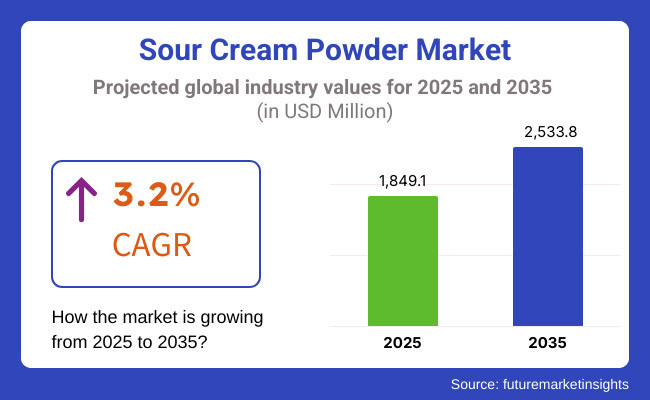

The global industry is estimated to be worth USD 1,849.1 million by 2025 and is projected to reach a value of USD 2,533.8 million by 2035, reflecting a CAGR of 3.2% over the assessment period 2025 to 2035.

The international sour cream powder sector has bright prospects for smooth progress as a result of factors that are very common and are defining the industry's direction. As consumers' preferences and dietary needs are in a constant state of flux, the manufacturers and suppliers are changing their strategies in order to deal with the difficulties of the new situation.

One of the most conspicuous trends to affect the sour cream powder market is the increase in demand for clean-label and minimally processed products. The people are getting more and more concerned about food with only a few identifiable ingredients, without artificial additives and preservatives.

The outcome is that many manufacturers reformulate their sour cream powder, offering alternatives like natural, organic, and non-GMO that comply with the clean-label trend. Also, the importance of clarity and true-to-name content lists has become paramount in the eyes of health-oriented consumers, which is why brands have been forced to change their sour cream powder recipes for that reason.

The clean-label trend and the development of plant-based products are both mostly what have affected the sour cream powder market. With the continuous increase in the request for vegan, lactose-free, and dairy-free products, manufacturers have presented a new product, sour cream substitutes made from cashew, coconut, and oats.

These plant-based options are in line with the dietary preferences of an ever-increasing number of consumers and they, therefore, become part of the renaming of the sour cream powder industry. The emergence of keto and low-carb diets has been another driver for the development of new products in category sour cream powder.

End consumers of such diets are looking for products with less amount of carbs and more of healthy fats, the reason for which some companies have come up with sour cream powder that differs from the traditional ones. This shift of focus has allowed the launch of low-carb and keto variants of sour cream powder thus creating an even wider range of choices for those who care about health.

Yet another very important trend that is seen in the global sour cream powder market is the movement towards smaller package sizes. This trend emerges from the growing demand for single-serve or portion-controlled products that are particularly favored by small households and health-conscious individuals.

In order to follow this trend, manufacturers are modifying their packaging which is now more diverse, like individual sachets or compact containers, and is not only more practical but is also more in-line with the general packaging of conscious mind and sustainability purchasing decisions.

Besides consumer-generated tendencies, the sour cream powder market is also undergoing the emergence of the most imaginative flavor profiles. Instead of just the regular tangy taste, the companies are also making new recipes with the flavors they think will be popular, like garlic, herbs, or the like. This widening of flavors enhances sour cream powder's multifacetedness, it could also be included in food such as salad dressings, cookies, and brownies.

In terms of geography, the sour cream powder market is structured over regions, namely North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. The USA and Germany are the top 2 consumers of sour cream powder globally, however, China is the most up-and-coming market benefitting from the food and beverage sectors' explosive growth rate and their customers' concerns about dairy and dairy products.

The global sour cream powder market repositioned and underwent those different development cycles amidst the aforementioned trends. To stay afloat in this evolving market, manufacturers and suppliers should be quick-footed and adjust to the changes in consumer preference and dietary needs.

By adding vertical value to their process via product development, diversification along with compliance with the increasing demand for clean-label, plant-based, and health-conscious formulations Industry stakeholders can overcome the threats and grab hold of the lucrative opportunities presented to them by the market place.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 2.9% (2024 to 2034) |

| H2 | 3.3% (2024 to 2034) |

| H1 | 3.1% (2025 to 2035) |

| H2 | 3.4% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 2.9% in the first half (H1) of 2024 and then slightly faster at 3.3% in the second half (H2) of the same year. The CAGR is anticipated to decrease somewhat to 3.1% in the first half of 2025 and continues to grow at 3.4% in the second half. The industry saw a decline of 35 basis points in the first half (H1 2025) and an increase of 46 basis points in the second half (H2 2025).

Demand for Clean-Label Formulations

Increasing consumer awareness and preferences have led to the rise of clean-label formulations in sour cream powder products. One of the most common trends now is consumers' preference for food items that include only simple, recognizable ingredients, free of artificial additives, preservatives, and other synthetic components.

Therefore, these changes have prompted industry players to amass it from aggregate plant material closer to the green label minimalists approach. Manufacturers have come to believe that ingredient lists' transparency and authenticity are a top priority for health-conscious customers, thus they have even gone so far as to change the recipes for raw sour cream powder.

Rise of Plant-Based Alternatives

The plant-based revolution is a broader wave reaching into dairy sectors, with a recently launched sour cream substitute made from other, non-dairy materials. These plant-based alternatives, made from such ingredients as cashews, coconut, or oats, answer the market's needs for dairy-free, vegan, and lactose-free products.

More and more customers watch what they eat, and at the same time, the market has reacted favourably to the introduction of these plant-based sour cream powder alternatives, thus sowing the seeds of change and growth across the entire sour cream powder sector. Based on this trend, producers are bringing and promoting a much wider range of sour cream powder made, especially for those who are focused on their health and eco-laws.

Increasing Popularity of Keto and Low-Carb Diets

The increasing popularity of the keto and the low-carb diet trends leads to the demand for sour cream powder products that meet these nutritional parameters. The consumers, who are observing these diets are on the lookout for items that are less carb and more fat-friendly, and the manufacturers are with special formula development for that kind the sour cream powder is meeting their exact request.

This direction has led to the arrival on the market of sour cream powder types that are specifically designed for health-conscious individuals who prefer to control their macronutrient balance; thus, it has also contributed to the evolution of the sour cream powder products and has offered more choices to the consumers.

Shift Towards Smaller Packaging Sizes

Healthy lifestyle trends have pushed sour cream powder consumers firmly into the corner of choosing more convenient and portion-controlled packaging. In practice, such a trend translates into a common preference for single-serve or smaller-sized products. This situation is most obvious with small households and health-conscious individuals who have to budget their disposable product development capacity and at the same time, reduce their kitchen waste.

Manufacturers are providing their customers with through the launching of individual sachets, small packs, and a whole variety of eco-pack solutions for different clients' needs and preferences. The array of choices in packaging not only improves consumers' convenience but is also a part of new consumption forms, among which eco-friendly purchasing is contracting.

Diversification of Flavor Profiles

Beyond the classic tangy taste, manufacturers are also giving the chance to consumers with the need for variety by launching sour cream powder with new innovative and eclectic tastes. These products are not just the standard sour cream flavor but they turn out with all kinds of fun ingredients such as garlic, herbs, or even some of the sweet ones.

The variation of flavors in the sour cream powder category manifold the uses of the product in culinary, such as dressings, sauces, baked goods, and desserts. Providing a larger selection of flavor choices provides a better chance for producers to convince a more extensive range of customers and at the same time to comply with the demand for custom-made and exclusive sour cream powder.

Emergence of Organic and Non-GMO Certifications

The adherence to the health, sustainability, and consumer transparency trends among the consumers have created a need for organic and non-GMO certified sour cream powder products. This sort of consumerism adds more weight to the preferences of the public and thus they search for those specific types of sour cream powder that suit their beliefs and food regimes.

Hence, the suppliers have reacted positively to this trend as they started acquiring the qualifications that go with it by getting organic and non-GMO certifications for their sour cream powder formulas and therefore have positioned them as the high-end health-conscious choices. The move to Organic certified and non-GMO sour cream powder is in response to the evolving demands of consumers that are prepared to part with extra cash for demanding stringent quality and ethical standards.

Sour cream powder markets across the globe expanded steadily throughout the recent period and this growth resulted from food and beverage operations using the ingredient broadly and expanding dairy-based product popularity among consumers. Since 2020 to 2024 the market has experienced continuing sales expansion because of bakery and confectionery industry requirements and sour cream dips and toppings popularity alongside increasing sour cream powder use in processed food preparations.

Sour cream powder manufacturers can expect a healthy market expansion during the upcoming decade because demand projections anticipate significant growth. The projected demand surge in sour cream powder will stem from three main factors: changing consumer tastes alongside industry expansion and market expansion into developing regions.

Tier 1 companies comprise industry leaders with revenue of above USD 30 million capturing a significant share of 50% to 60% in the global business landscape. High production capacity and a wide product portfolio characterize these leaders. These leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Dairy Farmers of America (DFA), Glanbia Nutritionals, Arla Foods Ingredients, Agropur Ingredients, Saputo Ingredients and few others.

Tier 2 companies include mid-size players with revenue of USD 10 to 30 million having a presence in specific regions and highly influencing the local commerce. These are characterized by a strong presence overseas and strong business knowledge. These players in the arena have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Darigold, Dairy Concepts INC, Lactalis Ingredients, Fonterra, Batory Foods.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche economies having revenue below USD 10 million. These companies are notably oriented towards fulfilling local demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized ecosystem, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The following table shows the estimated growth rates of the top three countries. USA, Germany, and China that are set to exhibit high consumption, recording CAGRs of 2.3%, 2.9%, and 3.8% respectively, through 2034.

| Countries | CAGR |

|---|---|

| USA | 2.3% |

| Germany | 2.9% |

| China | 3.8% |

The United States is the dominant force in the global sour cream powder market being the single biggest consumer, due to the nation's well-ingrained culinary practices and the extensive incorporation of this versatile ingredient in multiple food products. From the active bakery and snack sectors to the advancing processed food domain, sour cream powder has found a place and become irreplaceable being the American consumers' long-time favourite with its distinct sour and creamy taste.

The uplift of ready-to-eat meals and the apparent popularity of sour cream dips, dressings, and toppings have further expanded the need and thus the USA consumption of sour cream powder has now extended the horizon of being the main point of sour cream market consumption worldwide.

As manufacturers and consumers in the USA go on adding the different ways of processing the dairy element, the country's looming quest for sour cream powder appears to be unbreakable, crowning the USA the ultimate user worldwide.

Germany's food-processing and bakery sectors have grown to the point where they are the main drivers in the Eurozone sour cream powder market. The growing interest in quick meal alternatives and nab the increased enthusiasm for sour cream-based stuff, for instance, dips, and spreads both of these factors resulted in this broadly edible substance's gaining weight in the German market.

The exploitation of the powerful German brand-name has been the main factor for the high-quality food products and the strong industrial base that has made Germany the regional leader in sour cream powder utilization for applications stretching from traditional baked goods to original snack designs.

With the evolution of the general European palate changing to that of high-sour food flavor products, Germany is already solidifying its position as the biggest sour cream consumer in the region and gaining more prominence on the global market.

The rapidly expanding food and beverage industry has positioned China as the emerging powerhouse in the global sour cream powder market. Factors like the growing middle class and exposure to foreign-style bakery goods and dairy-related products have positively affected the sour cream powder demand.

The increased number of sour cream-flavored snacks, as well as the incorporation of sour cream powder in processed food formulations, have also driven higher consumption of this particular product in the Chinese market. As the palate of Chinese consumers keeps diversifying and seeking global influences in foods, it is reasonable to expect sour cream powder to remain at their plate. Thus, China is set to maintain its status as a key player in the sour cream powder market globally and a significant avenue for manufacturers and suppliers.

| Segment | Value Share (2024) |

|---|---|

| Conventional (Type) | 44.8% |

Even if the specialized sour cream powder forms that are used are experiencing a slow but steady rise, the conventional product still commands the market due to its adaptability, familiarity, and cost-effectiveness. The classic tangy flavor combined with the versatility of the traditional sour cream powder allows it to be applied in a massive spectrum of food and beverage products ranging from chips and crackers to cookies and cakes.

Consumers knowing the taste and texture of ordinary sour cream powder very well, together with its easy availability, no complex ingredients, and its traditional production method are the reasons for its sturdy market position. With the evolution of the industry, the conventional part is still expected to keep its prevalence, covering both the sides of manufacturers and end-consumers who like the reliable and cost-effective option thus sticking to their choice of this thoroughly tested sour cream powder.

| Segment | Value Share (2024) |

|---|---|

| Bakery and Confectionery (Application) | 32.7% |

The sour cream powder has carved a niche in the bakery and confectionery category as the most utilized end-use segment in the market. Sour cream powder's adaptability and utility in improving the texture, moisture, and flavor of a baked product make it an irreplaceable ingredient in a variety of baked items from cakes to cookies, pastries, and candies.

The driving factors for the consumption of sour cream powder in this sub-segment are the constantly changing consumer preferences towards sour cream-based baked goods and the industry's frequent launch of new products. Sour cream has become a well-established ingredient in the baking and confectionery sector with its set mode of usage and formulation, standing the most used end-use application for this multipurpose dairy component.

Multiple established market participants and emerging businesses compete to gain share in the world sour cream powder industry. Two major Sour Cream Powder manufacturers and Dairy Farmers of America together with Glanbia Nutritionals and Arla Foods Ingredients control this industry by employing their vast manufacturing capabilities and wide product selection with their established distribution channels.

The market leaders support product development with clean-label innovations as well as plant-based options that match consumer demands for specialized product versions. The market contains dominant players along with increasing numbers of regional and niche businesses which provide specialized sour cream powder products targeting specific consumer groups.

The rising market competition forces manufacturers to develop unique products while enhancing operations and building stronger brands in order to stay competitive in the global sour cream powder marketplace.

The industry valuation reported by FMI in 2025 is USD 1,849.1 million.

Expected business valuation in 2035 is USD 2,533.8 million.

The CAGR for last 4 years is about 2.9%

In this segment sector has been categorised as Conventional, Organic, Non-GMO, Flavored, and Low-Carb/Keto-Friendly.

Key applications like Food service (HoReCa), Salads and Dressings, Sauces and Dips, Snack Seasonings, Bakery Products, Dairy Products and Household/Retail are included in the report.

By packaging industry has been categorised as Airtight containers, Paper Bags and Pouches

Key distribution channels like Direct/B2B and Indirect/B2C (Hypermarket/Supermarket, Specialty Stores, Discount Stores, Modern Grocery Stores, Traditional Grocery Stores and Online Retail) are included in the report.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

Cheese Analogue Market Insights - Growth & Demand Analysis 2025 to 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Comprehensive Probiotic Strains market analysis and forecast by strain type, application and region.

Comprehensive Probiotic Ingredients market analysis and forecast by from, ingredient type, animal type and region

Brined Vegetable Market Analysis by Nature, Type, End-use, Distribution Channel and Region through 2035

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.