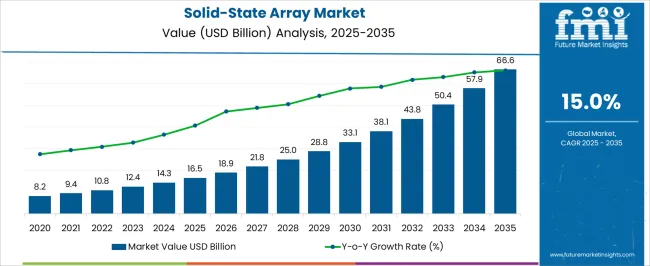

The Solid-State Array Market is estimated to be valued at USD 16.5 billion in 2025 and is projected to reach USD 66.6 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

| Metric | Value |

|---|---|

| Solid-State Array Market Estimated Value in (2025 E) | USD 16.5 billion |

| Solid-State Array Market Forecast Value in (2035 F) | USD 66.6 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The solid state array market is experiencing notable expansion as enterprises increasingly prioritize high performance storage solutions that ensure speed, reliability, and scalability. Growing data generation across industries including finance, healthcare, and telecommunications has intensified demand for solid state arrays due to their low latency and superior energy efficiency compared to traditional storage systems.

Advancements in flash memory technologies and declining costs of solid state storage are encouraging adoption across mid sized and large enterprises. In addition, the rising need for efficient data management to support artificial intelligence, machine learning, and big data analytics is further accelerating deployment.

Regulatory compliance requirements for data security and the need for uninterrupted business continuity are also contributing to market momentum. The outlook remains positive as enterprises shift toward cloud integration and hybrid IT environments, solidifying solid state arrays as a central component of modern storage infrastructure.

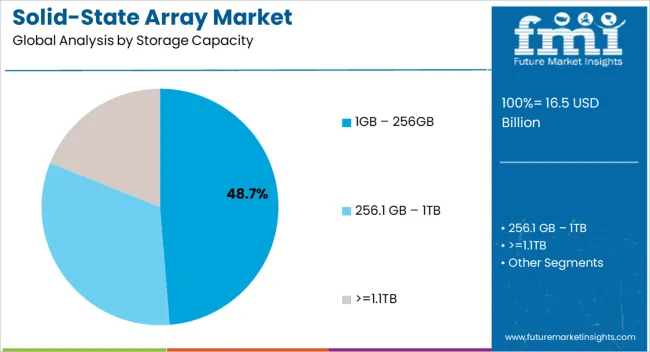

The 1GB to 256GB storage capacity segment is projected to account for 48.70% of total market revenue by 2025 within the storage capacity category, making it the most prominent segment. This growth is driven by its suitability for diverse enterprise workloads requiring balanced performance and cost efficiency.

The segment supports applications ranging from operational databases to virtualized environments, providing the scalability needed for medium scale deployments. Its affordability and energy efficiency are making it the preferred choice for businesses seeking reliable storage without incurring the higher costs of larger capacity arrays.

The balance of performance, reliability, and affordability has reinforced the dominance of this segment in the overall market.

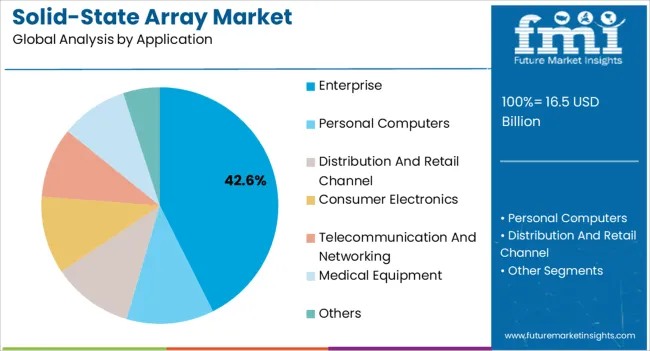

The enterprise application segment is expected to capture 42.60% of total market revenue by 2025 within the application category, positioning it as the leading segment. Growth is being driven by the rapid digitization of operations, increased reliance on data intensive applications, and the demand for secure and scalable storage infrastructure.

Enterprises are deploying solid state arrays to ensure low latency, high input output performance, and seamless integration with cloud platforms. The segment’s growth is further supported by ongoing investments in IT modernization and data center expansion initiatives.

With enterprises prioritizing resilience, scalability, and efficiency in their storage systems, this segment continues to dominate the market landscape.

In the past years, the solid-state array market has demonstrated a positive sales trajectory of 13.6% between 2020 to 2025.

The solid-state array market witnessed robust sales growth from 2020 to 2025, driven by increasing demand for high-performance storage solutions. However, the forecast outlook for the period 2025 to 2035 indicates even stronger growth potential for the market.

Factors such as advancements in technology, expanding data storage needs, and the rising adoption of solid-state arrays in various industries are expected to fuel the market's growth during this forecast period. The market is projected to experience significant sales expansion, reflecting the increasing popularity and widespread adoption of solid-state arrays as a preferred storage solution.

Expanding need for data storage:

The growing demand for mass storage and storage devices is the major driver of the solid-state array market. Also, the high usage of solid-state arrays in data centers for high-performance computing and big data workloads is the major factor that is driving the growth of the solid-state array market.

Big data, cloud computing, and the Internet of Things (IoT) are also likely to scale up the sales of solid-state array to an extent.

The rise in acceptance of solid-state arrays:

Due to their advantages over conventional hard disc drives in terms of performance and reliability, solid-state arrays are growing in popularity (HDDs), in turn expanding the market size. They are used in a wide range of products, including storage systems, laptops, and business servers.

HDD to SSD transition:

Due to SSDs' falling prices, rising capacities, and better performance characteristics when compared to HDDs, the switch from HDD to SSD is quickening, expanding the overall solid-state array market size. On the flip side, the high design cost is expected to be the restraint in the growth of the solid-state array market.

Also, the low environmental stability and rapidly changing technology are some of the factors which may hinder the solid-state array market. Moreover, the lack of device interoperability may slow down the demand for solid-state array during the forecast period.

The United States has captured a substantial value share of 19.5% in the solid-state array market due to various factors. The country's technological advancements and innovation prowess have propelled it to the forefront of the industry. With a strong emphasis on research and development, the United States has fostered a favorable environment for the development and manufacturing of solid-state arrays.

Additionally, the country boasts a robust IT infrastructure, which facilitates the effective implementation and utilization of these storage solutions. The United States also benefits from a strong market demand driven by the increasing need for efficient and high-performance storage solutions in the era of data-driven applications. The presence of key players and a favorable business environment further contribute to the United States' significant market share, establishing it as a leading player in the solid-state array market.

The United Kingdom (UK) is experiencing a notable compound annual growth rate (CAGR) of 15.1% in the solid-state array market due to several key factors. The country's strong emphasis on digital transformation across various industries, such as finance, healthcare, and manufacturing, is driving the demand for high-performance storage solutions like solid-state arrays. Furthermore, the UK's increasing focus on data-driven applications, such as artificial intelligence and big data analytics, necessitates efficient and reliable storage systems, making solid-state arrays a preferred choice.

Firstly, India is experiencing rapid digital transformation across various sectors, including IT, telecommunications, healthcare, and e-commerce. This transformation requires robust storage solutions to handle the increasing volume of data generated, stored, and processed by organizations. Solid-state arrays, with their high performance, reliability, and scalability, are well-suited to meet these demands.

The rise of smartphone usage, internet penetration, and e-commerce activities further drive the need for efficient and high-capacity storage solutions. Additionally, government initiatives such as "Digital India" and "Make in India" promote the adoption of advanced technologies, including solid-state arrays, to support the country's digital infrastructure and economic growth.

Furthermore, the presence of major technology companies, increasing investments in data centers, and the strong IT services industry in India contribute to the growth of the solid-state array market.

It offers a cost-effective solution for consumers and businesses. With a balance between storage space and affordability, this range appeals to a wide range of users. It caters to mainstream usage by providing ample storage for operating systems, applications, and personal data. This makes it suitable for everyday computing needs.

Additionally, solid-state arrays in this capacity range often exhibit optimized performance characteristics, including fast read and write speeds, low latency, and efficient data access. These features make them suitable for various applications, from consumer electronics to entry-level servers.

Lastly, the continuous advancements in technology within this capacity range have improved performance, reliability, and overall value, further contributing to its high market share.

This is primarily due to the increasing demand for high-performance storage solutions in devices such as smartphones, tablets, laptops, gaming consoles, and portable media players. Solid-state arrays provide several advantages for consumer electronics, including faster data transfer speeds, improved energy efficiency, and enhanced durability compared to traditional hard disk drives. These benefits make them ideal for applications that require quick access to data, such as gaming, multimedia streaming, and multitasking. Furthermore, the decreasing cost of solid-state storage has made it more accessible to a wider range of consumers, further driving its adoption in consumer electronic devices. As a result, consumer electronics hold a substantial portion of the solid-state array market and continue to fuel its growth.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Billion for Value |

| Key Countries Covered | USA, Canada, Germany, U.K., France, Italy, Spain, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, GCC Countries, Turkey, Northern Africa, and South Africa |

| Key Segments Covered | Storage Capacity, Application, Region |

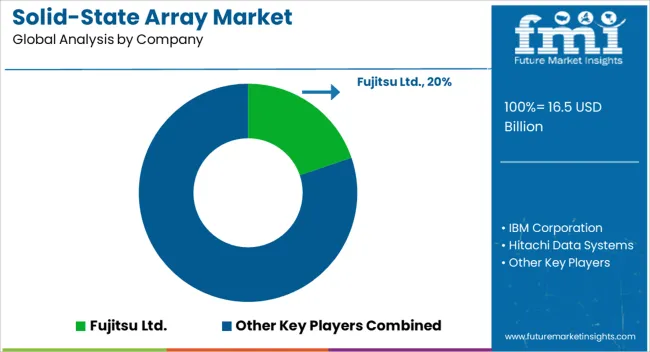

| Key Companies Profiled | Fujitsu Ltd.; IBM Corporation; Hitachi Data systems; Hewlett Packard Enterprise; Huawei Technologies Co., Ltd.; Kaminario; NetApp, Inc.; Tegile systems; Pure Storage; Tintri, Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global solid-state array market is estimated to be valued at USD 16.5 billion in 2025.

The market size for the solid-state array market is projected to reach USD 66.6 billion by 2035.

The solid-state array market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in solid-state array market are 1gb – 256gb, 256.1 gb – 1tb and >=1.1tb.

In terms of application, enterprise segment to command 42.6% share in the solid-state array market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inter Array Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

DNA Microarray Market Forecast Outlook 2025 to 2035

All Flash Array Market Size and Share Forecast Outlook 2025 to 2035

BGA Packaging Market Insights – Size, Demand & Growth through 2034

Transistor Arrays Market

Flash-based Arrays Market Insights - Trends & Growth Forecast 2025 to 2035

Key Players & Market Share in the Peptide Microarray Sector

Peptide Microarrays Market

Satellite Phased Array Antenna Market Size and Share Forecast Outlook 2025 to 2035

Electronically Scanned Arrays System Market Size and Share Forecast Outlook 2025 to 2035

Floating Microelectrode Array (FMA) Market Size and Share Forecast Outlook 2025 to 2035

Field Programmable Gate Array (FPGA) Size Market Size and Share Forecast Outlook 2025 to 2035

Field-programmable Gate Array (FPGA) Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA