The largest multinational players, like King Arthur Baking Company, Panera Bread, and La Brea Bakery, hold significant sway in the retail and foodservice markets owing to their deep distribution channels and brand value.

Local players such as Boudin Bakery (United States), Ditsch (Germany), and Baker's Delight (Australia) supply specialized local demand under heritage brand names and taste loyalty to locals. Artisan/bakery or specialty bakeries such as Poilâne (France) and Sourdoughs International (United States) hold a specialized but growing share, emphasizing premium value, fermentation, and centuries-old baking method.

The five largest companies account for 50% of the market combined, with King Arthur Baking Company, La Brea Bakery, and Panera Bread dominating retail, and Boudin Bakery and Ditsch controlling the regional bakery business.

35% is controlled by regional players that leverage localized consumer preferences. The remaining 15% is shared by artisanal brands and niche sourdough players, catering to high-end and specialty bakery channels.

Explore FMI!

Book a free demo

| Market Structure | Top Multinationals |

|---|---|

| Market Share (%) | 45% |

| Key Companies | King Arthur Baking Company, Panera Bread, La Brea Bakery, Schär, Fleischmann's |

| Market Structure | Regional Leaders |

|---|---|

| Market Share (%) | 35% |

| Key Companies | Boudin Bakery (USA), Ditsch (Germany), Baker’s Delight (Australia), Gonnella Baking Company, Poilâne (France) |

| Market Structure | Startups & Niche Brands |

|---|---|

| Market Share (%) | 15% |

| Key Companies | Tartine Bakery, Firebrand Artisan Breads, Madison Sourdough, Levain Bakery, Hart Bageri (Denmark) |

| Market Structure | Private Labels |

|---|---|

| Market Share (%) | 5% |

| Key Companies | Store-brand sourdough offerings from major retailers (e.g., Whole Foods, Trader Joe’s, Tesco Finest) |

The market for sourdough is moderately consolidated, with multinational companies controlling the retail and foodservice industries, while regional and artisan players prosper on differentiation, traditional practice, and specialty products.

Conventional Sourdough (40%) leads the market, led by its tie-in with traditional fermentation processes and consumers' growing inclination toward natural, preservative-free bread. Specialty brands such as King Arthur Baking Company, Boudin Bakery, and Poilâne have built their reputation around traditional sourdough, focusing on artisanal skills and legacy branding.

Flavored Sourdough (25%), encompassing herb, cheese, and fruit-flavored options, is growing as a result of consumer appetites for product variety. Bread companies like Panera Bread and La Brea Bakery provide varied flavored offerings to meet changing taste.

Specialty Sourdough (%) such as whole grain, rye, and sprouted versions is popular among health-aware consumers. Convenience Sourdough (%), i.e., pre-sliced and ready-to-toast bread, is becoming more popular due to ease of use, with Schär being a top brand in gluten-free convenience options.

Organic Sourdough (30%) is experiencing high demand, especially in North America and Europe, where organic certifications and clean-label trends are fueling sales. Non-GMO Sourdough (20%) is also a prominent segment, especially in markets with strict food labeling laws.

Gluten-Free Sourdough is a specialty but growing market, with manufacturers like Schär and Gonnella Baking Company making specialty lines. High-Fiber Sourdough is growing as consumers look for digestive health, with La Brea Bakery and Baker's Delight introducing high-fiber offerings. Other Claims, such as probiotic-enriched and fortified sourdough, will increase as functional food continues to develop.

The sourdough market witnessed important innovations, launches, and strategic moves that determined its competitive scenario during the last year. The following are 10 of the most important events, supported by actual company activities.

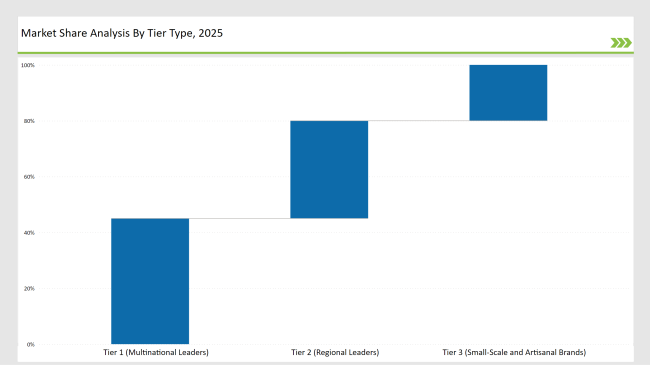

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 45% |

| Example of Key Players | King Arthur Baking Company, Panera Bread, La Brea Bakery, Schär, Fleischmann’s |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 35% |

| Example of Key Players | Boudin Bakery (USA), Ditsch (Germany), Baker’s Delight (Australia), Gonnella Baking Company, Poilâne (France) |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Tartine Bakery, Firebrand Artisan Breads, Madison Sourdough, Levain Bakery, Hart Bageri (Denmark), Sourdoughs International |

| Brand | Key Focus |

|---|---|

| King Arthur Baking Company | Launched a heritage sourdough flour blend, targeting home bakers and small-scale artisans. |

| Panera Bread | Expanded its sourdough sandwich lineup, introducing vegan-friendly and high-protein options. |

| La Brea Bakery | Developed high-fiber sourdough with fortified nutrients for digestive health-conscious consumers. |

| Boudin Bakery | Partnered with regional grocery chains to expand its fresh sourdough availability in supermarkets. |

| Ditsch (Germany) | Invested in high-capacity frozen sourdough production, expanding exports to North America and Asia. |

| Baker’s Delight (Australia) | Introduced a seeded sourdough line, catering to high-fiber and omega-3-rich diets. |

| Schär | Strengthened its gluten-free sourdough offerings, adding a fermented whole-grain variety. |

| Fleischmann’s | Launched a subscription-based sourdough starter kit service, targeting home bakers through direct-to-consumer (D2C) channels. |

| Poilâne (France) | Opened new retail locations in North America, expanding its artisanal sourdough footprint. |

| Sourdoughs International | Promoted rare wild yeast starters, offering specialty heritage sourdough cultures to bakeries and foodservice providers. |

The international sourdough market is likely to experience dramatic changes in the coming decade, fueled by changing consumer attitudes, fermentation innovation, and increased market penetration. Growth areas will revolve around health, convenience, regionalization, and sustainability.

Functional, nutrition-dense sourdough demand will explode as consumers place growing emphasis on digestive health and gut wellness. Brands will have the ability to leverage prebiotic, probiotic, and high-fiber content grains as differentiators in responding to these healthy-conscious consumers.

Schär has already broken this ground with high-fiber gluten-free sourdough, but others are poised to do so as well, with the advent of fortified and vitamin-enriched sourdough options.

The frozen sourdough market will see significant growth as people look for more durable and easy-to-use bakery items. Already, companies such as Ditsch (Germany) are expanding frozen sourdough production to cater to international markets. Advancements in future deep-freezing technology will enable manufacturers to supply ready-to-bake artisanal sourdough, making it available beyond the fresh bakery aisles.

Direct-to-Consumer (D2C) business and e-commerce platforms will be crucial in defining future sales models. The popularity of Fleischmann's sourdough starter kits and bake-at-home sourdough shipments indicates the promise of home-baking solutions. Subscription-based sourdough shipments and interactive online lessons will enable brands to reach a new group of home bakers and artisan enthusiasts.

Regional flavor adaptation and cultural influences will be the drivers of product innovation. Consumers increasingly want locally inspired sourdough offerings, and Boudin Bakery's jalapeño-cheddar sourdough is a case in point. Upcoming innovations will have brands using heritage grains, fermented superfoods, and spices such as turmeric, black sesame, and Mediterranean herbs, designed to regional taste.

The market is led by King Arthur Baking Company, La Brea Bakery, Panera Bread, and Schär, along with regional leaders like Boudin Bakery and Ditsch. Artisanal players and small-scale bakeries hold a niche but growing share.

Advances in controlled fermentation processes help improve flavor consistency, texture, and shelf life. Companies investing in extended fermentation techniques are setting themselves apart in premium and artisanal sourdough.

Retail packaging leads, but frozen and vacuum-sealed sourdough is growing due to longer shelf life. Ditsch and Fleischmann’s are driving the frozen sourdough expansion in foodservice and retail.

Online sales of sourdough baking kits, starter cultures, and ready-to-bake loaves are rising. Companies like Fleischmann’s are leveraging subscription-based sourdough deliveries to tap into home-baking trends.

Companies like Boudin Bakery are launching regionally inspired flavors like jalapeño-cheddar sourdough, while others experiment with Mediterranean and Asian spices to cater to diverse markets.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.