are enhancing both spectator and participatory tourism.

Moreover, the development of integrated travel packages, digital ticketing platforms, and sports-centric experiences such as stadium tours and athlete meetups are opening new opportunities for market expansion. As regional competition intensifies, South Korea is expected to maintain its advantage through innovation in event tourism formats and targeted demographic outreach.

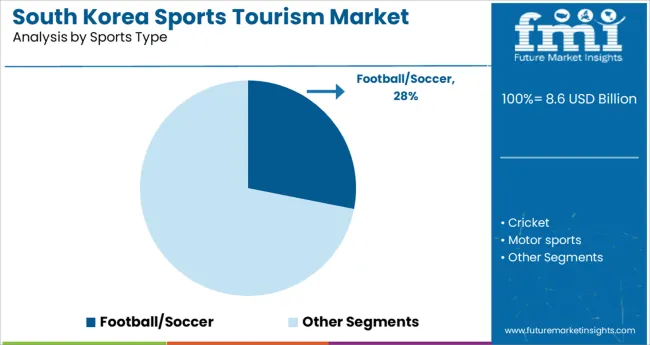

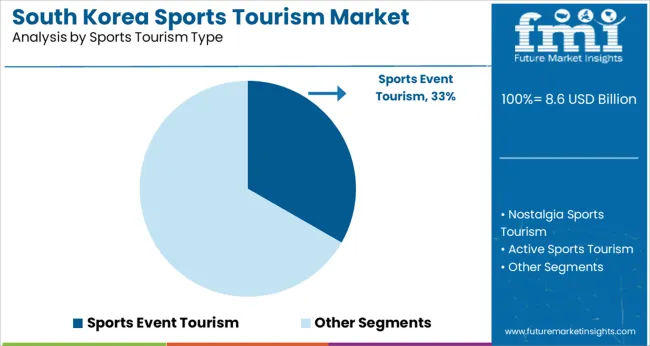

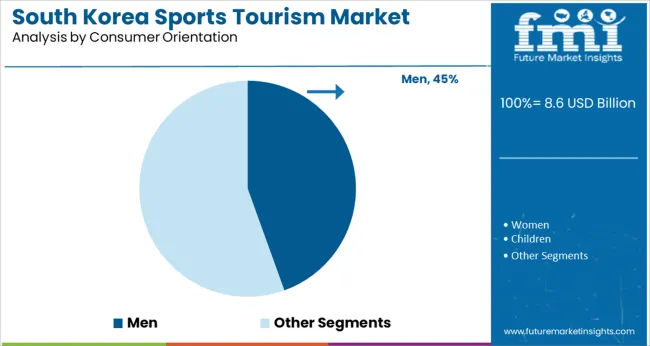

The market is segmented by Sports Type, Sports Tourism Type, Consumer Orientation, Booking Channel, Tourist Type, and Tour Type and region. By Sports Type, the market is divided into Football/Soccer, Cricket, Motor sports, Basketball, and Others. In terms of Sports Tourism Type, the market is classified into Sports Event Tourism, Nostalgia Sports Tourism, Active Sports Tourism, and Passive Sports Tourism. Based on Consumer Orientation, the market is segmented into Men, Women, and Children. By Booking Channel, the market is divided into Online Booking, In-Person Booking, and Phone Booking. By Tourist Type, the market is segmented into Domestic and International. By Tour Type, the market is segmented into Independent Traveler, Tour Group, and Package Traveler. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Sports Type, Sports Tourism Type, Consumer Orientation, Booking Channel, Tourist Type, and Tour Type and region. By Sports Type, the market is divided into Football/Soccer, Cricket, Motor sports, Basketball, and Others. In terms of Sports Tourism Type, the market is classified into Sports Event Tourism, Nostalgia Sports Tourism, Active Sports Tourism, and Passive Sports Tourism. Based on Consumer Orientation, the market is segmented into Men, Women, and Children. By Booking Channel, the market is divided into Online Booking, In-Person Booking, and Phone Booking. By Tourist Type, the market is segmented into Domestic and International. By Tour Type, the market is segmented into Independent Traveler, Tour Group, and Package Traveler. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The football soccer segment is anticipated to account for 28.1% of total revenue in the sports type category in 2025, establishing it as the leading sport within the market. This segment’s leadership is being reinforced by the country’s well-established professional leagues, international club partnerships, and strong domestic fan base.

Investments in football-specific stadiums, youth academies, and promotional campaigns have strengthened the infrastructure needed to host large-scale domestic and international tournaments. Broadcasting rights and media engagement have elevated football visibility, while collaborations with overseas clubs have deepened fan engagement.

The cultural resonance of football, coupled with its frequent seasonal scheduling, has led to increased travel associated with live match attendance, merchandise events, and training camps, consolidating its dominant revenue share in the market.

Sports event tourism is projected to generate 33.3% of total market revenue in 2025 within the tourism type category, making it the leading segment. This dominance has emerged from South Korea’s strong track record of hosting high-profile sporting events including international tournaments, championships, and exhibition matches.

Government-backed campaigns to promote inbound travel through sports events and the development of multipurpose sports complexes have enabled increased visitor inflow. Fans attending live events are also contributing to secondary revenue streams through accommodations, local transport, and experience-driven spending.

Digital ticketing and fan engagement platforms have further enhanced access and personalization, while structured event calendars across different sports disciplines are encouraging year-round visitor activity. These factors are collectively strengthening the market position of sports event tourism as the most impactful contributor to the country’s sports tourism landscape.

The men consumer orientation segment is expected to contribute 44.5% of total market revenue in 2025, maintaining its position as the dominant consumer group. This is being driven by higher participation in competitive and leisure sports activities, elevated interest in spectator events, and greater average spending on sports-related travel and merchandise.

Cultural alignment with team-based sports, particularly football and baseball, has led to deeper engagement across both domestic and international male travelers. Targeted marketing campaigns, male-centric travel itineraries, and exclusive fan experiences have further attracted this demographic.

Sporting venues and hospitality providers have also curated male-focused packages including team meetups, VIP match seating, and branded merchandise integration, resulting in increased conversion and retention. The combination of strong brand loyalty, content consumption, and event attendance has positioned men as the primary growth driver in the consumer orientation landscape.

People are becoming more health-conscious, and it is expected that they will actively participate in sporting activities to fulfill their desire for a healthy and active lifestyle. When the situation improves and travel restrictions are lifted, sports tourism will regain momentum due to the global population's insatiable love and passion for sports boosting the South Korea sports tourism market opportunities.

The South Korea sports tourism market is expanding due to a rise in the number of sporting events taking place in different states of South Korea, especially on Jeju Island, a semi-tropical island off the south coast.

New tournaments are being held in existing venues to attract more spectators, and new venues for existing tournaments are being established to attract more spectators, in order to broaden the reach and popularity of South Korea sports tourism market. As the number of sports tourists grows, so does the demand for more seating capacity at sporting venues around the world influencing the South Korea sports tourism market future trends.

As sports event venues can accommodate a larger number of visitors, larger seating capacities result in higher ticketing revenue generation. Increased revenue from tickets and sports packages will propel the South Korea sports tourism market opportunities forward. Many sports clubs and events are expanding their capacity to accommodate sports tourists. As a result, new tournaments held in existing venues will generate lucrative revenue for the South Korea sports tourism market.

Government Promotion:

Government is promoting major sports events to all corners of the country, widening economic development and raising awareness of zones beyond the capital city of Seoul, in order to encourage the South Korea sports tourism market. Additionally, the government is ensuring that the mass media have a reliable and balanced tourism description about the country to export internationally.

Achieving the Right to Host:

Winning the right to host a major sporting event offers a special opportunity to promote the South Korea sports tourism market, break down cultural stereotypes, and highlight the diversity of the nation in areas like the arts, culture, heritage, music, and dance.

Catalyst for Modification:

In addition to that, it acts as a catalyst for change with job creation and the development of skills through volunteerism and huge investment in expansive exhibition and conference halls equipped with advanced technology.

Incheon - Nearest International Gateway City:

After the capital city (Seoul), the nearest international gateway city is Incheon, which has seen huge expansion and aims to become one of the four top distribution hubs in the world, having been designated as a ‘free-economic zone’. One such great example is that it helped the country win the right to organize the 2014 Asian Games.

| Market Driver | Growing contribution to GDP and employment |

|---|---|

| Market Challenges | Terrorism has a significant impact. |

| Market Development | An increase in the number of sporting events |

Developing new South Korea sports tourism markets by facilitating the convergence of sports and other industries, supporting small but strong sports companies in financing and management, and encouraging development of new technology by certifying R&D, are likely to promote South Korea sports tourism market share.

Policies Supporting South Korea Sports Tourism Market Share

Infrastructural development in islands and countries like Jeju, Muju, etc. provided tremendous sports to sports tourism in South Korea.

Jeju Islands

Jeju Island has crafted sports tourism a centerpiece of its offerings.

South Korea has many islands and islets, and one of the biggest is Jeju, which is a semi-tropical island off the south coast, formed by the ancient exploits of an immersed volcano. It is home ground to PGA standard golf courses and a first-class football stadium. However, nature remains the key attraction to adventure and health tourists.

The Jeju International Ironman Korea officially owned and conducted by the World Triathlon Council. Jeju promotes the South Korea sports tourism market. Due to the adrenaline adventurers, the island is a natural playground to scuba dive, paraglide, mountain bike, or backpack to the craters and lava streams.

Muju Islands

Muju is a county located in the central part of the South Korean Peninsula. In 2013, Taekwondo Park was set to open in Muju, and which was anticipated to be a modern world cultural heritage for Koreans and foreign sports enthusiasts. The park is constructed under Mount Base Kunsan in Muju, which is popular for the beautiful scenery of nine valleys.

Taekwondo Park

The Taekwondo Park is a huge sports village divided into three theme sectors: “Mind” dedicated to training with a multi-purpose stadium and World Taekwondo Academy; “Body”, referred to as a ‘space for experience', encompass, for example, a Taekwondo Exhibition Hall and a ‘World Taekwondo Village’; “Spirit” symbolize what the sport means to the home nation, but also sports individuals around the world and contain a “Hall of Honor”, “Water Terrace” and “Observatory”.

It is projected that the development of each of these islands and their associated projects is likely to promote South Korea sports tourism market expansion.

Online Booking is More Preferred by Sports Tourists.

Since using an online booking or mobile application platform allows for a direct, hassle-free digital transaction, instant tracking, and increased security, tourists prefer online booking.

Online booking segment is expected to dominate the South Korea sports tourism market. Additionally, as people can use the internet to research and compare different holiday destinations, lodging options, dining options, and other factors, online booking is becoming more and more popular all over the world.

Popularity of South Korea Tourism among Middle-aged People is expected to Remain High during the forecast period.

In terms of age group, the number of tourists in the 26-35-year-old bracket is expected to rise significantly, since this demographic is more inclined to visit various tourist attractions and is more interested in seeing various adventure sites.

Consumers in this segment place a high value on recreational and adventure activities, such as exploring various islands, scuba diving, sightseeing, etc., and are inclined towards visiting popular sites as per the destination rankings. As a result, demand for sports tourism in South Korea is expanding.

Taekwondo is the national sport of South Korea, but Football and Baseball are the most popular sports among the South Koreans.

American missionaries brought baseball to South Korea in 1905, and since the sport has attracted a sizable following there. The country has one of the strongest teams in the world, and it frequently competes in the World Baseball Classic. The national league, the KBO League, is well-liked. Finest accomplishments include earning a bronze medal at the 2012 Summer Olympics and making it to the 2002 FIFA World Cup semifinals.

In order to diversify South Korea's sports tourism market offering and draw more travelers, travel companies working in the sports tourism sector seek strategic alliances and partnerships with other tour operators or travel agencies.

For instance:

During the 2020 Winter Olympics, the Ministry of Culture, Sports, and Tourism opened the gates not only for the North Korean players, but for its country’s spectators as well.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Region Covered | EA (East Asia) |

| Key Countries Covered | South Korea |

| Key Segments Covered | Sports Type, Sports Tourism Type, Consumer Orientation, Booking Channel, Tourist Type, Tour Type, Age Group, and Region. |

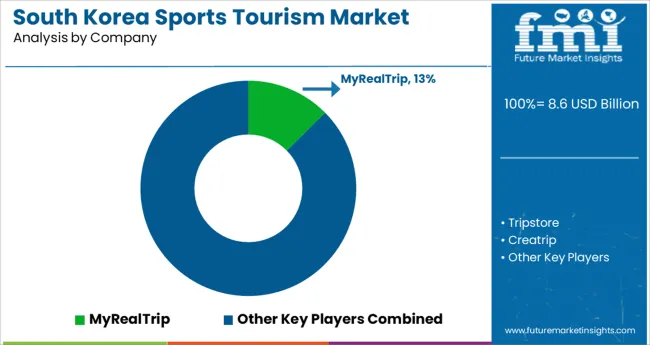

| Key Companies Profiled | MyRealTrip; Tripstore; Creatrip; TNDN; Tripbtoz; OnlineTour; Discover Seoul Travel PASS; Incheon Tourism Organization; Halalroad; JEJU TOURISM ORGANIZATION; Ministry of Culture, Sports and Tourism; Super Bike Tour Seoul; Danyang Paragliding; Others |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global south korea sports tourism market is estimated to be valued at USD 8.6 billion in 2025.

It is projected to reach USD 16.2 billion by 2035.

The market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types are football/soccer, cricket, motor sports, basketball and others.

sports event tourism segment is expected to dominate with a 33.3% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

South East Asia CMMS Market Size and Share Forecast Outlook 2025 to 2035

Southern Blotting Market Size and Share Forecast Outlook 2025 to 2035

Southeast Asia Submersible Pumps Market Growth – Trends & Forecast 2025 to 2035

South America Residential Water Treatment Equipment Market Trends – Growth & Forecast 2022 to 2032

Southeast Asia Pet Care Market Trends – Demand, Growth & Forecast 2022-2032

South America Tourism Market Growth – Trends & Forecast 2024-2034

South Africa Casino Tourism Market Size and Share Forecast Outlook 2025 to 2035

South Africa Safari Tourism Market Analysis – Growth, Trends & Forecast 2025-2035

South Africa Faith-Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

South Korea Intellectual Property Market Size and Share Forecast Outlook 2025 to 2035

South Korea Power Tools Market Report – Trends, Demand & Growth 2025-2035

South Korea Respiratory Inhaler Devices Market Insights – Trends, Demand & Growth 2025 to 2035

South Korea Mobile Sterile Units Market Report – Growth, Demand & Forecast 2025-2035

South Korea Hyaluronic Acid Products Market Growth – Trends, Demand & Innovations 2025-2035

South Korea DNA Polymerase Market Growth – Innovations, Trends & Forecast 2025-2035

South Korea 3D Bioprinted Human Tissue Market Trends – Demand & Forecast 2025-2035

South Korea Tourism Market Trends - Growth, Demand & Analysis 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Demand for Geosynthetics in South Asia Size and Share Forecast Outlook 2025 to 2035

Taurine Industry Analysis in South Korea - Trends, Market Insights & Applications 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA