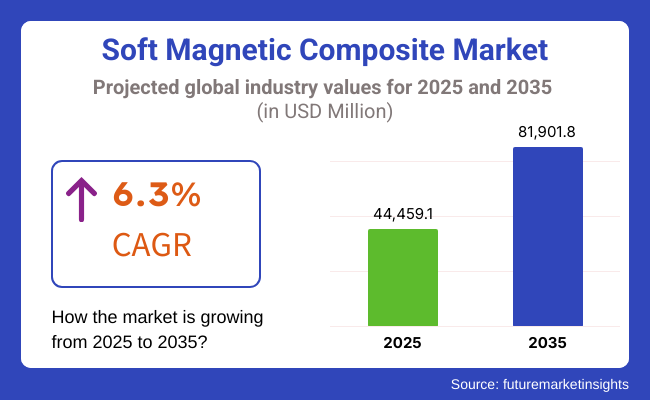

The Soft Magnetic Composite (SMC) market is poised for steady growth over the next decade, driven by advancements in electrical and electronic applications, increased demand for energy-efficient solutions, and the rising adoption of electric vehicles (EVs). The market is expected to expand from USD 44,459.1 million in 2025 to USD 81,901.8 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.3%.

The adoption of soft magnetic composites is being further facilitated by the growing focus on maintaining sustainability and the transition from traditional to state-of-the-art energy systems in all industries. Soft magnetic composites are a kind of material that has excellent magnetic traits, and less eddy current losses, and performs better in electromagnetic applications. Government backing of environmentally friendly and high-performance materials in automotive and industrial sectors will probably be a key factor in the market's growth.

The soft magnetic composite segment's growth is primarily fueled by industrial manufacturers who are moving toward more efficient and electrified production and distribution systems. The recent push for wind and solar power energy plants has also contributed to this market's growth. Besides, the trend of downsizing electronic components has led to a higher need for SMC materials in transformers and inductors, where better energy conversion performance is sought.

EVs and HEVs, which have taken precedence in the automotive industry, are the key factor driving market growth. Thanks to their features that enable improved magnetic performance with minimal core losses, SMC materials lead to better motor efficiency and overall performance. Furthermore, the ongoing studies and development projects, concentrating on boosting the thermal stability and mechanical strength of these composites, should also help propel the market growth.

Explore FMI!

Book a free demo

The North American soft magnetic composite market records rapid expansion related to technological enhancements in electric mobility, smart grid infrastructure, and the augmented need for energy-efficient electrical components. The region is receiving prominent funding for EV (electric vehicle) production with the USA and Canada marking the major parts in domestic manufacturing's expansion.

Besides, the rapid development of sustainable energy sources, especially wind and solar energy, is the primary driver for high-performance magnetic materials, demanding them. The liable regulatory mechanisms which are targeted at diminishing carbon footprint and advancing energy efficiency are mutually bringing about the broadening of this market. The major part of the automotive industry and tech enterprises rallies North America in the market.

Europe continues to be one of the leading players in the soft magnetic composite market, propelled by strict environmental regulations, the regions proactive approach to electrification, and sustainable energy initiatives. Nations like Germany, France, and the UK are heavily investing in the development of EVs, hybrid technologies, and smart grid applications.

Besides, the European Union's adherence to the objective of cutting carbon emissions has raised the implementation of inductors and transformers that use soft magnetic composites. The need for lightweight and compact components in both electronics and automotive sectors is yet another factor that adds to market growth. Joint efforts between research institutions and manufacturers are the main driving force behind technological innovations.

The Asia-Pacific region holds the title of the fastest-growing soft magnetic composite market, primarily due to dynamic industrialization, booming consumer electronics production, and active governmental support for green energy initiatives. China, Japan, and South Korea are leading this race as they have all-around experience in automotive manufacturing and electronics innovation.

The electric vehicle sector's spill over effect along with the trend of more investments in energy projects has a positive impact on the market. Besides, the low-cost raw materials, which are easy to obtain in combination with the favourable government policies that promulgate the use of renewable materials, are the primary growth drivers. The rising shifts in energy from power to storage push for market consolidation in the area.

The Rest of the World (RoW) market for soft magnetic composites, which also includes Latin America, Africa, and the Middle East, is undergoing a gradual period of growth. Countries in Latin America, principally Brazil and Mexico, are having a significant rise of adopting renewable energy sources, thus offering advanced magnetic materials.

The Middle East region is undertaking colossal infrastructural projects, and the creation of smart grids and power transmission systems is the field where [they] provide SMCs with opportunities. More to the point, Africa, which is now at the path of industrialization and electrification can be able to embrace that approach in a long-standing timeframe. The growing influx of foreign investments in the manufacturing sector adds more to the already good prospects of the market.

Challenges

High Manufacturing Costs

Manufacturing soft magnetic composites calls for intricate manufacturing procedures since they mainly involve powder metallurgy and advanced sintering methods which are the determining factors behind high costs. The requirement for specific equipment and strict testing which are mandatory are part of the newly added expenses.

Also, getting a hold of the high-purity materials such as iron and cobalt is another circling factor to the production of course these materials are the main reasons behind the high scrutiny of pricing quoted to manufacturers in the areas that are affected by high competition. Companies must explore cost-effective manufacturing techniques and alternative materials to mitigate these expenses and maintain competitiveness in the industry.

Raw Material Price Fluctuations

The soft magnetic composite market is particularly exposed to changes of raw materials like iron, nickel, and cobalt, which can be highly volatile. The factors that play are the political conflicts, supply chain break, and the mining outputs that fluctuate which in turn constitute the costs of the specific materials.

Such uncertainty leads to difficulties for the manufacturers in keeping stability in the profit margins and pricing structure. The primary strategy that the players are outlining includes researching new material compositions, establishing long-term supplier collaborative, and sponsoring recycling plans to guarantee cost-effective and steady procurements of raw materials.

Opportunities

Advancements in Powder Metallurgy

Innovations in the field of powder metallurgy are not only making the production of soft magnetic composites more efficient but also less costly. Advances in manufacturing techniques, such as the incorporation of additive and high-density compaction, provide the opportunity for the industry to commoditize the enhanced mechanical strength and magnetic properties of the products.

The long-term benefits of these advancements will particularly be seen in high-performance applications like electric vehicles, industrial automation, and renewable energy systems. The constant breakthroughs in powder machining methods will open new avenues for enterprises to boost their ranges of products and fill the market need for magnetic materials with better energy consumption.

Integration with Industry 4.0 and Smart Manufacturing

The ongoing integration of Industry 4.0 technologies into sectors is responsible for the boost for high-performance materials such as soft magnetic composites. Smart manufacturing is being incorporated with tools like machine learning, robotics, and data analysis which are shifting things to a new level regarding the control of raw materials, lessening waste, and heightening the efficiency in production as a result.

The amalgamation of SMCs with innovative manufacturing applications not only is a possibility in new areas like robotics, IoT-enabled devices but also in telecommunications such as high-speed data. By the time the other sectors gatekeep digital transformation, the market of soft magnetic composites is anticipated not only to be stable on the same line but to grow significantly.

The soft magnetic composite (SMC) arena has seen a hike in sales from 2020 to 2024 which is mainly attributed to the extensive improvements in electric motor technology, the increase in the automotive and energy sector requirements, and the growing popularity of high-efficiency magnetic materials. Some of the crucial aspects remained the launch of electric vehicles (EVs), the enhancement of industrial automation, the cornerstone of energy-efficient products, and the key drivers in this period of time.

The scenario in 2025 to 2035 is well-thought-out for the SMC market which is perceived as being consequential by the extension of environmental restrictions, material science revolution, and the introduction of new energy solutions.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Climate | Moderate regulations targeting efficiency and performance norms in principal sectors. |

| Technical Developments | Enhancements in powder metallurgy and coating technologies for better performance. |

| Sector Shooter Demand | Automotive sector, industrial motors, and consumer electronics have immense demand. |

| Sustainability & Circular Economy | First steps towards recycling improvement and material waste reduction. |

| Market Growth Catalysts | Commercial vehicle electrification, automotive digitalization, and component miniaturization drive the growth. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Climate | Environmental sustainability regulations, promotion of green materials, and more recycling regulations. |

| Technical Developments | Autonomous design materials with AI, nanostructured soft magnetic composites, and improved additive manufacturing processes. |

| Sector Shooter Demand | Wind energy, fusion power applications, and IoT-enabled devices for the next generation are being promoted. |

| Sustainability & Circular Economy | Closed-loop recycling with bio-based binders are fully utilized, and less rare element dependency is adopted. |

| Market Growth Catalysts | Tackling carbon neutrality through powerful measures, AI-assisted material design, and smart grids as a whole. |

The United States soft magnetic composite (SMC) market is witnessing a consistent growth trend as a result of the increased utilization of energy-efficient electric motors and transformers that are mostly found in the flourishing electric vehicle (EV) sector and in the renewable energy sectors.

The government programs that are directed at the energy-saving and the continuing developments of the additive manufacturing process are the two other contributors that have an impact on the growth of the market. The transition from traditional to lightweight and high-tech materials in the manufacturing of industrial and consumer electronics is another characteristic determinant.

The USA market has an evaluation of growing at a rate of CAGR of 6.5% (2025 to 2035), maintained substantially above the global average due to the strong demand in the manufacturing sector as well as the new technologies in the field of magnetic materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

Besides gaining benefits, the UK soft magnetic composite sector is boosted by financing in such fields as sustainable energies, electrification of transport, and developments that take place in modern power electronics. Due to strong pressure on the environment, SMCs have to be replaced with inductors and motors for section vehicles and wind energy applications in next-generation equipment, consequently, purchase them in high demand.

Furthermore, partner universities and industrial stakeholders have been the leading forces in this research trend. In the United Kingdom, the rise in the soft magnetic composite market is projected at 6.1% during the forecast period of 2025 to 2035, which is a little bit below the global figure due to the reason that the market is growing mature and there is a considerable need for raw material imports.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.1% |

The SMC market of the European Union is largely influenced by the refereeing environmental regulations, the increasing of electric vehicles, and the growing investment in renewable energy. The lead demand for discrete semiconductor components (SMCs) comes from countries like Germany and France mainly in vehicle and industrial applications, whereas the most particular products are high-performance electric motors and transformers.

Research projects oriented on sustainable magnetic materials and circular economy principles promote even more the growth. According to the forecasts, the EU market will expand at a compound 6.4% annual growth rate (2025 to 2035) which is very similar to the global average since the government is providing plenty of money to the industry and there are technological advancements.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.4% |

Japan's SMC (Soft Magnetic Composites) market is secured by the nation's advanced manufacturing ecosystem and being at the top of the field in electric motor technology. The emphasis on miniaturization and high-efficiency power systems, especially for hybrid and electric vehicles, leads to an increase in the demand for soft magnetic composites in the avowed sector.

The robotics and electronics industries support this growth of SMC market very well. In contrast, the lack of raw materials and the old workforce are the burdens for the economy. Japan's SMC market is expected to rise at a CAGR of 5.9% from 2025 to 2035, slightly under the global average, mainly due to market saturation and high manufacturing costs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

South Korea is emerging as a key player in the SMC market, fueled by its strong automotive, consumer electronics, and semiconductor industries. The remarkable development of EV and renewable energy infrastructures, along with government benefits for green technologies, inflates the demand for the business.

Progress in nanocrystalline and amorphous magnetic materials has a substantial impact on the competitiveness. South Korean SMC market, which is expected to expand at a 6.7% CAGR (2025 to 2035), is primarily driven by high-tech applications and export-oriented manufacturing. The market growth is above global average, due to the increase in R&D investment and industrial collaborations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

Electrical Steel Dominates the Market Due to High Efficiency and Widespread Use

Driven by its very high magnetic permeability, low core loss, and superior energy efficiency, electrical steel is the main material in the soft magnetic composite market. The material is extensively used in transformers, motors, and generators, thus making it an integral part of power transmission and industrial applications. Further, the use of EVs and the powered industry with the installation of renewable energy sources are the factors that help accelerate development.

The regulations for energy-efficient electrical equipment, which are particularly strict in North America and Europe, also contribute the market to the growth of the transformer steel sector. Besides, the new developments in grain-oriented electrical steel let it work better and, thus, reinforce its presence in high frequency and high power applications.

Soft Ferrite Gains Traction Due to High Resistivity and Frequency Stability

Soft ferret is another key sector, which is appreciated for its high electrical resistivity, low eddy current losses, and frequency stability. These are the properties that make it the best choice for inductors, transformers, and electromagnetic interference (EMI) suppression applications. Soft ferrites are through widespread use in high-frequency applications, such as power electronics, wireless charging, and telecommunications.

The rapid growth of the consumer electronics and automotive sectors has resulted in an increased supply of soft ferrite-based components. It’s cost-effectiveness in comparison to electrical steel and compatibility with future technologies like 5G and IoT guarantee sustainability in the market, especially in the Asia-Pacific manufacturing centres.

Motors Lead the Market with Rising Demand in EVs and Industrial Automation

Motors are the largest application segment because of high consumer demands for electric vehicles, industrial automation, and washing machines. Soft magnetic composites (SMCs) are the main materials in high-efficiency motors thanks to them being able to reduce eddy current losses, improve the magnetic flux, and enhance energy savings. The entire transformation towards sustainable energy sources, which include EV uptake and smart grid development, is even more accelerating the demand.

Regulatory mandates, which promote energy efficiency, such as IEC and DOE standards, make manufacturers integrate advanced SMC materials into motor designs, more a requirement. Apart from that, new developments in 3D-printed magnetic components have been contributing the enhance motor performance and design flexibility.

Transformers Maintain Strong Demand Due to Power Grid Expansion and Electrification

Transformers are very key parts in the power distribution sector, and the demand for them is rising even more because of the electrification and grid modernization drives. Meanwhile, electrical steel and soft ferrite add code-green transformer cores with high efficiency and low power loss.

The switch to the renewable energy such as solar and wind necessitates the development of transformational transformers for better energy conversion and transmission. Further, urbanization and industrialization are factors driving infrastructure investment and the transformer market growth in developing countries such as India and China. The attempt to produce compact, high-frequency SMCs transformer have a positive role in market development.

The Soft Magnetic Composite (SMC) sector is increasing very fast mainly due to more and more capacity for renewable energy sources, electric motors, and electromagnetic application projects. The main players in the sector lay emphasis on enhancing the quality of materials, improving the manufacturability and, in particular, decreasing the core losses in the magnetic components. The main trend in this market includes technological progress, green projects, and new partnerships between material suppliers and end-users, etc.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Höganäs AB | 15-20% |

| Rio Tinto Metal Powders | 10-14% |

| Hitachi Metals, Ltd. | 8-12% |

| GKN Powder Metallurgy | 6-10% |

| Sumitomo Electric Industries | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Höganäs AB | Produces high-purity iron powders for SMC applications, focusing on efficiency and low core loss. |

| Rio Tinto Metal Powders | Specializes in advanced powder metallurgy solutions for electromagnetic applications. |

| Hitachi Metals, Ltd. | Develops innovative magnetic materials with optimized permeability and reduced eddy currents. |

| GKN Powder Metallurgy | Invests in high-performance powder metal components for automotive and industrial applications. |

| Sumitomo Electric Industries | Manufactures advanced SMC materials for compact, high-frequency electrical devices. |

Key Company Insights

Höganäs AB

Höganäs AB is the most important player in the world of iron-based powder applications, especially in the field of soft magnetic composite solutions. The firm places the greatest emphasis on environment, health and social safety, productivity, and performance optimization the most in electric motors, and transformers.

Höganäs also keeps making investments in research and development, thus, bringing its portfolio to that level, which is necessary to cope with the expected surge in the demand for energy-efficient materials. Some of the recently promoted steps in this direction were taking up sustainable production methods and interacting with end-users to bring joint ideas to life.

By offsetting its share of various industries, the firm further strengthens its competitiveness and is enabled to stay on the forefront of the constantly transforming electromagnetic applications market.

Rio Tinto Metal Powders

Rio Tinto Metal Powders is among the most dominant producers in the metal SMC market and its focus is on high-density powder metallurgy. This giant takes advantage of its huge mining and processing facilities to function as the provider of metal powders with better magnetic properties than competing ones.

A few of the latest projects were the expansion of the customer base through cooperation with major car makers and industrial producers regarding the solution of sustainable and efficient materials. Focusing on technology innovation, and effective supply chains, Rio Tinto launches the project to increase the performance of the electric motors, and the like, while helping the cost-management and material-wastage issues.

Hitachi Metals, Ltd.

Hitachi Metals, Ltd. stands out for its cutting-edge magnetic materials that serve in high-frequency applications. The firm highlights prominently the importance of the reduction of core losses and increased permeability related to the operation of electrical devices. Through the continuous investment in the R&D projects, Hitachi Metals have designed exclusive materials that possess unique features.

For instance, they find extensive use in electric-car and industrial plants automation tasks, the need to be optimal for such applications. Besides that, the strategic partnerships and the green initiatives are the main reasons why the company could enlarge its focus on the SMC market and become a significant player in it, thus contributing to the industry change towards energy-saving and eco-friendly solutions.

GKN Powder Metallurgy

GKN Powder Metallurgy is among the leaders in providing powder metal components and has managed it for many years by adapting to the automotive and industrial sectors changing needs in a very quick manner. The company, on the other hand, is developing a new model of soft magnetic composites that performs better. This is important for the automotive and renewable energy applications.

Utilizing the professional knowledge, it has, GKN Powder Metallurgy preciously manufactures products, thus, avoids excess production costs. The drive for innovation is evident through its significant investments in material science and automation technologies, which aim at product efficiency improvement and the promotion of an ecologically sustainable electromagnetic application in different parts of the world.

Sumitomo Electric Industries

Sumitomo Electric Industries is mainly standing for high-performance SMC materials for electrical and automotive applications. The concentration on miniaturization and improved efficiency has resulted in the invention of advanced materials that allow the realization of compact and high-frequency operation.

Sumitomo Electric is a company that is loaded with a development push through the expansion of research and production resources, which aims at eco-friendly and efficient soft magnetic composites targeted at the cutting-edge technological applications.

The global Soft Magnetic Composite market is projected to reach USD 44,459.1 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.3% over the forecast period.

By 2035, the Soft Magnetic Composite market is expected to reach USD 81,901.8 million.

The Soft Ferrite segment is expected to dominate the market, due to its low core losses, high electrical resistivity, cost-effectiveness, and suitability for high-frequency applications in power electronics, telecommunications, and automotive industries.

Key players in the Soft Magnetic Composite market include Höganäs AB, Rio Tinto Metal Powders, Hitachi Metals, Ltd., GKN Powder Metallurgy, Sumitomo Electric Industries.

In terms of Material, the industry is divided into Electrical Steel, Soft Ferrite, Iron Powder

In terms of Application, the industry is divided into Electrical Coils, Motors, Generators, Transformers, Inductors, Sensors, Others

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Industrial Solvents Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

Polyurethane Foam Market Size & Trends 2025 to 2035

Polyurethane Adhesives Market Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.