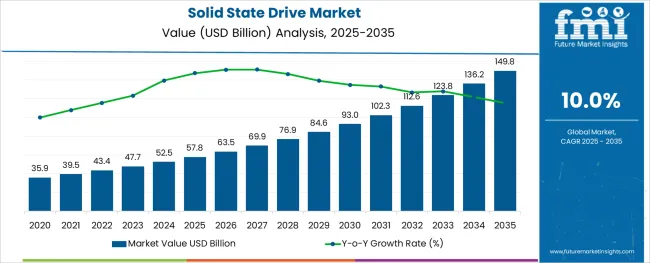

The Solid State Drive Market is estimated to be valued at USD 57.8 billion in 2025 and is projected to reach USD 149.8 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

The stainless steel valve tag market is expanding steadily as industrial sectors prioritize asset management, safety compliance, and equipment traceability. Increasing investments in infrastructure and process automation have heightened demand for robust and clear identification solutions capable of withstanding harsh environments.

The shift toward digital transformation in industries such as oil and gas, manufacturing, and utilities is encouraging the adoption of advanced tagging systems that support maintenance and audit operations. Growing awareness around regulatory compliance for equipment labeling and enhanced safety protocols is also influencing market expansion.

The rise of e-commerce platforms has facilitated easier procurement of valve tags, increasing accessibility for small to medium enterprises and broadening geographic reach. Material innovations and customization options continue to enhance product longevity and visibility, creating opportunities for market penetration across diverse industrial applications.

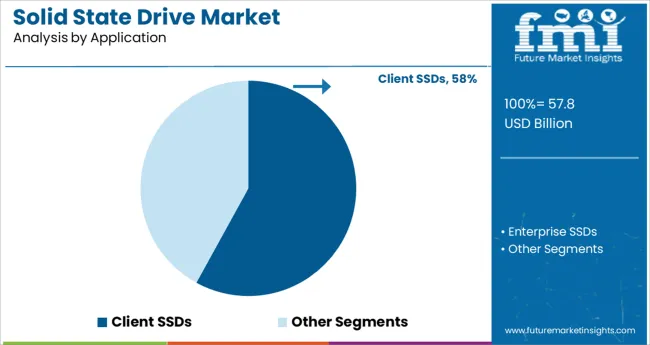

The market is segmented by Type, Interface Type, Form Factor, Storage Range, and Application and region. By Type, the market is divided into Internal and External. In terms of Interface Type, the market is classified into PCI-E SSD, SATA SSD, and SAS SSD. Based on Form Factor, the market is segmented into M.2, 1.8”/2.5”, 3.5”, U.2, and FHHL/ HHHL. By Storage Range, the market is divided into 1 TB - 2 TB SSD, Under 500 GB SSD, 599 GB - 1 TB SSD, and Above 2 TB SSD. By Application, the market is segmented into Client SSDs and Enterprise SSDs. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Type, Interface Type, Form Factor, Storage Range, and Application and region. By Type, the market is divided into Internal and External. In terms of Interface Type, the market is classified into PCI-E SSD, SATA SSD, and SAS SSD. Based on Form Factor, the market is segmented into M.2, 1.8”/2.5”, 3.5”, U.2, and FHHL/ HHHL. By Storage Range, the market is divided into 1 TB - 2 TB SSD, Under 500 GB SSD, 599 GB - 1 TB SSD, and Above 2 TB SSD. By Application, the market is segmented into Client SSDs and Enterprise SSDs. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 30 mm thickness segment is expected to hold 41.3% of the revenue share in 2025 within the thickness category. This segment’s leadership is supported by its suitability for a wide range of valve sizes and equipment types, providing sufficient durability while minimizing material costs.

The thinner tags offer flexibility in installation, especially in tight spaces and complex piping systems, making them preferable for industries where compactness is critical. Their compatibility with standard mounting hardware and ability to endure corrosion and wear have reinforced demand in sectors emphasizing both performance and cost efficiency.

This balance between robustness and adaptability has contributed to the segment’s dominant position.

Within the product type category, engraved valve tags are projected to command 57.8% of the market revenue share in 2025, marking them as the leading product form. The prominence of engraved tags is due to their superior legibility, permanence, and resistance to environmental degradation such as fading, scratching, and chemical exposure.

Engraving allows precise and customizable marking, meeting stringent industry standards for traceability and safety. The technique supports complex information including serial numbers, barcodes, and QR codes, enhancing integration with digital asset management systems.

Manufacturers’ emphasis on delivering long-lasting, tamper-proof tags that reduce maintenance costs has reinforced the adoption of engraved tags in heavy industries.

The online distribution channel is expected to generate 63.7% of market revenue in 2025, making it the most dominant sales route. The growth of e-commerce platforms has revolutionized procurement by offering convenience, broader product selections, and competitive pricing to end-users across industries.

Online channels enable buyers to access detailed product specifications, customization options, and customer reviews, simplifying purchase decisions. This has particularly benefited small and medium-sized enterprises lacking traditional supply chain networks.

