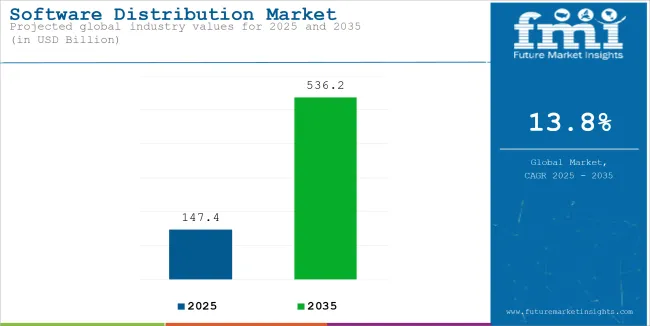

The global sales of Software Distribution are estimated to be worth USD 147.4 billion in 2025 and anticipated to reach a value of USD 536.2 billion by 2035. Sales are projected to rise at a CAGR of 13.8% over the forecast period between 2025 and 2035. The revenue generated by Software Distribution in 2024 was USD 129.6 billion. The market is anticipated to exhibit a Y-o-Y growth of 13.8% in 2025.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 129.6 billion |

| Estimated Size, 2025 | USD 147.4 billion |

| Projected Size, 2035 | USD 536.2 billion |

| Value-based CAGR (2025 to 2035) | 13.8% |

The Software Distribution Market represents the processes, platforms, and tools that make software applications and updates available for use by end-users across diverse devices and operating environments. These processes and systems range from more traditional on-premise methods to more modern digital distribution models in the form of cloud-based platforms, app stores, and enterprise software management systems.

It serves the vast spectrum of industries through its capability for the seamless distribution of software with automated licensing and version control management and scalable security and accessibility for the organization and user.

The global Software Distribution Market is witnessing strong growth, driven by increasing reliance on digital technologies, the proliferation of cloud-based and SaaS solutions, and the need for efficient software management across diverse industries.

Enterprises are leveraging advanced software distribution platforms to streamline deployment, updates, and licensing processes, catering to the rising demand for remote work solutions, IoT integration, and cross-platform compatibility. The market is bound to go steady with strong investments in IT infrastructure in developed and emerging economies, as automation, industrial cybersecurity, and AI-driven distribution tools are fast advancing.

The below table presents the expected CAGR for the global Software Distribution market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 11.4%, followed by a slightly higher growth rate of 11.8% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 11.4% (2024 to 2034) |

| H2, 2024 | 11.8% (2024 to 2034) |

| H1, 2025 | 13.8%(2025 to 2035) |

| H2, 2025 | 14.3% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 13.8% in the first half and remain relatively moderate at 14.3% in the second half. In the first half (H1) the market witnessed a decrease of 50 BPS while in the second half (H2), the market witnessed an increase of 70 BPS.

The section contains information about the leading segments in the Software Distribution industry. By Deployment, the Cloud-Based Distribution segment is estimated to grow at a CAGR of 15.9% during the forecasted period. moreover, by Organization Size, the Large Enterprises segment has holding the share of 39.7% in 2024.

| By Organization Size | Share (2025) |

|---|---|

| Large Enterprises | 39.7% |

The large enterprises segment has an overwhelming market share of the software distribution market, owing to their wide and complex IT infrastructures requiring robust, scalable, and secure software delivery solutions. These companies typically operate globally and require more advanced tools to support multi-site deployments, ensure real-time updates, and ensure that regional regulations are followed.

Because large enterprises typically have substantial budgets for IT modernization and automation, these firms are usually at the forefront of newer technologies, such as artificial intelligence and machine learning, in the process of software distribution. An integral focus on upgrading operational efficiency along with reducing potential downtime further emphasizes the demand of high-end premium distribution platforms making them the maximum revenue contributors.

| By Deployment Type | CAGR (2025 to 2035) |

|---|---|

| Cloud-Based Distribution | 15.9% |

The cloud-based distribution segment would have the most significant CAGR in the entire software distribution marketplace. This fact is attributed mainly to the increasingly widespread adoption across industries of various cloud computing platforms and SaaS solutions. Companies are increasingly shifting from on premise systems to cloud-based platforms due to their flexibility, cost-efficiency and scalability.

Cloud-based distribution solutions enable seamless software delivery and updates in remote and hybrid work environments, which have gained significant momentum in recent years. Likewise, the integration of AI and automation into cloud distribution systems enhances operational efficiency and security, addressing the evolving needs of modern enterprises. Adding the growth preference of hybrid and multi-cloud strategies among businesses further accelerates the adoption of cloud-based software distribution models.

Increasing Adoption of Cloud-Based Solutions and SaaS Applications Across Industries

There is a lot of standardization towards cloud-based solutions and Software-as-a-Service models across the industry, which helps in driving the distribution of software on a large scale. Enterprises have gained confidence in shifting away from traditional on premise software deployment for the advantages such as scalability, cost efficiency, and immediate access.

The shift has further led to a need for robust software distribution platforms that can automatically deliver updates and manage the lifecycle of software easily in hybrid and multi-cloud environments. The integration of cloud services with enterprise resource planning, customer relationship management, and other critical systems is expanding rapidly; therefore, there is a need for effective tools in software distribution.

Rising Demand for Remote Work and BYOD (Bring Your Own Device) Culture in Enterprises

The globalization of remote working and the integration of Bring Your Own Device policies in most organizations, there is now a huge necessity for the adoption of secure yet flexible software distribution solutions. These organizations are pushing business-critical software to remote teams and devices, hence creating the need for platforms that maintain compatibility, ensure security, and synchronize data real-time.

Additionally, the rapid expansion of the gig economy and freelance workforce is contributing to this trend, as companies seek efficient ways to deploy software to a diverse and dynamic user base without compromising data integrity or user experience.

Growing Integration of AI and Automation in Software Distribution Processes

The incorporation of AI and automation technologies is transforming the software distribution market by streamlining operations and improving efficiency. AI-powered tools have enabled predictive analytics, smart prioritization of updates, and proactive error detection that reduces downtime and increases user satisfaction.

The role of automation is critical in making complex workflows in software deployment easy and manageable, from zero-touch provisioning and patch management to real-time monitoring. In this regard, it not only contributes to improved productivity but also to compliance needs and security mitigation in organizations.

Challenges in Managing Compatibility and Integration Across Diverse Systems

A significant restraint in the software distribution market is the difficulty of ensuring cross-platform compatibility and smooth integration with an increasingly heterogenous device ecosystem, operating system, and other software environments. Organizations are plagued by problems maintaining homogeneous performance and function when distributing application updates or upgrades across legacy infrastructure and newer systems.

Incompatibilities can cause breakages, incur additional support and repair costs, and erode user satisfaction. In addition, the lack of standard protocols and the fractured landscape of the world IT further heighten these difficulties, thus retarding the spread of sophisticated software distribution tools in some regions and industries.

The global Software Distribution industry recorded a CAGR of 13.8% during the historical period between 2020 and 2024. The growth of Software Distribution industry was positive as it reached a value of USD 129.6 billion in 2024 from USD 77.3 billion in 2020.

The Software Distribution Market experienced growth from 2020 to 2024 mainly due to increased adoption of cloud-based solutions, increased remote work following the COVID-19 pandemic, and growing demand for automated deployment tools for software.

During this period, the industries around the world heavily invested in digital transformation, focusing on scalability, security, and seamless integration, which fueled robust sales demand. However, the demand outlook for 2025 to 2035 is expected to surpass the earlier period, driven by advancements in artificial intelligence (AI), machine learning (ML), and automation within software distribution platforms.

Integration of 5G technology, IoT ecosystems, and edge computing will redefine the software delivery and update processes to enable fast and efficient distribution across devices and geographies. Also, with growing hybrid and multi-cloud infrastructures, the need for flexible and interoperable software distribution solutions will increase exponentially, with support from growing demand for robust cybersecurity frameworks and compliance management in an evolving regulatory landscape.

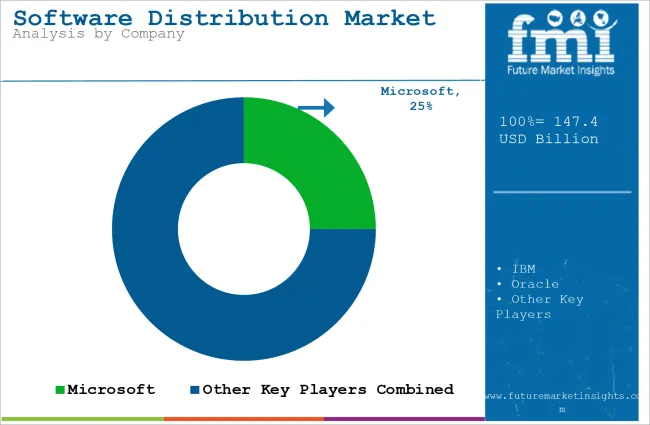

Tier 1: It includes giants like Microsoft, IBM, Oracle, SAP, and Amazon Web Services. They provide massive software distribution platforms and services addressing a broad spectrum of industries and customer segments across the globe. Their comprehensive service portfolios address both cloud services and enterprise software along with strengthened distribution networks, meeting software deployment and management needs in scale. Their large market shares and substantial resources along with continued innovation establish them as leaders in the landscape of software distribution.

Tier 2 consists of major cloud service providers such as Google Cloud and Salesforce. Although they have significant market power, their software distribution services are more niche than Tier 1 companies. Google Cloud provides a variety of cloud-based tools and services that enable software distribution, especially in data analytics and machine learning areas. Salesforce offers distribution solutions mainly focused on customer relationship management (CRM) and related applications. Their focused products and solid customer markets play a huge role in the software distribution market.

Tier 3 includes companies such as Red Hat, VMware, and Adobe. These companies concentrate on niche segments of the software distribution market. Red Hat specializes in open-source solutions and enterprise software distribution, particularly in Linux distributions and cloud infrastructure. VMware offers virtualization and cloud computing solutions that enable the deployment of software across different environments. Adobe offers technological software products with good distribution channels, focusing mainly on design and media professionals. Their niche service provides some versatility and profundity to the software distribution ecosystem.

The section below covers the industry analysis for the Software Distribution market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, Germany, Italy, China and India are provided.

The united states are expected to remains at the forefront in North America, with a value share of 65.2% in 2025. In South Asia & Pacific, India is projected to witness a CAGR of 16.6% during the forecasted period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 10.1% |

| Germany | 9.9% |

| France | 8.7% |

| China | 14.9% |

| India | 16.6% |

The USA is in lead in the global software distribution market, driven by supreme technological innovations, an massive IT infrastructure, and the presence of market leaders such as Microsoft, IBM, Oracle, and Amazon Web Services. The country rapidly adopts cloud-based solutions, a culture of innovation, and pushes the demand forward for advanced tools in software distribution.

With most businesses moving into SaaS models and hybrid work environments, this USA market is gaining high investments on automation, cybersecurity, and integration of data analytics within software distribution platforms. Furthermore, the digital transformation of governments in different sectors strengthens the United States' leadership and acts as a significant growth driver for the global software distribution market.

The UK's digital transformation efforts, underpinned by cloud adoption across all levels and enterprise investment in IT infrastructure, makes it a rising force in the software distribution market. With a flourishing financial sector, advanced manufacturing, and strong government support for digital innovation, the UK market has rapidly adopted technologies such as artificial intelligence and automation in software deployment processes.

The country's focus on data compliance, especially with GDPR regulations, has also fueled demand for secure and efficient software distribution platforms. In addition, the demand for easy deployment of software from various devices to multiple locations further drives the market to grow exponentially.

India has become an emerging growth market for software distribution; the country has transformed rapidly on the digital scale, and this coupled with increasing outsourcing of the IT industry and uptake of cloud by business houses irrespective of their sizes, is proving to be quite successful for the overall industry.

India, seeing high growth in the number of small and medium enterprises and startups due to the initiatives of Digital India and Startup India, is showing high demand for low-cost and scalable software distribution platforms. Additionally, India's global IT outsourcing hub has led to the creation and implementation of advanced software tools and distribution models, usually fashioned toward international users.

The vast adoption of work-from-home practices, along with a young and tech-savvy workforce, and rising penetration of the Internet, are signs of India's increasing dominance in the emerging markets of the software distribution landscape.

The highly competitive landscape of the Software Distribution Market is driven by global technology giants, cloud service providers, and specialized software vendors competing with each other in terms of differentiated offerings. The top market players are Microsoft, IBM, Oracle, and Amazon Web Services (AWS), who are very well equipped with their full distribution platforms and rich ecosystems catering to diverse industries.

Google Cloud and Salesforce utilize strong cloud infrastructure and domain-specific knowledge to lead in their markets. The additional players comprise of Red Hat, VMware, and Adobe, specializing in open-source solutions, virtualization, and creative software, respectively.

Rapid technical innovations have brought intense competition as companies are heavily investing in AI, automation, and cybersecurity to enhance their offerings. The Strategic partnerships, mergers, and acquisitions are prevalent as players seek to expand their capabilities and geographical reach in this dynamic and evolving market.

Recent Industry Developments in Software Distribution Market

In terms of deployment type is segregated Cloud-Based Distribution and On-Premise Distribution.

In terms of Organization Size, is distributed into Small and Medium Enterprises (SMEs), Mid-Sized Enterprises and Large Enterprises.

In terms of Industry Vertical, is segregated IT & Telecom, BFSI (Banking, Financial Services, and Insurance), Healthcare, Retail and Education.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The global Software Distribution industry is projected to witness CAGR of 13.8% between 2025 & 2035.

The global Software Distribution industry stood at USD 147.4 billion in 2025.

The global Software Distribution industry is anticipated to reach USD 536.2 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 14.8% in the assessment period.

The key players operating in the global Software Distribution industry include Microsoft, IBM, Oracle,SAP, Amazon Web Services (AWS), Google Cloud and other vendors.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in the Software Distribution Industry

UK Software Distribution Market Analysis – Size & Industry Trends 2025-2035

GCC Software Distribution Market Analysis - Size, Share & Trends 2025 to 2035

USA Software Distribution Market Report – Growth, Demand & Forecast 2025-2035

Japan Software Distribution Market Growth – Innovations, Trends & Forecast 2025-2035

Germany Software Distribution Market Insights – Size, Trends & Forecast 2025-2035

Content Distribution Software Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA