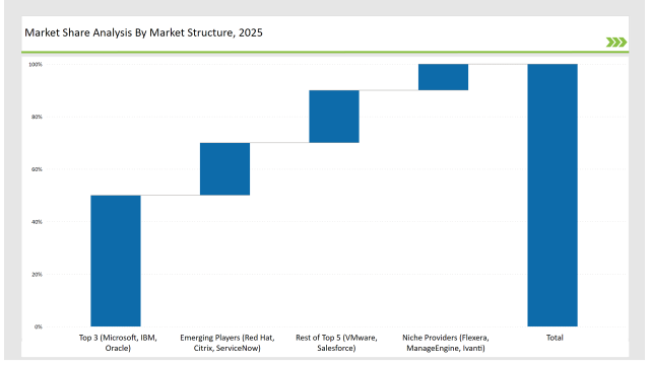

The Software Distribution market is evolving rapidly as organizations embrace digital transformation to streamline software deployment, licensing, and management. The top three vendors- Microsoft, IBM, and Oracle-hold a collective 50% of the market, leveraging cloud-based software distribution and AI-driven automation to enhance software deployment and security.

The remaining two in the top five, VMware and Salesforce, command a 20% share, emphasizing hybrid cloud models and enterprise software automation. Emerging players such as Red Hat, Citrix, and ServiceNow capture 20% of the market, focusing on open-source software distribution and real-time application management. Niche providers, including Flexera, ManageEngine, and Ivanti, account for 10%, specializing in software asset management, compliance, and endpoint security.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

| Category | Industry Share (%) |

|---|---|

| Top 3 (Microsoft, IBM, Oracle) | 50% |

| Rest of Top 5 (VMware, Salesforce) | 20% |

| Emerging Players (Red Hat, Citrix, ServiceNow) | 20% |

| Niche Providers (Flexera, ManageEngine, Ivanti) | 10% |

The software distribution market is fairly consolidated, with the top 10 companies accounting for over 60%. The lead players set industry standards, and smaller rivals are not able to easily gain market share and drive innovation.

The Software Distribution market is categorized into Cloud-Based Distribution and On-Premise Distribution:

The market is segmented based on organization size:

The market is further segmented by industry vertical:

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

Cloud-Based Software Management: SaaS-Based Deployment Models Will Dominate Software Distribution

Industries are witnessing how major distribution of a software model is coming from Software-as-a-Service (SaaS) deployment models. Cloud-hosted applications are also preferred by businesses due to their scalable nature, cost-effectiveness and easy accessibility. The SaaS solutions do not require on-premise infrastructure and thus help in minimizing dependency on hardware and on-prem servers and saving some costs related to the maintenance of such servers.

Subscription-based models are particularly popular among companies in finance, healthcare, and IT services, who are leveraging such models for guaranteed access to software, timely updates, and easy integration within already-established digital ecosystems. The increasing use of multi-cloud environments also encourages the deployment of SaaS-based software, enabling enterprises to achieve more efficient resource usage and providing high availability and redundancy.

AI-Driven Software Deployment: Predictive Analytics and Automation Will Enhance Efficiency

Automation powered by Artificial Intelligence and machine learning are reshaping the way software is deployed and managed. AI-driven analytics are being employed by enterprises to forecast the functioning of software, automate updates, and simplify patch management. Predictive models assist in detecting, forecast failures or outages within the system, potential security threats and even performance degradation before it truly affects operations.

AI-based software deployment solutions can automate the provisioning, configuration, and version control of software applications and reduce the need for manual intervention and downtime of those applications. AI-IT test automation implementations: The BFSI and healthcare industries are particularly regulated, and companies in these sectors are embedding AI into software compliance monitoring, to make sure that their security and data governance policies are being complied with, thereby providing increased operational efficiency.

Hybrid Cloud Solutions: Enterprises Will Increasingly Adopt Hybrid Models for Flexibility and Compliance

The organizations are quickly transitioning to hybrid cloud infrastructure for balance and compliance between performance, security and regulatory requirements. The enterprises accomplish flexibility in software setup help for integrating private and public cloud atmospheres while ensuring information self-reliance and compliance with neighbourhood regulations.

The hybrid cloud appeals to sensitive industries such as banking, healthcare and government services help for preferring to store sensitive data on private servers but use the scalability of the public cloud for less workloads. The hybrid model should allow seamless workload migration help for enabling disaster recovery and facilitating cost-effective resource utilization making it an approach for long-term digital transformation strategies.

Cybersecurity Integration: Advanced Security Features Will Be Embedded in Software Distribution Platforms

Security in Software deployment is pushing built-in cybersecurity features of distribution platforms. To secure against cyber threats and unauthorized access, software providers incorporate zero-trust security models, AI-powered threat detection, and end-to-end encryption directly into software distribution frameworks.

Organizations that manage sensitive customer data such as e-commerce, banking and government agencies are prioritizing software solutions that offer multi-factor authentication (MFA), identity access management (IAM) and real-time security monitoring. As ransomware attacks and breaches become more common, enterprises are implementing secure software deployment processes that enable continuous compliance with cybersecurity regulations.

Regulatory Compliance Enhancements: Vendors Will Integrate Compliance Frameworks for BFSI, Healthcare, and IT Sectors

Software distribution in various industries with the strict data protection regulations, necessitates adherence to regulatory compliance. The vendors are embedding industry-specific compliance frameworks with software distribution to enable organizations meet their compliance requirements like GDPR, HIPAA, PCI-DSS, and ISO 27001.

For example, in the BFSI vertical, compliance-based software solutions become enablers for securing payments, eliminating fraud, and keeping an eye on risk management. Whereas medical providers expect the software to be compliant with HIPAA to protect sensitive data, IT businesses focus on ensuring that the software is compatible with ISO and NIST security protocols. These improvements help enterprises reduce compliance risks while streamlining software lifecycle management in a business environment.

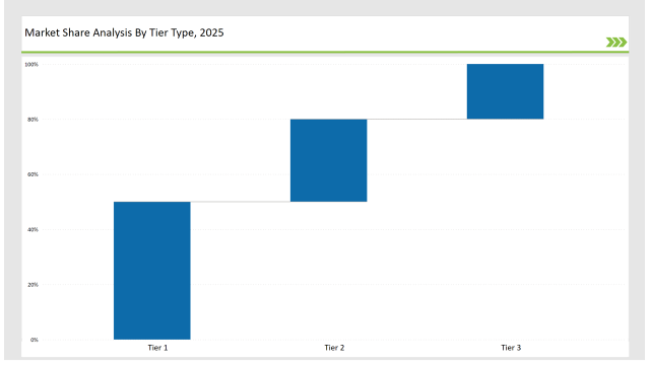

| Tier | Tier 1 |

|---|---|

| Vendors | Microsoft, IBM, Oracle |

| Consolidated Market Share (%) | 50% |

| Tier | Tier 2 |

|---|---|

| Vendors | VMware, Salesforce, Red Hat |

| Consolidated Market Share (%) | 30% |

| Tier | Tier 3 |

|---|---|

| Vendors | Citrix, ServiceNow, Flexera, ManageEngine, Ivanti |

| Consolidated Market Share (%) | 20% |

| Vendor | Key Focus |

|---|---|

| Microsoft | AI-driven cloud software management & automation. |

| IBM | Hybrid cloud software distribution with security compliance. |

| Oracle | AI-enhanced software licensing & cloud deployment. |

| VMware | Hybrid cloud integration for flexible software deployment. |

| Red Hat | Open-source software distribution and DevOps solutions. |

| Salesforce | SaaS-based software distribution and omnichannel support. |

Software distribution is under continuous pressure to refine AI-based deployment models to optimize automation, improve security, and provide predictive software licensing in order to stay competitive. The use of blockchain-based software verification will help reduce software piracy and ensure compliance.

Material growth potential resides in expansion into emerging markets where a surge in digital adoption is driving demand for cloud-based distribution models. Localization, multilingual support, and adherence to region-specific legislation - all of this is on the vendors.

AI, cybersecurity innovations, and hybrid deployment models will most certainly shape the future of software product distribution over the coming years. Vendors that invest in open standards, AI-driven automation, cloud-native solutions, and compliance-focused software management will find themselves at an advantage in this growing market.

Microsoft, IBM, and Oracle hold 50% of the market.

Emerging players Red Hat, Citrix, and ServiceNow hold 20%.

Niche providers Flexera, ManageEngine, and Ivanti hold 10%.

The top 5 vendors (Microsoft, IBM, Oracle, VMware, Salesforce) control 70%.

Market concentration is categorized as medium, with the top 10 players controlling 80%.

Explore Vertical Solution Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.