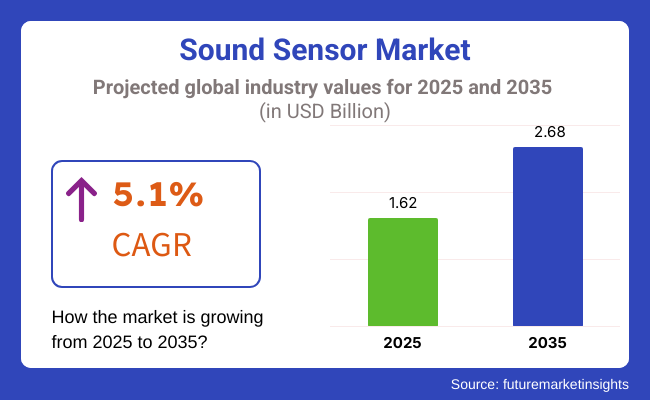

The sound sensor market is expected to experience steady growth from 2025 to 2035, driven by increasing adoption in automotive, industrial automation, healthcare, and consumer electronics. The market is projected to reach USD 1.62 billion in 2025 and expand to USD 2.68 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.1% during the forecast period.

The growing demand for smart sensing technologies in voice recognition, noise monitoring, and acoustic analysis is fueling innovation in MEMS-based sound sensors, AI-driven sound processing, and IoT-enabled monitoring systems. These technologies facilitate real-time machine diagnosis, security surveillance, and home control. Furthermore, they are also being used in environmental noise monitoring, medical diagnostic equipment, and defense, thereby creating further growth.

Additionally, the confluence of AI-based acoustic recognition, edge audio processing, and high-quality MEMS technology is revolutionizing the role of these sensors in many industries. Companies are investing increasingly in wireless acoustic monitoring, real-time noise analysis, and machine learning-based anomaly detection to upgrade safety, efficiency, and automation.

Explore FMI!

Book a free demo

The growth of this industry is driven by rapid advancements in AI, IoT, and machine learning. The primary reasons for the use of sound sensors in consumer electronics like smartphones, voice assistants, and wearable devices are high sensitivity, accuracy, and low power consumption requirements.

Industrial applications are dedicated to durability, resistance to environmental conditions, and IoT integration of sensors attached to machines. Their general environment is machine condition monitoring and fault detection.

Automotive, in particular, enables voice recognition, noise cancellation, and advanced driver assistance systems (ADAS) with the help of sound sensors, where the accuracy of these parameters and integration with AI are the key factors.

The healthcare industry, however, utilizes these sensors in the fields of patient monitoring, hearing aids, and diagnostic equipment, which must be highly sensitive and reliable. Security and surveillance, through threat detection, smart alarms, and automatic response systems, are also AI-equipped devices that have to be strong in durability, environmental resistance, and robustness in functioning.

| Company | Contract Value (USD Million) |

|---|---|

| Bosch | Approximately USD 30 - 40 |

| STMicroelectronics | Approximately USD 25 - 35 |

| Knowles Corporation | Approximately USD 20 - 30 |

| Infineon Technologies | Approximately USD 35 - 45 |

| Analog Devices | Approximately USD 40 - 50 |

Between 2020 and 2024, the industry expanded significantly, driven by the growing adoption of AI-powered voice recognition, smart home security, and industrial automation. The integration of MEMS microphones in voice assistants, IoT devices, and consumer electronics accelerated demand for high-sensitivity, miniaturized sensors.

Automotive applications also surged as autonomous vehicles and ADAS technologies relied on acoustic sensors for noise reduction, engine diagnostics, and safety enhancements. Additionally, industries leveraged sensors for predictive maintenance and fault detection, while environmental monitoring applications addressed noise pollution and disaster warnings.

Despite advancements, challenges such as high power consumption and noise differentiation remained, prompting manufacturers to introduce AI-enhanced, low-power sensors with edge computing capabilities. From 2025 to 2035, sound sensor technology will advance through AI-driven acoustic intelligence, 6G-powered networks, and bio-inspired auditory processing.

Machine learning algorithms will enable sensors to classify sounds with human-like precision, enhancing applications in security, smart cities, and healthcare. 6G connectivity will facilitate real-time, ultra-low latency sound data transmission for AR experiences, remote healthcare, and autonomous systems.

Bio-inspired sensors using neuromorphic chips will improve hearing aids, robotics, and disaster detection. Wearable sensors will further revolutionize health diagnostics, detecting respiratory and cardiovascular irregularities through vocal and biometric analysis.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter data privacy laws (GDPR, CCPA) required sensor manufacturers to enhance audio encryption and user consent frameworks. | AI-driven, blockchain-secured sound monitoring ensures real-time compliance, decentralized acoustic data processing, and privacy-preserving voice authentication. |

| AI-powered sensors improved noise classification, voice recognition, and anomaly detection in industrial and consumer applications. | AI-native sensors autonomously analyze acoustic patterns, predict security threats, and optimize real-time speech and environment monitoring. |

| Sound sensors became integral to IoT ecosystems, enabling smart homes, industrial automation, and healthcare monitoring. | AI-driven, IoT-connected sound detection networks provide real-time environmental noise analytics, predictive maintenance alerts, and AI-powered adaptive sound control. |

| Smart assistants and voice-controlled devices leveraged sound sensors for hands-free user interaction in homes and workplaces. | AI-powered, multi-modal sound recognition systems enable advanced voice authentication, gesture-based interactions, and biometric security through real-time audio analysis. |

| High-frequency sensors improved industrial safety, medical imaging, and object detection applications. | AI-integrated ultrasonic and subsonic sensors enhance medical diagnostics, underwater navigation, and non-invasive health monitoring with high precision. |

| Battery-operated and ultra-low-power sensors enabled long-term deployments in remote locations and smart cities. | AI-optimized, energy-harvesting acoustic sensors leverage adaptive power management, self-sustaining operation, and ultra-efficient signal processing for real-time monitoring. |

| Security systems integrated sound sensors for gunshot detection, glass break alerts, and suspicious activity monitoring. | AI-driven, real-time acoustic threat detection autonomously identifies security risks, filters out false alarms, and enhances public safety with predictive sound analytics. |

| Faster 5G networks improved real-time data transmission, enabling instant cloud-based acoustic analytics. | AI-integrated, 6G-powered sound sensing ecosystems provide ultra-low latency, real-time ambient intelligence, and high-resolution spatial sound analytics in connected environments. |

| Rising concerns over eavesdropping and unauthorized sound monitoring led to stronger encryption and AI-based anomaly detection. | AI-driven, quantum-encrypted sound processing ensures tamper-proof acoustic monitoring, secure voice communication, and real-time threat detection in sensitive environments. |

| Companies focused on developing recyclable, low-power sensors to align with environmental sustainability goals. | AI-powered, biodegradable sensors leverage self-repairing nanomaterials and sustainable energy sources to enable long-term, eco-conscious sound monitoring solutions. |

The market is exposed to a variety of risks, such as technological constraints, issues regarding the privacy of data, stiff competition, non-adherence to certain regulations, and weak chains in supply.

A significant concern is the technological side of things. The sound sensors are used in industrial automation, cars, hospitals, and smart consumer electronics. Nonetheless, noises from the surroundings, interference of signals, and limited frequency response can be the main factors that decrease their performance.

Companies need to adopt advanced signal-processing algorithms and noise-canceling technologies to make the devices function properly. On the other hand, data privacy and security have become matters of concern, especially in voice-activated systems, environmental assistants, and surveillance devices.

The audio data recorded by the sensors raises the possibility of unauthorized recording, hacking, and misuse of personal information. Companies need to comply with global data protection laws just like GDPR and CCPA to gain consumer trust.

The sector of sound sensors is on the anvil, competing with power, and through such competition, with the aid of established companies and the entrance of new players in the field, technical improvements are made. The situation with pricing, ownership of intellectual property, and rapid innovations can make this industry rather unstable.

Consequently, to keep their place in the market, companies must offer customized solutions, integration of AI, and better sound detection precision. Regulatory issues also hinder the growth of the market. Sectors like healthcare, automotive, and security require sensors as a mandate to adhere to strict health and safety, quality, and environmental standards. Regular monitoring of the regulatory structure globally is essential to evade legal risks.

| Countries/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 9.2% |

| UK | 8.9% |

| European Union | 9.1% |

| Japan | 8.8% |

| South Korea | 9.5% |

Through AI-enabled audio analytics, voice recognition, and noise monitoring, growing industries in the USA, such as automotive, industrial automation, and smart homes, have a critical need of sound sensors. Offering voice-activated technology, real-time monitoring, and advanced audio processing solutions, businesses and consumers strive for enhanced security, efficiency, and convenience.

USA DoD tech firms are developing ultrasonic sensors, AI-driven noise filtering, and real-time acoustic monitoring systems to improve industrial safety and smart device capabilities. Smart city initiatives and the increasing adoption of the Internet of Things drive the need for environmental noise detection and AI-driven voice assistants.

Texas Instruments, Honeywell, and Knowles Corporation are fueling innovation through investment in miniaturized MEMS microphones, AI-powered sound analytics, and energy-efficient acoustic sensors. According to FMI, the USA is expected to register a growth of 9.2% over the forecast period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Automotive Sound Recognition | AI-based noise cancellation and voice interfaces are changing the landscape of in-car communications and road safety. |

| Industrial Automation | Acoustic monitoring systems such as these, powered by AI, can be trained to detect machinery faults, helping improve workplace safety. |

Augmented by the Industrial Internet of Things (IoT), smart home automation, and artificial intelligence (AI) based acoustic diagnostics, the UK sound sensor market has moved ahead on the path of evolution that will define the way technology is adopted. Next-gen sound detection solutions are being deployed.

The government’s focus on cybersecurity, AI research, and smart city projects has enabled the deployment of next-gen sound detection solutions across the finance, healthcare, and defense sectors. The UK’s Department for Science, Innovation & Technology (DSIT) backs AI-enhanced audio monitoring and real-time voice authentication, as well as noise pollution control technologies.

Infineon Technologies, Cirrus Logic, and AMS AG are investing in low-power sound sensors, AI-driven speech recognition, and ultrasonic object detection solutions to usher in a new era in which businesses and consumers will interact by speaking to each other in smart environments. According to FMI, the UK Sound Sensor Market is expected to remain a lucrative one, growing at a CAGR of around 8.9% through the forecast period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| AI in Security & Finance | Digital safety and authentication are also improved by biometric security and AI-driven voice recognition. |

| Smart Cities | Noise pollution is controlled in real-time, and urban services are activated with voice. |

Increasing government policies for Digital Transformation, along with the increase in demand for Smart Automotive Technologies, industrial automation, and the Internet of Things (IoT), are the main driving factors for the growth of the Sound Sensor market in the European Union.

The EU Smart Mobility and Green Deal initiatives encourage the use of AI to speed up the technology in this speed; AI-powered noise reduction sensors and sound-based anomaly detection in vehicles and factories are included in the initiatives.

Germany, France, and the Netherlands excel in automotive acoustics, AI-driven sound analytics, and IoT-based smart surveillance. Also, AI-assisted healthcare monitoring and acoustic-based predictive maintenance are getting traction.

We will see companies like Bosch, STMicroelectronics, and NXP Semiconductors, who are realizing the high-sensitivity MEMS microphones, AI-enhanced voice control, and next-generation noise cancellation sensors for industrial and consumer applications, investing in these solutions. According to FMI, the EU Sound Sensor Market is expected to grow at a CAGR of 9.1% during the study period.

| Key Drivers | Details |

|---|---|

| Smart Automotive Acoustics | AI-powered DTS sound reduction and antioxidant tech enhance vehicle efficiency. |

| AI in Healthcare | One application is in AI-assisted patient monitoring and diagnostics |

Factors supporting the Japan Sound Sensor Market include government-sponsored smart city initiatives, AI-fueled industrial automation, and the increasing application of high-precision acoustic sensors in the automotive and healthcare sectors. With a strong focus on robotics and AI-integrated sensing solutions, Japan has advanced sound analysis and real-time voice processing techniques.

The ministry of economy, trade and industry (METI) acoustic safety watch AI speech assistant and speech analytics. Environmental Noise Assessment Automotive Acoustics and AI-powered Audio Security Are Gaining Steam Sony, along with Murata Manufacturing and Yamaha Corporation, are at the forefront of using AI for voice recognition, high-sensitivity ultrasonic sensors, and MEMS-based sound detection technologies. FMI anticipates the Japan’s industry to grow at a 8.8% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI-Integrated Robotics | AI algorithms for sound detection revolutionize industrial and service robotics. |

| Automotive Acoustics | AI-powered noise canceling and voice interfaces enhance vehicle safety and communication. |

The AI-driven, data-covered voice and sound monitoring emerge to help transform our homes, workplaces, and lives, contributing to the growth of sound sensors in the South Korean market. The South Korean government is driving its Smart City Initiative and promoting a combination of sound analytics with smart devices, autonomous vehicles, and industrial automation.

Secure AI-Powered Sound Recognition, Voice-based IoT, and Sound Pollution Management: Supported by the Ministry of Science and ICT (MSIT). Samsung Electronics, LG Innotek, and SK Telecom are planting seeds for the future of audio intelligence through investments in ultra-sensitive sound sensors, AI-enhanced voice command processing, and acoustic cybersecurity solutions. According to FMI, the South Korean Sound Sensor Market is expected to register a CAGR of 9.5% during the assessment period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| Smart Infrastructure | Smart city projects incorporate AI-based noise monitoring. |

| AI-Powered IoT | While voice-based interfaces and automated sound analysis enhance efficiency. |

The Surface Acoustic Wave (SAW) Sensor segment is projected to hold the larger share, accounting for 57.8% of it by 2025. The sensor has applications in RF circuits, chemical detection, and industrial monitoring owing to high sensitivity, reliability, and the ability to sense without wires.

These sensors are critical in telecommunications infrastructure, specifically in SAW-based RF filters for cellular and IoT applications. SAW technology, such as the recently announced speedier SAW by Qualcomm and Murata Manufacturing, is in the works for signal processing and environmental sensing purposes.

Moreover, the healthcare and aerospace industries are applying SAW sensors as biosensors and for real-time structural health monitoring of aircraft. Conversely, the share held by the Bulk Acoustic Wave (BAW) Sensor segment is expected to amount to 42.2% due to its growing use in high-frequency applications, such as 5G telecommunications, automotive radar, and medical diagnostics.

BAW sensors outperform their counterparts in the high-frequency spectrum, yielding advanced BAW sensors for the next generation of wireless communication modules and collision detection systems in autonomous vehicles. Leading innovations can be seen in BAW filters in terms of low power consumption and high data transmission efficiency by companies like Broadcom and Qorvo.

The demand for advanced acoustic sensors used in wireless technology, environmental monitoring, and medical applications is on the rise, boosting the growth of both SAW/type & BAW devices, which should help drive the overall sound sensor market.

The Low-Frequency Detection Segment is estimated to lean over the market by 2025, contributing 60.7% of the share. Its widespread use in aerospace, defense, and industrial monitoring is contributing to this dominance. There are many key applications in gas turbine engines, rocket engine combustion instability testing, cryogenic fuel pulsations, and helicopter health monitoring (HUMS).

Pearce: The biggest shift in equipment is bringing your predictive maintenance, structural integrity assessment, and real-time vibration analysis together - making our clients and industries more proactive with real-time data attributes to ensure this does not impact their downtime and overall efficiency. For example, Honeywell and GE Aviation integrate low-frequency detection sensors in their aerospace systems for safety and reliability.

The High-Frequency Detection segment is projected to dominate with a 39.3% market share, as it is gaining more traction in ultrasonic applications, non-destructive testing (NDT), and advanced medical diagnostics.

High-frequency sound sensors find applications in various fields like industrial flaw detection, material inspection, or structural health monitoring, particularly within the manufacturing and automotive sectors.

Additionally, high-frequency acoustic sensors, which serve as a foundation for ultrasound imaging, cardiovascular diagnostics, and biomedical research, are undergoing tremendous improvements due to advancements in healthcare technology. Siemens Healthineers and Olympus Corporation are working on high-frequency sound sensors to improve the resolution of medical images and enable more accurate diagnostics.

As heart detectors continue to detect increasing needs for real-time monitoring, safety enhancements, and medical advancements, trends will grow in both low- and high-frequency sound sensor technologies for innovation and market expansion as demand becomes a requirement.

The Sound Sensor Market is being buoyed as industries take up acoustic sensing for security, automotive, healthcare, and smart device applications. Growth of the market is driven by the increasing uptake of voice recognition, noise monitoring, and AI-enabled anomaly detections in connected systems.

Top players like Knowles Corporation, STMicroelectronics, Infineon Technologies, Analog Devices, and Robert Bosch GmbH command the high-sensitivity MEMS microphones, AI-powered sound processing, and real-time noise analyses, while startups and niche players are competing with custom acoustic sensors, ultra-low-power designs, as well as smart audio interfaces.

The evolution of the marketplace has been directed by developments in AI-driven voice assistants, miniaturized sensors, and IoT-enabled audio analytics. Emerging trends include enhanced far-field voice recognition, edge AI sound processing, and environmental noise reduction technologies.

Strategic factors that affect competition include power-efficient designs, high-fidelity sound detection, and seamless integration with AI-driven ecosystems. The companies that provide scalable, real-time, and AI-enabled acoustic sensing solutions will strengthen their positioning in the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Knowles Corporation | 20-25% |

| STMicroelectronics | 15-20% |

| Infineon Technologies | 12-16% |

| Analog Devices Inc. | 10-14% |

| Robert Bosch GmbH | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Knowles Corporation | Focused on developing MEMS microphones as well as audio solutions for advanced smart devices and hearing aids. |

| STMicroelectronics | Specialize in the design and development of world-class high-performance MEMS-based sensors and AI-driven audio processing technologies. |

| Infineon Technologies | Innovate and maintain ultra-low power microphones aimed at smart IoT applications for vehicles. |

| Analog Devices Inc. | Solutions for sound analysis; advanced acoustic sensing for industrial applications. |

| Robert Bosch GmbH | Provides high-precision sensors for noise monitoring and intelligent security. |

Key Company Insights

Knowles Corporation (20-25%)

Knowles, the industry leader in sound sensors, has high-performance MEMS microphones and voice processing solutions to enhance smart audio experiences.

STMicroelectronics (15-20%)

STMicroelectronics fosters advancement in MEMS sound sensors that integrate AI-based voice recognition and ultra-low-power design for IoT applications.

Infineon Technologies (12-16%)

Infineon is impacting the sound sensor market with MEMS microphones that provide high sensitivity for automotive, consumer electronics, and industrial applications.

Analog Devices Inc. (10-14%)

Analog Devices provides intelligent sound analysis and acoustic sensing technologies with a high degree of accuracy for medical and industrial applications.

Robert Bosch GmbH (6-10%)

Bosch specializes in environment sound sensors for security, environment monitoring as well as smart homes, providing high-fidelity solutions to noise intrusion.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 1.62 billion in 2025.

The industry is predicted to reach a size of USD 2.68 billion by 2035.

Key companies include Knowles Corporation, STMicroelectronics, Infineon Technologies, Analog Devices Inc., Robert Bosch GmbH, Texas Instruments, Cirrus Logic, Sony Corporation, TDK Corporation, and Murata Manufacturing Co., Ltd.

South Korea, driven by advancements in consumer electronics, automotive applications, and industrial automation, is expected to record the highest CAGR of 9.5% during the forecast period.

Surface Acoustic Wave (SAW) Sensors are widely used due to their high sensitivity, durability, and application in wireless sensing and industrial automation.

The market includes Surface Acoustic Wave (SAW) Sensors and Bulk Acoustic Wave (BAW) Sensors.

The market covers automotive, healthcare, aerospace & defense, industrial, and Consumer electronics.

The market comprises low-frequency detection and high-frequency detection

The market spans North America, Latin America, Europe, East Asia, South Asia Pacific, and the Middle East & Africa (MEA).

Flash-based Arrays Market Insights - Trends & Growth Forecast 2025 to 2035

Fiber to the X Market - Connectivity & Expansion 2025 to 2035

Event Apps Market Analysis – Size, Trends & Forecast 2025 to 2035

Gaming Hardware Market Analysis by Gaming Platform, Product Type, End-user, and Region Through 2035

Quantum Dot Market Analysis by Application, End-Use Industry, Material Type, Technology, and Region Through 2035

Mobile Device Management Market Analysis by Deployment Type, Solution, Business Size, Vertical, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.