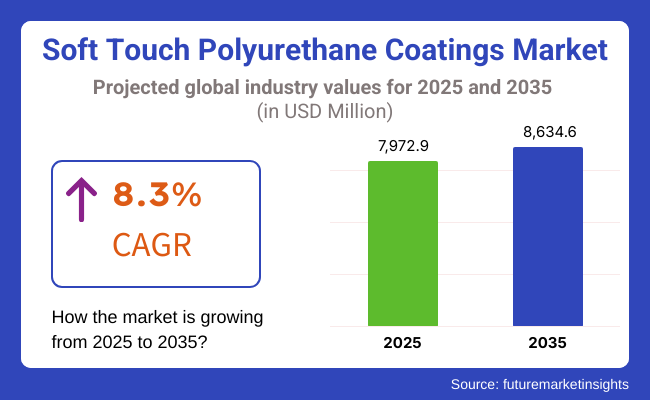

The Soft Touch Polyurethane (PU) Coatings market is poised for steady growth, with an expected increase from USD 7,972.9 million in 2025 to USD 8,634.6 million by 2035, reflecting a CAGR of 8.3% over the forecast period.

The booming demand on the market can be attributed also to the growing demand in several industries, such as automotive, consumer electronics, and furniture, for better tactile properties and increased durability. The combination of technological advancements in coating formulations stands as one of the key factors enabling the market, alongside growing consumer preference for high-end aesthetics and comfort.

The global market for Soft Touch Polyurethane Coatings is driven by the demand for high-performance surface coatings that provide excellent tactile experiences along with abrasion and scratch resistance. Automotive and consumer electronics are among the industries feeling an increasing dependence on these coatings to improve durability and usability.

With the evolving formulations by manufacturers (including bio-based and waterborne), a steady demand along with technological advancements can be anticipated through the rest of the forecast period.

Soft Touch PU coatings are being increasingly used in applications for premium feel, scratching resistance, and durable surface protection. Demand is a major driver of the automotive industry particularly in interior components like dashboards and door panels.

In the same way, consumer electronics such as smartphones and laptops, utilize these coatings to improve the overall user experience. The furniture sector is seeing increased adoption as well with increasing preference for soft, matte finishes in modern interior designs.

The growing research is being driven by the increasing regulatory policies, promoting using consumer friendly, environment friendly & low VOC coatings, which are motivating manufacturers to develop water based & UV cured PU coatings. Nanotechnology and bio-based polyurethane coatings are further innovations paving the way for eco-friendly but high-performance solutions.

Explore FMI!

Book a free demo

In North America, the demand from automotive and consumer electronics sector is driving the soft touch polyurethane coatings market. Stringent environmental regulations in the USA and Canada, coupled with a preference for low-VOC and water-based solutions, have propelled the development of advanced coatings technologies in these regions. The region’s established automotive industry, especially in luxury and electric vehicles, is driving demand.

Moreover, the growing culture of premium furniture and luxury consumer electronics propels the market growth. North America is anticipated to be a stable region with steady growth due to continuous investment in research and development, especially in the field of sustainable and technologically advanced polyurethane coating solutions during the forecast period.

Germany, France, and Italy being major producers and innovators in the automotive industry, Europe is still one of the dominant market due to the need for some eco-friendly alternatives. The stricter environmental regulations from the European Union are driving the shift toward a solvent-free, eco-friendly coating which may lead to the growth of waterborne and UV cured polyurethane coatings.

Also supporting demand is the region’s focus on high-quality interior design and luxury furniture. Furthermore, key automotive OEMs and electronics manufacturers accelerate market growth. Expecting sustainability to dominate the trends in the industry, manufacturers from Europe are driving demand for biodegradable and bio-based polyurethane coatings to comply with regulatory norms and fulfil consumer preferences.

Asia-Pacific dominates the Soft Touch Polyurethane Coatings market with the fastest growth due to the increasing consumer demand and rapid industrialization. The strongest automotive, consumer electronics and furniture industries are found in China, Japan, South Korea and India. Increasing disposable income and urbanization are driving the demand for premium products with enhanced finishes.

Another big driver is the growing electric vehicle market in China and India. Variables thereof, rise in the trend of sustainable coatings within the region as to supportive government initiatives to develop greener and sustainable manufacturing of coatings. Asia-Pacific region anticipated to dominate next-generation polyurethane coating solutions owing to their increasing technology advancements.

The Rest of World, which includes Latin America, the Middle East, and Africa, continues to offer exceptional Soft Touch Polyurethane Coatings prospects. Demand is being driven by increasing investments in infrastructure, automotive production, and consumer goods. This includes electronics and automotive interiors in countries such as Brazil and Mexico.

The Middle East is experiencing market growth due to luxury furniture and high-end architectural applications. Africa is also experiencing industrialization at a rising phase which is, although quite in its infancy stage, a ground for future opportunities for industrial growth. Due to rising awareness of sustainable coatings and continually increasing manufacturing capabilities, these regions are likely to play a crucial role in the development of the market.

Challenges

High Raw Material Costs

One of the primary challenges in the Soft Touch Polyurethane Coatings market is the high cost of raw Polyurethane resins and specialty additives used to formulate Soft Touch Polyurethane Coatings are relatively more expensive, as they are high performance materials. The volatile crude oil prices reflect on the production costs of polyurethanes, exerting pricing pressure on manufacturers.

Moreover, the availability of sustainable / bio-based coatings also contributes to the increased cost as the research, development and sourcing of eco-friendly raw materials is expensive. These cost barriers are particularly challenging for small and medium-sized enterprises, constraining their market penetration.

Stringent Environmental Regulations

The Soft Touch Polyurethane Coatings market faces a significant challenge due to stringent environmental regulations related to emissions of volatile organic chemicals (VOCs) and hazardous substances. Surely governments and regulatory bodies, the USA and Europe in particular, have made strict compliance requirements to mitigate environmental hazard.

This compels producers to reformulate their products, use low-VOC, waterborne or UV-cured substitutes, a task that can be expensive and quite demanding of the technology. Evolving regulatory frameworks and compliance are leading to an increase in production costs, as well as limiting the availability of solvent-based coatings. To stay competitive and comply with environmental requirements, companies need to continuously innovate while matching the performance and cost of their products.

Opportunities

Growth in Sustainable and Eco-Friendly Coatings

The growing global interest in sustainability offers a sizable opportunity to the Soft Touch Polyurethane Coatings market. Tightening environmental legislation and increasing consumer awareness are driving demand for low-VOC, waterborne, and bio-based and other sustainable coatings. Businesses that focus on green chemistry and sustainable formulations will have some sort of an edge on the competition and be able to meet regulations as well.

Secondly, such sustainable polyurethane coatings have new market opportunities. Moreover, industries like automotive and consumer electronics are favouring sustainable solutions, which will further boost demand. The development of environmentally friendly, high-performance coatings will be critical as technology continues to develop in order to implement market growth in the future.

Expansion in Consumer Electronics and Automotive Industries

Growing consumer electronics and automotive sectors are positively impacting the demand for Soft Touch Polyurethane Coatings in a highly soluble manner. These coatings allow for improved aesthetics, friction, and user experience, and they are more prevalent in smartphones, updates, gaming consoles, and wearables.

Likewise, the automotive industry is applying soft-touch coatings in luxury interiors (in addition to steering wheels and dashboards) on premium and electric vehicles. The growth of electric and self-driving vehicles only increases the demand for superior, long-lasting coatings. As consumers increasingly favor sleek, high-end finishes, manufacturers have the opportunity to innovate and expand their product lines in these high-growth sectors.

The soft touch polyurethane (PU) coatings market has been generating positive growth from 2020 to 2024, as consumers are increasingly opting for visually appealing and durable coatings. Moreover, stringent environmental policies have resulted into waterborne and bio-based PU coatings.

In addition, strict environmental regulations have propelled the development of bio based and waterborne PU coatings. The trend continues beyond 2023, with 2025 to 2035 also showing growth driven by advances in material science technology, sustainability, and growing end-use industries.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Demand for low-emission coatings was driven by VOC regulations. |

| Technological Advancements | Modification of waterborne PU coatings by creation of increased durability. |

| Industry-Specific Demand | High demand in automotive, electronics, and furniture sectors. |

| Sustainability & Circular Economy | Adoption of waterborne and solvent-free coatings. |

| Production & Supply Chain | Disruptions in supply chains from COVID-19 and shortages of raw materials. |

| Market Growth Drivers | Rising demand for premium aesthetic finishes and tactile comfort. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Strict global sustainability regulations are driving the market for bio-based formulations. |

| Technological Advancements | AI-driven formulation optimization and nanotechnology integration. |

| Industry-Specific Demand | Expansion into medical devices and aerospace applications. |

| Sustainability & Circular Economy | Higher demand for bio-based, recyclable, and self-healing PU coatings. |

| Production & Supply Chain | Localized production hubs and AI-powered supply chain management. |

| Market Growth Drivers | Innovation on functional coatings and growing smart material applications. |

USA market for Soft Touch Polyurethane Coatings is also seeing strong demand related to the vital prospects over automotive interior, consumer electronics, and high-end furniture segments. Increase in adoption across industries is due to a shift towards durable, aesthetically appealing, and sustainable coatings.

Moreover, stringent environmental regulations pertaining to the VOC emissions are propelling the manufacturers to devise eco-friendly formulations. Innovations in water-based and bio-based polyurethane coatings having many ways for growth. With significant R&D investments and a thriving automotive sector, the market in the USA is projected to grow at a CAGR of 7.9% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.9% |

The UK Soft Touch Polyurethane Coatings Market is primarily driven by increasing demand from various applications such as luxury automotive, premium furniture, and consumer goods. The innovations are also driven by the country’s increased focus towards sustainability and circular economy practices to achieve low-VOC and recyclable coatings.

Strict regulatory requirements as established by the EU’s REACH and other environmental policies are forcing manufacturers to seek greener alternatives. Growing demand in electronics and packaging industries also aids market growth. With strong government incentives for sustainable coatings, the UK market is anticipated to grow at a CAGR of 7.5% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.5% |

The European Union (EU) is at the forefront of sustainability-driven advancements in Soft Touch Polyurethane Coatings. EU region leading the charge Key consumers include the automotive, aerospace, and consumer goods industries, driven by demand for high-performance and low-emission coatings.

The stricter regulations of EU Green Deal policies and REACH are driving the transition to bio-based and waterborne PU coatings. Innovation and strict safety regulations in the region are further projected to enhance market growth. Germany, France, and Italy are among the most important countries in driving industrial demand. The EU market is projected to grow at a CAGR of 8.1% from 2025 to 2035.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.1% |

Japan’s Soft Touch Polyurethane Coatings Market is witnessing significant growth due to rising emphasis on high-precision coatings for advanced technologies within the country that increasing on the market growth. Current investments are natural polyurethane coatings for scratch resistance, self-healing, eco-friendly by leading automakers and electronic manufacturers.

As such, the government is working to support low-emission coatings and sustainable materials as part of its carbon neutrality objectives. Moreover, Japan can also further promote the coatings industry with its nanotechnology and polymer science technologies. The market is expected to grow at a CAGR of 8.5% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.5% |

The South Korea Soft Touch Polyurethane Coatings Market also is growing very fast due to the market demand in automotive, consumer electronics, and high-end packaging. Domenova has a stronghold in smartphone and automotive sectors in the country, contributing to innovations in its wear-resistant, anti-fingerprint, and soft-feel coatings.

Major companies are pivoting to biodegradable and waterborne polyurethane formulations to cater to eco-friendly initiatives. The growth is further propelled by favourable government policies towards sustainable industrial coatings. With a strong focus on R&D and cutting-edge manufacturing, South Korea’s market is projected to grow at a CAGR of 8.7% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.7% |

The water-based soft touch polyurethane coating is the leading type in the market, due to its extremely low VOC emissions and strict compliance with stringent environmental regulations such as REACH and EPA guidelines. This data includes industrial coatings, with an emphasis on automotive interiors and consumer electronics; these coatings provide top-notch haptic response, scratch and chemical resistance.

Another factor that facilitates the adoption of such coatings is the soaring demand for sustainable, non-toxic coatings especially in North America and Europe. Moreover, the recent advancements made in the waterborne polyurethane technology have enhanced their performance, reducing the performance gap with their solvent-based counterparts and providing the impetus for better market penetration.

Despite the rise of waterborne systems, solvent-based soft touch polyurethane coatings have yet to be rendered obsolete due to their superior adhesion, abrasion resistance, and fast cure times. They are engineered to offer enhanced performance in demanding applications, including high-end automotive interior and industrial devices that require strength and resistance to harsh chemicals.

Although heavily regulated for VOC emissions, where there are weak environmental laws, such as some parts of the Asia-Pacific and Latin America, demand should be maintained. Manufacturers are also innovating with lower-VOC formulations to comply with tightening regulations while maintaining the performance advantages of solvent-based coatings.

Soft touch polyurethane coatings having extensive application in transport and automotive sector, being the largest consumer of soft touch polyurethane coatings mainly used for dashboards, steering wheels, and door panels in vehicles. Apart from superior scratch resistance and durability, these coatings also offer a richer feeling texture.

Rising consumer preference for luxury and comfort along with rising electric vehicle production is fuelling demand. The market is also being propelled by the shift of leading automotive manufacturers towards water-based polyurethane coatings, which aligns with the stringent government regulations of European and North American countries.

Soft touch polyurethane coatings have found extensive applications in electrical and electronic devices like smartphone, laptop and gaming consoles to improve aesthetic appeal and provide a better grip. The increasing demand for high-end feel consumer electronics and innovative flexible and wearable devices is driving market expansion.

Non-toxic water-based coatings are expected to witness an upswing in this segment on account of their environment-friendly attributes, whereas solvent-based coatings dominate the high-end and industrial electronics. Asia Pacific, particularly China and South Korea, dominates demand owing to electronics manufacturing.

The soft touch polyurethane coatings market is highly competitive, with key players focusing on innovation, product differentiation, and sustainability. Over the past few decades, the global soft touch polyurethane (PU) coatings market has witnessed steady growth owing to the rising demand for soft touch PU coatings from automotive interiors, consumer electronics, and furniture applications.

This luxury touch by these coatings being highly durable and scratch-resistant (in some matte/ gloss/ satin finish) is very important for any premium range products. The prominent market players including AkzoNobel, PPG Industries, Axalta Coating Systems, and Sherwin-Williams combat through new product development and regional growth. As regulation becomes stricter, higher-performing, one- and two-pack low-emission coatings will increasingly take a greater share of the growing demand in this sector.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AkzoNobel N.V. | 12-17% |

| PPG Industries, Inc. | 10-14% |

| Sherwin-Williams Co. | 8-12% |

| Axalta Coating Systems | 5-9% |

| BASF SE | 3-7% |

| Other Companies (Combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| AkzoNobel N.V. | PU coatings with high performance for automotive interiors and furniture Heavy emphasis on sustainability and low-VOC solutions. |

| PPG Industries, Inc. | Offers a full line of water-based and solvent-free soft-touch coatings. Offers coatings for consumer electronics and automotive applications. |

| Sherwin-Williams Co. | Develops scratch-resistant coatings with enhanced haptic feedback. Focused on premium furniture and high-end consumer goods. |

| Axalta Coating Systems | Provides niche coatings for automotive original equipment manufacturers and electronics makers. |

| BASF SE | Provides new generation PU coatings with better adhesive and resistance characteristics. Huge presence in industrial and electronics sectors. |

Key Company Insights

AkzoNobel N.V.

AkzoNobel is a global leader in polyurethane coatings, particularly in automotive interiors and furniture. As a company, they emphasize sustainability, creating low-VOC and water-based formulas. AkzoNobel, with significant R&D investments, is at the forefront of developing innovative soft-touch coatings that optimize durability and aesthetics.

Its market position has been bolstered through strategic acquisitions and partnerships. It also highlights high-performance coatings that adhere to strict environmental regulations. “Having built a solid global supply chain, AkzoNobel is able to provide consistent products and innovation that enable our customers to deliver the best surface finishes possible.” The firm is focused on sustainable development and building a circular economy through resource-efficient manufacturing services.

PPG Industries, Inc.

PPG Industries has a strong presence in the soft-touch polyurethane coatings market, serving automotive, electronics, and industrial sectors. MML Group not only specializes in water-based and solvent-free coatings at a premium class level, but also produces well within the limits of environmental protection laws. PPG has a focus on product performance improvements like developing self-healing and ultra-durable coatings.

Its investments in digital coating solutions are strategically aimed at providing cost-effective, more consistent application for users. PPG has been focused on expanding its market reach, both through acquisitions and partnerships, to extend its global footprint. Innovation continues to be a focus, with advances in anti-fingerprint and antimicrobial coatings designed specifically for high-touch surfaces in consumer electronics and vehicles.

Sherwin-Williams Co.

Sherwin-Williams is a significant player in the polyurethane coatings market that targets high-end consumer goods and furniture along with automotive applications. And with over two decades of experience, the company has invested significantly in both research and development, and advanced coatings with higher scratch resistance and haptic feedback.

It actively seeks eco-friendly formulations, lowering VOC emissions and encouraging sustainable materials. With its expansive distribution network, Sherwin-Williams offers tailored solutions across industries. That's a commitment reflected in recent innovations in fast-drying and UV-curable coatings. Additionally, as a leader in specialty coatings for premium segments, this company can deliver beautiful, durable finishes for a wide range of various applications.

Axalta Coating Systems

Axalta Coating Systems is focused on soft-touch polyurethane coatings for automotive OEMs, consumer electronics and industrial applications. It looks at high-performance formulations, especially UV-curable and fast-drying coatings that can be made more efficient. Axalta is part for the sustainable future with bio-based polyurethane products to respond to the growing expectation for even higher environmental standards.

The company also invests actively in R&D, focusing on developing coatings that offer better adhesion and wear resistance. It also stays ahead of design trends thanks to its strategic partnerships with automotive manufacturers. The company's market development activities in the Asia-Pacific region and Europe have established the company as a key supplier of coatings, allowing it to gain an edge as an innovator in its sector.

BASF SE

BASF SE is an industry leader in polyurethane coatings, emphasizing advanced material science to improve adhesion, flexibility, and resistance properties. With a deep focus on sustainability, the company is introducing renewable raw materials into its formulations. BASF is a player in coatings which are used extensively in industrial and electronics fields, where both durability and adherence to environmental-friendly practices are vital.

Its global supply chain and research facilities enable the development of next-generation coatings, such as smart and self-healing types. Against the backdrop of rising energy prices and demand for environmentally friendly production processes, BASF places great value on energy-efficient production processes for our customers: Energy-efficient production processes are not only cost-effective, but also reliable, and produce high-quality solutions for customers. It continues to grow in the market through innovation and partnerships.

The global Soft Touch Polyurethane Coatings market is projected to reach USD 7,972.9 million by the end of 2025.

The market is anticipated to grow at a CAGR of 8.3% over the forecast period.

By 2035, the Soft Touch Polyurethane Coatings market is expected to reach USD 8,634.6 million.

The water-based segment is expected to dominate the market, due to low VOC emissions, regulatory compliance, superior durability, fast drying, and growing demand in automotive, consumer electronics, and furniture applications.

Key players in the Soft Touch Polyurethane Coatings market include AkzoNobel N.V., PPG Industries, Inc., Sherwin-Williams Co., Axalta Coating Systems, BASF SE.

In terms of Base Type, the industry is divided into Water-based, Solvent-based.

In terms of End use industry, the industry is divided into Transport and automotive, Electrical and electronics, Wood and furniture, Others.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.