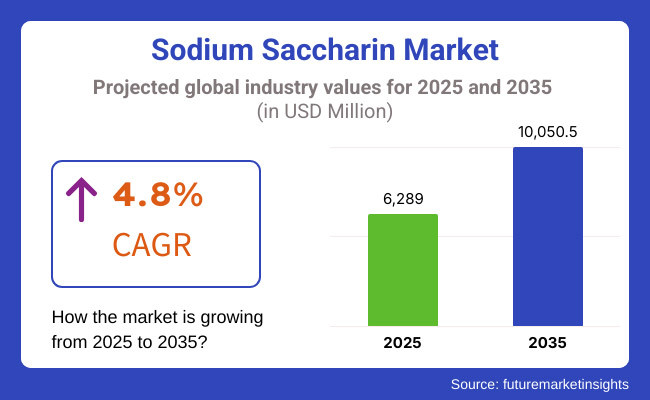

The global Sodium Saccharin market is estimated to be worth USD 6,289.0 million in 2025 and is projected to reach a value of USD 10,050.5 million by 2035, expanding at a CAGR of 4.8% over the assessment period of 2025 to 2035

Sodium saccharin's versatility makes it suitable for various applications beyond food and beverages. In the pharmaceutical industry, it is used to enhance the taste of medications, making them more palatable for patients. Additionally, it finds applications in personal care products, such as toothpaste and mouthwash, where it provides sweetness without calories. Its use in industrial applications, including as a sweetening agent in certain chemical processes, further broadens its market appeal and drives demand across multiple sectors.

Continuous innovation in product development is a key driver of sodium saccharin's market growth. Manufacturers are exploring new formulations that incorporate sodium saccharin to create appealing low-calorie and sugar-free options for consumers.

This includes the development of novel food and beverage products, such as flavored drinks, snacks, and desserts that cater to health-conscious consumers. By adapting to changing consumer preferences and dietary trends, companies are enhancing the versatility and attractiveness of sodium saccharin in the marketplace. Diet Coke, which uses sodium saccharin as part of its sweetening blend to provide a low-calorie alternative to regular soda.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global Sodium Saccharin market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 3.8% (2024 to 2034) |

| H2 | 4.2% (2024 to 2034) |

| H1 | 4.6% (2025 to 2035) |

| H2 | 5.0% (2025 to 2035) |

The above table presents the expected CAGR for the global Sodium Saccharin demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 3.8%, followed by a slightly higher growth rate of 4.2% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 4.6% in the first half and remain relatively moderate at 5.0% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

Shift Towards Healthier Alternatives

The global shift towards healthier alternatives is reshaping consumer preferences, particularly in the food and beverage industry. As awareness of health issues related to excessive sugar consumption rises, consumers are actively seeking low-calorie options that do not compromise on taste.

Sodium saccharin, a well-established low-calorie sweetener, is increasingly being utilized by manufacturers to reformulate products, allowing them to reduce sugar content while still delivering the desired sweetness. This trend is evident in various categories, including soft drinks, snacks, and desserts, where sodium saccharin serves as an effective substitute. As a result, the demand for sodium saccharin is experiencing significant growth, driven by the desire for healthier dietary choices among consumers.

Growing Popularity of Sugar-Free Products

The growing popularity of sugar-free products is a pivotal trend influencing the sodium saccharin market. As consumers become more health-conscious, there is a marked increase in the demand for sugar-free alternatives to traditional snacks and beverages. This shift is particularly pronounced among individuals looking to manage their weight or reduce sugar intake due to health concerns such as diabetes.

Brands are responding to this trend by incorporating sodium saccharin into their formulations, allowing them to offer appealing sugar-free options without sacrificing flavor. This has led to a proliferation of sugar-free products in the market, including candies, beverages, and baked goods, ultimately driving the sales of sodium saccharin across various applications.

Global Sodium Saccharin sales increased at a CAGR of 3.7% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on Sodium Saccharin will rise at 4.8% CAGR

Sodium saccharin's versatility is a significant factor in its growing popularity across multiple industries. It can be effectively used in a variety of products, including food and beverages, where it serves as a low-calorie sweetener in soft drinks, candies, and baked goods.

Additionally, sodium saccharin finds applications in pharmaceuticals, enhancing the taste of medications, and in personal care items like toothpaste and mouthwash. This broad adaptability allows manufacturers to innovate and diversify their product offerings, catering to a wide range of consumer preferences.

The regulatory approvals that sodium saccharin has received in numerous countries play a crucial role in its market acceptance. These approvals enhance the sweetener's credibility and safety perception among consumers, alleviating concerns about potential health risks.

As regulatory bodies endorse sodium saccharin for use in food, beverages, and other applications, manufacturers are encouraged to incorporate it into their products. This regulatory support not only boosts consumer confidence but also drives demand, further solidifying sodium saccharin's position in the market.

Tier 1 Companies consist of industry leaders with market revenues exceeding USD 20 million, capturing approximately 40% to 50% of the global market share. These companies are recognized for their high production capacities and extensive product portfolios, which allow them to cater to a wide array of consumer needs. Their operational excellence is supported by advanced manufacturing techniques and a strong geographical presence, enabling them to serve both local and international markets effectively.

Tier 1 companies are also distinguished by their significant investment in research and development, which fosters innovation and helps them stay ahead of market trends. Notable players in this tier include Niran BioChemical, Gremount International, and Salvi Chemical Industries Ltd., all of which leverage their established market positions to drive growth and maintain competitive advantages.

Tier 2 Companies encompass mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies typically have a strong regional presence and play a crucial role in influencing local markets. They are characterized by their solid understanding of consumer preferences and regulatory requirements within their operating regions.

While Tier 2 companies may not possess the same level of technological advancement or global reach as Tier 1 firms, they are adept at ensuring compliance with industry standards and regulations. Prominent companies in this tier include JMC Saccharin, Foodchem, and Shree Vardayini Chemical, which focus on niche markets and specialized applications of sodium saccharin.

Tier 3 Companies represent the majority of small-scale enterprises operating primarily at the local level, with revenues below USD 5 million. These companies are often focused on fulfilling specific local market demands and are characterized by limited geographical reach and product offerings.

Tier 3 companies typically operate in an unorganized sector, lacking the extensive structure and formalization seen in larger competitors. They play a vital role in catering to niche markets and local consumer preferences, contributing to the overall diversity of the sodium saccharin market.

To enhance their market presence, companies across all tiers are increasingly forming strategic partnerships with research institutions, universities, and other industry players. This collaborative approach facilitates knowledge sharing and resource optimization, leading to innovative solutions and a stronger competitive position in the global sodium saccharin market.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 1,507.6 million |

| Germany | USD 1,105.6 million |

| China | USD 703.5 million |

| India | USD 402.0 million |

| Brazil | USD 211.1 million |

The pharmaceutical industry in the USA is significantly driving the demand for sodium saccharin due to its effectiveness in improving the taste of medications. Many pharmaceutical formulations, particularly liquid medications, often have unpleasant or bitter flavors that can deter patient compliance. Sodium saccharin serves as a powerful sweetening agent that masks these undesirable tastes, making medications more palatable, especially for children and those sensitive to flavors.

As the pharmaceutical sector continues to innovate with new drug formulations and delivery methods, the reliance on sodium saccharin to enhance taste and improve patient adherence is expected to increase, further boosting its demand.

The German market has experienced a notable surge in sugar-free and reduced-calorie product offerings, driven by consumer demand for healthier alternatives. Food and beverage manufacturers are actively reformulating their products to incorporate sodium saccharin, a low-calorie sweetener that effectively replaces sugar without compromising taste.

This trend spans a wide range of categories, including soft drinks, snacks, and confectionery items, which are increasingly marketed as sugar-free options. By leveraging sodium saccharin, companies can appeal to health-conscious consumers seeking to reduce sugar intake while enjoying flavorful products, thereby enhancing their market competitiveness and meeting evolving consumer preferences.

The increasing demand for sodium saccharin in China is significantly influenced by government initiatives aimed at promoting healthier dietary practices to address rising obesity rates and related health issues. The Chinese government encourages the consumption of low-calorie sweeteners, including sodium saccharin, as part of a comprehensive strategy to reduce sugar intake among the population.

This regulatory support has prompted manufacturers to incorporate sodium saccharin into their product formulations, aligning with national health policies. Concurrently, China’s food and beverage industry is experiencing rapid growth, fueled by urbanization and evolving consumer lifestyles.

This expansion has led to a heightened demand for low-calorie and sugar-free products, with sodium saccharin being widely adopted in various offerings, such as soft drinks, snacks, and desserts. As health-conscious consumers seek alternatives to traditional sugary products, sodium saccharin serves as an effective solution, driving its increased utilization in the market.

| Segment | Value Share (2025) |

|---|---|

| Industrial Grade (Extract Type) | 24% |

Sodium saccharin's versatility is a key driver of its popularity in the industrial grade market, as it can be effectively utilized across various applications, including food and beverage production, pharmaceuticals, and personal care products. Its unique ability to provide sweetness without calories enables manufacturers to develop diverse formulations that appeal to health-conscious consumers seeking low-calorie options.

Additionally, sodium saccharin has garnered regulatory approvals in numerous regions, including the United States and Europe, which bolsters its credibility and safety perception among both manufacturers and consumers. This regulatory support not only reassures companies about its use but also encourages them to incorporate sodium saccharin into their products, further fueling demand in the industrial sector and promoting innovation in product development.

| Segment | Value Share (2025) |

|---|---|

| Cosmetics (Application) | 17% |

Sodium saccharin plays a crucial role in the cosmetic industry, particularly in oral care products like toothpaste and mouthwash, where it enhances flavor. Its ability to provide sweetness without calories effectively masks the bitterness of active ingredients, improving the overall user experience and promoting regular use.

Additionally, as the cosmetic industry shifts towards sustainability, sodium saccharin's cost-effectiveness and stability make it an appealing choice for manufacturers aiming to develop eco-friendly formulations. By incorporating sodium saccharin, companies can create high-quality products that meet consumer demands for both performance and environmental responsibility. This dual functionality positions sodium saccharin as a valuable ingredient in the evolving landscape of cosmetic formulations.

Manufacturers are investing in research and development to create new formulations that cater to health-conscious consumers, while also enhancing product quality and functionality. Additionally, firms are expanding their geographical reach and optimizing production processes to reduce costs. Collaborations with research institutions and other industry players are also being pursued to leverage expertise and drive sustainable practices, ensuring a robust market presence.

For instance

The global Sodium Saccharin industry is estimated at a value of USD 6,289.0 million in 2025.

Sales of Sodium Saccharin increased at 3.7% CAGR between 2020 and 2024.

Niran BioChemical, Gremount International, JMC Saccharin, Shree Vardayini Chemical, and Foodchemare some of the leading players in this industry.

This segment is further categorized into Industrial Grade, Food Grade and Pharma Grade.

This segment is further categorized into Pharmaceuticals, Food Beverage, Cosmetics and Others

This segment is further categorized into Online and Offline.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.