Additionally, digital platforms have streamlined order fulfillment and reduced lead times, fostering faster adoption. Vendors are increasingly investing in online marketplaces and direct-to-customer websites to expand reach and improve customer engagement, reinforcing the online channel’s leadership in the stainless steel valve tag market.

It is expected that solid-state enterprise storage will become less expensive in the coming years. Even though SSDs are a dollar more expensive per gigabyte than HDDs, businesses tend to switch to SSDs when they see quick profits. As technology advances from SLC (single-level cell) to MLC (multi-level cell) to TLC (3 bits per cell), this development is attributed to improvements in scaling and the transition from the 2D to the 3D era.

It is currently possible to add multiple layers to the cell structure to make it more cost-effective. The emergence of new device categories and architectures, including the emergence of computational storage in Ethernet SSDs, is expected to eliminate system bottlenecks. To improve the performance of applications and improve the efficiency of the infrastructure, computational storage would reduce data movement and offload post-processing, for example.

QLC-based SSDs are suited for read-intensive workloads, resulting in a reduction of the total number of P/E cycles for read-intensive workloads. In addition to real-time analytics, machine and deep learning, artificial intelligence, streaming media, delivering content, and backing up data, QLC technology is suitable for a variety of workloads.

Aside from the cloud, CDNs, all-flash arrays, and other tiered solutions are also found in many applications. Many end-market applications will experience data growth as a result of trends such as cloud, artificial intelligence, 5G, and IoT. These trends will extend to public and private cloud environments, traditional IT environments, the edge, and endpoints.

As per the SSD Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the SSD Market increased at around 10% CAGR.

The growth of cloud computing services for personal use by organizations and individuals to store their data will boost the growing need for SSDs in the years ahead.

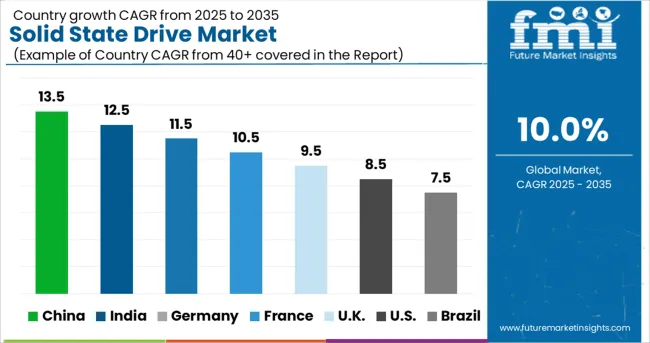

During the past few years, the Asia Pacific solid state drive market has held the top share of the global market. One of the key drivers of the regional market's growth is its large consumer base. As mobile devices such as smart gadgets become more popular, the demand for advanced storage devices has increased, spurring the Asia Pacific solid state drive market's revenue growth.

There is also a large manufacturing base in the Asia Pacific solid state drive market, which has propelled the market. Both large and small drive manufacturers are eager to unveil technologically advanced storage & memory devices. As a result, several of them are developing new techniques for enhancing SSD read and write performance substantially.

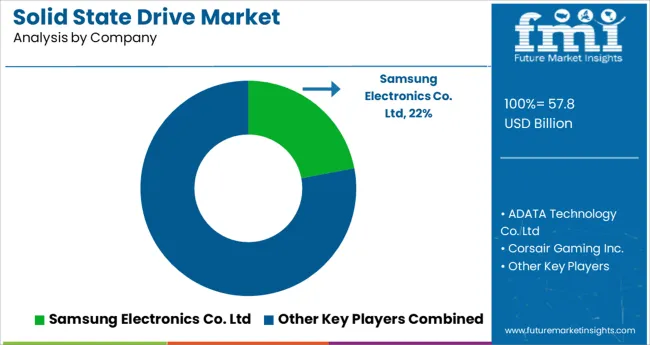

The solid-state drive (SSD) market is dominated by several major vendors, such as Intel, Micron Technology, Samsung Electronics, and Western Digital Corporation. Since the entry barriers to the SSD market are high, it is difficult for new players to enter the market. It is widely accepted that the existing vendors in the market are investing heavily in the research and development of new and innovative products.

Some of the recent developments in the market are:

The increased usage of social media, expanding online commerce, and growth in media content will all play a significant part in boosting the SSD market throughout the projected period. Due to the high usage of tablets and smartphones, which have enabled customers to produce massive amounts of digital data, the average household's storage consumption is likely to expand in the future years. As a result, there is an increasing demand for sufficient storage.

It is also observed that SSD usage in data centers has been increasing due to a variety of factors, including improved efficacy in contrast to conventional HDD storage, rising need for storage facilities, and breakthroughs in enterprise-level SSD reliability and performance. SSDs are preferred by businesses since they require less energy, which further enables less dispersion, resulting in a reduced environmental imprint.

Additionally, SSDs are capturing the attention of people all over the world due to their benefits such as rapid read-write efficiency, minimal noise, lower power consumption, and mobility, among others. It has the potential to provide a quicker, more energy-efficient, highly secure, and reliable data storage experience. Furthermore, with the increase in game loading speed, the demand for responsive and multi-task processing storage has also surged.?

Solid state drives are also gaining traction in the automotive industry for next-generation connected automobiles and multimedia passenger vehicles, which is fuelling SSD market development. They are utilized in connected automotive applications to address the demand for high-definition graphics, data storage, and networking.

Flash memory-based solid-state drives offer solutions that help to supply high-performance storage and dependability in a variety of in-vehicle applications such as driver-assist technologies, entertainment systems, navigation systems, and 3D mapping.

During the projected period, the market in North America is expected to continue being the largest market for Solid State Drive with a projected value of over USD 149.8 Billion by 2035. The large IT corporations in the region require significant data storage solutions at an uncompromised speed. While most of the documentation, as well as records, have started to go on the cloud, the need for solid-state drives is expected to surge in the region.

China is expected to account for the highest Solid State Drive (SSD) Market Share. The market in the country is projected to reach a valuation of USD 149.8 Million by the end of 2035 with an expected CAGR of 35.8% by the end of 2035.

The key element driving market expansion includes the decline in the price of SSDs and the general degradation of the price of data storage. Besides, several global memory manufacturers are spending massive sums, which are bolstered by government initiatives such as Made in China 2025.

The Chinese data center industry is predicted to increase due to the supporting government measures and foreign investments. The government's quest for AI in intelligence and security applications is expected to boost the market for SSDs in the region. China is both a massive IoT market and a key provider of component technology.

According to Axa Insurance, by 2024, there will be 200 Billion IoT-connected modules and gadgets in the world, with China producing 95% of them. As a result of the increased volume of Big Data generated by IoT gadgets and corporate applications, the need for faster storage has risen to the top of the priority list.

SSD utilization by Enterprises is forecasted to grow at the highest CAGR of around 10% from 2025 to 2035. The worldwide enterprise SSD market is growing due to greater efficiency, high throughput, and improved power efficiency of business SSD. Furthermore, fast developments in high-end cloud services are imparting a substantial influence on the higher usage of SSD solutions for data center applications.

NAND-based flash memory solutions are witnessing substantial demand from organizations due to their long durability, low cost, and quicker storage with a low error rate. This drives the need for SSD solutions in enterprises globally.

The market of enterprise SSD is predicted to develop significantly during the forecast period, due to the rising introduction of high-tech cloud computing in organizations. Furthermore, the significant rise in the utility of SSD over Hard Disc Drive (HDD) in the key business verticals is projected to drive market expansion.

However, the expensive cost of implementing SSD solutions is a significant market barrier. On the contrary, an increase in unstructured data combined with real-time analysis is likely to create a significant potential for the demand of the enterprise SS.

Since the market's entry barriers are high, it is difficult for new firms to enter. The market's existing suppliers are substantially spending on research and development to improve their existing portfolio. The top solid-state drive manufacturers include Intel Corporation, Samsung Group, Micron Technology, Inc., Toshiba Corporation, Western Digital Corporation, Inc., ADATA Technology Co. Ltd., Transcend Information Inc., Kingston Technology Corporation, SK Hynix Inc., and Teclast Electronics Co., Limited.

Some of the recent developments in Solid State Drive Market are as follows:

Similarly, recent developments related to solid-state drive companies have been tracked by the team at Future Market Insights, which are available in the full report.

The global solid state drive market is estimated to be valued at USD 57.8 billion in 2025.

It is projected to reach USD 149.8 billion by 2035.

The market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types are internal and external.

pci-e ssd segment is expected to dominate with a 49.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solid Aluminium Cladding Panel Market Size and Share Forecast Outlook 2025 to 2035

Solid White Films Market Size and Share Forecast Outlook 2025 to 2035

Solid Sulphur Market Size and Share Forecast Outlook 2025 to 2035

Solid Terpene Resin Market Forecast Outlook 2025 to 2035

Solid Phase Carrier Resin for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Solid Board Market Size and Share Forecast Outlook 2025 to 2035

Solid Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Solid Vacuum Reclosers Market Size and Share Forecast Outlook 2025 to 2035

Global Solid Serum Market Size and Share Forecast Outlook 2025 to 2035

Solid Bleached Board Market

Solid Oxide Fuel Cell Market

Solid Electrolyte Market

Solid-State Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Solid State Relay Market Size and Share Forecast Outlook 2025 to 2035

Solid State Battery Silicon Carbon Negative Electrode Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Array Market Size and Share Forecast Outlook 2025 to 2035

Solid-State Power Amplifier Market Size and Share Forecast Outlook 2025 to 2035

Solid State LiDAR Sensor Market Analysis Size and Share Forecast Outlook 2025 to 2035

Solid-State Lighting Market Size and Share Forecast Outlook 2025 to 2035

Solid State Power Controller Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA