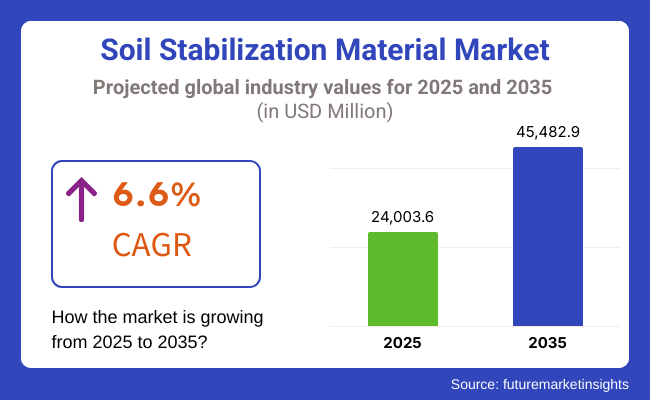

The global soil stabilization material market is poised for steady growth, with a projected market size of USD 24,003.6 million in 2025, expanding to USD 45,482.9 million by 2035, at a CAGR of 6.6% during the forecast period.

The increasing demand for soil stabilization materials is driven due to rapid infrastructure development, urbanization and sustainable land management globally is expected to drive the soil stabilization materials market over the coming years. The growing demand for better soil condition and soil compaction is spurring the growth of the soil stabilization techniques.

The growing emphasis on sustainable construction and land rehabilitation is further accelerating the demand for soil stabilization materials. Advanced stabilization techniques to increase soil strength, combat erosion and provide longevity to infrastructure are being adopted by both governments and private sector players.

Increasing occurrence of extreme weather events and highlights the struggles of degraded soil are driving industries to create strategic plans for investing in cutting-edge, environmentally friendly stabilization solutions that not only protect from short-term environmental and economic impact, but builds long-term environmental and economic benefits.

Soil stabilization is the process of strengthening soil by treating soil with synthetic or organic materials, is a crucial technology in the construction industry; the need for construction (road construction, highway construction, airport construction, commercial construction, etc.) is a significant factor in the soil stabilization market, as various global countries' governments are investing tremendously in building development and infrastructure, which will have a positive impact on soil stabilization market growth in the next few years.

Shift in the industry's trend towards bio-based and green stabilization solutions is altering the current situation. Soil stabilization materials are primarily consumed by the construction industry for applications in roads, foundation, and embankments. At the same time, the farm end of the economy is making use of these materials to reduce soil degradation and maximize land utilization. Stringent environmental laws have encouraged sustainable land-use practices which is supporting the adoption of advanced stabilization methods such as chemical and mechanical stabilization.

Explore FMI!

Book a free demo

The North America soil stabilization material market is attributed to high infrastructure growth in countries such as USA and Canada. Demand for advanced stabilization techniques is driven by government initiatives emphasizing road rehabilitation, smart highways, and sustainable land management. The rise in strict environmental regulations encourages using eco-friendly stabilizers like bio-based polymers and fly ash.

Moreover, climate-driven challenges such as soil erosion and severe weather events are pushing up the demand for sustainable soil stabilization solutions. North America continues its stronghold on the market with steady growth in the urban expansion, commercial assests, and agricultural land preservation, focusing heavily on innovation and sustainability.

Europe's soil stabilization material market is characterized by stringent environmental policies and increasing adoption of green construction materials. Germany, France and the UK are spearheading infrastructure projects that focus on ecologically sustainable road construction and soil rehabilitation. Regulatory regimes of carbon emission and soil conservation in the European Union are pushing the demand on bio-based stabilizers and alternative cementitious materials.

In addition, demand for high-performance stabilization solutions is being driven by the call for smart cities and freight networks. Dedicated to R&D, Europe is still leading the way in innovative stabilization technologies that align with the region's sustainability objectives.

The soil stabilization material market in the Asia-Pacific region is growing at the highest rate, owing to rapid urbanization, increasing industrial activities, and various government infrastructure projects on a large scale. Countries including China, India, Japan are widely demanding soil stabilization material with constructing of roads railway and airport.

Focusing on natural disasters like recurrent landslides, deforestation or soil erosion, sophisticated stabilization methods are needed. The market is anticipated to be driven by the growing demand for economic solutions, such as fly ash and lime, along with government initiatives supporting sustainable land development. The Asia-Pacific’s abundance of climates means that solutions for stabilization are critical in the longer-term resiliency of infrastructure.

The soil stabilization material market in the Rest of the World, including Latin America, the Middle East, and Africa, is expanding due to increasing investments in infrastructure and urban development. Desert soils need stabilization for mega construction programs in Middle East countries such as Saudi Arabia or the UAE, while agricultural land degradation is being addressed in Latin American countries.

More affordable stabilization solutions are being demanded in Africa as needs for improved road systems and soil conservation arise. Increasing government initiatives and foreign investments directly influencing the growth of regional markets, are expected to overshadow the key challenges including limited access to advanced technologies.

Challenges

High Initial Cost of Advanced Stabilization Techniques

High initial cost of advanced stabilization techniques is one of the key challenge in the soil stabilizing agents market. Although alternative materials, such as polymers, geosynthetics and nanomaterials provide comparatively improved stabilization performance, they are more expensive than conventional stabilizers, including lime and cement.

In developing areas, this cost factor presents a major hurdle as budgetary constraints invariably affect infrastructure projects. While the need for specialized equipment and skilled labour is emphasized, this adds to the overall cost, hindering adoption of modern stabilization methods for small-scale projects. Addressing this challenge will take low-cost innovations and government incentives.

Environmental Concerns Related to Chemical Stabilizers

Using chemical stabilizers like cement, lime, and bitumen is questionable from an environmental point of view due to their carbon footprint and impact on soil health. Cement production, for example, is an important source of CO₂ emissions and a contributor to climate change. It also changes the composition of the soil, affecting its natural properties and fertility due to excessive usage of chemical stabilizers.

Moreover, the use of chemical substances for stabilization is hindered by regional legislative constraints on both emissions and soil contamination. This is leading to an increasing demand for sustainable alternatives like bio-based stabilizers and enzyme-based solutions designed to reduce environmental impact while keeping soil integrity intact.

Opportunities

Development of Sustainable and Bio-Based Stabilization Materials

The increasing emphasis on environmental sustainability presents a significant opportunity for the soil stabilization material market. Soil stabilization solutions like enzyme-based stabilizers and organic polymers are becoming a growing area of research and development and manufacture, providing a more energy efficient and environmentally sustainable means of soil stabilization. These sustainable alternatives decrease the carbon footprint related to standard stabilizers such as cement and lime.

Furthermore, bio-based stabilizers positively affect soil health, making them applicable to agricultural applications. Rising awareness among governments and industries such as construction and land conservation towards making greener choices is projected to significantly boost the demand for sustainable soil stabilization solution for stability, adherence, and more strength in construction without any potential reduction of quality, which will open-up new opportunities for product development and innovation in global soil stabilization market.

Integration of Smart and Advanced Soil Stabilization Technologies

The soil stabilization material market is witnessing the introduction of smart technologies, including nanomaterials, geosynthetics, and IoT-based monitoring systems, which is enabling new avenues for growth in the market. Stabilizers enhanced by nanotechnology strengthen soil with low material use, lowering cost and environmental footprint.

Geosynthetics fabrics like geogrids and geotextiles can offer long-lasting soil reinforcement and are very adaptable for large-scale infrastructural development projects. IoT and AI powered soil monitoring systems also aid stabilization processes in harvesting and mining by eliminating seasonal errors. This facilitates investment from construction, transportation, and environmental sectors seeking innovative and high-performance solutions for stable soil at lower costs.

The soil stabilization material market has seen significant growth between 2020 and 2024, driven by growing infrastructure development projects and urbanization, as well as the need for sustainable land-use solutions. Stringent regulations relating to soil erosion control in the world have resulted in increasing demand for stabilization materials like polymers, lime, fly ash, and cement. Market expansion has also been driven by innovations in chemical stabilization technologies and bio-based alternatives.

Looking ahead to 2025 to 2035, advancements in nanotechnology, AI-driven soil analysis, and the adoption of environmentally friendly stabilization agents will shape the industry. The growing focus on climate resilience and carbon-neutral construction methods will also drive the development of sustainable soil stabilization materials.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Increasing emphasis on erosion management, infrastructure security, and eco-friendly land management. |

| Technological Advancements | New polymer-based stabilizers, more effective chemical additives, and upgraded geotextiles. |

| Industry-Specific Demand | Driven by road construction, agricultural land improvement, and commercial infrastructure projects. |

| Sustainability & Circular Economy | Initial efforts toward eco-friendly stabilizers and recycled materials in construction. |

| Production & Supply Chain | Income uncertainties related to variable raw material supply and growth in manufacturing costs from supply chain shocks. |

| Market Growth Drivers | Urbanization, rising infrastructure spending, and government policies favoring green development. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | More stringent environmental regulations, carbon neutrality programs, and green building policies. |

| Technological Advancements | Soil analysis using AI, bio- engineered stabilizers, and nanoscale technologies for better soil binding. |

| Industry-Specific Demand | Expanding into renewable energy sites, smart cities, and climate-resilient infrastructure. |

| Sustainability & Circular Economy | Mass adoption of bio-based alternatives, carbon capture-enhanced materials, zero-waste construction initiatives. |

| Production & Supply Chain | AI-enabled forecasting, local material manufacturing, and a stronger focus on circular economy practices. |

| Market Growth Drivers | Boom in smart infrastructure projects and climate adaptation needs, accompanied by investment in a surge of green technology. |

The USA soil stabilization material market is driven by expanding infrastructure projects, road rehabilitation, and sustainable construction initiatives. The government initiatives to build highways and develop smart cities act as a catalyst for the need for advanced soil stabilizers such as geopolymers, lime, and polymer solutions. Impact on trends Aspects like the environmental regulations give a scope for sustainable substitutes in stabilizers bio-based and recycled stabilizers.

The increase in urbanization and climate resilience strategies also lends support to the growth of the market. The development of nanomaterials and chemical binders has also improved the durability and performance of these soils. Public-private partnerships further focus on innovation and cost-effective solutions for large-scale projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

In the UK, the soil stabilization material market is growing due to increasing infrastructure modernization and flood management projects. The UK net zero strategy imposes strict environmental policies that promote the application of low-carbon stabilizers like fly ash and biopolymers. Increasing rates of urbanization and sustainable road-building initiatives are responsible for the demand for advanced stabilization solutions.

The increase in the renewable energy projects such as wind farms also drives the need for stable ground conditions in turn, reflecting positive on market demand. A steady market growth can also be attributed to investments in expansion of railways and smart transport initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.3% |

The European Union’s soil stabilization material market is shaped by stringent environmental regulations, sustainable construction policies, and a strong focus on circular economy practices. Countries like Germany, France, and Italy, are developing resilient infrastructures by applying innovative material such as cementitious binders, and enzyme-based stabilizers.

EU regulation helps push even quicker adoption of eco-friendly alternatives by a wide variety of projects to decrease carbon footprints. Furthermore, growing investments in transportation networks, such as high-speed rail and green roads increase the market demand. Similarly, the increasing need for erosion protection and flood management solutions drives the industry.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.5% |

Japan’s soil stabilization material market is primarily propelled by disaster prevention measures, earthquake-resistant construction, and infrastructure rehabilitation. Due to the country’s susceptibility to earthquakes and typhoons, it requires durable and high-performance stabilizers, including polymer-modified binders and cement alternatives.

Demand is buoyed by government projects for railway expansion, urban redevelopment and coastal protection. With the growing trends toward sustainable construction, the utilization of eco-friendly soil stabilizers is becoming increasingly popular. Emerging nanotechnology, and smart materials enhancements also help ensure soil durability and long performance, allowing for continued strength of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

South Korea's soil stabilization material market is fueled by rapid urbanization, smart city initiatives, and expanding transportation infrastructure. Demand for geosynthetic and chemical binder-based stabilization solutions is driven by government-led projects such as smart roads and high-speed rail networks.

Promoting green construction practices is in line with South Korea's green growth policies and encourages the use of green stabilizers. Moreover, investments in flood prevention and climate adaptation strategies also increase the growth of the market. Growing adoption of AI-driven soil analysis technologies help bolster productivity and innovation in soil stabilization applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

Polymers having better binding properties, durability, and compatibility with varied types of soils majorly contributes to the soil stabilization material market. These polymers, which can be either synthetic or natural, work to enhance the strength of soil by creating a flexible and stable matrix, making them especially effective for use in infrastructure projects like roads, highways, and airport runways. They are also in high demand because they can help increase resistance to erosion and reduce water permeability.

Increased emphasis on sustainable and eco-friendly soil stabilization methods has also increased demands for bio-based polymers. Due to the non-toxic nature of polymer-based stabilizers in contrast to cement and lime based stabilizers, which can have a severe impact on the environment, governments and regulatory bodies across the globe advocate the use of polymer-based stabilizers.

Polymers are also vital in preventing soil degradation and enhancing marine road longevity in extreme climatic conditions in North America and the Middle East. The polymer segment is projected to continue the steady growth trend with increasing investments in transport and urban infrastructure projects. The development of cost-effective polymer formulations and advancements in nanotechnology-based stabilizers will further propel the market expansion in the coming years.

Portland cement remains one of the most widely used materials for soil stabilization due to its high availability, affordability, and proven effectiveness in improving soil strength and load-bearing capacity. The product is widely used in constructing roads and for industrial purpose, where you need a long-term stability for foundation purpose. When mixed with soil, Portland cement reacts through a hydration process and binds soil particles, providing a strong and durable material.

The increasing infrastructure development across developing economies such as India, China, and Brazil where large-scale road and highway development has created a global demand for low-cost stabilization solutions is supporting the growth of this segment. Cement-stabilized soils, in particular, are also very effective in areas with high traffic, because they are generally more durable than others, and they do not weaken when they get wet.

Due to increased interest in sustainability and decarbonisation, there has been an increase in research into alternative cement formulations including the use of blended cements with supplementary materials, such as fly ash and slag.

Despite concerns regarding CO₂ production during cement manufacturing, its reliability and long-standing effectiveness would make it a critical component of the soil stabilization marketplace. The integration of innovative cement blends is expected to maintain the segment's growth trajectory in the upcoming years.

Roads and runways are recognized as the largest and most vital application in the soil stabilization material markets and are anticipating growth with surging global investments in transportation infrastructure. Road networks and airstrips need to have stabilized subgrades to increase the longevity, decrease the maintenance costs, and to reach higher load-bearing capacity. Soil modification is employed to improve its properties such as prevention of settlement, cracking, and erosion through different materials like polymers, lime and portland cement.

The extensive budgets assigned toward highway expansion, urban road projects and airport modernization in several nations across the globe will drive the demand for soil stabilization materials. Strict regulations in terms of road performance and safety in places like North America and Europe help to identify the necessity for effective soil stabilization.

In contrast, the same demand in fast growing economies, such as India and China, is being generated by huge-scale highway construction projects within the framework of the Belt and Road Initiative (BRI).

Moreover, with the challenges posed by climate change, including soil erosion and waterlogging, the demand for soil stabilization in runway construction has grown, particularly in coastal and high-rainfall areas. Continuous innovations in stabilization materials, including eco-friendly binders and nanotechnology-based solutions, the segment is poised for robust growth in the coming years.

Industrial applications are the major segment of the soil stabilization material market. Soil stabilization ensures that these structures are capable of bearing heavy loads, resisting settlement, and maintaining long-term stability under different environmental conditions. Common industrial land preparation materials in this segment include Portland cement, lime and fly ash, which offer economical solutions.

Rapid industrialization in developing regions like Southeast Asia, Latin America, and Africa is a major driver for this market segment. Growing needs of industries and the establishment of new industrial facilities, the need for soil stabilization materials is surging. In particular, the mining and step energy services industries utilize soil stabilization in the construction and maintenance of stable haul roads, tailings dams and operational zones in remote locations characterized by poor soil conditions.

Additionally, as sustainability gains importance, the industry is investigating eco-friendly stabilization solutions like bio-polymers and recycled industrial by-products based stabilizers. The fast forwarding segment has gained popularity as it provides cost-efficient and durable soil stabilization solution which helps industries best utilize their investments in infrastructure.

The global Soil Stabilization Material Market is witnessing significant growth due to increasing infrastructure projects, road construction, and agricultural land improvements. The market is driven by rising road construction and infrastructural projects for agricultural land improvements. Increasing demand for environment-friendly cost-effective soil stabilization solutions in highways, railways, and airstrips is spurring the market expansion.

Some of the leading companies operating in the global soil stabilization market include Soilworks LLC, Global Road Technology (GRT), Tensar International, Carmeuse Group and BASF SE, along with a number of regional players driving market growth. Technological advancements, sustainable materials, and government regulation promoting soil stability in construction and agricultural projects are driving the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Soilworks LLC | 12-16% |

| Global Road Technology (GRT) | 10-14% |

| Tensar International | 9-13% |

| Carmeuse Group | 7-11% |

| BASF SE | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Soilworks LLC | Provides synthetic and polymer-based soil stabilization engineering solutions for the construction and mining in India. Dust and erosion control and mitigation focus. |

| Global Road Technology (GRT) | Focuses on chemical stabilisers and polymer-based solutions in relation to roads, railways and airports. Having a strong emphasis on sustainable and environmentally friendly materials. |

| Tensar International | Specialist in geogrid technology for soil reinforcement and stabilization. Invest in research and product technology projects for infrastructure. |

| Carmeuse Group | Offers lime and cement-based stabilization solutions for improving soil strength and durability. Focuses on construction and environmental applications. |

| BASF SE | Produces polymer-based stabilizers and chemical additives. But Highly energy-efficient solutions for green building materials. |

Key Company Insights

Soilworks LLC

Soilworks LLC is a leading provider of advanced soil stabilization solutions, specializing in synthetic and polymer-based materials. he company operates in dust control, erosion prevention and permanent soil stabilization solutions for the mining, military and road industries. This global leader is well-known for developing proprietary products like Durasoil and Soiltac to improve soil integrity without harmful chemicals.

Extensive range of products, the company adheres to strict regulatory standards and focuses extensively on research and development, producing innovative methods to increase soil stabilization efficiency. With its focus on enhancing user experience along with tailor-made solutions for conditions of soil present in distinct regions, you end up as a market leader.

Global Road Technology (GRT)

GRT (Global Road Technology) is a market leader in chemical and polymer-based soil stabilization. The company makes eco-friendly soil stabilizers used in road infrastructure, mining and airport projects. GRT is dedicated to sustainable practices, as they provide non-toxic, biodegradable products that help strengthen the soil while eliminating dust emissions.

The company focusing on innovate and looking at new technology that will make soil durable within a structure as well as make it cost-effective to maintain. GRT is uniquely positioned in the market due to its engineering and project management allows it to tailor solutions to needs across multiple markets.

Furthermore, the company's international presence and partnerships with government agencies and private contractors further solidify its position in the market. With a focus on environmental sustainability and high-performance materials, GRT continues to be a company of choice for infrastructure projects on a global scale.

Tensar International

Tensar International is a leading developer of geosynthetic solutions for soil reinforcement and stabilization. Tensar Geogrid, is used worldwide in infrastructure projects to enhance soil strength and stability. The company also places great emphasis on its research and development activities, allowing Tensar to bring new forms of reinforcement solutions to the market, increasing both construction efficiency and longevity.

The firm works worldwide, delivering tailored solutions for roadways, railways, and industrial sites. With a track record of reliability and quality, Tensar is the partner of choice in the civil engineering sector. Additionally, the company offers comprehensive technical support and engineering know-how to guarantee the best utilization of its products. Tensar incorporates sustainability into its solutions to provide cost-effective, durable soil stabilization materials with minimal environmental impact.

Carmeuse Group

Carmeuse Group is a worldwide leader in lime and cement-based soil stabilization. The company’s products are used extensively in construction, agriculture and environmental applications to increase soil strength and durability. Carmeuse primarily deals with high-quality lime stabilization products that improve the workability of soil and improve long-term performance. With a diverse client base in the infrastructure and industrial sectors, the company operates extensively in North America and Europe.

Carmeuse invests in research and development to streamline its production processes and offer new soil stabilization solutions. Sustainability has also been high on their agenda, and they are committed to sourcing raw materials responsibly using energy-efficient manufacturing processes to keep environmental impact to a minimum. With a proven portfolio of soil improvement and erosion control offerings, Carmeuse becomes the partner of choice for the soil stabilization market.

BASF SE

BASF SE (Germany), a prominent player in the global chemical market, exhibits extensive involvement in the soil stabilization market with polymer-based high-performance solutions. Their soil stabilization additives are used to strengthen soil, minimize erosion and simplify construction efforts. BASF applies a world-class portfolio of materials for the innovative and sustainable solution of modern infrastructure projects.

Its global supply chain and strong distribution network can provide needs across industries such as agriculture, transportation and construction. The company has been conscious of environmental protection and works on developing eco-friendly stabilizers in compliance with strict regulatory standards. BASF brings strength to your project with strong soil stabilization technology, it focuses on product performance, sustainability, and technological advancements.

The global Soil Stabilization Material market is projected to reach USD 24,003.6 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.6% over the forecast period.

By 2035, the Soil Stabilization Material market is expected to reach USD 45,482.9 million.

The Polymers segment is expected to dominate the market, due to superior bonding strength, durability, and resistance to water erosion, making them ideal for road construction, slope stabilization, and infrastructure projects.

Key players in the Soil Stabilization Material market include Soilworks LLC, Global Road Technology (GRT), Tensar International, Carmeuse Group, BASF SE, GEOWEB.

In terms of Material Type, the industry is divided into Polymers, Minerals & Stabilizing agents, Portland Cements, Lime, Fly-Ash, Agriculture Waste, Sludge & Slag, Salts

In terms of Application, the industry is divided into Industrial, Roads, Runways, Landfills, Non Agriculture, Sports, Residential, Agriculture

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenylethyl Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenoxycycloposphazene Market Growth - Innovations, Trends & Forecast 2025 to 2035

Drag Reducing Agent Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.